Terminal Tractor Market Size

Get More Information on Terminal Tractor Market - Request Sample Report

Terminal Tractor Market Overview

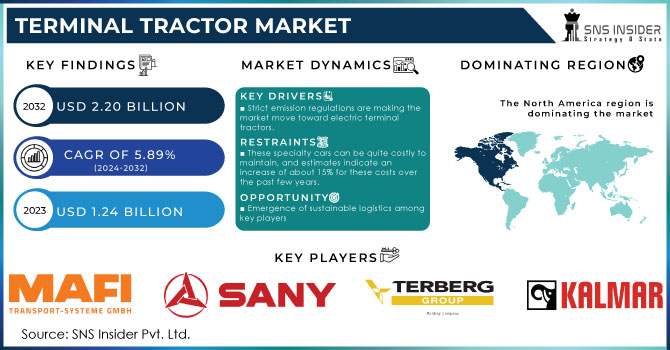

The Terminal Tractor Market is expected to reach USD 2.20 Billion by 2032 and was valued at USD 1.24 billion in 2023. The projected CAGR for the forecast period 2024-2032 is 5.89%.

The most important factor why the terminal tractor demand keeps going upward is the fast-growing e-commerce and online retail industries. Therefore, current logistics systems are heavily strained due to rapid growth in online shopping that leads to more goods being shipped and delivered. Terminal tractors are a must have for moving trailers through warehouses and distribution centers so as to improve fulfillment and delivery times. SNS Insider has estimated that this sector will account for over 83% of the growth in the US terminal tractor market. Automation is yet another key driver within the logistics industry.

There is a trend towards automation based solutions because businesses are contending with labor shortages particularly in America amid calls for improved operational efficiency. Some of the major advantages of automated terminal tractors include; they operate around-the-clock, reduce human errors, as well as enhance safety on site. For instance, Terberg teamed up with Kramer Group and StreetDrone to deploy self-driving yard trucks in different locations at Port of Rotterdam. Ports must deal with more cargo as global trade grows. For prompt hauling of containers, terminal tractors are critical in ensuring smooth operation of these ports with minimal delays. Terminal tractors use trailers which carry the loads that these unique vehicles shift around at terminals and stores. To be effective, therefore, trailers are central to terminal tractors. The increasing use of containers in sea transport also supports the need for terminal tractors at docks.

Drivers:

-

Although the upfront cost is higher compared to diesel models, electric tractors offers lower operating costs and environmental benefits in the long run.

-

Strict emission regulations are making the market move toward electric terminal tractors.

Electric terminal tractors eliminate emissions from their engines improving air quality in ports and their surrounding communities. Replacing diesel powered tractors with electric ones can reduce emissions by up to 90%, thus promoting cleaner air and public health improvement. Many governments are offering incentives such as terminal tractors to promote electric vehicles adoption. These incentives can foster transition from diesel-powered alternatives thereby offsetting high initial cost of an electric vehicle.

Restrains:

-

These specialty cars can be quite costly to maintain, and estimates indicate an increase of about 15% for these costs over the past few years.

-

Lack of skilled labor is a major concern affecting market growth.

Terminal tractors require experienced drivers conversant with safety procedures and confined space movements. According to the American Trucking Associations (ATA), there is a shortage of approximately 80,000 drivers in the US trucking industry which also affects terminal tractor industry. An inadequate workforce could result in ineffectiveness and possible safety hazards.

Opportunity:

-

Emergence of sustainable logistics among key players

Diesel-powered terminal tractors remain the most common, though interest in electric and hybrid alternatives has been growing. These solutions have significant positive environmental impacts because they consume less fuel and produce fewer pollutants, thus adhering to growing emphasis on eco-friendly operations within the logistics industry.

Terminal Tractor Market Segmentation Analysis:

By Drive Type

4x2 tractors, which are characterized by two rear wheels and can be used in smart transportation and small-sized warehouses due to their fuel economy and maneuverability, dominate with the largest market share of about 42%. For instance, 85% of the North American and Asia Pacific markets includes 4x4 models with high movement ability and good traction needed for uneven areas or slippery surfaces commonly found in industrial yards as well as ports. In order to ensure that the hardest tasks are executed properly six wheelers called 6x4 tractors may be employed since all-wheel drive is equipped on such vehicles. On top of that, it consumes more petrol however it’s power is capable of doing heavy-duty works like moving large loads in ports or lifting huge pieces of equipment at construction sites.

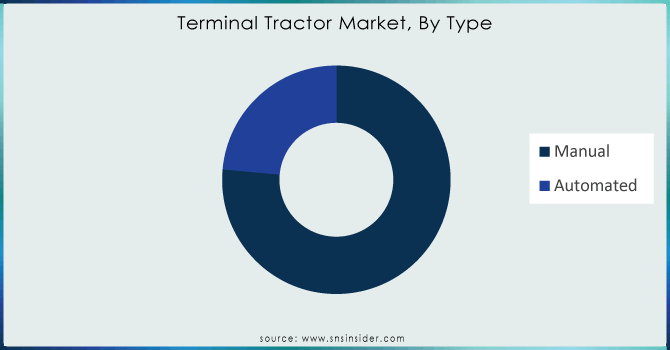

By Type

The manual terminal category currently represents approximately 60-70% of the market share. This kind of trucks is affordable thus suitable for an economical buyer who pursues a degree of control. But they are also less efficient because they demand more labor than automatic machines do and sometimes humans make mistakes. By 2032 automated will be growing at the fastest growth rate an will account for 30-40% of share. Besides, automation makes work faster by reducing personnel costs involved in operation while at the same time increasing safety through minimizing human errors. Automation also makes it possible to integrate with terminal management systems for better route planning and scheduling.

Need any customization research on Terminal Tractor Market - Enquiry Now

By Propulsion

Diesel is currently the industry leader with a market share of nearly 70%. This is because it has well developed infrastructure, cost-effective prices and better performance. Electric terminal tractors are quickly gaining ground at approximately 20% of the market. Their rise stems from stricter emission standards and lower operating costs especially when battery prices decrease. In this regard, electric tractors are more suitable indoors because they run more smoothly and quieter. Nevertheless, compressed natural gas (CNG) and liquefied natural gas (LNG) powered tractors provide a cleaner option than diesel although their contribution to overall market share is about 10%.

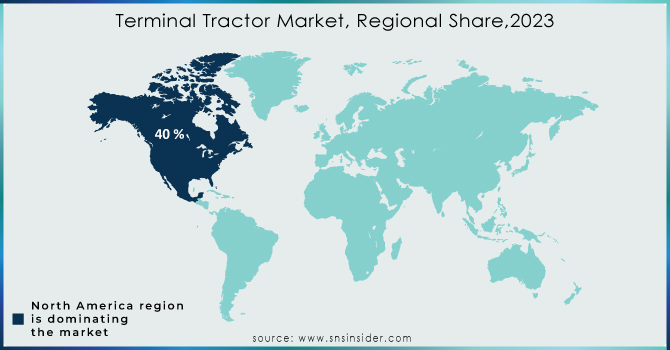

Terminal Tractors Market Regional Analysis:

North America held the dominant share of 42% in 2023 in terminal tractors market. Many sectors in this area face strong material handling requirements. Busy maritime ports, warehouses and logistics centers account for most of these special purpose vehicles. Still, the 4x2 arrangement commands over 85% of the market. It has a lot of appeal since it reasonably priced for both initial purchase as well as ongoing support costs plus more than that. The 4x4 market has a promising future and is well known for its superb movement when it comes to small space and congested terminals. Notably, Hyster-Yale Group, Mitsubishi Caterpillar Forklift Americas, and Kalmar (Cargotec Corporation) are leading in this industry. These mammoth players are constantly coming up with new ways through automation and alternative energy sources to meet evolving needs.

The Asia Pacific region has seen an increase in containerization over the past years resulting into approximately 40% growth according to SNS Insider while cargo standardization hastened the process for enterprises involved. This implies that there will be a significant increase in demand for shunt trucks chiefly within warehouse-logistic sectors .

Key Players:

MAFI Transport-System GmbH, SANY Group, Terberg Group B.V., Kalmar Inc., Hyster-Yale Group, Inc., Cargotec, REV Group Inc., Linde Material Handling, CVS Ferrari S.p.A., Konecranes Oyj and others.

Recent Developments:

-

Terberg: Tested an autonomous terminal tractor with EasyMile driverless technology at Lineage Logistics terminal in the Netherlands.

-

TICO: Launched its electric terminal tractor in North America through partnerships with Cummins and Volvo Penta.

-

Autocar LLC: Launched the E-ACTT, an all-electric, zero-emission version of its Autocar ACTT terminal tractor.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.24 billion |

| Market Size by 2032 | US$ 2.20 Billion |

| CAGR | CAGR of 5.89 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Application: (Airport, Marine Port, Oil & Gas, Warehouse & Logistics) By Drive Type (4X2, 4X4, 6X4) By Tonnage (<50 Ton, 50-100 Ton, >100 Ton) By Type (Manual, Automated) By Industry (Retail, Food & Beverages, Inland waterways & Marine services, Rail Logistics, RoRo) By Propulsion (Diesel, Electric, CNG/LNG) By Battery Chemistry (LFP, NMC, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MAFI Transport-System GmbH, SANY Group, Terberg Group B.V., Kalmar Inc., Hyster-Yale Group, Inc., Cargotec, REV Group Inc., Linde Material Handling, CVS Ferrari S.p.A., Konecranes Oyj and others. |

| Key Drivers | Strict emission regulations are making the market move toward electric terminal tractors. |

| RESTRAINTS | lack of skilled labor is a major concern affecting market growth. |