Plastic Films & Sheets Market Size & Overview:

The Plastic Films & Sheets Market size was valued at USD 135 billion in 2023 and is expected to reach USD 212.3 billion by 2032 and grow at a CAGR of 5.20% over the forecast period 2024-2032.

Get More Information on Plastic Films & Sheets Market - Request Sample Report

The plastic films & sheets market report provides a comprehensive analysis of production capacity and utilization rates by country and type, highlighting key manufacturing hubs. It examines raw material price trends, including fluctuations in polyethylene, polypropylene, and PVC costs across major regions. The report also explores the regulatory impact, covering evolving policies such as plastic bags and recycling mandates worldwide. Additionally, it assesses environmental metrics, including recycling rates and sustainability initiatives, alongside R&D and innovation trends in high-barrier and biodegradable films. Lastly, the report provides insights into end-user demand shifts, analyzing growth trends in packaging, agriculture, healthcare, and industrial applications.

Plastic Films & Sheets Market Dynamics

Drivers

-

Growing demand for bi-axially oriented films drives market growth.

Increasing demand for bi-axially oriented films (BO films) owing to their better mechanical and glossy property along with enhanced barrier performance are factors involved in the growth of the market. This grade of films such as BOPP (bi-axially oriented polypropylene), BOPET (bi-axially oriented polyester), and BOPA (bi-axially oriented polyamide) find applications in food packaging, pharmaceuticals, and industrial applications owing to their improved mechanical strength, moisture barrier, and printability. Moreover, the growing inclination towards sustainable and lightweight packaging solutions coupled with rising flexible packaging adoption in e-commerce and FMCG sectors provide an impetus for market growth. The growth of the industry is further boosted by the advent of film processing technologies and recyclable BO films that meet the growing regulatory and environmental requirements.

Restraint

-

Fluctuating raw material prices which may hamper the market growth.

The variations in prices of the raw materials are one of the key restraining factors to the growth of this market. The key raw materials for plastic films & sheets such as polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and polyethylene terephthalate (PET) are derived from crude oil and natural gas. With rising geopolitical tensions, supply-chain disruptions, and energy prices fluctuating from parity, price variability in petrochemical feedstocks affects the production costs of plastic films and sheets. This inconsistency puts financial stress on the manufacturers impacting profit margins and pricing. Moreover, a sudden spike in the cost can cause supply shortages, and delays in the production cycle, and the end-users in the packaging, agriculture, and construction sectors could lower the purchasing capacity. To address these concerns, manufacturers are looking into expanding their reach into recycled and bio-based counterparts to reduce reliance on fossil-fuel-based raw materials and better balance pricing.

Opportunities

-

Growing use of high-barrier films in food packaging creating an opportunity for the market.

The key factor driving the demand for plastic films, particularly high-barrier films is the significant growth of the market for extended shelf-life and food safety which is expected to create remarkable opportunities in the plastic films & sheets Market. Films with higher barriers, like EVOH (ethylene vinyl alcohol), PVDC-coated, metalized films, and multi-layer laminates provide the best moisture, oxygen, and UV resistance to protect the contents from spoilage and preserve freshness. The rise in demand for such fresh and ready-to-eat meals along with frozen and perishable items from the e-commerce and retail sectors are further driving the advanced packaging products demand. Moreover, the increasing government mandates regarding food safety and waste reduction are encouraging manufacturers to develop cost-competitive high-performance recyclable barrier films, which is anticipated to offer the market manufacturers attractive innovation and expansion opportunities.

Challenges

-

Limited raw material availability major challenge for Plastic Films & Sheets market.

One of the key factors hampering the Plastic Films & Sheets (HPFs) market is the raw material availability as HPF production is based on a limited range of fluorspar, one of the critical minerals needed for its production. Supply chain disruptions and the consequent price volatility have been major issues plaguing the chemical sector which, in tandem with ongoing geopolitical tensions, export restrictions, and mining swings, have reduced the overall production capacity of fluoropolymers. Strong fluorspar reserves are often accompanied by export control practices from countries that do hold the reserves, in prioritizing domestic industry over external supply during constrained market conditions. The associated extraction and refining costs further complicate matters and make pricing stability difficult to sustain among manufacturers. The growing demand for high-performance fibers in the automotive, aerospace, semiconductors, and renewable energy sectors is a primary driver for these HPF suppliers to address high raw material supply risks at competitive prices for players in the market. In response, companies are investigating different sourcing solutions, recycling technologies, and sustainable production methods for fluoropolymers.

Plastic Films & Sheets Market Segmentation Analysis

By Material Type

LDPE/LLDPE held the largest market share around 38% in 2023. This is due to their overall performance such as versatility and cost, transparency, and mechanical properties (High tensile strength). With high flexibility and impact resistance, moisture barrier, and transparency, they are popular in the food packaging industry, agriculture films, industrial liners, and some medical applications. Also, their increased supremacy in the Flexible packaging solutions which are increasing with consumer demand as well as food & beverage and e-commerce sectors reinforces demand and therefore reflects their ascendant status. Moreover, LDPE/LLDPE films are also extremely recyclable and processable, making them an integral part of the global sustainability movement. They can be combined with additives to increase UV resistance, antistatic properties, and durability which makes them the preferred option for several end-user industries, further strengthening its market position.

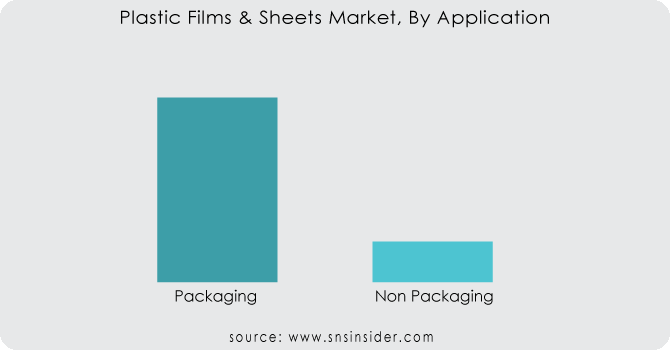

By Application

The packaging held the largest market share around 68% in 2023. The rising demand for lightweight, flexible, and durable packaging solutions in various sectors including food & beverage, pharmaceuticals, personal care, and e-commerce. Plastic films offer excellent moisture, oxygen and contaminants barrier properties and ensure product safety and shelf life. Furthermore, the fast-paced growth of the e-commerce and retail industries and the changing consumer trend for convenience and single-use packaging have strongly embedded the position of plastic films in several packaging applications. Enhancements in their attractiveness for cost competitiveness, functionality, and recyclability have continued to cement their place at the head of the market.

Plastic Films & Sheets Market Regional Outlook

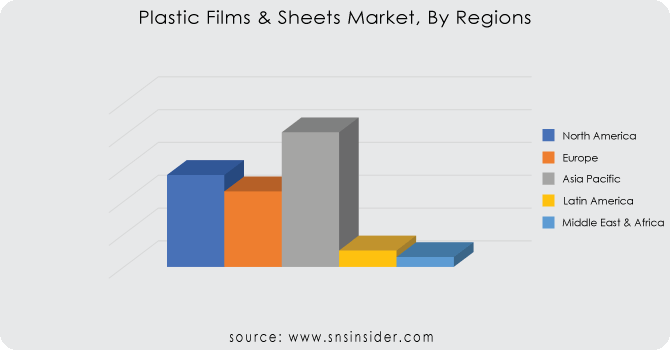

Asia Pacific held the largest market share around 42% in 2023. It is owing to its well-established manufacturing industry, high demand for packaged goods and rapid rate of industrialization in emerging economies. It is the major plastic producers and converters in that region gain from low production cost, high availability of raw materials, and availability of processing technologies. Market growth is mainly driven by rapid demand for flexible packaging in the food & beverage, pharmaceutical, and e-commerce industry, particularly for countries such as China, India, and Japan. In Asia Pacific, the high-growth agriculture sector also supports the growth of mulch films, greenhouse films, and silage wraps. The market expansion is further strengthened due to government initiatives for bioplastics and recyclable plastics which help the region stay dominant over the market.

North America held the significant market share. It is driven by the regions established packaging industry besides also high demand for high-performance films and advanced recycling infrastructure. Strong end-user consumption of flexible packaging in food & beverage, pharmaceutical, and personal care industries in the form of packaging for extension of shelf-life and convenience are driving demand in this region. Moreover, the market is further boosted by the ongoing developments in barrier films, biodegradable plastics, and multi-layered structures. Market growth is further accelerated by a favorable e-commerce scenario and strict government regulations to promote sustainable packaging solutions among key market players. In addition to this, North America holds a significant market position due to the increasing industrial and agricultural applications as well as tremendous investments in recyclable and bio-based plastic films.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Novolex (Eco-Products, Shields Poly Films)

-

Saudi Basic Industries Corporation (SABIC) (LLDPE Films, BOPP Films)

-

Toyobo Co. Ltd (HINOMARU Film, COSMOSHINE SRF)

-

British Polythene Industries Plc (Silage Films, Pallet Wrap)

-

The Dow Company (ELITE Polyethylene, INNATE Precision Packaging Resins)

-

DuPont (Mylar Polyester Films, Tedlar PVF Films)

-

Toray Industries, Inc. (LUMIRROR Polyester Film, TORAYFAN™ PP Films)

-

Berry Global, Inc. (FormiFor Films, AgriSeal Films)

-

Plastic Film Corporation of America (PVC Films, PETG Films)

-

Bemis Company, Inc. (PerfecTear Films, SmartTack Films)

-

Sealed Air Corporation (Cryovac Barrier Films, Opti Shrink Films)

-

Uflex Ltd (FLEXPET Polyester Films, FLEXMETPROTECT Metallized Films)

-

Amcor Plc (Propafilm OPP Films, EcoLam Recyclable Films)

-

Avery Dennison Corporation (FASSON Overlaminate Films, Nexgen Films)

-

Jindal Poly Films Limited (BICOR BOPP Films, MICRORITE Anti-fog Films)

-

Mitsubishi Chemical Corporation (Hostaphan Polyester Films, Diafoil PET Films)

-

Inteplast Group (AmTopp BOPP Films, VISTOPP Stretch Films)

-

Polyplex Corporation Ltd. (Sarafil Polyester Films, BOPET Heat-sealable Films)

-

Cosmo Films Ltd. (BOPP Thermal Lamination Films, Synthetic Paper)

-

Klöckner Pentaplast (Pentapharm Medical Films, Pentaclear Packaging Films)

Recent Development

- In 2023, Amcor Plc launched EcoLam, a recyclable polyethylene-based laminate aimed at reducing plastic waste and enhancing sustainability in packaging. The product offers high barrier protection while being fully recyclable, aligning with global sustainability goals.

- In 2023, Berry Global, Inc. expanded its Sustane line by integrating recycled content into its plastic films to support sustainability. This initiative enhances the circular economy by reducing reliance on virgin plastics and minimizing environmental impact.

-

In May 2023, three industry leaders - Berry Global Group, Peel Plastic Products Ltd., and ExxonMobil - joined forces to create a more sustainable future for pet food packaging. Their collaboration focuses on incorporating certified recycled plastics into packaging for household pet food brands. This initiative leverages ExxonMobil's innovative Exxtend™ technology, which uses advanced recycling to transform plastic waste into high-quality, food-safe packaging materials. This approach, known as mass balance, ensures the responsible use of recycled content.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 135 Billion |

| Market Size by 2032 | USD 212.3 Billion |

| CAGR | CAGR of 5.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material Type (LLDPE, LDPE, HDPE, BOP, CPP, PVC, PES, PA, Others) •By Application (Packaging, Non-Packaging) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Novolex, Saudi Basic Industries Corporation (SABIC), Toyobo Co. Ltd, British Polythene Industries Plc, The Dow Company, DuPont, Toray Industries, Inc., Berry Global, Inc., Plastic Film Corporation of America, Bemis Company, Inc., Sealed Air Corporation, Uflex Ltd, Amcor Plc, Avery Dennison Corporation, Jindal Poly Films Limited, Mitsubishi Chemical Corporation, Inteplast Group, Polyplex Corporation Ltd., Cosmo Films Ltd., Klöckner Pentaplast |