Color Cosmetics Market Size & Overview:

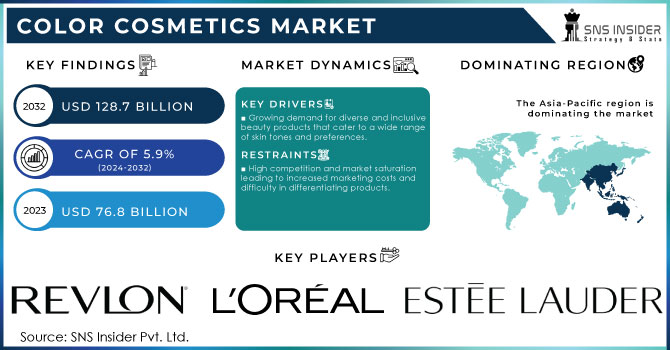

The Color Cosmetics Market Size was valued at USD 81.33 billion in 2024, and is expected to reach USD 128.65 billion by 2032, and grow at a CAGR of 5.9% over the forecast period 2025-2032.

The Color Cosmetics market has been very dynamic in terms of growth and development lately because the level of interest from consumers in beauty and self-expression has increased rapidly. Color cosmetics consist of lipstick, foundation, eye shadow, and blush-on-colors all applied to brighten up the skin and enhance the look. The market is swelling, with a spate of innovations by beauty brands in terms of formulae and shade diversity, to meet every whim of every consumer, recent reports show.

Recent trends in the industry have indicated a movement towards inclusivity and personalization. Enterprises are consequently increasingly investing in product line expansion to a wide range of shades that could suit various skin tones and even individual preferences. For example, brands like WOW Skin Science enter the rising demand among younger consumers by releasing new lines of makeup brand Color Cupid-designed with only Gen Z consumers in mind. Such a trend justifies the commitment of the industry to diverse needs and preferences on the customer side.

Moreover, the market is also driven by an upsurge in digital platforms and social media that have become key channels for marketing and engaging consumers. The easy accessibility of beauty content online, along with influences from popular beauty influencers and makeup artists, accelerates growth in color cosmetics since most consumers are keen to stay updated on the latest trends and products. This is mirrored in the increased prominence of color cosmetics on e-retail sites and on social media, where businesses use these avenues to maximum effect for reach and impact.

Get E-PDF Sample Report on Color Cosmetics Market - Request Sample Report

Color Cosmetics Market Size and Forecast:

-

Market Size in 2024: USD 81.33 Billion

-

Market Size by 2032: USD 128.65 Billion

-

CAGR: 5.9% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Color Cosmetics Market Highlights:

-

Rising demand for inclusive beauty with brands like MAC, Urban Decay, and E.l.f. Cosmetics expanding shade ranges to cater to diverse skin tones

-

Eco-friendly and sustainable trends leading brands such as BareMinerals and Tarte Cosmetics to adopt green formulations and packaging

-

Influence of social media and beauty influencers on platforms like Instagram and TikTok driving trends and boosting consumer engagement

-

High competition and market saturation increasing marketing costs and making product differentiation challenging for brands like L’Oréal, Revlon, and Maybelline

-

Innovation as a key differentiator through new formulations, packaging, and shade ranges to stand out in a crowded market

-

Premiumization and ethical consumerism shaping consumer preference for high-quality, sustainable, and ethically produced products

-

Dynamic market growth opportunities arise from the combination of inclusivity, sustainability, and social media influence, allowing brands to capture emerging consumer segments

Another fast-evolving trend in the Color Cosmetics market is eco-friendly consumerism and sustainability. Companies embracing environmentally friendly formulation and packaging have encouraged increased realization among consumers in respect of the ecological footprint of their buying decisions. More companies go green through sustainability by choosing eco-friendly ingredients in their products and packaging. All of these are tied to consumers' demands for products that are in line with their values for a sustainable future. This new perspective reflects an overall increased momentum toward integrating ethical perspectives into the beauty world that might shape the trajectory of the sector in the forecast period.

Color Cosmetics Market Drivers:

-

Growing demand for diverse and inclusive beauty products that cater to a wide range of skin tones and preferences.

The demand for inclusivity and diversity in the products coming alive within beauty products has made a huge difference in the Color Cosmetics market, where companies increase their positioning with the capability of offering product offerings that can cater to a wide array of skin tones and preferences. In reaction, MAC Cosmetics extended its Studio Fix Fluid Foundation line with an additional 30 shades back in March 2023 to keep up with this increasingly growing trend. The move came after the company's years-long climb toward inclusiveness first started in the early 2000s with its initial diverse shade range. Similarly, in August 2023, Urban Decay launched the Stay Naked range of differently pigmented concealers and foundations developed for a wide range of skin tones and undertones. The launch was quite strategic, showcasing real models of diversity and claiming that the brand is out to represent all skin types. Later, in November 2023, E.l.f. Cosmetics launched a line of color correctors and highlighters targeted at several skin tones and preferences. This range will include different shades to suit various skin concerns and undertones, hence reaffirming this brand's commitment to becoming more inclusive and accessible. These examples show how the color cosmetics industry is reacting positively and actively to consumer demand for more inclusive products that would give options to more types of individual needs, serving as a strong driver toward new beauty standards.

-

Increased influence of social media and beauty influencers driving consumer interest in the latest color cosmetics trends.

Increased influence from social media and beauty influencers has shaped consumer interest in the latest color cosmetics trends, and the market is nothing short of fast-paced. June 2023 saw Huda Beauty tap into its partnership with popular beauty influencers on Instagram and TikTok to launch its "Glowish" collection, a line of luminous foundations and blushes aiming to appeal to the trend of radiant dewy skin. This campaign featured viral beauty influencers NikkieTutorials and James Charles. Their immense social media footprint helped ensure buzz and immediate consumer engagement for the new collection. Similarly, in February 2024, Anastasia Beverly Hills introduced a new line of eyeshadow palettes in collaboration with the popular TikTok star Charli D'Amelio, leveraging her large number of followers to drive excitement and influence shopping behavior. This collaboration brought front-row seats to exclusive previews, with live tutorials displaying the versatility of the new shades while tapping into one of today's hottest trends: bold, experimental eye looks. Specific examples like this show how social media platforms and beauty influencers are becoming essential in color cosmetics trend-setting, with brands increasingly leveraging such digital avenues to reach a wide audience, build buzz, and drive consumer demand for their newest products. This interaction between influential and led individuals rapidly accelerates the trends that increase the beauty industry visibility factor, making it one of the most dynamic and responsive areas of the marketplace.

Color Cosmetics Market Restraints:

-

High competition and market saturation leading to increased marketing costs and difficulty in differentiating products.

The Color Cosmetics market is influenced by high competition and market saturation, which consequently increase marketing costs and make differentiation very challenging. For example, Maybelline launched a new line of matte lipsticks onto a highly competitive market in January 2024 where similar products from well-established companies like L'Oréal and Revlon were already at the center. That means Maybelline had to invest high into its marketing to make her products stand out among high-profile adverts and through partnering with many influencers. The saturation made the new product hard to differentiate and underscored the broader industry challenge of brands having to invest heavily in marketing and innovation to carve a competitive edge. This competitive environment raises not only the costs but also positions at a strategic level the need for constant innovation to grasp the consumer's attention within an increasingly crowded marketplace.

Color Cosmetics Market Opportunities:

-

Rising consumer preference for eco-friendly and sustainable beauty products, offering a chance for brands to innovate with green formulations.

The growing trend of consumer preference for green and sustainable beauty products opens a wide opportunity for the Color Cosmetics market to innovate with green formulations. BareMinerals followed suit in March 2024 with its latest collection, Clean Glow, comprising foundations and blushes in fully recyclable packaging and containing natural and responsibly sourced ingredients. This move goes with the growing demand for 'green' products. After all, consumers are seeking brands that ring in sustainability. Similarly, in October 2023, Tarte Cosmetics introduced its Eco-Friendly line of eyeshadows and lipsticks in biodegradable packaging, adding organics and vegan elements. This initiative showcases the brand's response to the shifting tide of consumer expectation toward greener choices, allowing them to recruit the eco-conscious shopper while setting the industry benchmark for sustainable beauty. These examples illustrate how embracing eco-friendly practices can offer brands a competitive advantage and align with evolving consumer values in the color cosmetics market.

Color Cosmetics Market Segment Analysis:

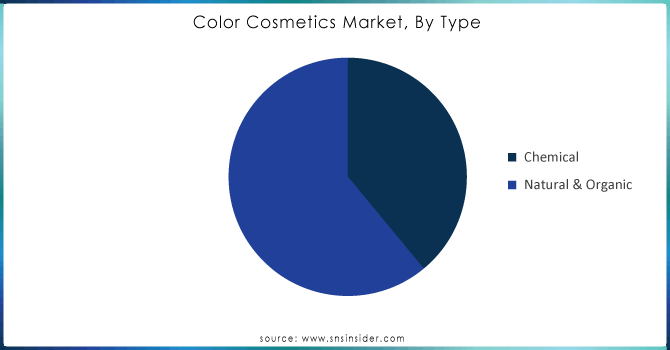

By Type

In 2024, Natural & Organic dominated the color cosmetics market, holding an estimated market share of about 60%. This leading position signifies the increasing trend among consumers toward naturally and organically formulated products, as more consumers become aware of the possible negative impact of synthetic chemicals on human life and the demand for ethical and more sustainable beauty solutions. For example, in August 2023, Juice Beauty continued to lead the way with its organic formulations and marked a huge surge in sales with its new line of eco-friendly foundations and lipsticks, which resonated with the increasing demand for natural beauty products. Similarly, RMS Beauty, in November 2023, expanded its range relating to organic color cosmetics, hence underlining the shift toward natural ingredients within the market. This growth is indicative of a wider trend within the consumer market for cleaner, greener beauty products; thus, it hands the Natural & Organic segment a formidable lead ahead of the competition.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Product Type

Facial Makeup segment dominated and accounted for a substantial market share of about 40% in the Color Cosmetics market. The leading position that facial makeup holds is attributed to the high demand on the part of consumers for these products; in particular, foundation, concealer, and powder, among others, that form the necessities of everyday beauty and usually serve as the base for other makeup applications. For instance, in March 2023, Estee Lauder launched its new Double Wear Stay-in-Place foundation, which had incredibly high attention and strong sales, hence indicating sustained demand by consumers for facial makeup high-performance products. In September 2023, Maybelline's extended complexion product range, including the popular Super Stay range of products, also contributed to the segment's dominance through the satisfaction of consumer needs for long-lasting effective facial makeup solutions. This strong demand underlines the important role that facial makeup plays within the color cosmetics market, consequently driving it to hold a considerable market share.

By Form

In 2024, the Powder segment of Color Cosmetics dominated the market, accounting for approximately 45% of the market share. This leading position reflects the enduring popularity of powder-based products, such as foundations, blushes, and setting powders, for versatility and ease in application on varied skin types and preferences. For example, Clinique launched its new Even Better Refresh Hydrating and Repairing Powder Foundation in June 2023, which had high interest among consumers and was selling well. Likewise, in October 2023, Laura Mercier launched its Translucent Loose Setting Powder, remaining a bestseller and proving the demand for powder products. Its growth is attributed to the fact that consumers have an urge for the light texture and matte finish offered by powder products. This is highly responsible for powders taking a better lead within the market.

By Distribution Channel

The e-commerce segment dominated the Color Cosmetics market with a revenue share of around 50%. Online shopping has highly influenced the e-commerce sector to reach easily because consumers feel very comfortable purchasing color cosmetics from their homes and even view a wider product range. For instance, Sephora announced that the firm witnessed a significant rise in its online sales in May 2023 owing to a better online platform and exclusive online deals. Similarly, the Ulta Beauty e-commerce platform marked good growth on the back of rising online shopping trends along with direct-to-consumer sales methods in August 2023. This dominance reflects the movement in consumer behavior towards digital shopping channels, which has been characterized by broad choice, ease of price comparison, and the convenience of home delivery.

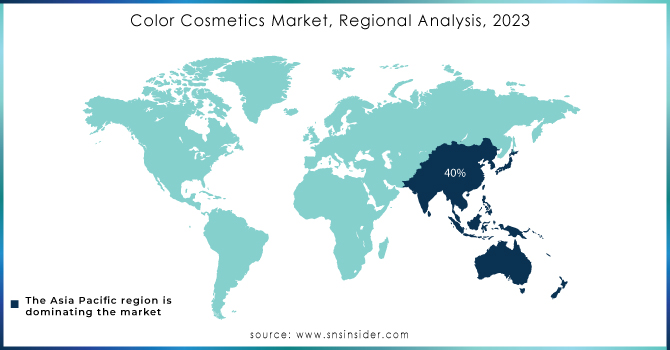

Color Cosmetics Market Regional Analysis:

Asia-Pacific Color Cosmetics Market Trends:

In 2024, the Asia Pacific region dominated the Color Cosmetics market with an estimated market share of about 40%. This is attributed to the large and diverse consumer base, rapid urbanization, and growing middle class in the region that have driven demand for beauty and personal care products significantly. For example, South Korean beauty brand Laneige said in July 2023 that sales across Asia have strongly risen on the back of growing demand for its innovative skincare and color cosmetics. Similarly, in October 2023, it was noticed that China's booming e-commerce market was driving up color cosmetics, wherein both domestic and international brands benefited from the high online shopping penetration. A laden beauty culture of the region, coupled with rising disposable incomes and a trend toward premium and diverse beauty products, consolidates the position of Asia Pacific as the leading market for color cosmetics.

North America Color Cosmetics Market Trends:

North America accounted for a significant share of the color cosmetics market in 2024, driven by high consumer awareness, strong brand loyalty, and demand for premium and innovative products. The U.S. market, in particular, saw growth in indie and clean beauty brands, with digital marketing and social media influencing consumer preferences. For instance, brands like Fenty Beauty and Glossier expanded their presence through online platforms, boosting sales. Rising disposable incomes, coupled with a focus on personal expression and diversity in beauty, supports steady market growth in this region.

Europe Color Cosmetics Market Trends:

Europe held a substantial market share in 2024, fueled by established beauty markets such as France, Germany, and the UK. Consumers increasingly prefer high-quality, sustainable, and ethically produced color cosmetics. Luxury and heritage brands continue to dominate, while demand for natural and organic products rises. The region also benefits from mature retail infrastructure and high digital adoption for online purchases. Trends like personalization, inclusivity, and premiumization are key drivers for color cosmetics in Europe.

Latin America Color Cosmetics Market Trends:

Latin America’s color cosmetics market in 2024 showed steady growth, supported by increasing urbanization, rising disposable incomes, and a young population keen on beauty trends. Countries such as Brazil and Mexico led demand for vibrant and diverse product offerings. Social media influencers and digital campaigns play a strong role in shaping consumer preferences. Local and international brands are expanding through e-commerce and retail channels, making the market increasingly competitive and dynamic.

Middle East & Africa Color Cosmetics Market Trends:

In 2024, the Middle East & Africa region experienced growing demand for color cosmetics, driven by rising disposable incomes, fashion-conscious consumers, and a young demographic. Markets in the UAE, Saudi Arabia, and South Africa show increased adoption of international and premium brands. The influence of social media, beauty tutorials, and luxury shopping experiences contributes to market expansion. Additionally, a trend toward halal-certified and skincare-integrated cosmetics is gaining momentum in the region.

Color Cosmetics Market Key Players:

-

L’Oréal Group

-

Shiseido Company, Ltd.

-

The Estée Lauder Companies Inc.

-

Coty Inc.

-

Unilever N.V.

-

Kryolan Professional Make-Up

-

Ciaté London

-

Avon Products, Inc.

-

Mary Kay Inc.

-

Beiersdorf AG

-

Amorepacific Corporation

-

Oriflame Cosmetics

-

Kose Corporation

-

Johnson & Johnson (Beauty Division)

-

LG Household & Health Care Ltd.

-

Glossier, Inc.

-

Clarins Group

-

Yves Rocher

Color Cosmetics Market Competitive Landscape:

Honasa Consumer Pvt. Ltd., founded in 2016 by Varun and Ghazal Alagh, is a leading digital-first beauty and personal care company in India. Its flagship brand, Mamaearth, offers toxin-free products, while its diverse portfolio includes The Derma Co., Aqualogica, BBlunt, Dr. Sheth’s, and Ayuga. Honasa emphasizes innovation, sustainability, and a consumer-first approach to meet evolving beauty needs.

-

April 2024: Honasa Consumer Pvt. Ltd., known for Mamaearth, launched its new color cosmetics brand, Staze, marking its entry into the color cosmetics market.

BO International Pvt. Ltd. is a leading Indian contract manufacturer specializing in personal care and cosmetic products. Established in 2016 and headquartered in Gurugram, Haryana, the company offers a wide range of services including private label and third-party manufacturing for skincare, haircare, color cosmetics, and essential oils. BO International is ISO 22716 certified, ensuring adherence to global quality standards. Their state-of-the-art facilities feature automatic tube and bottle filling lines, catering to both domestic and international clients. The company is led by Aayush Gupta and Nitika Aggarwal

-

February 2023: BO International launched a new color cosmetics range for private labeling, allowing other brands to utilize their high-quality products for various market needs.

Avon Products, Inc. is a renowned global beauty company founded in 1886 by David H. McConnell in New York City. Initially known as the California Perfume Company, it pioneered direct selling and became a leading cosmetics brand worldwide. In 2020, Brazilian beauty conglomerate Natura & Co acquired Avon, integrating it into a portfolio that includes Natura, Aesop, and The Body Shop, forming the world's fourth-largest pure-play beauty company. Despite the acquisition, Avon continues to operate independently in North America under the name "The Avon Company," while its international operations are managed separately. In August 2024, Avon Products, Inc. filed for Chapter 11 bankruptcy in the U.S. to address over $1.3 billion in debt and numerous lawsuits related to talc-based products

-

November 2023: Avon Products, Inc. opened its first store in the UK, displaying over 150 products. It introduced 'mini beauty boutiques' in local communities to capture the middle-income group of customers.

Unilever PLC is a British-Dutch multinational consumer goods company headquartered in London and Rotterdam. Established in 1929 through the merger of Lever Brothers and Margarine Unie, Unilever is one of the world's largest consumer goods firms, offering products in over 190 countries. Its portfolio includes more than 400 brands across categories such as beauty & personal care, home care, nutrition, and ice cream. In 2024, the company reported a revenue of €60.8 billion, with 58% generated from emerging markets. Unilever employs approximately 128,000 people globally and serves 3.4 billion consumers daily

-

December 2023: Unilever has acquired K18, a hair care brand anchored by its biotech-based research, with the view to strengthen its portfolio of premium hair care offerings with a solution to repair hair damage.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 81.33 Billion |

| Market Size by 2032 | USD 128.65 Billion |

| CAGR | CAGR of 5.9% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Chemical, Natural & Organic) •By Product Type (Nail Products, Facial Makeup, Eye Makeup, Lip Products, Hair Colour Products, Special Effects Products) •By Form (Powder, Spray, Crème, Gel) •By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Direct Selling, e-Commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Revlon, Inc., L’Oréal Group, Shiseido Company, Ltd., The Estée Lauder Companies Inc., Coty Inc., Unilever N.V., Kryolan Professional Make-Up, Chantecaille Beaute Inc., Ciaté London, Avon Products, Inc., Mary Kay Inc., Beiersdorf AG, Amorepacific Corporation, Oriflame Cosmetics, Kose Corporation, Johnson & Johnson (Beauty Division), LG Household & Health Care Ltd., Glossier, Inc., Clarins Group, Yves Rocher |