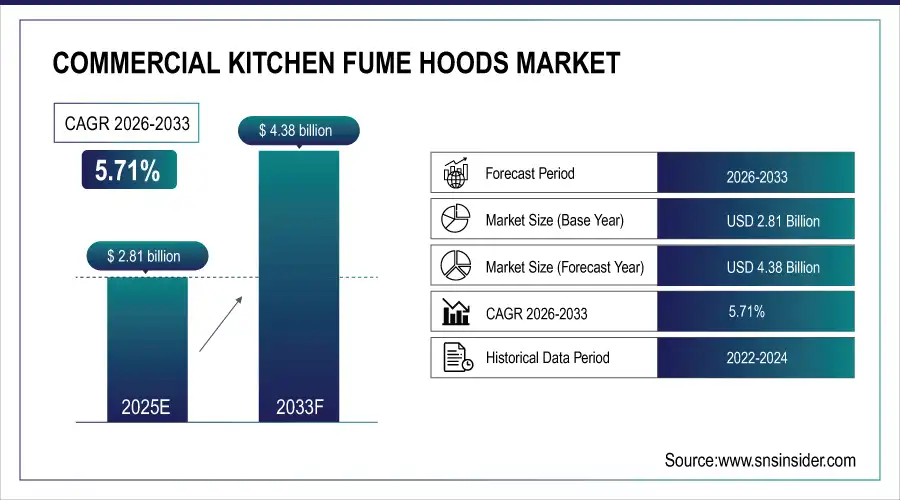

Commercial Kitchen Fume Hoods Market Size Analysis:

The Commercial Kitchen Fume Hoods Market Size was valued at USD 2.81 billion in 2025 and is expected to reach USD 4.38 billion by 2032 and grow at a CAGR of 5.71% over the forecast period 2026-2033.

The global Commercial Kitchen Fume Hoods Market is witnessing robust growth, due to increasing awareness related to fire safety, air quality and hygiene in commercial kitchens. The growing need for energy efficient, high-performance ventilation across both commercial and residential applications is driving innovation of new products, design and functionality. Rigorous regulations pertaining to indoor emissions and workplace safety will continue to complement the adoption of improved fume hood solutions in different foodservice outlets such as restaurants, hotels, and institutional kitchens.

According to research, over 80% of commercial kitchens globally are adopting fume hoods with grease, smoke, and odor filtration systems to meet hygiene and safety norms.

Market Size and Forecast: 2025E

-

Market Size in 2025 USD 2.81 Billion

-

Market Size by 2033 USD 4.38 Billion

-

CAGR of 5.71% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information on Commercial Kitchen Fume Hoods Market - Request Free Sample Report

Commercial Kitchen Fume Hoods Market Trends:

-

Growing adoption of energy-efficient fume hoods with variable air volume systems to reduce operational costs and carbon footprints.

-

Increasing demand for sustainable kitchen ventilation solutions driven by green building certifications and LEED compliance.

-

Rising integration of IoT-enabled sensors and smart controls for real-time airflow, temperature regulation, and safety monitoring.

-

Expansion of connected commercial kitchens accelerating the use of automated and remotely monitored fume hood systems.

-

Development of AI-enabled, self-learning ventilation solutions with predictive maintenance capabilities to enhance efficiency and reliability.

The U.S. Commercial Kitchen Fume Hoods Market size was USD 0.63 billion in 2025 and is expected to reach USD 0.84 billion by 2033, growing at a CAGR of 3.75% over the forecast period of 2026–2033. The U.S. commercial kitchen fume hoods market growth is primarily due to the growing number of foodservice establishments, stringent air quality guidelines, and investments in commercial kitchen infrastructure. The expanding urbanization and focus on energy-efficient cooking spaces are also driving demand for high-end technological ventilation systems in the U.S. restaurants, hotels and institutional kitchens.

According to research, School and hospital kitchens account for nearly 18% of the U.S. commercial fume hood installations, driven by compliance with public health standards.

Commercial Kitchen Fume Hoods Market Growth Drivers:

-

Sustainability and Energy Efficiency Drive Demand for Smart, High-Performance Fume Hoods in Commercial Foodservice Sector.

The commercial foodservice market is more and more moving toward sustainability and energy conservation. New generation fume hoods are made considering energy efficiency with variable air volume systems and smart controls. Green building certifications and LEED compliance are driving the need for sustainable and high-performance fume hoods. Vendors in the market are focusing on R&D to develop products which cater to the demand of the customers, thereby, driving the market growth. As restaurants strive to cut costs of operation and reduce carbon footprints, energy-efficient fume hoods are increasingly important.

According to research, LEED-certified commercial buildings are 25% more likely to incorporate energy-efficient kitchen ventilation systems than non-certified ones.

Commercial Kitchen Fume Hoods Market Restraints:

-

Retrofitting Modern Fume Hoods in Older Kitchens Faces Structural Challenges, High Costs, and Operational Disruptions.

Integrating new-generation fume hoods into existing commercial kitchen layouts, especially in older buildings, poses major logistical and structural challenges. Limited ceiling space, outdated ductwork, and incompatible HVAC systems require expensive renovations or complete redesigns. This creates friction for adoption in historical sites or compact urban locations. Furthermore, downtime during retrofitting processes can impact business operations, making operators hesitant. These technical barriers often force businesses to retain substandard systems or delay upgrades, slowing down overall market expansion.

Commercial Kitchen Fume Hoods Market Opportunities:

-

IoT and Automation Drive Smart Fume Hood Adoption in Connected Commercial Kitchens for Safety and Efficiency.

The adoption of IoT and automation is transforming commercial kitchen operations, and fume hoods are no exception. Smart hoods with sensor-based airflow control, temperature regulation, and remote monitoring are gaining traction. These systems not only improve safety but also reduce energy usage and maintenance needs. Real-time analytics can alert operators to potential issues, minimizing downtime. The increasing demand for connected commercial kitchens is fostering innovation and giving manufacturers opportunities to introduce AI-enhanced, self-learning ventilation solutions with predictive maintenance features.

According to research, as of 2024, over 35% of new commercial kitchen installations globally include at least one IoT-enabled appliance, including fume hoods.

Commercial Kitchen Fume Hoods Market Segment Analysis:

By Ventilation Type

The ducted segment dominated the highest commercial kitchen fume hoods market revenue share of 71.19% in 2025 due to its superior performance in removing heat, smoke, and airborne grease from busy commercial kitchens. These systems are highly efficient for large-scale operations, ensuring compliance with stringent ventilation and fire safety regulations. A notable player in this space is CaptiveAire Systems, known for its high-performance ducted hoods tailored for heavy-duty use. Their compatibility with various kitchen layouts and long-term cost-effectiveness makes them a preferred choice for restaurants and institutions. The ductless segment is projected to grow at the fastest CAGR of 6.71% over 2026-2033, driven by its ease of installation and increasing popularity in small-scale kitchens and food trucks. These systems eliminate the need for complex ductwork, making them ideal for retrofit projects and temporary setups. Commercial kitchen ventilation systems companies including Fisher & Paykel are developing compact, ductless models with advanced filtration to meet this rising demand. Urbanization and tighter kitchen spaces are pushing adoption of these flexible, modern ventilation solutions.

By Product Type

The wall-mounted hoods segment dominated the highest commercial kitchen fume hoods market revenue share of 57.97% revenue share in 2025, supported by their wide usage in traditional commercial kitchen designs where cooking ranges are placed against walls. Their space-saving design and effective performance make them suitable for most restaurants. Halton Group, a key player in this category, offers customizable wall-mounted hoods that support both safety and efficiency. Their easy integration with existing infrastructure makes them the default choice across diverse foodservice formats. Island hoods are anticipated to grow at the highest CAGR of 6.93% over 2026-2033, driven by increasing adoption in modern and open-kitchen restaurant layouts. These hoods are ideal for freestanding cooktops, where aesthetics and visibility are critical. Vent-A-Hood, a notable manufacturer, offers stylish and functional island hoods designed to blend seamlessly with upscale kitchen interiors. As more restaurants shift to open formats to enhance guest experience, demand for these ventilation systems is accelerating.

By Application

Restaurants segment dominated the highest commercial kitchen fume hoods market share of 46.25% revenue share in 2025, due to their high frequency of cooking operations and regulatory needs for air quality. Their continuous usage of fryers, grills, and ovens necessitates robust fume extraction. Greenheck Fan Corporation, a leader in commercial ventilation, provides comprehensive hood systems widely used in chain and independent restaurants. The expansion of fast-casual and quick-service chains globally further supports this segment’s dominance in the market. Hotels are forecasted to grow at the fastest CAGR of 7.00% over 2026-2033, as they increasingly invest in high-efficiency kitchen infrastructure. In-house restaurants and premium dining spaces within hotels demand advanced fume control systems. Systemair, known for its energy-efficient ventilation solutions, caters to this growing hospitality demand with customizable fume hoods that meet both functional and design requirements. As global tourism rebounds, hotel kitchens are upgrading to meet rising guest expectations and regulatory norms.

By Material

The stainless steel segment dominated the highest commercial kitchen fume hoods market revenue share of 52.73% in 2025 due to its exceptional durability, corrosion resistance, and ease of cleaning, which are critical in high-heat, grease-intensive kitchen environments. Its ability to maintain hygiene standards and withstand long-term wear makes it the preferred material across commercial kitchens. Elta Group is a key manufacturer offering high-grade stainless steel fume hoods known for reliability and compliance with global safety norms, contributing significantly to the material’s widespread industry dominance. The aluminum segment is projected to grow at the fastest CAGR of 7.16% over 2026-2033, primarily driven by its lightweight properties, lower cost compared to stainless steel, and ease of fabrication. These characteristics make aluminum fume hoods ideal for modular or mobile kitchen setups, where flexibility and affordability are key. Commercial kitchen fume hoods companies, such as Britannia Kitchen Ventilation are increasingly adopting aluminum in new product designs, meeting rising demand from small-scale kitchens and start-ups seeking efficient yet budget-friendly ventilation solutions.

Commercial Kitchen Fume Hoods Market Regional Analysis:

North America Commercial Kitchen Fume Hoods Market Insights

North America region dominated the highest share of 36.91% in 2025, supported by a mature and highly regulated foodservice industry. The presence of a vast number of restaurants, hotels, and institutional kitchens, combined with strict fire safety and environmental standards, drives sustained demand for advanced kitchen ventilation systems. The region’s strong focus on energy efficiency, hygiene, and technological innovation in commercial kitchen infrastructure further reinforces its market leadership, particularly in the U.S. and Canada where frequent renovations and system upgrades are common.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American market due to its expansive foodservice industry, stringent ventilation regulations, and widespread adoption of advanced kitchen technologies. Frequent kitchen upgrades and a high concentration of restaurants and hospitality venues further support the country’s leading market position.

Asia Pacific Commercial Kitchen Fume Hoods Market Insights

Asia Pacific is expected to expand at the fastest CAGR of 6.79% over 2026-2033, driven by rapid urban development, growing disposable incomes, and a surge in small to mid-sized foodservice establishments. The region’s booming hospitality and quick-service restaurant sectors are increasingly investing in affordable, high-performance ventilation solutions. Rising government emphasis on food safety compliance, combined with a trend toward modernizing kitchens in countries like China, India, and Southeast Asia, is accelerating demand for efficient and scalable fume hood systems.

-

China leads the Asia Pacific market owing to its massive restaurant base, rapid urbanization, and strong domestic manufacturing of kitchen ventilation systems. Government focus on food safety and the rise of modern commercial kitchens continue to drive growth.

Europe Commercial Kitchen Fume Hoods Market Insights

Europe maintains a strong presence in the Commercial Kitchen Fume Hoods Market, driven by strict environmental and hygiene regulations, advanced culinary infrastructure, and a high density of restaurants, cafés, and hotels. Countries including Germany, the UK, and France lead demand, with growing interest in energy-efficient and smart ventilation solutions. Continuous upgrades in commercial kitchen setups further contribute to market expansion across the region.

-

Germany dominates the European Commercial Kitchen Fume Hoods Market due to its advanced foodservice infrastructure, strict ventilation and safety regulations, and strong emphasis on energy-efficient technologies. Its robust manufacturing base and high standards in commercial kitchen operations drive consistent market demand and innovation.

Latin America (LATAM) and Middle East & Africa (MEA) Commercial Kitchen Fume Hoods Market Insights

In the Middle East & Africa, the UAE leads due to its booming hospitality sector, tourism-driven foodservice demand, and investment in premium commercial kitchens. In Latin America, Brazil dominates the market, supported by a growing restaurant industry, urban expansion, and rising adoption of ventilation systems to meet hygiene regulations.

Commercial Kitchen Fume Hoods Market Key Players:

Major Key Players in Commercial Kitchen Fume Hoods Market are

- CaptiveAire

- Halton Group

- Greenheck

- Systemair

- Ventilation Direct

- CK Direct

- Air Clean UK

- S&P Ventilation

- Britannia

- ProVent

- SCK Group

- IMC

- RDM Industrial

- Hoodsly

- Spring Air Systems

- Hesco

- Airedale

- Beecraft

- Thermaco

- Larkin Industries

Competitive Landscape for Commercial Kitchen Fume Hoods Market:

Halton Group is a Finland-based global leader in commercial kitchen ventilation and indoor air solutions, designing and manufacturing high-performance fume hoods, exhaust systems, and energy-efficient technologies such as Capture Jet™ and UV-enhanced hoods for restaurants, hotels, and foodservice operations to ensure safety, comfort, and regulatory compliance

-

March 2024, Halton Group introduced demand-controlled smart ventilation hoods in 700 kitchens, achieving approximately 51% energy savings while significantly improving fire safety measures and overall staff working conditions.

Systemair is a Swedish global ventilation and HVAC solutions provider founded in 1974, offering energy-efficient fans, air handling units, and air distribution systems for commercial and industrial applications including kitchen and exhaust ventilation to improve indoor air quality, sustainability, and regulatory compliance across building environments worldwide

-

April 2025, Systemair launched Retrofit, a sustainable solution for upgrading existing kitchen ventilation systems, aiming to extend equipment life and reduce energy and operational costs in commercial and institutional kitchens.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.81 Billion |

| Market Size by 2033 | USD 4.38 Billion |

| CAGR | CAGR of 5.71% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Ventilation Type (Ducted, Ductless) • By Product Type (Wall-Mounted Hoods, Island Hoods, Proximity Hoods, Others) • By Application (Restaurants, Hotels, Hospitals, Others) • By Material (Stainless Steel, Aluminum, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CaptiveAire, Halton Group, Greenheck, Systemair, Ventilation Direct, CK Direct, Air Clean UK, S&P Ventilation, Britannia, ProVent, SCK Group, IMC, RDM Industrial, Hoodsly, Spring Air Systems, Hesco, Airedale, Beecraft, Thermaco, and Larkin Industries. |