Refrigeration Compressor Market Size Analysis:

The Refrigeration Compressor Market Size was valued at USD 28.79 billion in 2025 and is expected to grow at 4.98% CAGR to reach USD 46.81 billion by 2035.

The global market for refrigeration compressors is witnessing strong momentum, driven by increasing Urbanization, expanding Infrastructure and growing need for Cold Chain Logistics. With the increase in demand of perishable food and temperature-sensitive pharmaceuticals, the influence of efficient and reliable cooling systems extends to different sectors. The move to green, energy-efficient technologies is fueling product innovation and implementation. Furthermore, the growth in the commercial spaces, such as supermarkets, hotels and restaurants along with industrial refrigeration is impacting the demand trends and thereby offering long term opportunities in international markets.

According to the research, global regulations targeting low-GWP refrigerants are influencing more than 60% of compressor design upgrades globally.

Refrigeration Compressor Market Size and Forecast:

-

Market Size in 2025: USD 28.79 Billion

-

Market Size by 2035: USD 46.81 Billion

-

CAGR: 4.98% from 2026 to 2035

-

Base Year: 2024

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Refrigeration Compressor Market - Request Free Sample Report

Key Refrigeration Compressor Market Trends:

-

Rising adoption of energy-efficient and low-global-warming-potential (GWP) compressors drives sustainability and regulatory compliance in refrigeration systems.

-

Growing demand for commercial and industrial refrigeration in food & beverage, pharmaceuticals, and cold chain logistics boosts compressor market growth.

-

Integration of advanced control technologies, such as variable speed drives and smart sensors, enhances system performance, reduces energy consumption, and improves maintenance efficiency.

-

Expansion of cold storage infrastructure in emerging economies accelerates demand for reliable and durable refrigeration compressors.

-

Increasing focus on environmentally friendly refrigerants promotes the development of next-generation compressors compatible with natural and low-GWP refrigerants.

-

Advancements in compact and high-capacity compressors enable miniaturization and higher efficiency for HVAC and commercial refrigeration applications.

-

Government incentives and energy efficiency regulations encourage the adoption of advanced refrigeration technologies, supporting innovation and market expansion.

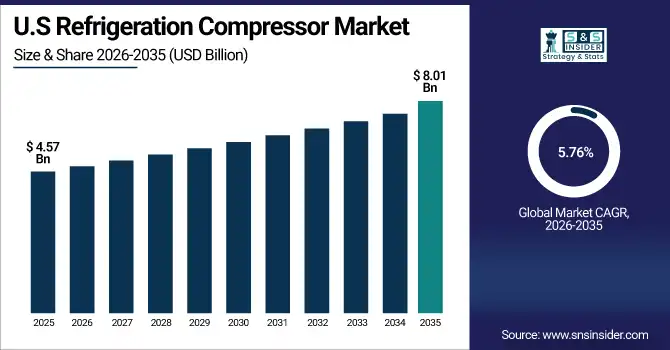

The U.S. Refrigeration Compressor Market size was USD 4.57 billion in 2025 and is expected to reach USD 8.01 billion by 2035, growing at a CAGR of 5.76% over the forecast period of 2026–2035.The U.S. refrigeration compressor market growth is primarily driven by the rising adoption of energy-efficient refrigeration systems in food retail, cold chain logistics, and medical storage. Additionally, stringent energy regulations and the ongoing modernization of commercial refrigeration systems in supermarkets, restaurants, and convenience stores are further accelerating demand across the country’s highly organized cold supply infrastructure.

According to a research, more than 80% of hospitals and clinics in the U.S. are now equipped with temperature-monitoring-enabled refrigeration systems.

Refrigeration Compressor Market Drivers:

-

Expanding Cold Chain Infrastructure Across Food And Pharmaceutical Sectors Is Creating Unprecedented Demand For Refrigeration Compressors Globally

Cold chain infrastructure is expanding rapidly worldwide, driven by the need to preserve perishable food, vaccines, and pharmaceuticals under stringent temperature requirements. Emerging economies are heavily investing in logistics upgrades to reduce spoilage and increase food export capacity. In developed nations, e-commerce and online grocery platforms require advanced refrigeration systems. As temperature-sensitive product demand rises globally, refrigeration compressors become essential components for maintaining consistent and energy-efficient cold environments across storage and transportation, fueling sustained demand across various end-user industries.

According to the FAO, over 30% of food is lost or wasted globally, much of it due to inadequate cold storage.

Refrigeration Compressor Market Restraints:

-

Supply Chain Disruptions And Component Shortages Negatively Affect Production Timelines And The Availability Of Refrigeration Compressors Globally

The refrigeration compressor market is highly dependent on the availability of key raw materials such as copper, aluminum, and steel, and specialized components including motors and valves. Disruptions caused by geopolitical conflicts, trade restrictions, or pandemics have strained global supply chains, leading to production delays and increased manufacturing costs. These interruptions impact delivery schedules and product availability, especially for OEMs requiring bulk orders. Extended lead times and rising prices erode customer confidence and delay new installations or upgrades. Continued instability in global supply networks remains a major restraint for manufacturers and suppliers aiming to meet rising market demand.

Refrigeration Compressor Market Opportunities:

-

Technological Innovation In Variable-Speed Compressors And Iot Integration Enhances Performance, Diagnostics, And Energy Optimization

The integration of smart technologies and IoT-enabled systems into refrigeration compressors presents a major opportunity for market players. Variable-speed compressors, for instance, allow dynamic load adjustment, significantly improving energy efficiency and reducing operational costs. Smart monitoring and predictive maintenance capabilities offer real-time diagnostics, fault detection, and performance analytics. These digital enhancements appeal to industrial, commercial, and residential users alike, as they ensure reliability and sustainability. As industries embrace automation and connected systems, demand for intelligent compressors is expected to surge.

According to the research, variable-speed compressors can improve energy efficiency by 25–35% compared to conventional fixed-speed systems.

Refrigeration Compressor Market Segmentation Analysis:

By Compressor Type, Reciprocating Compressors Dominate Refrigeration Compressor Market in 2025; Scroll Compressors Lead in Growth

Reciprocating compressors dominated the highest refrigeration compressor market share of about 59.46% in 2025, due to their robust structure, ease of maintenance, and suitability for varied refrigerant types. These compressors are favored in residential and commercial refrigeration systems for their cost-effectiveness and performance in fluctuating load conditions. Emerson Electric Co., a leading global player, has a strong portfolio of reciprocating compressors that cater to both domestic and light commercial applications, reinforcing market dominance through wide availability, efficient models, and a trusted global service network. Scroll compressors are expected to grow at the fastest CAGR of about 6.32% over 2026–2035 due to their silent operation, compact design, and superior energy efficiency. These features make them increasingly suitable for HVAC systems and commercial refrigeration. Danfoss A/S, a major player in the HVACR industry, is actively expanding its scroll compressor product line to meet growing demands for energy-saving and space-efficient cooling systems, particularly in urban commercial spaces and green building initiatives across developed and emerging economies.

By Capacity, Up to 5 Hp Segment Leads Refrigeration Compressor Market; 10–15 Hp Segment Exhibits Fastest Growth

Upto 5 Hp segment dominated the refrigeration compressor market with the highest revenue share of about 39.18% in 2025, primarily due to its dominance in residential refrigerators, small freezers, and light commercial applications. Compact design, affordability, and moderate cooling needs make this segment suitable for home appliances and small-scale retail operations. Mitsubishi Electric Corporation supports this dominance with its range of highly reliable low-capacity compressors used extensively in energy-efficient domestic and small commercial refrigeration products across global markets. 10 to 15 Hp segment is expected to grow at the fastest CAGR of about 6.43% over 2026–2035, driven by rising demand in mid-sized cold chain setups, restaurants, and small warehouse refrigeration units. These systems balance performance and efficiency while offering scalability. Refrigeration compressor companies, such as Panasonic Corporation are focusing on this capacity range with innovative mid-size compressor offerings that address the evolving needs of the commercial refrigeration sector while supporting compliance with energy and environmental standards globally.

By Application, Residential Refrigeration Segment Commands Market Share; Commercial Applications Drive Highest CAGR

Residential segment dominated the refrigeration compressor market with the highest revenue share of about 66.74% in 2025 due to booming housing demand, appliance ownership, and household refrigeration upgrades. The push for energy-efficient appliances has also spurred new installations and replacements. Whirlpool Corporation, a prominent appliance manufacturer, integrates high-performance compressors into its vast range of refrigerators, significantly contributing to demand within the residential market by offering reliable and energy-conscious refrigeration solutions. Commercial segment is expected to grow at the fastest CAGR of about 6.42% over 2026–2035, fueled by increasing installations in supermarkets, cold storage chains, and food service establishments. The demand for continuous and consistent refrigeration is rapidly rising. Carrier Global Corporation plays a critical role in this space, offering commercial-grade compressor solutions known for durability and energy efficiency, helping businesses meet strict cooling and sustainability standards while optimizing operating costs.

By Type, Hermetic Compressors Hold Largest Market Share; Open Compressors Witness Rapid Growth

Hermetic segment dominated the refrigeration compressor market with the highest revenue share of about 57.22% in 2025, as it offers a sealed, maintenance-free design ideal for residential and small commercial use. These compressors are quieter, compact, and cost-efficient. Tecumseh Products Company is a well-known manufacturer of hermetic compressors that power millions of refrigeration units globally, maintaining their popularity through trusted quality and integration ease across OEM systems. Open segment is expected to grow at the fastest CAGR of about 6.09% over 2026–2035, mainly due to its applications in large industrial systems where high capacity and easy serviceability are crucial. These compressors offer more flexibility in maintenance and motor selection. GEA Group AG is one of the key players offering open-type compressors for industrial refrigeration, used widely in sectors, such as food processing, pharmaceuticals, and petrochemicals, where large-scale cooling is required.

By Motor, Fixed-Speed Compressors Dominate Market; Variable-Speed (Inverter) Compressors Show Fastest CAGR

Fixed speed compressor segment dominated the refrigeration compressor market with the highest revenue share of about 72.08% in 2025 due to its simple design, lower initial cost, and widespread use in traditional residential and commercial applications. Their reliable operation under constant load makes them a preferred choice. Hitachi Ltd. is a prominent contributor to this segment, offering robust fixed-speed compressors used extensively in home appliances and conventional refrigeration units across Asia and global markets. Variable Speed Compressor (Inverter) segment is expected to grow at the fastest CAGR of about 6.35% over 2026–2035 due to the rising adoption of smart cooling systems and demand for energy efficiency. These compressors adjust speed based on cooling load, enhancing operational savings. LG Electronics Inc. leads this transition with its advanced inverter-based compressor technologies widely embedded in its residential and commercial refrigeration appliances, aligning with global energy regulations and smart-home trends.

By Distribution Channel, OEM Segment Leads Refrigeration Compressor Market; Aftermarket Segment Experiences Strongest Growth

OEM segment dominated the refrigeration compressor market with the highest revenue share of about 61.08% in 2025 as compressor procurement is typically done in bulk by system integrators and appliance manufacturers. Consistent quality and customization drive OEM preference. Haier Group Corporation, a global appliance leader, sources and integrates large volumes of compressors into its refrigerators and freezers, enabling it to deliver competitive pricing and quality through streamlined OEM supply chains. Aftermarket segment is expected to grow at the fastest CAGR of about 5.95% over 2026–2035, supported by increasing demand for compressor replacements in aging systems and upgrades to energy-efficient models. As environmental regulations evolve, users are switching to modern units. Johnson Controls International plc addresses this market with a broad portfolio of replacement compressors, offering compatibility, energy savings, and warranty-backed options that appeal to commercial and industrial customers looking to modernize existing refrigeration infrastructure.

Refrigeration Compressor Market Regional Overview:

Asia Pacific Refrigeration Compressor Market Insights

Asia Pacific dominated the market with the highest revenue share of about 34.87% in 2025 due to rapid urbanization, rising disposable incomes, and the growing adoption of household and commercial refrigeration appliances. Expanding cold chain infrastructure, especially in countries including China and India, is driving strong demand for compressors across food processing, pharmaceuticals, and logistics sectors. Additionally, government initiatives to improve energy efficiency and the presence of large-scale manufacturing hubs further strengthen the region’s dominance by ensuring cost-effective production and broad market accessibility.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Drives Asia Pacific Market Dominance

China leads the Asia Pacific market owing to its large-scale manufacturing capacity, rising consumer appliance demand, and aggressive investments in cold chain infrastructure. The country’s strong export network and domestic adoption of smart, energy-efficient refrigeration systems further strengthen its dominant market position.

North America Refrigeration Compressor Market Insights

North America is expected to grow at the fastest CAGR of about 6.32% over 2026–2035, propelled by increasing replacement of outdated systems with energy-efficient and environmentally compliant refrigeration solutions. Rising demand for smart, inverter-based compressors in residential and commercial applications is accelerating growth. Moreover, the region’s stringent regulatory framework and incentives for adopting low-GWP refrigerants are pushing businesses and consumers to upgrade refrigeration infrastructure.

Advanced infrastructure, high consumer awareness, and emphasis on sustainability make North America a key growth hotspot in the coming years.

-

United States Leads North American Market

The U.S. dominates the North American market due to its advanced cold chain logistics, widespread commercial refrigeration infrastructure, and strong demand from retail, foodservice, and healthcare sectors. Regulatory pressure for energy efficiency further drives adoption of advanced compressor technologies.

Europe Refrigeration Compressor Market Insights

Europe’s refrigeration compressor market is characterized by mature demand, driven by stringent environmental regulations, early adoption of low-GWP refrigerants, and strong emphasis on energy-efficient systems. The region witnesses high compressor use in food processing, pharmaceuticals, and commercial buildings. Increasing retrofitting of older systems and compliance with EU climate goals are prompting sustained innovation and demand for eco-friendly and high-performance compressor technologies.

-

Germany dominates the European market due to its strong industrial manufacturing base, advanced technology adoption, and strict energy efficiency regulations. High demand from food processing, pharmaceuticals, and commercial sectors further strengthens its leadership in both production and consumption across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Refrigeration Compressor Market Insights

In the Middle East & Africa, the UAE leads the refrigeration compressor market due to rapid infrastructure growth, rising demand in food logistics, and energy-efficient cooling systems. In Latin America, Brazil dominates owing to its expansive food industry, cold chain development, and increasing adoption of modern refrigeration technologies across commercial sectors.

Competitive Landscape for Refrigeration Compressor Market:

Mitsubishi Electric Corporation

Mitsubishi Electric Corporation is a Japan-based global leader in electrical and electronic equipment, including advanced refrigeration compressors. The company designs, engineers, and manufactures a wide range of reciprocating, scroll, and inverter-based compressors for residential, commercial, and industrial applications. Mitsubishi Electric’s focus on energy efficiency, reliability, and noise reduction has positioned it as a preferred supplier for appliance manufacturers and HVACR system integrators worldwide. Its role in the refrigeration compressor market is vital, as it provides high-performance, durable, and eco-friendly solutions that meet global energy standards and support sustainable cooling systems.

-

In 2024, Mitsubishi Electric expanded its inverter-based compressor portfolio for residential and commercial refrigerators, emphasizing energy savings, compact design, and enhanced cooling efficiency.

Carrier Global Corporation

Carrier Global Corporation is a U.S.-based leader in heating, ventilation, air conditioning, and refrigeration (HVACR) solutions, including a robust lineup of refrigeration compressors. The company offers hermetic, semi-hermetic, and scroll compressors for commercial and industrial applications. Carrier’s compressors are known for energy efficiency, long operational life, and integration into large-scale cold chain and commercial refrigeration systems. Its role in the refrigeration compressor market is significant, enabling businesses to optimize cooling performance while complying with environmental regulations and sustainability goals.

-

In 2024, Carrier introduced advanced scroll compressors with reduced energy consumption and quieter operation, catering to supermarkets, cold storage facilities, and industrial refrigeration setups.

Emerson Electric Co.

Emerson Electric Co., headquartered in the U.S., is a leading provider of innovative refrigeration compressors, including reciprocating, scroll, and semi-hermetic models. The company focuses on energy-efficient and environmentally friendly solutions for residential, commercial, and industrial refrigeration applications. Emerson’s compressors are widely integrated into OEM systems, offering reliability, performance, and regulatory compliance. Its role in the refrigeration compressor market is central, providing technologies that support energy savings, operational efficiency, and reduced environmental impact in cooling systems.

-

In 2024, Emerson launched a next-generation scroll compressor series optimized for inverter operation, enhancing efficiency in commercial and industrial refrigeration applications.

Panasonic Corporation

Panasonic Corporation, based in Japan, is a global leader in electronics and home appliances, offering a comprehensive range of refrigeration compressors. The company specializes in reciprocating, scroll, and inverter compressors designed for residential and commercial refrigeration systems. Panasonic’s focus on energy efficiency, low noise, and high reliability makes its compressors widely adopted by appliance manufacturers worldwide. Its role in the refrigeration compressor market is crucial, supporting sustainable, high-performance cooling solutions and enabling manufacturers to meet international energy standards.

-

In 2024, Panasonic unveiled energy-efficient inverter compressors for household and commercial refrigerators, emphasizing compact design, low power consumption, and enhanced cooling performance.

Refrigeration Compressor Market Key Players:

-

Mitsubishi Electric Corporation

-

Carrier Global Corporation

-

Emerson Electric Co.

-

Panasonic Corporation

-

GEA Group AG

-

Nidec Corporation

-

LG Electronics Inc.

-

Midea Group

-

Frascold SpA

-

Danfoss Group

-

Mayekawa MFG. Co., Ltd.

-

Huayi Compressor Co., Ltd.

-

Qianjiang Compressor Co., Ltd.

-

Shanghai Highly (Group) Co., Ltd.

-

Bitzer Kühlmaschinenbau GmbH

-

Tecumseh Products Company

-

Samsung Electronics Co., Ltd.

-

Toshiba Corporation

-

Whirlpool Corporation

-

Hitachi Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 28.79 Billion |

| Market Size by 2035 | USD 46.81 Billion |

| CAGR | CAGR of 4.98% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Compressor Type (Reciprocating Compressor, Scroll Compressor, Screw Compressor • By Capacity (Upto 5 Hp, 5 to 10 Hp, 10 to 15 Hp, Above 15 Hp) • By Application (Residential, Commercial, Industrial) • By Type (Open, Hermetic, Semi-hermetic) • By Motor (Fixed Speed Compressor, Variable Speed Compressor (Inverter)) • By Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Emerson, Danfoss, Bitzer, GEA, Mitsubishi Electric, Tecumseh, LG, Panasonic, Samsung, Daikin, Johnson Controls, Fusheng, Frascold, Hanon Systems, Mayekawa, Secop, Kulthorn Kirby, Rechi, Güntner, and Highly International. |