White Inorganic Pigments Market Report Scope & Overview:

Get More Information on White Inorganic Pigments Market - Request Sample Report

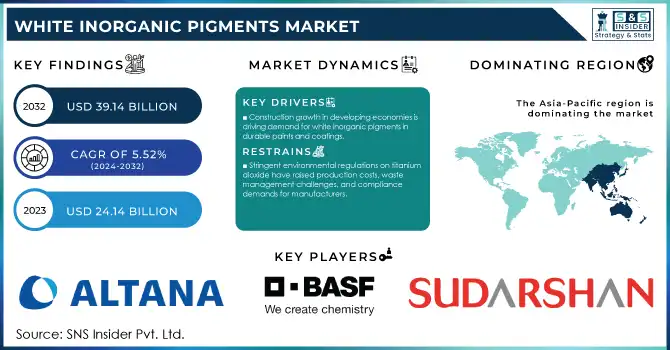

The White Inorganic Pigments Market size was estimated at USD 24.14 billion in 2023 and is expected to reach USD 39.14 billion by 2032 at a CAGR of 5.52% during the forecast period of 2024-2032.

The White Inorganic Pigments Market has experienced robust growth driven by their extensive application across industries such as paints and coatings, plastics, paper, and construction. White inorganic pigments, primarily titanium dioxide (TiO₂), zinc oxide, and lithopone, are valued for their high opacity, brightness, and color stability. The demand for these pigments is closely tied to the growth of end-use industries, particularly construction and automotive sectors, which utilize them extensively in paints, coatings, and surface treatments. A key trend shaping the market is the increasing adoption of environmentally sustainable pigments. With growing environmental regulations and consumer awareness, manufacturers are shifting toward eco-friendly production processes, such as chloride process-based TiO₂ production, which reduces emissions. Additionally, advancements in pigment formulations to enhance durability, heat resistance, and UV stability are gaining traction, catering to high-performance applications. The market also benefits from the increasing use of white inorganic pigments in the packaging industry, driven by the rising demand for aesthetically appealing packaging. The plastics industry is another significant contributor, where these pigments are used to improve brightness and opacity in products such as films, containers, and household goods.

White Inorganic Pigments Market Dynamics

DRIVERS

-

The global rise in construction and infrastructure development, particularly in developing economies, is driving the demand for white inorganic pigments, essential for durable, high-quality paints and coatings used in buildings and infrastructure.

The global rise in construction and infrastructure development, particularly in developing economies, is significantly driving the demand for white inorganic pigments. As urbanization accelerates and new infrastructure projects are undertaken, the need for high-quality paints and coatings has surged. White inorganic pigments, such as titanium dioxide, are crucial for providing opacity, durability, and UV protection to surfaces. These pigments are widely used in paints for both residential and commercial buildings, as well as for industrial coatings, to ensure long-lasting finishes. Additionally, the construction of infrastructure such as roads, bridges, and airports require protective coatings to withstand harsh weather conditions, making white inorganic pigments essential. The growing focus on energy-efficient buildings also contributes to the demand for lighter-colored coatings, which reflect heat and enhance thermal performance. As economies continue to develop, particularly in Asia-Pacific and Africa, the demand for these pigments is expected to remain strong.

RESTRAIN

-

Stringent environmental regulations on titanium dioxide, a key white inorganic pigment, have increased production costs, waste management challenges, and compliance requirements for manufacturers.

Stringent environmental regulations have significantly impacted the production and disposal of white inorganic pigments, particularly titanium dioxide, which is a key component in the market. Regulatory bodies, such as the European Chemicals Agency (ECHA), have classified titanium dioxide as a potential carcinogen in powder form, leading to stricter guidelines for its handling and use. Additionally, the production process of titanium dioxide is energy-intensive and generates substantial waste, including carbon emissions and acidic by-products, which are subject to stringent environmental controls. Compliance with these regulations requires manufacturers to invest heavily in advanced technologies and sustainable practices, increasing production costs and creating entry barriers for smaller players. Furthermore, the disposal of titanium dioxide-containing products is closely monitored to mitigate environmental risks, adding further complexity to the supply chain.

White Inorganic Pigments Market Segmentation

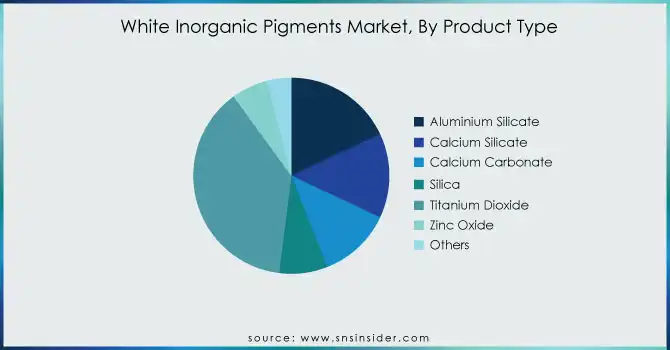

By Product Type

Titanium Dioxide (TiO₂) segment is dominated with the market share over 38% in 2023. These attributes make it an ideal choice for a range of applications across multiple industries. In the paints and coatings sector, TiO₂ provides excellent coverage, durability, and UV protection, making it indispensable in the production of exterior and interior paints. It is also commonly used in plastics, where it enhances color stability and opacity. In the paper industry, TiO₂ is valued for its ability to improve brightness and provide a smooth finish.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

The Paints & Coatings segment dominated with the market share over 32% in 2023. This is primarily driven by the extensive use of white pigments, such as titanium dioxide, which offer excellent opacity, durability, and color consistency. These pigments are integral in the formulation of paints and coatings used in various industries, including construction, automotive, and industrial sectors. The demand for high-performance coatings in buildings, vehicles, and industrial equipment further fuels this segment’s growth.

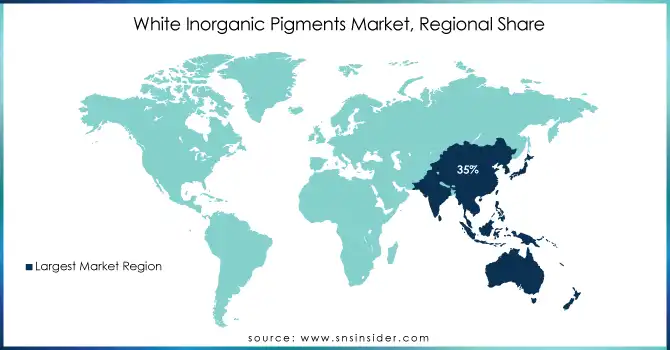

White Inorganic Pigments Market Regional Analysis

Asia-Pacific region is dominated with the market share over 35% in 2023, commanding a substantial share due to its strong industrial base. Countries like China and India play a pivotal role, with well-established manufacturing hubs that drive the demand for white inorganic pigments, particularly titanium dioxide. These nations have robust sectors in automotive, construction, and coatings, where white pigments are widely used for applications such as paints, plastics, and automotive coatings. The increasing industrialization, urbanization, and infrastructure development in the region further fuel the demand for these pigments.

North America is experiencing the fastest growth in the White Inorganic Pigments Market, driven by rising demand across key sectors such as paints and coatings, plastics, and automotive. The region's growth is further fueled by the increasing adoption of eco-friendly and sustainable pigments, as industries shift towards more environmentally responsible practices. Additionally, advancements in industrial processes, including more efficient pigment production and application methods, have contributed to the market's expansion.

Some of the major key players of the White Inorganic Pigments Market

-

Altana AG (TiO2-based pigments)

-

BASF SE (BASF TiO2, Satintone)

-

Sudarshan Chemical Industries Limited (Titanium Dioxide Pigments)

-

Cathay Industries Group (Titanium Dioxide Pigments, Cathay TiO2)

-

Clariant International Ltd. (White pigments, TiO2)

-

Cristal (Titanium Dioxide, TiO2-based pigments)

-

Ferro Corporation (Titanium Dioxide Pigments, Ferro White Pigments)

-

Gharda Chemicals Limited (Titanium Dioxide Pigments, TiO2)

-

Heubach GmbH (White inorganic pigments, TiO2)

-

KRONOS Worldwide Inc. (Titanium Dioxide Pigments, Kronos TiO2)

-

Lanxess AG (Titanium Dioxide Pigments, Bayertitan)

-

Venator Materials PLC (Titanium Dioxide, Venator TiO2)

-

The Chemours Company (TiO2, Ti-Pure)

-

Tronox Holdings plc (Titanium Dioxide Pigments, Tronox TiO2)

-

Lomon Billions Group (Titanium Dioxide Pigments)

-

ISCA Group (Inorganic White Pigments, TiO2)

-

Yunnan Tin Company (Titanium Dioxide Pigments)

-

Sachtleben Chemie GmbH (Titanium Dioxide)

-

Taiwan Chemicals Company (White Pigments, Titanium Dioxide)

-

Shandong Dongjia Group (Titanium Dioxide Pigments)

Suppliers for (Specializes in titanium dioxide pigment production for a variety of applications) of White Inorganic Pigments Market

-

Venator Materials Plc

-

Tronox Limited

-

Chemours Company

-

Lomon Billions Group

-

Kronos Worldwide, Inc.

-

Toho Titanium Co., Ltd.

-

Ishihara Sangyo Kaisha, Ltd.

-

Cristal Global (now part of Tasnee)

-

Huntsman Corporation

-

Jinan Yuxing Chemical Co., Ltd.

RECENT TRENDS

-

In January 2024: ALTANA acquired Silberline Group, a US-based leader in effect pigments, enhancing its portfolio of effect pigments used in various applications, including automotive coatings and printing inks.

| Report Attributes | Details |

| Market Size in 2023 | USD 24.14 Billion |

| Market Size by 2032 | USD 39.14 Billion |

| CAGR | CAGR of 5.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Aluminium Silicate, Calcium Silicate, Calcium Carbonate, Silica, Titanium Dioxide, Zinc Oxide, Others) • By Application (Paints & Coatings, Adhesives & Sealants, Plastics, Cosmetics, Paper, Inks, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Altana AG, BASF SE, Sudarshan Chemical Industries Limited, Cathay Industries Group, Clariant International Ltd., Cristal, Ferro Corporation, Gharda Chemicals Limited, Heubach GmbH, KRONOS Worldwide Inc., Lanxess AG, Venator Materials PLC, The Chemours Company, Tronox Holdings plc, Lomon Billions Group, ISCA Group, Yunnan Tin Company, Sachtleben Chemie GmbH, Taiwan Chemicals Company, Shandong Dongjia Group. |

| Key Drivers | • The global rise in construction and infrastructure development, particularly in developing economies, is driving the demand for white inorganic pigments, essential for durable, high-quality paints and coatings used in buildings and infrastructure. |

| Restraints | • Stringent environmental regulations on titanium dioxide, a key white inorganic pigment, have increased production costs, waste management challenges, and compliance requirements for manufacturers. |