Liquid Biopsy Market Size & Overview:

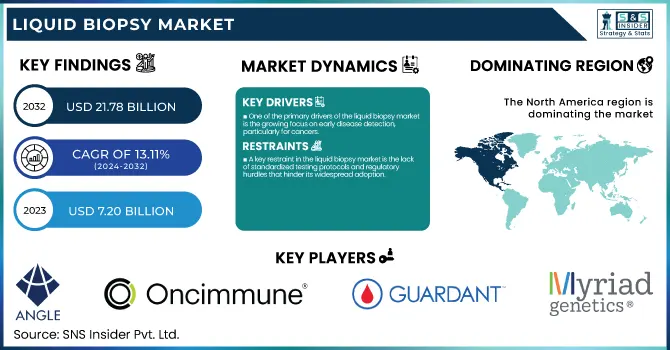

The Liquid Biopsy Market size is projected to grow from USD 7.20 billion in 2023 to USD 21.78 billion by 2032, at a CAGR of 13.11% during the forecast period of 2024–2032.

To Get more information on Liquid Biopsy Market- Request Free Sample Report

The liquid biopsy market is transforming the diagnostic landscape by offering a minimally invasive approach to disease detection and monitoring. This technology analyzes circulating biomarkers, including circulating tumor cells, cell-free DNA, and exosomes, from bodily fluids such as blood, urine, and saliva. Unlike traditional tissue biopsies, liquid biopsies allow real-time monitoring, early detection, and personalized treatment interventions, especially in oncology.

The increasing global cancer burden highlights the critical need for innovative diagnostics. According to the World Health Organization, cancer caused approximately 10 million deaths in 2020, with breast, lung, and colorectal cancers being the most prevalent. Studies show that liquid biopsy tests, such as those analyzing EGFR mutations in non-small cell lung cancer, achieve sensitivity rates exceeding 85% and are increasingly used to guide targeted therapy decisions.

The adoption of liquid biopsy in early cancer detection is gaining momentum. For example, Grail’s Galleri test can detect over 50 types of cancer from a single blood draw, with studies reporting a specificity of 99.5% and the ability to identify cancers that are traditionally challenging to diagnose. Similarly, Guardant360 is widely used for comprehensive genomic profiling, enabling oncologists to select appropriate therapies with greater precision.

Beyond oncology, liquid biopsy applications are expanding into prenatal testing and organ transplant monitoring. Natera’s Panorama test has proven effective in detecting chromosomal abnormalities during pregnancy, with an accuracy exceeding 99%. In organ transplantation, donor-derived cfDNA analysis is becoming the gold standard for detecting early signs of organ rejection, with studies showing detection rates of up to 91% for kidney transplant patients. Furthermore, liquid biopsy is proving vital for monitoring minimal residual disease. Research published demonstrated that ctDNA analysis in colorectal cancer could predict recurrence with 89% accuracy, months before it becomes clinically detectable through imaging.

The rise of collaborative initiatives such as the BloodPAC consortium aims to standardize biomarker analysis and improve clinical utility. Additionally, advancements in next-generation sequencing technology have made multi-gene panels possible, improving detection rates for rare mutations, as seen in recent trials for BRCA1/2 mutations in ovarian cancer.

Liquid Biopsy Market Dynamics

Drivers

-

One of the primary drivers of the liquid biopsy market is the growing focus on early disease detection, particularly for cancers.

Traditional diagnostic methods often involve invasive procedures, but liquid biopsy offers a non-invasive alternative, enabling the detection of cancers at early stages. This allows for more timely interventions, improving survival rates and reducing overall healthcare costs. Liquid biopsy tests can identify biomarkers from bodily fluids, offering a less painful, quicker, and more accessible solution for patients. This shift towards early detection has led to increased interest in liquid biopsy technologies as they enable proactive disease management, especially in oncology, where early intervention significantly impacts treatment success. The ability to detect a wide range of cancers with a single test further supports the widespread adoption of liquid biopsy in clinical practice.

-

Advancements in Genomic and Molecular Technologies

Technological innovations, especially in next-generation sequencing (NGS) and molecular biology, have significantly improved the sensitivity and accuracy of liquid biopsy tests. These advancements enable the detection of rare mutations and genetic alterations at very low concentrations, enhancing the precision of cancer diagnosis and monitoring. Liquid biopsies are now able to detect minimal residual disease (MRD) and monitor disease progression or recurrence, offering clinicians valuable insights for treatment planning. Furthermore, advancements in bioinformatics and machine learning algorithms have improved the ability to interpret complex genomic data, making liquid biopsy a more reliable tool for personalized medicine. These technological strides are not only expanding the scope of liquid biopsy applications but also enhancing the overall diagnostic process by providing more detailed and actionable information for clinicians.

-

Rise of Personalized Medicine and Precision Therapies

The rise of personalized medicine is a significant driver for the liquid biopsy market, as these tests are critical for tailoring treatment plans to individual patients. By identifying specific genetic mutations and actionable biomarkers through liquid biopsy, healthcare providers can select therapies that are more effective for the patient's unique genetic profile. This approach is particularly beneficial in oncology, where liquid biopsy is used to determine the best course of action based on the tumor’s genetic makeup. Additionally, the growing emphasis on precision medicine has been supported by the increased availability of liquid biopsy tests, enabling clinicians to move beyond one-size-fits-all treatments. The ability to monitor treatment response and detect minimal residual disease in real time also empowers healthcare professionals to adjust treatment plans swiftly, improving outcomes for patients. As precision medicine continues to evolve, liquid biopsy plays a key role in driving more personalized and effective healthcare.

Restraints

-

A key restraint in the liquid biopsy market is the lack of standardized testing protocols and regulatory hurdles that hinder its widespread adoption.

While liquid biopsy shows promise, inconsistencies in test accuracy, sensitivity, and reproducibility across different platforms and applications have raised concerns. The absence of universally accepted guidelines for sample collection, processing, and analysis further complicates its integration into routine clinical practice. Regulatory approval for liquid biopsy tests also remains a significant challenge, as regulatory bodies, such as the FDA, require robust clinical evidence demonstrating the tests' safety, reliability, and efficacy before approval. These factors contribute to delays in the commercial availability of liquid biopsy products and restrict their use to a limited number of clinical settings. Additionally, the high costs associated with developing and validating liquid biopsy tests pose financial barriers, slowing down adoption in resource-constrained regions.

Liquid Biopsy Market Segmentation Insights

By Product

The instruments segment in the liquid biopsy market dominated in 2023, accounting for a 47.1% share of the liquid biopsy market. This dominance can be attributed to the essential role that advanced instruments play in the accuracy and efficiency of liquid biopsy testing. Key instruments used in liquid biopsy include next-generation sequencing systems, PCR machines, and microarray platforms. These instruments are critical for the extraction, detection, and analysis of genetic material such as DNA and RNA from blood, urine, or other bodily fluids.

Kits and reagents, a crucial product category within the consumables segment, are expected to be the fastest-growing segment in the liquid biopsy market. This growth is fueled by the rising adoption of liquid biopsy as a non-invasive diagnostic tool, particularly for cancer detection and monitoring. Kits and reagents are integral to the liquid biopsy process, as they are responsible for extracting, purifying, and analyzing DNA or RNA from liquid samples. The need for high-quality, reliable reagents is paramount in ensuring accurate results, and as the liquid biopsy market expands, the demand for advanced kits and reagents is increasing.

By Technology

In 2023, the multi-gene parallel analysis (NGS) segment dominated the liquid biopsy market, holding 76.1% revenue share. NGS technology allows for the simultaneous analysis of multiple genes, which is essential for comprehensive genetic testing, particularly in oncology. The high demand for NGS is driven by its ability to identify a wide range of genetic mutations across various types of cancer, enabling early diagnosis, treatment planning, and personalized medicine. NGS platforms offer exceptional sensitivity and accuracy in detecting rare mutations, which is critical for determining appropriate targeted therapies.

The single gene analysis segment, particularly PCR microarrays, is anticipated to exhibit significant growth during the forecast period. Although it currently holds a smaller share of the market compared to NGS, PCR microarrays are gaining traction due to their cost-effectiveness and the ability to target specific mutations in genes such as EGFR, KRAS, and BRAF, which are commonly associated with various cancers. PCR microarrays are widely used for detecting mutations in specific genes, making them a valuable tool for targeted therapy and personalized treatment strategies. Their ability to provide rapid results with high specificity is particularly beneficial in clinical settings where timely decision-making is crucial.

Liquid Biopsy Market Regional Analysis

North America commanded the largest share of the liquid biopsy market with 52.3% share, driven by its advanced healthcare system, widespread adoption of cutting-edge diagnostic technologies, and a strong emphasis on personalized medicine. The United States is particularly influential in this growth due to substantial investments in research and development, strong regulatory support from the FDA, and the presence of key industry players. Additionally, the rising use of liquid biopsy tests in oncology diagnostics is a significant contributor to the region’s market dominance.

Asia Pacific is projected to experience the fastest growth in the liquid biopsy market during the forecast period. Nations such as China and Japan are leading the charge, spurred by investments in healthcare infrastructure, a large and aging population, and the rising incidence of cancer. The growing demand for affordable, non-invasive diagnostic options in developing countries further accelerates market growth in this region. The combination of these factors is expected to drive significant advancements in liquid biopsy adoption and usage across Asia Pacific, positioning the region as a key player in the global market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Liquid Biopsy Comapnies

-

ANGLE plc – PARSORTIX

-

Oncimmune Holdings PLC – ImmunoINSIGHT

-

Guardant Health – Guardant360

-

Myriad Genetics, Inc. – myChoice CDx

-

Biocept, Inc. – Target Selector

-

Lucence Health Inc. – LiquidHALLMARK

-

Freenome Holdings, Inc. – Freenome Liquid Biopsy Platform

-

F. Hoffmann-La Roche Ltd. – Cobas EGFR Mutation Test v2

-

QIAGEN – QIAseq Targeted DNA Panels

-

Illumina, Inc. – NextSeq and MiSeq Systems

-

Thermo Fisher Scientific, Inc. – Oncomine Target Test

-

Epigenomics AG – Epi proColon

-

Natera, Inc. – Signatera

Recent Developments in Liquid Biopsy Market

In Jan 2025, Oxford Cancer Analytics secured USD 11 million in Series A funding to advance early lung cancer detection and facilitate curative treatments. Additionally, Dr. Heinrich Roder, a specialist in lung cancer proteomics liquid biopsy, has been appointed as Senior Vice President of Research and Development at OXcan.

In Jan 2025, Mayo Clinic Laboratories partnered with oncology diagnostics company Lucence to broaden global access to Lucence's LiquidHallmark liquid biopsy technology. This collaboration will allow Mayo Clinic Laboratories to offer Lucence's liquid biopsy solutions to international markets.

In Aug 2024, Guardant Health Japan received regulatory approval for its Guardant360 CDx liquid biopsy as a companion diagnostic for amivantamab-vmjw. This approval enables the identification of patients with inoperable or recurrent non-small cell lung cancer (NSCLC) harboring EGFR exon 20 insertion mutations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.20 Billion |

| Market Size by 2032 | USD 21.78 Billion |

| CAGR | CAGR of 13.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Consumables Kits, and Reagents, Software, and Services) • By Technology (Multi-gene-parallel Analysis (NGS), Single Gene Analysis (PCR Microarrays)) • By Sample Type (Blood Sample, Others) • By Biomarker (Circulating Tumor Cells (CTCs), Circulating Nucleic Acids, Exosomes/ Microvesicles, Circulating Proteins) • By Application (Cancer, Reproductive Health, Others) • By Clinical Application (Therapy Selection, Treatment Monitoring, Early Cancer Screening, Recurrence Monitoring, Others) • By End-use (Hospitals and Laboratories, Specialty Clinics, Academic and Research Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Moderna, Inc., Pfizer, BioNTech SE, CureVac N.V., Arcturus Therapeutics, Sanofi, Genentech (Roche), Vaxart, eTheRNA immunotherapies, GSK (GlaxoSmithKline), Helmholtz Center for Infection Research (HZI). |

| Key Drivers | • One of the primary drivers of the liquid biopsy market is the growing focus on early disease detection, particularly for cancers. • Advancements in Genomic and Molecular Technologies • Rise of Personalized Medicine and Precision Therapies |

| Restraints | • A key restraint in the liquid biopsy market is the lack of standardized testing protocols and regulatory hurdles that hinder its widespread adoption. |