CNG vehicles Market Report Scope & Overview:

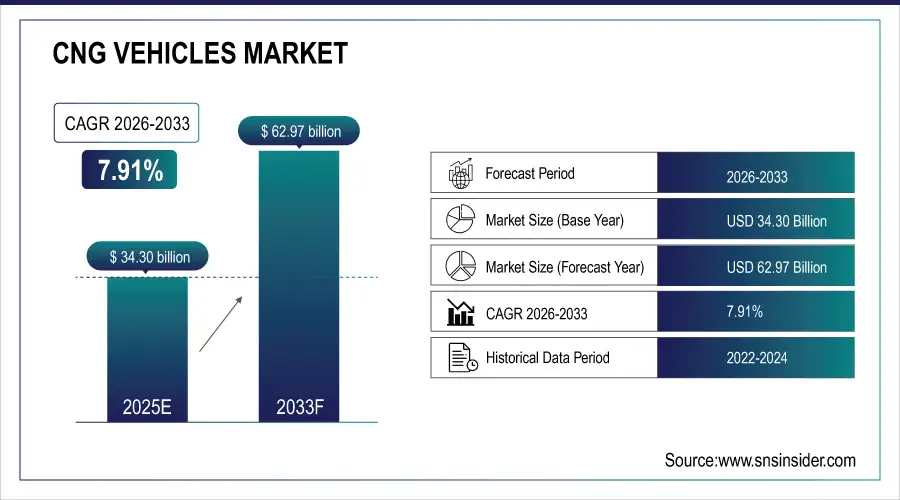

The CNG vehicles Market Size was valued at USD 34.30 Billion in 2025E and is expected to reach USD 62.97 Billion by 2033 and grow at a CAGR of 7.91% over the forecast period 2026-2033.

The CNG vehicles Market analysis growth, driven by rising environmental concerns, government incentives promoting clean fuel alternatives, and the lower operational cost of CNG compared to petrol and diesel. Expanding CNG refueling infrastructure, advancements in bi-fuel and dual-fuel technologies and increasing fleet electrification awareness further support adoption. According to study, Environmental Impact: Adoption of CNG can lower CO₂ emissions by 15–25% per vehicle annually.

Market Size and Forecast:

-

Market Size in 2025: USD 34.30 Billion

-

Market Size by 2033: USD 62.97 Billion

-

CAGR: 7.91% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on CNG vehicles Market - Request Free Sample Report

CNG vehicles Market Trends

-

Rising environmental regulations globally accelerate adoption of CNG-powered vehicles rapidly.

-

Fleet operators increasingly switch to CNG vehicles for cost and emission benefits.

-

Government subsidies and tax incentives promote CNG vehicle purchases worldwide.

-

Urban public transportation systems expand CNG buses to reduce air pollution.

-

Commercial fleets, including taxis and logistics, are converting petrol/diesel vehicles.

-

Growing consumer awareness of eco-friendly fuels drives demand for CNG vehicles.

The U.S. CNG vehicles Market size was USD 5.09 Billion in 2025E and is expected to reach USD 9.04 Billion by 2033, growing at a CAGR of 7.47% over the forecast period of 2026-2033, driven by government incentives, strict emission regulations, and rising demand for cost-effective, eco-friendly transportation. Adoption is increasing across commercial fleets, public transport, and passenger vehicles, supported by expanding CNG refueling infrastructure.

CNG vehicles Market Growth Drivers:

-

Government Regulations Push CNG Vehicle Adoption For Cleaner Urban Air

The CNG vehicles Market Growing, due to Governments worldwide are increasingly implementing strict emission standards to curb air pollution and greenhouse gas emissions. CNG vehicles emit significantly lower CO₂, NOx, and particulate matter compared to traditional petrol and diesel vehicles. This regulatory push encourages automakers and fleet operators to adopt CNG technology. For example, cities with high pollution levels, such as Delhi and Beijing, have promoted CNG buses and taxis, leading to a surge in demand for cleaner, fuel-efficient vehicles, thereby boosting the market.

Regulatory Impact: Over 50 countries have introduced policies or incentives specifically promoting CNG vehicle adoption.

CNG vehicles Market Restraints:

-

Limited Refueling Infrastructure Slows Growth Of CNG Vehicle Market

One of the major challenges hindering the growth of the CNG vehicles market is the lack of sufficient refueling stations, particularly in rural or less-developed regions. Consumers and fleet operators often face “range anxiety,” fearing they might run out of fuel without access to nearby stations. This limitation increases reliance on urban areas for refueling, restricts long-distance travel, and slows the adoption of CNG vehicles compared to petrol, diesel, or electric vehicles in regions without adequate infrastructure.

CNG vehicles Market Opportunities:

-

Fleet Conversions And Incentives Unlock Huge Potential For CNG Vehicles

The rising adoption of CNG in taxis, ride-hailing fleets, buses, and logistics vehicles presents a significant market opportunity. Fleet operators benefit from lower fuel costs, reduced maintenance expenses, and compliance with environmental regulations. Additionally, many governments offer subsidies, tax incentives, and grants for converting existing petrol/diesel fleets to CNG or purchasing new CNG vehicles. This combination of cost savings and policy support encourages rapid fleet electrification, creating a substantial growth avenue for the CNG vehicles market.

Fleet Conversion: Commercial and public transport fleets are projected to convert 15–20% of vehicles to CNG annually in major markets.

CNG vehicles Market Segmentation Analysis:

-

By Vehicle Type: In 2025, Passenger vehicles led the market with a share of 54.60%, while the Commercial vehicle segment is the fastest-growing, registering a CAGR of 8.95%.

-

By Engine System: In 2025, the Bi-Fuel segment dominated the market with a share of 47.80%, while Dual Fuel systems are the fastest-growing, expanding at a CAGR of 9.10%.

-

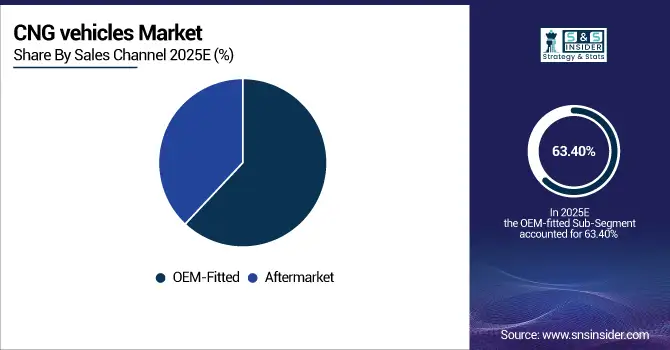

By Sales Channel: In 2025, OEM-fitted vehicles held the largest share of 63.40%, while the Aftermarket segment is the fastest-growing, with a CAGR of 8.75%.

-

By End-use: In 2025, Private fleets accounted for the largest market share of 45.20%, while Taxi and Ride-hailing Fleets are the fastest-growing, exhibiting a CAGR of 9.30%.

By Sales Channel, OEM-fitted Lead Market and Aftermarket Fastest Growth

The OEM-fitted leads the market in 2025, as vehicles come factory-equipped with CNG systems, ensuring reliability, safety, and compliance with emission standards. This segment held the largest share in 2025, supported by major automakers offering ready-to-use CNG models for private and commercial users. Meanwhile, the Aftermarket segment is the fastest-growing, driven by the increasing retrofitting of existing petrol and diesel vehicles with CNG kits, supported by government incentives, cost-effective conversion options, and rising demand for cleaner, fuel-efficient vehicles across urban and regional markets.

By Vehicle Type, Passenger Vehicles Lead Market and Commercial Vehicles Fastest Growth

The Passenger Vehicles lead the market in 2025, due to their widespread adoption among private consumers, offering cost-effective and environmentally friendly alternatives to petrol and diesel cars. This segment held the largest share in 2025, driven by rising awareness of fuel efficiency and emission reduction benefits. Meanwhile, the Commercial vehicle segment is the fastest-growing, fueled by the increasing shift of taxis, buses, and logistics fleets toward CNG, supported by government incentives, lower operational costs, and the need for sustainable urban transportation solutions, ensuring rapid adoption.

By Engine System, Bi-Fuel Lead Market and Dual Fuel Fastest Growth

The Bi-Fuel lead the market in 2025, due to its flexibility of running on both CNG and petrol, offering extended range and cost savings for consumers and fleet operators. Meanwhile, the Dual Fuel segment is the fastest-growing, benefiting from increasing demand for diesel-CNG hybrid systems in buses, trucks, and logistics fleets, supported by government incentives and the push for reduced emissions, ensuring accelerated market expansion.

By End-use, Private Fleets Lead Market and Taxi and Ride-hailing Fleets Fastest Growth

The Private Fleets leads the market in 2025, driven by widespread adoption among individual consumers seeking cost-effective, fuel-efficient, and environmentally friendly transportation solutions. Moreover, supported by rising awareness of lower operational costs and emission benefits. Meanwhile, Taxi and Ride-hailing Fleets represent the fastest-growing segment, fueled by government incentives, fleet conversion programs, and the increasing push for sustainable urban mobility. The combination of economic benefits and regulatory support is accelerating CNG adoption across commercial urban transport networks globally.

CNG vehicles Market Regional Analysis:

Asia Pacific CNG vehicles Market Insights:

The Asia Pacific dominated the CNG vehicles Market in 2025E, with over 42.10% revenue share, due to rapid urbanization, increasing environmental awareness, and strong governmental support for clean fuel adoption. Growth is driven by widespread adoption in passenger and commercial vehicles, and public transport and logistics fleets. Expanding CNG refueling infrastructure, favorable policies, and rising fuel cost savings encourage market penetration. Increasing concerns over air pollution and emissions, combined with incentives for fleet conversion and cleaner transportation solutions, continue to propel rapid growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

China and India CNG vehicles Market Insights

China and India lead the CNG vehicles market due to high urbanization, severe air pollution concerns, and strong government support through subsidies and incentives. Widespread adoption in passenger, commercial, and public transport fleets, coupled with expanding CNG infrastructure, drives significant market growth.

Europe CNG vehicles Market Insights:

The Europe region is expected to have the fastest-growing CAGR 9.23%, driven by stringent emission regulations, increasing environmental awareness, and government initiatives promoting cleaner fuels. The adoption of CNG vehicles across passenger, commercial, and public transport segments is accelerating due to incentives, subsidies, and supportive policies. Expanding refueling infrastructure and rising fuel cost efficiency are further fueling growth. Fleet operators, including taxis, buses, and logistics providers, are increasingly converting to CNG, contributing to market expansion. The combination of regulatory support and economic benefits ensures strong and sustainable growth in Europe.

Germany and U.K. CNG vehicles Market Insights

Germany and the U.K. are experiencing rapid CNG vehicle market growth due to strict emission regulations, government incentives, and rising environmental awareness. Increasing adoption in commercial fleets and public transport, along with expanding refueling infrastructure, accelerates CNG vehicle penetration across both countries.

North America CNG vehicles Market Insights:

The North America region holds a significant share in the CNG vehicles market, driven by increasing demand for eco-friendly transportation and government incentives promoting alternative fuels. Adoption is rising across passenger, commercial, and public transport fleets due to cost-effective fuel benefits and stricter emission regulations. Expanding CNG refueling infrastructure and technological advancements in bi-fuel and dual-fuel vehicles support market growth. Fleet operators, including logistics and ride-hailing services, are increasingly transitioning to CNG vehicles.

U.S and Canada CNG vehicles Market Insights

The U.S. and Canada are growing the CNG vehicles market due to government incentives, strict emission standards, and rising demand for cost-effective, eco-friendly transportation. Expanding CNG refueling infrastructure and increasing adoption in commercial and public transport fleets further support market growth.

Latin America (LATAM) and Middle East & Africa (MEA) CNG vehicles Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) CNG vehicles Market are emerging regions showing steady growth, driven by rising environmental awareness, government incentives, and increasing fuel cost advantages. Adoption is growing across passenger, commercial, and public transport segments, supported by expanding CNG refueling infrastructure and fleet conversion initiatives. Urban air quality concerns and emission reduction targets encourage the shift from conventional fuels to CNG. The combination of regulatory support, economic benefits, and the need for sustainable transportation solutions continues to propel market expansion across Latin America and the Middle East & Africa.

CNG vehicles Market Competitive Landscape:

Hyundai Motor Company is expanding its CNG vehicle lineup, including models like the Exter and Grand i10 NIOS. The company leverages dual-fuel and bi-fuel technologies to provide cost-effective, eco-friendly mobility solutions. Growing demand for cleaner fuels, supportive government policies, and rising fleet conversions in taxis and commercial vehicles drive Hyundai’s increasing presence in the CNG vehicles market.

-

In April 2025, November 2024, Hyundai Motor Company Launched the 'Hy-CNG Duo' dual-cylinder system in the EXTER and Grand i10 NIOS models, offering higher fuel efficiency and boot space.

Maruti Suzuki leads India’s CNG vehicle segment, offering a wide range of models like the Alto, WagonR, and Ertiga with CNG variants. The company focuses on fuel-efficient, eco-friendly solutions for private and commercial consumers. Government incentives, rising urban air pollution, and increasing fuel cost awareness have accelerated CNG adoption, strengthening Maruti Suzuki’s position as a market leader.

-

In April 2025, Maruti Suzuki introduced the Grand Vitara S-CNG, expanding its eco-friendly vehicle portfolio with a factory-fitted CNG kit, enhancing fuel efficiency and reducing emissions, reinforcing its leadership in the CNG vehicle market.

Nissan has introduced CNG variants such as the Micra to capture the growing demand for sustainable vehicles. Focused on fuel efficiency and lower emissions, Nissan targets urban and semi-urban consumers seeking environmentally friendly alternatives. Rising awareness of operational cost savings, combined with government incentives, positions Nissan to strengthen its market share in the expanding CNG vehicles segment.

-

In April 2025, Nissan India launched a factory-approved CNG retrofit kit for the Magnite SUV, offering a sustainable and economical powertrain option to Indian consumers, catering to increasing demand for flexible and cost-effective CNG solutions.

CNG vehicles Market Key Players:

Some of the CNG vehicles Market Companies are:

-

Volkswagen Group

-

Ford Motor Company

-

Suzuki Motor Corporation

-

Renault

-

Volvo Group

-

General Motors

-

Groupe PSA

-

Fiat Chrysler Automobiles

-

Hyundai Motor Company

-

Daimler AG

-

Honda Motor Co. Ltd.

-

Toyota Motor Corporation

-

Tata Motors Limited

-

Maruti Suzuki India Limited

-

Mahindra & Mahindra Limited

-

Nissan Motor Company

-

Bajaj Auto Limited

-

Piaggio Vehicles Pvt Ltd

-

Audi

-

Ashok Leyland Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 34.30 Billion |

| Market Size by 2033 | USD 62.97 Billion |

| CAGR | CAGR of 7.91% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger, Commercial, Others) • By Engine System (Dedicated Fuel, Bi-Fuel, Dual Fuel) • By Sales Channel (OEM-fitted, Aftermarket) • By End-use (Private, Taxi and Ride-hailing Fleets, Public Transit Authorities, Industrial and Utility Fleets) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Volkswagen Group, Ford Motor Company, Suzuki Motor Corporation, Renault, Volvo Group, General Motors, Groupe PSA (now Stellantis), Fiat Chrysler Automobiles (Stellantis), Hyundai Motor Company, Daimler AG, Honda Motor Co. Ltd., Toyota Motor Corporation, Tata Motors Limited, Maruti Suzuki India Limited, Mahindra & Mahindra Limited, Nissan Motor Company, Bajaj Auto Limited, Piaggio Vehicles Pvt. Ltd., Audi, and Ashok Leyland Limited. |