True Wireless Stereo (TWS) Earbuds Market Size & Trends:

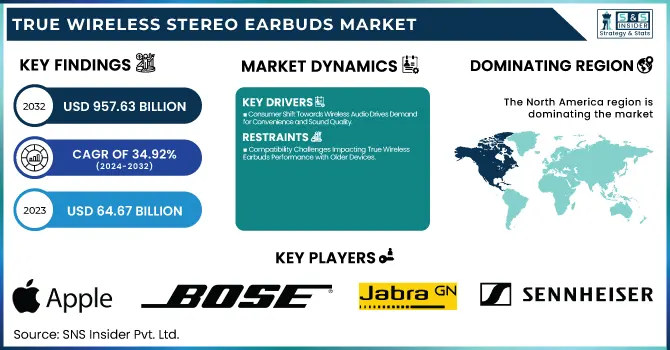

The True Wireless Stereo (TWS) Earbuds Market size was valued at USD 64.67 Billion in 2023, and expected to reach USD 957.63 Billion by 2032, growing at a CAGR of 34.92 % during 2024-2032. The Market driven by several factors, including advancements in battery life and technology adoption, which continuously enhance the overall user experience. The increasing dependency on wireless audio systems across consumer groups including music lovers, sports and fitness enthusiasts, and home office seekers has further galvanized the market.

To Get more information on True Wireless Stereo Earbuds Market - Request Free Sample Report

Moreover, the rising trend of smartphone integration and wireless connectivity also increased the demand of TWS earbuds (Bluetooth 5.0 and above). The popularity of subscription-based services, which include personalized sound profiles and firmware updates, has also boosted growth. Additionally, as sustainable products gain traction and sound quality improves with noise cancellation technologies, these earbuds have become must-haves for the average lifestyle.

True Wireless Stereo Earbuds Market Dynamics:

Drivers:

-

Consumer Shift Towards Wireless Audio Drives Demand for Convenience and Sound Quality

The increasing consumer preference for wireless audio solutions is driving the growth of the True Wireless Audio Earbuds market. With the advent of smartphones, smart devices and wearable technology, more and more consumers are looking for audio products that remove the nuisance of tangle free wires with no compromise in sound quality. The wireless connectivity with improved portability helps you enjoy music, podcasts, and calls while on the move and have become an essential accessory for modern-day lifestyle. Improvements in sound technology and Bluetooth connectivity also guarantee better audio performance, providing more reasons why consumers are buying wireless earbuds. These easy to wear, and wireless devices, are a result of a broader consumer shift toward wireless solutions, propelled by the priorities that consumers place on functionality, ease of use, and an uninterrupted audio experience throughout their lives, whether travelling to work or exercising.

Restraints:

-

Compatibility Challenges Impacting True Wireless Earbuds Performance with Older Devices

Limited compatibility with older devices poses a challenge for the true wireless earbuds market. Many older smartphones, laptops, and other gadgets may not support the latest Bluetooth technologies, such as Bluetooth 5.0 or higher, which are essential for providing optimal performance in terms of range, connectivity, and battery efficiency. As a result, consumers with older devices may experience connection dropouts, poor audio quality, or shorter battery life, which limits the overall functionality of their true wireless earbuds. This incompatibility can deter potential buyers from investing in wireless audio products and restrict market growth among consumers who are reluctant to upgrade their devices.

Opportunities:

-

Eco-Friendly True Wireless Earbuds Meeting Consumer Demand for Sustainable Audio Solutions

As environmental awareness grows among consumers, there is a significant opportunity for companies to create sustainable and eco-friendly true wireless earbuds. By using recyclable materials or biodegradable components, manufacturers can appeal to the increasing number of eco-conscious buyers who seek products that align with their values. In a world where people are becoming increasingly conscious of the environmental impact of their purchases, creating earbuds that use sustainable materials, like recycled plastics, natural fibers, or biodegradable packaging, can elevate brands above the competition. In addition, practicing sustainability not only meets the consumer demand but also comes on the international movement to reduce electronic waste, which makes the companies seem more responsible and forward-thinking in the competitive audio market.

Challenges:

-

Durability and Loss Risks Impacting True Wireless Earbuds User Experience Due to Small Size

True wireless earbuds, due to their compact and lightweight design, are prone to durability issues, particularly from accidental drops. Their small size makes them vulnerable to physical damage, such as cracked casings or broken components, if dropped or mishandled. Additionally, because of their portable nature, earbuds are easy to misplace, especially when users take them on the go. This risk of loss can significantly affect the product's lifespan, as consumers may need to replace lost or damaged units more frequently, leading to reduced customer satisfaction. This issue is particularly challenging for users who are prone to misplacing small items, as the cost of replacement and the inconvenience of losing the earbuds can diminish the overall user experience and brand loyalty.

TWS Earbuds Market Segment Analysis:

By Price Band

The USD 100–99 price segment is dominated the largest share revenue in True Wireless Stereo Earbuds Market of around 41% in 2023 , and growing the fastest during the forecast period 2024 to 2032. This segment is unique because it provides a mixture of affordable and high-quality features, thus appealing to a wider audience. Consumers are growing used to, in this price range, reliable performance — from battery life to sound quality to connectivity. Due to the segment’s value proposition, demand is expected to grow rapidly in the all periodmaking it the fastest growing segment. This price point will drive more brands competing up until this point, ultimately fuelling further growth in this market.

By Sales Channel

In 2023, the offline segment accounted for the largest share of revenue in the True Wireless Stereo Earbuds Market, with approximately 59%. This dominance can be attributed to consumers' preference for in-store shopping, where they can experience the products firsthand before making a purchase. Many buyers value the opportunity to test the sound quality, comfort, and fit of the earbuds, as well as receive personalized recommendations from sales representatives. Additionally, offline retail offers immediate product availability, which appeals to consumers who prefer instant gratification rather than waiting for online delivery.

The online segment is expected to be the fastest-growing segment in the True Wireless Stereo Earbuds Market during the forecast period from 2024 to 2032. This growth has been fuelled by the increasing adoption of e-commerce as consumers prefer to browse through an array of products and purchase them from the comfort of their homes. The reasoning is that the internet has an abundance of supplies available, frequently accompanied by marking down costs, markup specials, and client evaluations that can direct shopping choices. Besides, the increasing adoption of mobile devices and digital payment systems has also contributed to the growth of online sales. The online segment can look forward to significant growth in the coming years, due primarily to the ready availability of e-commerce platforms that provide easy access, convenient delivery and intuitive interfaces.

True Wireless Stereo Earbuds Market Regional Analysis:

In 2023, North America held a dominant share of approximately 40% in the True Wireless Stereo Earbuds Market, reflecting its strong consumer demand, high disposable income, and early adoption of technology. owing to surrounding consumer demand, higher disposable income, and early technology adoption in the region in 2023. This dominance can be attributed to the region's preference for premium audio products and well-established retail and e-commerce infrastructure. In the United States and Canada, leading tech companies and innovative brands continue to move the market forward with product developments and improved functionality. Additionally, the increasing adoption of wireless audio solutions in diverse applications such as fitness, travel, and entertainment reinforce North America's dominance of the global market.

Asia-Pacific is expected to be the fastest-growing region in the True Wireless Stereo Earbuds Market over the forecast period from 2024 to 2032. This increase is bolstered by the surging demand for smart devices, increasing disposable incomes, and a penchant for portable and wireless audio solutions in China, India, Japan, and others. Additionally, in the region, the rapid development of e-commerce together with the growing trend for quality and cost-effective audio devices further contributes to the growth of the market. In addition, the Asia-Pacific region is home to a substantial young and tech-savvy population, which eagerly welcomes innovations that boost acceptance of true wireless stereo earbuds.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major key Players in True Wireless Stereo Earbuds Market along with their Product:

-

Apple Inc. (USA) - AirPods, AirPods Pro, AirPods Max

-

Bose Corporation (USA) - Bose QuietComfort Earbuds, Bose Sport Earbuds

-

Jabra (Denmark) - Jabra Elite 75t, Jabra Elite Active 75t

-

Harman International Industries, Incorporated (USA) - JBL Free, JBL Tune 225TWS

-

Sony Corporation (Japan) - Sony WF-1000XM4, Sony LinkBuds

-

Sennheiser Electronic GmbH & Co. (Germany) - Sennheiser Momentum True Wireless 2, Sennheiser CX 400BT

-

Xiaomi (China) - Xiaomi Mi True Wireless Earphones 2, Xiaomi Redmi Earbuds S

-

Samsung Electronics (South Korea) - Samsung Galaxy Buds Pro, Samsung Galaxy Buds Live

-

Skullcandy (USA) - Skullcandy Indy ANC, Skullcandy Push Active

-

Anker Innovations (China) - Soundcore Liberty 2 Pro, Soundcore Liberty Air 2

-

Realme (India) - Realme Buds Air 3, Realme Buds Q2

-

Huawei Technologies Co., Ltd. (China) - Huawei FreeBuds Pro, Huawei FreeBuds 4

List of suppliers that provide raw materials and components for the True Wireless Stereo Earbuds Market:

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Qualcomm Inc.

-

Broadcom Inc.

-

Samsung SDI Co., Ltd.

-

LG Chem Ltd.

-

Panasonic Corporation

-

Knowles Corporation

-

Murata Manufacturing Co., Ltd.

-

STMicroelectronics

-

Vishay Intertechnology, Inc.

-

NXP Semiconductors

-

SK Hynix Inc.

Recent Development:

-

December 13 2024, Apple is expected to start manufacturing its AirPods in India in early 2025. This move will mark a significant expansion of its production operations, as the company currently only manufactures iPhones in the country. The shift is seen as part of Apple’s strategy to diversify its production beyond China amidst rising global political tensions.

-

27 November 2024, Huawei FreeBuds Pro 4 TWS headphones launched في China along with Mate X6, Mate 70 series smartphones These new earbuds have dual drivers, ANC, and are the brand's first with HarmonyOS Next for faster pairing with Huawei devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 64.67 Billion |

| Market Size by 2032 | USD 957.63 Billion |

| CAGR | CAGR of 34.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Price Band (Below USD 100, USD 100 – 99, Over USD 200) • By Sales channel(Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc. (USA), Bose Corporation (USA), Jabra (Denmark), Harman International Industries, Incorporated (USA), Sony Corporation (Japan), Sennheiser Electronic GmbH & Co. (Germany), Xiaomi (China), Samsung Electronics (South Korea), Skullcandy (USA), Anker Innovations (China), Realme (India), Huawei Technologies Co., Ltd. (China). |