Commercial Insurance Market Report Scope & Overview:

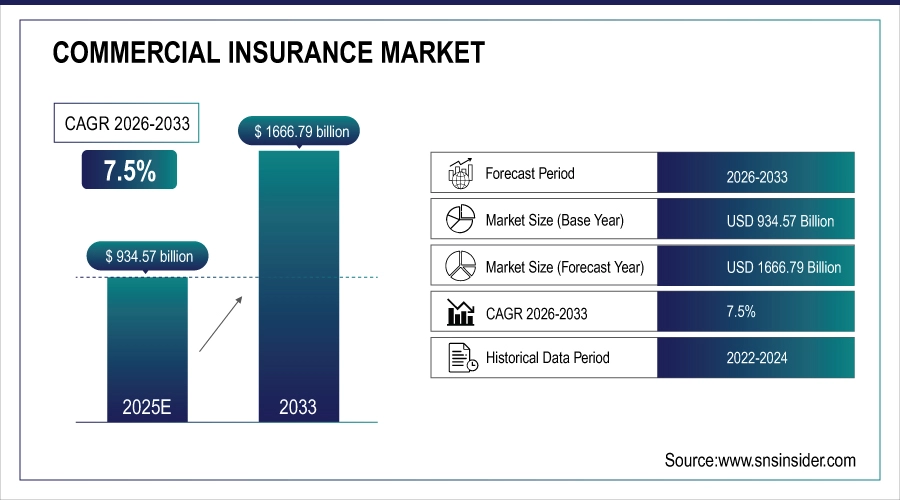

The Commercial Insurance Market was valued at USD 934.57 billion in 2025E and is expected to reach USD 1666.79 billion by 2033, growing at a CAGR of 7.5% from 2026-2033.

The Commercial Insurance Market is crucial for mitigating risks across industries such as construction, healthcare, manufacturing, and logistics. Rising awareness of risk exposure and regulatory demands is driving investments in customized insurance solutions. The market is rapidly adopting digital platforms, enabling real-time policy issuance and claims processing. Technologies like AI, blockchain, and big data are enhancing underwriting accuracy and fraud prevention. Increased digital access is boosting SME participation, while insurers focus on industry-specific products to address threats like cyberattacks and climate change. This evolution is shifting the market from traditional practices to tech-driven, customer-centric, and efficient insurance ecosystems.

Market Size and Forecast

-

Market Size in 2025E: USD 934.57 Billion

-

Market Size by 2033: USD 1666.79 Billion

-

CAGR: 7.5% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Commercial Insurance Market - Request Free Sample Report

Commercial Insurance Market Trends

-

Rising business risks and growing awareness of liability coverage are driving the commercial insurance market.

-

Increasing adoption of digital platforms and AI-driven underwriting is enhancing policy management and claims processing.

-

Expansion of SMEs, large enterprises, and multinational corporations is boosting demand for tailored insurance solutions.

-

Growing focus on risk mitigation, regulatory compliance, and business continuity is shaping market trends.

-

Integration of telematics, IoT, and analytics is improving risk assessment and fraud detection.

-

Rising exposure to cyber threats, natural disasters, and supply chain disruptions is fueling product innovation.

-

Collaborations between insurers, brokers, and technology providers are accelerating adoption and digital transformation.

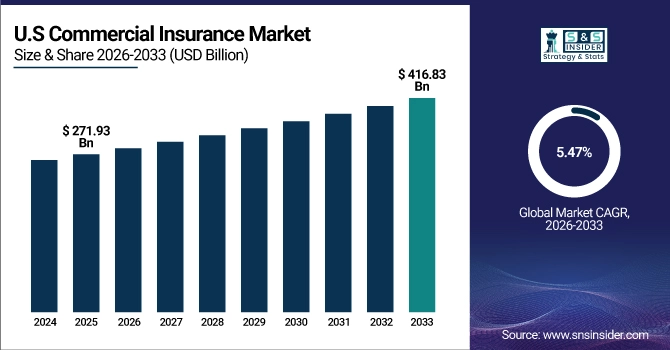

U.S. Commercial Insurance Market was valued at USD 271.93 billion in 2025E and is expected to reach USD 416.83 billion by 2033, growing at a CAGR of 5.47% from 2026-2033.

The U.S. Commercial Insurance Market is witnessing steady growth due to rising demand for customized insurance solutions across various industries. Businesses are increasingly prioritizing risk management in areas like cyber threats, property damage, and liability coverage. Technological advancements are enabling faster policy issuance and smarter claims processing. The market is also benefiting from digitalization, allowing SMEs greater access to insurance products. Additionally, insurers are focusing on sector-specific offerings to meet evolving business needs. Regulatory compliance and a growing awareness of potential financial exposures are further driving the market forward.

Commercial Insurance Market Growth Drivers:

-

Increasing Business Risk Awareness and Regulatory Compliance Pushes Growth in the Commercial Insurance Market

The rising awareness among enterprises regarding potential financial losses from unexpected events like cyberattacks, natural disasters, or operational liabilities is a key driver of the Commercial Insurance Market. Businesses are more proactively seeking comprehensive insurance coverage to mitigate risks and ensure operational continuity.

Additionally, governments and industry bodies are enforcing stricter regulations around workplace safety, environmental responsibility, and data protection, compelling organizations to invest in tailored insurance policies. This trend is especially pronounced in industries such as construction, healthcare, and IT, where risks are higher. Insurers are responding by offering more nuanced, industry-specific packages and leveraging digital tools to enhance customer experience and risk assessment. As compliance becomes non-negotiable, commercial insurance is transitioning from an optional safeguard to a business essential.

Commercial Insurance Market Restraints:

-

Complex Policy Structures and High Premium Costs Restrain the Commercial Insurance Market Growth

One of the major restraints in the Commercial Insurance Market is the complexity of insurance policy structures and the associated high premium costs. Many small and medium-sized enterprises (SMEs) find it challenging to understand or afford comprehensive commercial insurance plans, which often include layers of coverage, exclusions, and legal jargon. This complexity discourages potential buyers and leads to underinsurance or reliance on basic coverage that may not meet actual risk needs.

Furthermore, high premiums, particularly for sectors exposed to frequent or severe claims like logistics or manufacturing, create a financial burden that some businesses are unwilling or unable to bear. This gap between product availability and affordability hinders broader market penetration, particularly in emerging economies.

Commercial Insurance Market Opportunities:

-

Growing Integration of AI and Big Data Analytics Offers New Opportunities in the Commercial Insurance Market

The incorporation of advanced technologies such as Artificial Intelligence (AI) and big data analytics presents a significant opportunity for growth in the Commercial Insurance Market. These innovations are transforming how insurers assess risks, price policies, and manage claims, leading to more accurate underwriting and reduced fraud. Real-time data from IoT devices, telematics, and customer platforms allows insurers to create dynamic, usage-based insurance models that better suit modern business operations.

Additionally, predictive analytics can help in anticipating risk patterns and customer behavior, allowing insurers to tailor products more effectively. This shift toward technology-driven services not only enhances efficiency and customer satisfaction but also opens up the market to digital-native SMEs looking for accessible, fast, and flexible insurance solutions.

Commercial Insurance Market Challenge:

-

High Vulnerability to Evolving Risks, Such as Cyberattacks, Presents a Major Challenge in the Commercial Insurance Market

The rapid evolution of risks, especially cyber threats, poses a significant challenge for the Commercial Insurance Market. Traditional insurance models often fail to keep up with the frequency, sophistication, and financial impact of modern threats like ransomware, phishing, and data breaches. As businesses become increasingly digital, they face heightened exposure to these risks, yet many policies lack adequate or specific cyber coverage.

Additionally, there's a lack of standardized risk assessment frameworks and sufficient historical data to accurately price such dynamic threats. Insurers must constantly adapt and innovate their offerings while also educating clients on emerging exposures. Failing to address these vulnerabilities not only limits the value proposition of commercial insurance but could also undermine trust and long-term market sustainability.

Commercial Insurance Market Segment Analysis

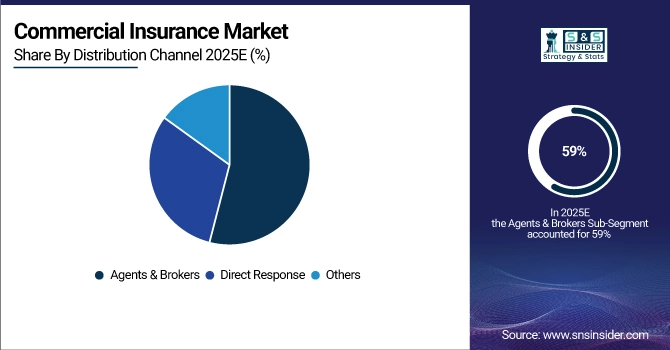

By Distribution Channel, Agents & Brokers led in 2025 with 59% revenue share. Direct Response growing fastest.

In 2025, the Agents & Brokers channel dominated the Commercial Insurance Market, accounting for 59% of the revenue. This traditional distribution model thrives on personalized service, with agents and brokers offering tailored insurance solutions based on in-depth risk assessments. Companies like Willis Towers Watson leverage their extensive networks and expertise to provide clients with comprehensive coverage options. The enduring trust and relationships built by agents and brokers continue to make this channel a preferred choice for many businesses, especially those seeking customized insurance packages.

The Direct Response channel is projected to experience the fastest growth, with a CAGR of 8.96% over the forecast period 2026-2033. This model leverages digital platforms to offer insurance products directly to consumers, streamlining the purchasing process. Innovations in this space are evident; for instance, Arch Insurance's acquisition of Thimble has enhanced its ability to provide on-demand insurance solutions through user-friendly apps and websites. This approach appeals to small and medium-sized enterprises seeking quick and flexible coverage options.

By Type, Liability Insurance led in 2025 with 35% revenue share. Commercial Property Insurance growing fastest.

In 2025, the Liability Insurance segment accounted for 35% of the Commercial Insurance Market revenue, underscoring its critical role in protecting businesses against legal claims and financial liabilities. This segment covers a range of policies, including general liability, professional indemnity, and product liability insurance, catering to diverse industries. Companies like Beazley plc have been at the forefront, offering specialized liability products that address emerging risks. For instance, Beazley's expansion into cyber liability insurance reflects the growing demand for coverage against digital threats. The prominence of liability insurance is further amplified by increasing litigation cases and stringent regulatory frameworks, compelling businesses to seek comprehensive coverage.

The Commercial Property Insurance segment is experiencing significant momentum. Projected to grow at a CAGR of 9.21% over the forecast period, this growth is driven by heightened awareness of asset protection, especially in the wake of increasing natural disasters and unforeseen events. Insurers are innovating to meet this demand; for example, Arch Insurance's acquisition of Thimble in April 2023 has enhanced digital solutions for small businesses, allowing for flexible coverage options. Such developments cater to the evolving needs of businesses seeking swift and tailored insurance solutions.

By Industrial Vertical, Transportation & Logistics dominated in 2025 with 22% revenue share. IT & Telecom growing fastest.

In 2025, the Transportation & Logistics sector led the Commercial Insurance Market with a 22% revenue share, highlighting its reliance on comprehensive insurance solutions. This sector faces multifaceted risks, from cargo damage to regulatory compliance challenges. Insurers are responding with specialized products; for instance, Beazley plc offers tailored coverage addressing the unique needs of logistics companies. The sector's growth is further propelled by the global expansion of e-commerce and supply chain complexities, necessitating robust insurance frameworks.

The IT & Telecom sector is anticipated to register the highest CAGR of 8.59% in the Commercial Insurance Market during the forecast period. This growth is attributed to the sector's increasing exposure to cyber threats, data breaches, and technological disruptions. Insurers are developing innovative products to address these challenges; for example, Beazley plc's launch of Beazley Security in 2024 offers integrated cyber risk management services, including managed detection and response solutions. As digital transformation accelerates and regulatory scrutiny intensifies, IT and telecom companies are prioritizing comprehensive insurance coverage to mitigate potential risks.

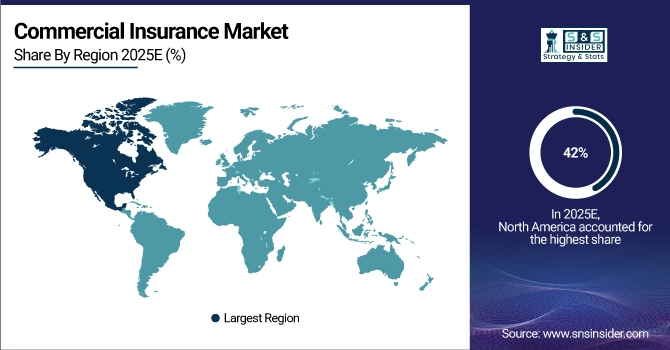

Commercial Insurance Market Regional Analysis

North America Commercial Insurance Market Insights

In 2025, the North America region dominated the Commercial Insurance Market with an estimated market share of around 42%. This dominance can be attributed to the presence of major insurance providers such as Chubb Limited, AIG, and Marsh & McLennan, along with a highly structured regulatory environment and mature business ecosystem. The region’s strong economic foundation and the widespread adoption of commercial insurance products across sectors, like construction, healthcare, manufacturing, and logistics, continue to drive market growth. Additionally, increasing demand for specialized insurance products such as cyber liability, environmental liability, and professional indemnity is encouraging companies to expand their product portfolios. For example, in 2024, AIG expanded its cyber insurance offerings tailored for SMEs in North America, further cementing the region’s leadership position in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Commercial Insurance Market Insights

The Asia-Pacific region is emerging as the fastest-growing market for commercial insurance, with an estimated CAGR of 11.55% during the forecast period 2026-2033. Rapid urbanization, industrial expansion, and growing awareness of risk management among businesses are key contributors to this growth. Countries such as China, India, and Southeast Asian nations are witnessing increased adoption of commercial insurance products, driven by regulatory reforms and economic growth. For instance, in 2023, AXA and Allianz expanded their commercial insurance portfolios across Asia-Pacific through digital platforms, aiming to reach underinsured SMEs and startups. The region’s dynamic business environment and increasing investment in infrastructure and technology continue to open up lucrative opportunities for commercial insurers.

Europe Commercial Insurance Market Insights

Europe dominates the Commercial Insurance Market with a well-established insurance infrastructure and a high concentration of multinational corporations. Strong regulatory frameworks, advanced risk management practices, and rising demand for property, liability, and specialty insurance support market growth. Increasing adoption of digital insurance platforms, coupled with innovations in product offerings, enhances customer accessibility and operational efficiency. Growing awareness of risk mitigation and corporate compliance further drives the market across Western and Northern Europe.

Middle East & Africa and Latin America Commercial Insurance Market Insights

The Middle East & Africa and Latin America Commercial Insurance Markets are witnessing steady growth driven by increasing industrialization, infrastructure development, and foreign investments. Rising awareness of risk management and regulatory compliance is boosting demand for commercial insurance solutions. Additionally, digitalization and tailored insurance products are improving accessibility and adoption. Expansion in sectors like construction, energy, and transportation further fuels market growth, making these regions attractive for insurance providers seeking emerging opportunities.

Commercial Insurance Market Competitive Landscape:

AIG

AIG, founded in 1919 and headquartered in New York, is a global insurance and financial services company offering life, property, casualty, and retirement solutions. The company provides a diverse portfolio of products to individuals, businesses, and institutions worldwide. With a strategic focus on core U.S. operations, risk management, and financial stability, AIG continues to optimize its global portfolio while maintaining leadership in insurance and retirement solutions.

-

September 2023: AIG's subsidiary, Corebridge Financial, agreed to sell its UK life insurance business, AIG Life Limited, to Aviva plc for £460 million. This divestiture is part of AIG's strategy to streamline its portfolio and focus on core U.S. life and retirement solutions.

Aon plc

Aon, founded in 1982 and headquartered in London, UK, is a leading global professional services firm providing risk management, insurance brokerage, and human capital solutions. The company focuses on designing innovative risk transfer and consulting solutions for businesses, governments, and nonprofits. Aon supports large-scale risk mitigation, insurance programs, and strategic advisory services worldwide, helping clients manage uncertainty, improve resilience, and capitalize on growth opportunities in diverse industries and emerging Commercial Insurance Markets.

-

June 2023: Aon, in collaboration with the U.S. International Development Finance Corporation, launched a USD 350 million war risk insurance scheme to support Ukrainian businesses. This initiative includes a $50 million reinsurance facility and $300 million coverage for projects in healthcare and agriculture, aiming to bolster Ukraine's wartime economy and reconstruction efforts.

Aviva plc

Aviva plc, founded in 1696 and headquartered in London, UK, is a multinational insurance company offering life, general, health, and pensions products. Aviva serves millions of customers across the UK, Europe, and Asia, providing innovative insurance solutions and risk management services. With a focus on strategic acquisitions and digital transformation, Aviva aims to expand its Commercial Insurance Market presence, diversify product offerings, and deliver sustainable value to policyholders and shareholders alike.

-

December 2024: Aviva agreed to acquire Direct Line Insurance Group plc for approximately £3.7 billion. This acquisition will create the UK's largest motor insurer, expanding Aviva's footprint in the commercial insurance sector and enhancing its product offerings.

Key Players

-

American International Group Inc.

-

Aon plc

-

Aviva plc

-

Axa S.A.

-

Direct Line Insurance Group plc

-

Marsh & McLennan Companies Inc.

-

Willis Towers Watson Public Limited Company

-

Zurich Insurance Group Ltd.

-

Tokio Marine Holdings, Inc.

-

CNA Financial Corporation

-

Liberty Mutual Insurance Group

-

Hartford Financial Services Group, Inc.

-

Travelers Companies, Inc.

-

Berkshire Hathaway Specialty Insurance

-

Munich Re

-

Sompo Holdings, Inc.

-

Swiss Re Ltd.

-

Generali Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 934.57 Billion |

| Market Size by 2033 | US$ 1666.79 Billion |

| CAGR | CAGR of 7.5% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises [SME]) • By Distribution Channel (Agents & Brokers, Direct Response, Others) • By Industry Vertical (Transportation & Logistics, Manufacturing, Construction, IT & Telecom, Healthcare, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Allianz SE, American International Group Inc., Aon plc, Aviva plc, Axa S.A., Chubb Limited, Direct Line Insurance Group plc, Marsh & McLennan Companies Inc., Willis Towers Watson Public Limited Company, Zurich Insurance Group Ltd., Tokio Marine Holdings, Inc., CNA Financial Corporation, Liberty Mutual Insurance Group, Hartford Financial Services Group, Inc., Travelers Companies, Inc., Berkshire Hathaway Specialty Insurance, Munich Re, Sompo Holdings, Inc., Swiss Re Ltd., Generali Group |