Commercial Satellite Imaging Market Report Scope & Overview:

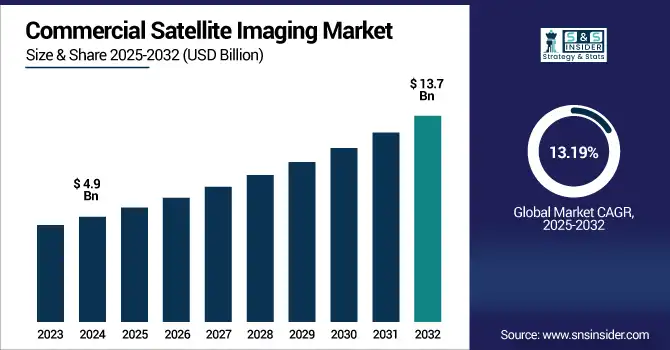

The commercial satellite imaging market size was valued at USD 4.9 billion in 2024 and is expected to reach USD 13.7 billion by 2032, growing at a CAGR of 13.19% during 2025-2032.

To Get more information on Commercial Satellite Imaging Market- Request Free Sample Report

Commercial Satellite Imaging Market growth is being fueled by growing usage in the domains of defense, agriculture, urban planning, and disaster management. Satellite-capture capabilities are being augmented with continued progress in high-resolution imaging, geospatial analytics, and AI integration, all extended into higher-frequency temporal bands to further enrich satellite-captured data. Governments and private entities are using satellite imaging for border surveillance, monitoring of infrastructure, and tracking environmental changes. In addition, adoption is driven by the increase in natural disasters and the need to monitor the climate. The spread of small satellite constellations and decreasing launch prices are also enabling satellite imaging to be a more affordable option. The increased utilization of aerial imagery by the media, real estate, and insurance industries is also adding fuel to the fire. Reportedly, the market is anticipated to record substantial CAGR during 2025-2032 due to the growing adoption of AI-enabled analytics, rising Earth observation missions, and increasing commercial applications in precision agriculture and smart cities.

The U.S. market is driven by defense modernization, precision agriculture, and climate monitoring. Expanded demand for high-resolution geospatial data and AI-driven analysis products drives rapid growth in enterprise geospatial analytics. The Integrated Commercial Satellite Imaging Market trend in the U.S. will see the market grow from USD 1.53 billion in 2024 to USD 4.02 billion by 2032, at a CAGR of 12.90%.

Market Dynamics:

Drivers:

-

Rising Multi-Sector Demand for Real-Time Geospatial Intelligence Drives Adoption of High-Resolution Satellite Imaging

High-resolution Earth observation data has become essential for many sectors, including agriculture, defense, mining, urban planning, and disaster management, and is thus a significant driver of the commercial satellite imaging market. Increased satellite sensor technologies allow for capturing detailed imagery in real time or near real time, which is changing how organizations monitor environmental changes, manage resources, and respond to emergencies. Satellite imagery plays a crucial role in border monitoring, as well as tactical planning, in defense. In agriculture, satellite images can be used for vegetation and soil data that is essential to precision farming. The increasing multi-industry reliance on high-quality geospatial intelligence is driving investment in satellite imaging infrastructure and expanding commercial use of this imagery worldwide

For instance, in 2023 alone, commercial operators captured and distributed over 500 million high-resolution images (up from 350 million in 2022), fueling real-time analytics demand

Restraints:

-

High Satellite Development and Launch Costs Limit Market Accessibility for Smaller Players and Startups

The cost of satellite manufacturing, launching, and maintenance remains the key restraint for the commercial satellite imaging market despite technological advancements. For new entrants and smaller industries, the entry barrier is high. Even small satellites require millions of dollars to be placed in orbit and rely on the availability of space launch providers. In addition, national security and image resolution limits may act as operational challenges associated with regulatory constraints as well. High-resolution data is fast and useful, but is rarely released to the public in a way that can be more widely used because of U.S. and European regulations. Such financial and legal aspects may hinder innovation and postpone the project's implementation, restraining market expansion and leaving only better-capitalized companies or state-backed firms to take part in it.

For Instance, In 2023, just 5% of the 2,680 small satellites were launched using small/micro launch vehicles, with most piggybacking on larger rockets, reflecting cost constraints.

Opportunities:

-

Integration of AI and Cloud Analytics Enables Faster, Scalable Insights from Satellite Imagery for Diverse Applications

Artificial intelligence and cloud computing integration with satellite imaging opens a new paradigm for the commercial satellite imaging market. AI-driven analytics facilitate on-demand object identification, pattern detection, and predictive analysis using satellite images by providing real-time insights in various sectors. High-volume image analysis can be even more portable, scalable, and efficient when cloud platforms are leveraged for storage and processing. In agriculture, AI can be harnessed to identify crop stress or forecast yield, and for urban planning, it can be deployed to observe infrastructure development, for instance. This merging of satellite information with smart computing platforms not only enables new revenue streams and easier decision-making, it also makes the information more widely accessible to non-expert users, which makes the satellite imaging sector much more commercially viable and agile.

As of April 2025, AI technologies in the space industry are enhancing satellite data analysis speed and accuracy by up to 70% .

Challenges:

-

Rising Data Privacy Concerns and Cybersecurity Risks Threaten Widespread Commercial Use and Client Trust

Data privacy and cybersecurity risks are among the most fundamental issues facing the commercial satellite imaging market. With advances in high-resolution satellite imagery and its court accessibility, geographic or individual sensitive information can be easily abused. This technology can also serve the malicious purpose of unauthorized surveillance, exposure of critical infrastructure layouts, or being abused by hostile entities. Besides, satellite systems are exposed to cyberattacks, signal jamming, and data breaches that can endanger mission integrity and compromise client trust. To counter these, strong encryption, regulatory compliance, and international cooperation are needed. If data security is not ensured, it could be a barrier to adoption, most importantly by government organizations and other critical industries that need to operate in strict confidentiality and reliability.

Segmentation Analysis:

By Component:

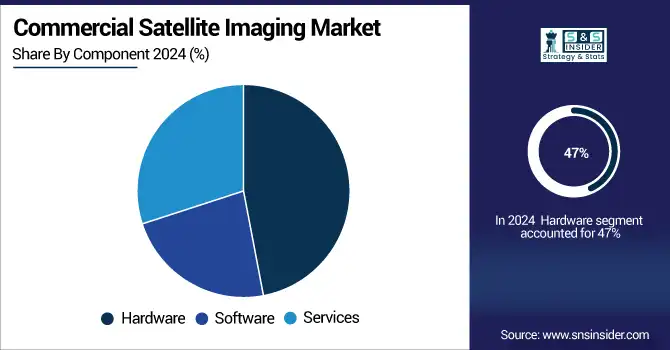

The hardware segment dominated the market in 2024 and accounted for 47% of the commercial satellite imaging market share due to constant deployment of high-resolution satellites and rising need for advanced optical sensors. This segment will remain the largest through 2032, due to investment in next-gen payloads, miniaturization, and multispectral imaging. The number of hardware adoption will continue to rise tied to growing government defense contracts and private Earth observation missions across environmental, military, and infrastructure applications.

Software is the fastest-growing segment. Soaring adoption of AI, cloud, and automation for real-time image analysis drives the growth of the software segment. In 2032, software tools will prove essential in transforming raw satellite data into actionable intelligence. Improved predictive analytics, object recognition, and scalable platforms will cement software as the center of decision-making in areas including, but not limited to, agriculture, surveillance, and urban planning.

By Application:

Defense & Intelligence dominated the commercial satellite imaging market in 2024 and accounted for a significant revenue share, due to image acquisition needs to fulfill the high demand for real-time surveillance, target tracking, and border security. High-resolution satellite constellations for surveillance and reconnaissance are being developed globally by governments. The continued economic growth through 2032 will be driven by the need for sustained growth as geopolitical tensions persist and nations continue counter-terrorism operations and move toward modernizing their intelligence capabilities, making satellite imaging an integral and most sought-after component of national security and defense operations.

On April 9, 2025, the U.S. National Reconnaissance Office (NRO) and U.S. Space Force are finalizing a joint framework to streamline the acquisition and sharing of commercial satellite imagery for defense intelligence. The initiative aims to bolster ISR (intelligence, surveillance, reconnaissance) capabilities using commercial Earth observation assets.

Disaster Management is set to register the fastest CAGR during the forecast period, owing to increasing climate-related events and global commitment to early warning systems. Since 2023, satellite images have become conventional for real-time detection of disasters, designing responses, and assessing recovery. The Humanitarians and Emergency Service Providers will need fast access to satellite imaging, and by the year 2032, the advent of rapidly processed imaging data in step with AI-powered pattern recognition will enable rapid disaster readiness.

By End-Use

Forestry and Agriculture lead the commercial satellite imaging market in 2024 and represented a significant revenue share, due to increasing use of satellite-based imaging solutions for crop monitoring, yield prediction, and land use, therefore making Forestry and Agriculture the leading vertical, and accounting for the highest revenue share. Satellites are an important tool for precision farming, but they also play an essential role in the policy supporting it: governments and agritech firms alike track environmental compliance using satellite data. Imaging will be indispensable for the sustainable manufacturing of food and woody products, enabling resource optimization in agriculture and forestry by 2032 due to increasing food demand and accelerating climate variability.

Jan 14, 2025, Google-backed Pixxel successfully launched three hyperspectral imaging satellites, enhancing Earth observation capabilities for agriculture, forestry, environmental monitoring, and mining. This marks a significant advancement in delivering detailed crop health and forest biomass insights.

Transportation and Logistics is the fastest-growing segment during 2025-2032, owing to route optimization, infrastructure monitoring, and supply chain visibility. Fleet overflight, port switching, or even securing motion for traffic forecasting, after all 2023 satellite images are implemented. The demand for Smart Cities and autonomous logistics and the need for real-time mapping will spur the growth of imaging for transport networks, leading to a 10X increase by 2032.

Regional Analysis:

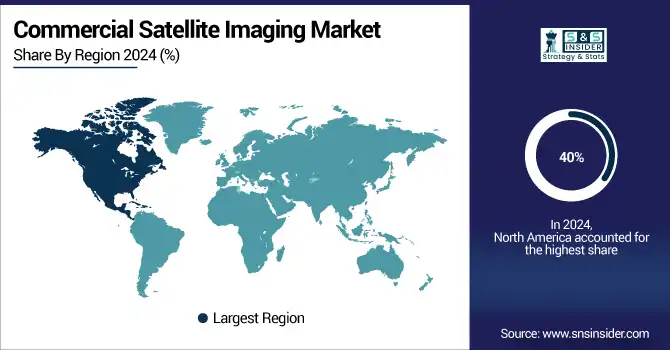

North America dominated the commercial satellite imaging market in 2024 and accounted for 40% of revenue share, due to investments by major players such as Maxar and Planet Labs focusing on defense, space exploration, and commercial Earth observation. For example, satellite imagery is very commonly used by government agencies, such as NASA and NOAA. Then by 2032, the region will still be viewed as the imaging solution leader, as they will continue to invest in AI-integrated space technology, homeland security, and environmental monitoring.

Asia-Pacific is expected to register the fastest CAGR during the forecast period, driven by increasing space programs in China, India and Japan, and increasing demand for imaging for agriculture, disaster response and infrastructure requirement. As the private sector roles up and a high rate of urbanization is followed by potential investments in small satellite constellations, the region will fast-track its commercial satellite imaging applications by 2032.

Europe’s commercial satellite imaging market growth is driven by the increasing investments in climate monitoring, defense imaging, precision agriculture, smart infrastructure, and more, which are generating opportunities for the growth of the market in Europe. Growth in EU space programs and public-private assignments will expedite adoption. Europe will be a hotbed for strategic satellite imaging by 2032, driven by demand for high-resolution imaging to support national infrastructure and sustainability goals.

Germany dominates the European commercial satellite imaging market due to strong defence spending, innovation from its defence industry, and cooperation with innovative satellite imaging companies like Planet Labs. Advanced Earth observation use cases are supported by AI and space tech initiatives, which are backed by the government. Germany will top the defence intelligence, agricultural monitoring, and environmental mapping applications by the year 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major commercial satellite imaging market companies are Maxar Technologies, Airbus Defence and Space, Planet Labs PBC, BlackSky Global, ICEYE, ImageSat International, L3Harris Technologies, Satellogic, Capella Space, GeoIQ.io and others.

Recent Developments:

-

On March 6, 2025, Airbus Defence & Space deployed the CSO‑3 satellite via Ariane 6, delivering very-high-resolution optical imagery to France's DGA and Space Command under the MUSIS military program.

-

On May 8, 2025, ICEYE and Rheinmetall signed an MoU to form Rheinmetall ICEYE Space Solutions JV in Germany, aiming to produce SAR satellites in Neuss for defense-grade ISR capabilities.

-

On February 25, 2025, Planet Labs extended its multi-year enterprise license with Bayer, integrating PlanetScope, Tasking, Fusion, Basemaps, and analytics to support precision farming operations

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 123.9 Billion |

|

Market Size by 2032 |

US$ 815.3 Billion |

|

CAGR |

CAGR of 26.58% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Enterprise Size (SMEs, Large Enterprises) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

Microsoft, Amazon Web Services, Google Cloud, IBM Corporation, Oracle, SAP SE, T-Systems, OVHcloud, Atos, VMware and others in the report |