Adhesive Films Market Report Scope & Overview:

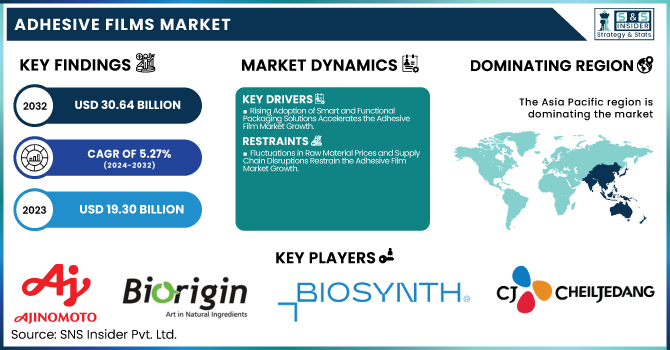

The Adhesive Films Market Size was valued at USD 19.30 Billion in 2023 and is expected to reach USD 30.64 Billion by 2032, growing at a CAGR of 5.27% over the forecast period of 2024-2032.

To Get more information on Adhesive Films Market - Request Free Sample Report

The adhesive film market is evolving with changing industrial needs and sustainability initiatives. Trade & export-import analysis reveals shifting supply chains and regulatory impacts on global trade. Raw material availability & price volatility remain key concerns, as fluctuations in resin prices affect production costs. Rising environmental awareness is driving innovations in waste management & recycling trends, with manufacturers adopting circular economy models. As industries seek efficient bonding solutions, benchmarking against alternative materials compares adhesive films with mechanical fasteners and liquid adhesives. Our report explores these crucial aspects, offering deep insights into market trends, challenges, and opportunities that define the competitive landscape of adhesive films.

The US Adhesive Films Market Size was valued at USD 4.06 Billion in 2023 and is expected to reach USD 6.78 Billion by 2032, growing at a CAGR of 5.86% over the forecast period of 2024-2032.

The U.S. adhesive film market is witnessing steady growth, driven by advancements in packaging, automotive, and electronics industries. Increasing demand for sustainable and high-performance adhesives is fueled by rising environmental regulations set by organizations like the Environmental Protection Agency (EPA) and the U.S. Green Building Council (USGBC). The expansion of smart packaging solutions and electric vehicles (EVs) is accelerating the adoption of specialty adhesive films. For instance, 3M and Avery Dennison are developing advanced pressure-sensitive films for automotive and industrial applications. Additionally, the Flexible Packaging Association (FPA) emphasizes the role of adhesive films in enhancing product safety and sustainability, further driving market growth.

Adhesive Films Market Dynamics

Drivers

-

Rising Adoption of Smart and Functional Packaging Solutions Accelerates the Adhesive Film Market Growth

The increasing adoption of smart and functional packaging solutions is significantly driving the growth of the adhesive film market. As the packaging industry shifts toward intelligent and sustainable solutions, adhesive films play a crucial role in security, authentication, and freshness preservation. The Flexible Packaging Association (FPA) highlights how advanced adhesive films contribute to moisture resistance, tamper-evidence, and interactive consumer engagement. For instance, NFC-enabled and RFID-integrated adhesive films allow brands to provide real-time product tracking and anti-counterfeit features, which are increasingly adopted in pharmaceutical and luxury goods packaging. In the food industry, adhesive films with barrier properties help extend shelf life, aligning with the U.S. Food and Drug Administration (FDA) regulations for food safety. Furthermore, the e-commerce boom has led to an increased demand for adhesive films in protective mailers, secure labeling, and sustainable flexible packaging. Companies like Avery Dennison and Constantia Flexibles are focusing on low-waste, recyclable, and biodegradable adhesive films to support sustainable packaging initiatives. The continued evolution of smart packaging applications is fueling innovation in the adhesive film market, positioning it as a key component of next-generation packaging solutions.

Restraints

-

Fluctuations in Raw Material Prices and Supply Chain Disruptions Restrain the Adhesive Film Market Growth

The adhesive film market faces a significant challenge due to raw material price fluctuations and supply chain disruptions. Key materials such as polypropylene, polyethylene, and specialty resins are heavily dependent on petroleum-based derivatives, making them susceptible to crude oil price volatility. According to the American Chemistry Council (ACC), periodic supply shortages and fluctuating demand cycles in the chemical industry have contributed to unpredictable material costs. Additionally, geopolitical tensions, trade restrictions, and environmental regulations further impact the availability and pricing of essential raw materials. The COVID-19 pandemic and extreme weather events have intensified supply chain challenges, leading to higher freight costs, production delays, and inventory shortages. For instance, the Texas winter storm of 2021 caused severe disruptions in resin production, affecting adhesive film manufacturers in North America. The ongoing labor shortages and increased transportation costs are further straining supply chains, limiting production capacities, and raising operational costs for market players. These uncertainties complicate long-term procurement strategies, forcing manufacturers to adopt cost-cutting measures and alternative sourcing approaches to remain competitive in the adhesive film market.

Opportunities

-

Rising Adoption of Bio-Based and Recyclable Adhesive Films Supports the Growth of the Adhesive Film Market

The adhesive film market is witnessing a shift towards bio-based and recyclable adhesive films, driven by sustainability initiatives and increasing environmental concerns. The U.S. Plastics Pact’s commitment to achieving 100% recyclable or compostable plastic packaging by 2025 is encouraging manufacturers to develop eco-friendly alternatives. Companies like Mondi Group and Avery Dennison are investing in bio-based adhesives derived from renewable sources such as plant starch, cellulose, and polylactic acid (PLA). These biodegradable adhesive films are finding applications in food packaging, pharmaceutical labeling, and disposable medical products, reducing dependence on petroleum-based materials. Moreover, advancements in solvent-free and water-based adhesives are improving recyclability, aligning with circular economy goals. The Flexible Packaging Association (FPA) emphasizes the growing consumer preference for sustainable packaging solutions, further fueling demand for recyclable adhesive films. While transitioning to green adhesives involves higher R&D costs, government incentives and industry collaborations are accelerating the adoption of bio-based solutions, positioning them as a lucrative opportunity for adhesive film manufacturers.

Challenge

-

Technical Limitations in Adhesion Strength and Compatibility Challenge the Adoption of Adhesive Films in Critical Applications

Adhesive films must meet strict performance standards across industries such as aerospace, medical devices, and automotive manufacturing, but technical challenges in adhesion strength, substrate compatibility, and environmental durability limit their widespread adoption. Traditional adhesives may fail under extreme temperatures, moisture exposure, or mechanical stress, impacting their reliability in high-performance applications. The American Society for Testing and Materials (ASTM) has set stringent guidelines for adhesive bonding in structural applications, requiring manufacturers to enhance film durability and resistance to environmental factors. In the medical sector, adhesive films used in wearable biosensors and wound dressings must provide secure skin adhesion without causing irritation, posing formulation challenges. Similarly, in electric vehicles (EVs), adhesive films must withstand vibration, chemical exposure, and prolonged high temperatures, demanding advancements in high-temperature-resistant and conductive adhesives. While R&D efforts are addressing these issues, the complexity of achieving universal adhesion strength across multiple substrates remains a key challenge, slowing down the adoption of adhesive films in critical applications.

Adhesive Films Market Segmental Analysis

By Resin Type

Acrylic adhesive films dominated the adhesive films market in 2023, accounting for 42.8% of the total market share. The dominance of acrylic adhesive films is attributed to their high durability, excellent weather resistance, and strong adhesion to various surfaces, making them a preferred choice across multiple industries. Unlike rubber and silicone adhesives, acrylic-based films provide better UV stability and resistance to chemicals, which enhances their longevity in harsh environments. According to the Pressure Sensitive Tape Council (PSTC), acrylic adhesives are widely used in automotive, packaging, and medical applications, where high-performance bonding is required. In the electronics sector, companies like 3M and Avery Dennison have been developing acrylic-based adhesives for flexible printed circuits and protective films, further driving demand. Additionally, the U.S. Environmental Protection Agency (EPA) has been promoting the transition to low-VOC and solvent-free adhesives, which has favored the growth of water-based acrylic films. Moreover, increasing demand for biodegradable and recyclable adhesives in sustainable packaging solutions has led to innovations in eco-friendly acrylic adhesives, further solidifying the segment’s leading position in the adhesive film market.

By Film Material

Bi-axially Oriented Polypropylene (BOPP) adhesive films dominated the adhesive films market in 2023, capturing a 38.5% share. BOPP films are highly preferred due to their excellent tensile strength, high transparency, and superior moisture resistance, making them ideal for packaging, labeling, and lamination applications. According to the Flexible Packaging Association (FPA), the demand for BOPP adhesive films has surged in food and beverage packaging, particularly in snack, confectionery, and ready-to-eat meal segments. Unlike polyvinyl chloride (PVC) and polyethylene (PE), BOPP films offer better recyclability and lower environmental impact, aligning with sustainability initiatives promoted by the U.S. Plastics Pact. Additionally, BOPP adhesive films are extensively used in graphic films, gift wraps, and industrial tapes, enhancing their application scope. Major manufacturers such as Berry Global and UPM Raflatac have been investing in sustainable BOPP film solutions, further driving market growth. The rising preference for lightweight, cost-effective, and high-performance films in e-commerce and consumer goods packaging has solidified BOPP’s dominance, making it the most widely used material in the adhesive film industry.

By Application

Tapes application dominated the adhesive films market in 2023, holding a 41.2% market share. The growth of adhesive tapes is primarily driven by their versatility, ease of application, and strong bonding properties, making them a superior alternative to mechanical fasteners and liquid adhesives. The Pressure Sensitive Tape Council (PSTC) highlights the increasing adoption of adhesive tapes in industrial, automotive, construction, and medical applications due to their lightweight nature and ability to bond diverse materials. In the automotive sector, adhesive tapes are replacing traditional fasteners for trim attachment, wire harnessing, and noise reduction, with companies like tesa SE and 3M launching advanced high-strength automotive tapes. Furthermore, the construction industry is utilizing adhesive films for window sealing, flooring applications, and HVAC systems, driving further demand. In healthcare, medical-grade adhesive films are essential in wound care and wearable medical devices. The rising preference for low-VOC, solvent-free, and biodegradable adhesive tapes aligns with government sustainability regulations, ensuring continued growth for this segment in the adhesive film market.

By End-use Industry

The packaging industry dominated the adhesive film market in 2023, accounting for 46.8% of the total market share. The increasing need for high-performance, lightweight, and flexible packaging solutions has significantly driven demand for adhesive films in food, pharmaceutical, and consumer goods packaging. According to the Flexible Packaging Association (FPA), the rise of e-commerce, on-the-go consumption, and sustainable packaging initiatives has led to widespread adoption of adhesive films in labels, pouches, and resealable packaging. Additionally, tamper-evident and security packaging requirements in pharmaceuticals and food safety regulations have further accelerated market growth. The U.S. Plastics Pact’s push for recyclable and biodegradable packaging has encouraged manufacturers to develop eco-friendly adhesive films. Major industry players, including Avery Dennison and Amcor, are investing in biodegradable, compostable, and water-based adhesive film solutions to meet evolving sustainability demands. The growing preference for resealable, transparent, and lightweight packaging in consumer goods has reinforced the packaging sector’s dominance, ensuring it remains the leading end-use industry for adhesive films.

Adhesive Films Market Regional Outlook

Asia Pacific dominated the adhesive film market in 2023, holding a market share of 42.6%. The region's dominance is driven by rapid industrialization, booming e-commerce, and high demand for flexible packaging, electronics, and automotive applications. Countries like China, India, and Japan play a pivotal role due to their strong manufacturing capabilities, low production costs, and expanding end-use industries. China, the largest contributor, benefits from its extensive packaging industry, which accounts for over 50% of the region’s adhesive film demand, as per the China Packaging Federation. The country’s thriving electronics and automotive sectors further boost demand. India, witnessing a 12.5% annual growth in e-commerce sales, is rapidly expanding its flexible packaging sector, supported by investments from companies like Uflex and Cosmo Films. Meanwhile, Japan leads in high-performance adhesive films for medical, automotive, and semiconductor applications, with firms like Nitto Denko and Lintec Corporation innovating sustainable solutions. The Asia Pacific region's dominance is further fueled by government policies promoting sustainable and recyclable adhesive films, ensuring continued market leadership.

North America emerged as the fastest-growing region in the adhesive film market during the forecast period of 2024 to 2032 with a significant growth rate. The region's rapid growth is driven by increased adoption of sustainable adhesive films, rising demand from the automotive and medical industries, and advancements in pressure-sensitive adhesives. The United States dominates the North American market, accounting for over 70% of regional demand, fueled by the strong presence of key manufacturers like 3M, Avery Dennison, and Scapa Group. The Biden Administration’s focus on sustainability has accelerated the shift towards eco-friendly, solvent-free, and biodegradable adhesive films, aligning with the U.S. Plastics Pact’s 2025 sustainability goals. Canada is witnessing growth in construction and aerospace industries, where adhesive films are increasingly used in thermal insulation and structural bonding applications. Mexico, benefiting from the nearshoring trend, has seen a 15% increase in adhesive film demand due to rising automotive production, with companies like Flex Films expanding operations. The region’s emphasis on advanced adhesive technologies and regulatory support for low-VOC adhesives positions North America as the fastest-growing market in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Ajinomoto Co., Inc. (IMP, GMP, Disodium 5'-RiboAdhesive Films)

-

Biorigin (Adhesive Films Yeast Extract, RNA-rich Yeast Extract)

-

Biosynth Ltd. (Cytidine Monophosphate, Uridine Monophosphate)

-

CJ CheilJedang Corp. (5'-IMP, 5'-GMP, RiboAdhesive Films Mixtures)

-

Daesang Corporation (Disodium 5'-RiboAdhesive Films, Yeast Extract Adhesive Filmss)

-

DSM Nutritional Products Ltd. (Purine Adhesive Filmss, Pyrimidine Adhesive Filmss)

-

F. Hoffmann-La Roche Ltd. (Research-grade Adhesive Filmss, Synthetic Adhesive Filmss)

-

Jena Bioscience GmbH (ATP Disodium Salt, CTP Sodium Salt)

-

Lallemand Inc. (Yeast RNA, Adhesive Films-rich Yeast Extract)

-

MEIHUA HOLDINGS GROUP CO., LTD. (5'-IMP, 5'-GMP, Yeast-derived Adhesive Filmss)

-

Merck KGaA (Adenosine Monophosphate, Guanosine Monophosphate, Adhesive Films Solutions)

-

Meridian Bioscience, Inc. (dNTP Mix, PCR-grade Adhesive Filmss)

-

New England Biolabs Inc. (dNTP Set, Modified Adhesive Filmss)

-

Ohly GmbH (RNA Yeast Extract, 5'-Adhesive Filmss)

-

Promega Corporation (dNTP Mix, ATP Solution, Adhesive Films Triphosphates)

-

Prosol S.p.A. (Yeast-derived Adhesive Filmss, Free Adhesive Filmss)

-

Star Lake Bioscience (5'-IMP, 5'-GMP, Disodium 5'-RiboAdhesive Films)

-

Thermo Fisher Scientific Inc. (dNTP Mix, Adhesive Films Triphosphates, RNA Adhesive Filmss)

-

Tianjin Zhongrui Pharmaceutical Co., Ltd. (Disodium 5'-GMP, Disodium 5'-IMP)

-

Zhejiang Yaofi Bio-Tech Co., Ltd. (5'-IMP, 5'-UMP, RiboAdhesive Filmss)

Recent Developments

-

July 2024: German startup Phytonics launched a self-adhesive film to reduce glare on PV modules. Featuring bionic microstructures, the film enhances light absorption and durability against UV, moisture, and hail. It is available in rolls or sheets at €70 per module.

-

August 2023: Park Aerospace Corp. introduced AeroAdhere FAE-350-1, a high-strength structural film adhesive for aerospace applications. Designed for bonding metals and composites, it meets industry standards for durability under extreme conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 19.30 Billion |

| Market Size by 2032 | USD 30.64 Billion |

| CAGR | CAGR of 5.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Acrylic, Rubber, Silicone, Others) •By Film Material (Bi-axially Oriented Polypropylene (BOPP), Polyethylene (PE), Polyvinyl Chloride (PVC), Polyamide (PA), Others) •By Application (Labels, Tapes, Envelops, Bags & pouches, Graphic films, Others) •By End-use Industry (Packaging, Construction, Transportation, Electrical & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Avery Dennison Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, Nitto Denko Corporation, Toray Industries / Toray Advanced Composites, Cosmo Films, Mondi Group, CCL Industries, Constantia Flexibles and other key players |