Hyper Car Market Report Scope & Overview

Get More Information on Hyper Car Market - Request Sample Report

The Hyper Car Market Size was valued at USD 49.8 billion in 2023 and is expected to reach USD 115.51 billion by 2032 and grow at a CAGR of 9.8% over the forecast period 2024-2032.

The increasing number of high-net-worth individuals (HNWIs) globally translates to a growing customer base with the financial resources to acquire these exclusive cars. Thus, the passion for collecting and owning a piece of automotive history is a strong driver. Hyper cars often push boundaries in design, speed, and performance, making them highly sought-after collectibles.

The advancements in technology are constantly propelling the market forward. Hybrid and electric hyper car concepts are emerging, offering both the thrill of extreme performance and a nod towards environmental responsibility. For instance, the Ferrari SF90 Stradale is a plug-in hybrid that delivers mind-bending acceleration while boasting significant fuel efficiency compared to traditional hyper cars. The lighter and stronger materials like carbon fibre are being increasingly utilized, resulting in lighter cars with superior handling.

Demand for hyper cars in the United States is supported by combined factors of technological innovation, superior consumer tastes for luxury and performance, and greater trends toward sustainability. Actually, one of the paramount factors driving demand is the general interest in electric and hybrid hyper cars. About 30% of the hyper cars sold in the United States in 2023 were electrified, either fully electric or hybrid models. This is a trend characterized by environmental consciousness among consumers as well as the need to own the latest technology that can balance performance with being environmentally friendly. To this end, near 40% of hyper car buyers in the U.S. perceive superior personalization as key, not only making these vehicles exclusive but also personalized.

Another very important influence is the rising disposable income of ultra-high-net-worth individuals. Ultra-high-net-worth individuals account for around 20% of hyper car buyers in the U.S., and this segment has been increasing steadily in recent years. Members of this segment view a hyper car primarily as a status symbol and investment rather than as a mode of transportation. In addition, the integration of advanced driver assistance systems in hyper cars is gradually influencing the tech-orientated customer. About 25% of the U.S. buyers claim to prefer vehicles with advanced safety and performance technologies, thereby increasing the demand for this niche market.

Hyper Car Market Dynamics:

KEY DRIVERS:

-

Rising wealth of high-net-worth individuals creates a larger pool of potential buyers for hyper cars.

-

Limited production numbers heighten desirability and create a sense of owning a unique automotive masterpiece.

-

Carbon fibre and other advanced materials create lighter cars with superior handling.

Compared to traditional materials like steel, carbon fibre boasts exceptional strength-to-weight ratio. This translates to significant weight reduction in hyper cars, leading to a multitude of benefits. The lighter cars require less power to achieve the same level of acceleration, improving fuel efficiency. The lighter weight allows for superior handling and agility, as the car can move more precisely and respond more quickly to driver inputs. This leads to more exhilarating and confidence-inspiring driving experience. by incorporating carbon fiber and other advanced materials, engineers can design hyper cars with improved aerodynamics. This enhances downforce, which is the force pushing the car downwards against the track, leading to increased grip and stability, particularly at high speeds. The adoption of lightweight materials is creating a hyper car that performs exceptionally well while offering a truly unique driving experience.

RESTRAINTS:

-

The exorbitant cost of hyper cars limits the market to a select group of ultra-wealthy buyers.

-

Manufacturers prioritize exclusivity by producing limited numbers, leading to long waitlists and frustrated potential buyers.

Manufacturers deliberately cap production numbers to create a sense of rarity and desirability. This strategy plays on the psychology of human collectors, who crave items that are not readily available. This approach undoubtedly fuels brand image and prestige and also creates a significant roadblock for potential buyers. This limited availability can leave potential customers feeling excluded and dampen their enthusiasm. The restricted production numbers can cause an impact on the overall market. With fewer hyper cars available, there's less opportunity for innovation and competition. This can stifle technological advancements and potentially hinder the long-term growth of the hyper car market.

OPPORTUNITIES:

-

Immersive experiences can allow potential buyers to virtually experience the thrill of a hyper car.

-

Offering extensive customization to cater to individual tastes and preferences.

CHALLENGES:

-

The advanced technology in hyper cars makes them expensive and complex to maintain.

Hyper Car Market Segment Overview:

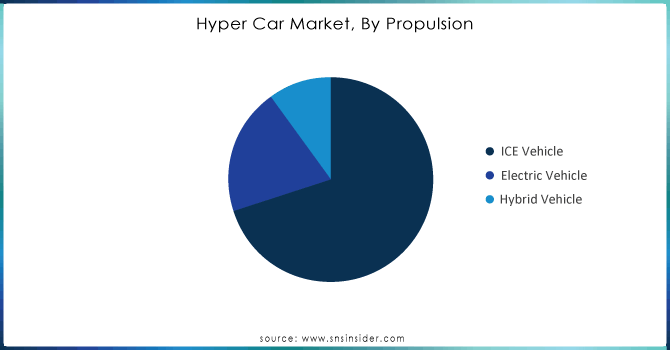

By Propulsion:

Internal Combustion Engine (ICE) is the dominating sub-segment in the Hyper Car Market by propulsion holding around 70-75% of market share. Despite the rising popularity of electric vehicles, ICE vehicles still hold a dominant position in the hyper car market. This dominance is primarily driven by the established performance capabilities of ICE engines. Hyper car manufacturers can leverage extensive experience in fine-tuning these engines to deliver exceptional power, acceleration, and top speeds. Additionally, the emotional appeal of a roaring engine and the familiar driving experience associated with ICE vehicles continue to resonate with a significant portion of hyper car enthusiasts.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Racing Competition is the dominating sub-segment in the Hyper Car Market by application. Purpose-built hyper cars designed specifically for racing competitions are a dominant segment within the application category. These vehicles prioritize factors like downforce generation, aerodynamic efficiency, and lightweight construction to achieve peak performance on the racetrack. Manufacturers heavily invest in research and development to create these racing machines, pushing the boundaries of automotive technology and engineering. The prestige associated with winning prestigious races and the multi-million dollar sponsorships involved further solidify the dominance of racing-focused hyper cars.

By Car Type

Full-size (Above 2500cc) is the dominating sub-segment in the Hyper Car Market by car type holding around 80-90% of market share. When it comes to car type, full-size hyper cars reign supreme. These behemoths boast powerful engines with large displacements, typically exceeding 2500cc. This allows for unmatched power output, enabling them to achieve staggering acceleration figures and reach phenomenal top speeds. Additionally, the larger size provides ample space for incorporating advanced aerodynamic elements and sophisticated cooling systems, crucial for managing the immense heat generated by these powerful engines. While movability might be slightly compromised compared to smaller cars, the sheer dominance in terms of power and performance makes full-size hyper cars the preferred choice for many enthusiasts.

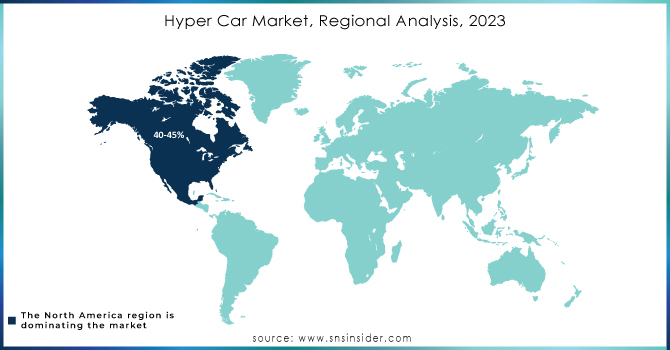

Hyper Car Market Regional Analysis

The North America is the dominating region in the hyper car market, capturing an estimated 40-45% of market share. This dominance stems from a deeply ingrained car culture with passionate collectors, a wealth concentration allowing for hefty price tags, and extensive infrastructure like road networks and racetracks to unleash these beasts.

Europe is the second highest region in this market. European manufacturers are known for their advanced engineering and technological advancements, reflected in their hyper car offerings. Thus, Europe's long history of prestigious racing events like Formula 1 fuels the demand for high-performance vehicles.

The Asia Pacific is the fastest growing region in this market. This surge is driven by the rising economy creating new hyper car buyers, the aspirational value associated with ownership, and even government support for high-performance vehicle development.

KEY PLAYERS

The major hyper car market players are as follows:

-

Ferrari: (Ferrari LaFerrari, Ferrari SF90 Stradale)

-

Lamborghini:(Lamborghini Aventador SVJ, Lamborghini Sián FKP 37)

-

McLaren:(McLaren P1, McLaren Speedtail)

-

Lotus Cars: (Lotus Evija, Lotus 3-Eleven)

-

Bugatti:(Bugatti Chiron, Bugatti Divo)

-

Porsche: (Porsche 918 Spyder, Porsche 911 GT2 RS)

-

Koenigsegg Automotive AB: (Koenigsegg Jesko, Koenigsegg Regera)

-

Aston Martin: (Aston Martin Valkyrie. Aston Martin Vulcan)

-

Pagani: Pagani Huayra, Pagani Zonda HP Barchetta)

-

Pagani Huayra: (Pagani Zonda HP Barchetta, Mineko)

-

Mercedes (AMG): (Mercedes-AMG Project One, Mercedes-AMG GT Black Series)

-

Zenvo Automotive: (Zenvo TSR-S, Zenvo ST1)

-

Alfa Romeo: (Alfa Romeo 8C Competizione, Alfa Romeo TZ3 Stradale)

-

W Motors: (W Motors Lykan HyperSport, W Motors Fenyr SuperSport)

-

Jaguar Land Rover (JLR): (Jaguar C-X75, Range Rover)

-

Dendrobium: (Dendrobium D-1, )Xing Mobility)

-

Pininfarina: (Pininfarina Battista, Pininfarina H2 Speed)

-

Aspark: (Aspark Owl, Ariel)

-

Ariel Atom V8: (Ariel HIPERCAR (upcoming electric hypercar), Tesla)

-

Tesla Roadster (next-gen): (Tesla Model S Plaid)

-

Hispano Suiza: (Hispano Suiza Carmen, Hispano Suiza Carmen Boulogne)

RECENT DEVELOPMENT

-

In March 2023: Danish automaker Zenvo unveiled the Aurora, their latest hypercar. This V12 powerhouse boasts a modular design, featuring a lightweight carbon fiber monocoque core and complementary subframes for ultimate performance.

-

In June 2022: Mercedes unleashes the production-ready AMG One, a hypercar featuring a hybrid 1.6-liter V6 engine with F1 inspiration. This 1000-horsepower beast boasts four electric motors, bringing advanced racetrack tech to the road.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 49.8 Billion |

| Market Size by 2032 | US$ 115.51 Billion |

| CAGR | CAGR of 9.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Propulsion (Electric vehicles, ICE vehicles, Hybrid vehicles) • by Car Type (Compact, Mid-Size, Full-Size) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ferrari, Lamborghini, McLaren, Lotus Cars, Bugatti, Porsche, Koenigsegg Automotive AB, Aston Martin, Pagani, Mineko, Mercedes, Zenvo Automotive, Alfa Romeo, W Motors, JLR, Dendrobium, Xing Mobility, Pininfarina, Aspark, Ariel, Tesla, Hispano Suiza |

| Key Drivers | • An increase in sports car manufacturers' competition. • The shift in taste from ordinary to luxurious sports automobiles is a result of advances in technology. |

| RESTRAINTS | • Hyper-car sales are hampered by their high price. • The cost of the final product rises due to the inclusion of more advanced technologies in the vehicle. |