Construction Tapes Market Report Scope & Overview:

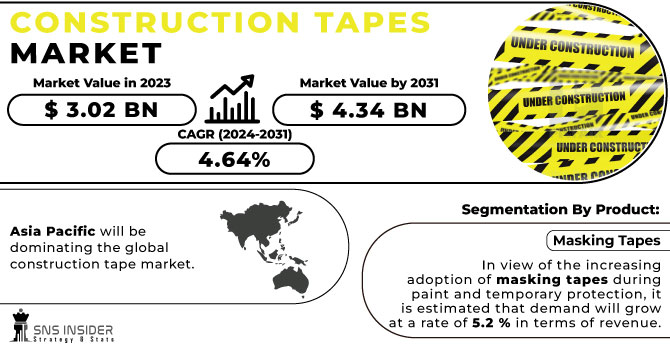

The Construction Tapes Market size was USD 3.02 billion in 2023 and is expected to Reach USD 4.34 billion by 2031 and grow at a CAGR of 4.64% over the forecast period of 2024-2031.

Polypropylene, polyvinyl chloride, acrylic, styro-butane rubber, plastics and newsprint are the basic raw materials used to produce building and construction tapes. The volatility of crude oil prices directly affects the cost of those raw materials and thus limits market growth because they are influenced by price fluctuations in final products.

Get Sample Copy of Construction Tapes Market - Request Sample Report

In the North America residential segment, consumer adoption is high due to growing concerns about appearance. Alternative products such as adhesives and sealants are, however, common for consumers in the Asia Pacific region. In terms of revenue, the demand for adhesive tapes in the residential segment is expected to grow at a compound annual rate of 5.3% over forecast period on account of increasing application of bonding and barrier protection products.

By 2031, as a result of the high aesthetic characteristics offered by this product and its broad application in installations, it is expected that demand for commercial buildings will amount to USD 2.78 billion.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing industrialization and urbanization

There is the rapid rise in the global industrialization and urbanization. This is having positive impact on the demand for global construction tape market. Growth in construction of large-scale infrastructure such as highways, airports is giving market growth.

-

Growing popularity of DIY and Home Improvement Trends.

RESTRAIN:

-

Fluctuating Raw Material Costs

Various raw materials such as adhesives, backings and additives form part of the tape production process. Production costs may be affected by fluctuations in the prices of these raw materials and, where relevant, could affect profit margins.

OPPORTUNITY:

-

Adoption of sustainable and green building practices and demand for eco-friendly tapes

There is an opportunity to develop eco-friendly tapes that use biodegradable or recycled materials and environmentally friendly adhesives, as sustainability becomes increasingly important. Customers and businesses that are environmentally conscious may be attracted to these products.

-

Huge increasing demand for the fire-resistant tapes for the construction industry

There were 3,900 civilian deaths and 14,900 injuries in 1,356,500 fires in 2021 in fire in buildings. Due to this there is need for the fire-resistant tapes, which will ensure the safety of the customers.

CHALLENGES:

-

Maintaining quality control of the product is a major concern

It is important to maintain consistently good quality in tape batches, because the various characteristics that can affect adhesion, durability or suitability for use by customers may lead to dissatisfaction and a reduction of customer confidence.

IMPACT OF RUSSIA-UKRAINE WAR

Russia accounts for total of 10 % of global construction tape market. The global construction tapes market is expected to be affected by the war, as countries across the globe seek alternate suppliers. This, in turn, could lead to more price increases and shortages. The war has led to a substantial increase in tape prices, with some of them increasing by as much as 30%. Due to Russia-Ukraine war the supply of crude oil has been affected which increased the prices of the oil. Since petroleum is the major raw material required for the production of the polyethylene and other materials, the prices of the construction tape also went high. As a result, the market for construction tapes is expected to decline by 5% in 2023.

IMPACT OF ONGOING RECESSION

According to, the National Association of Home Builders expects that housing starts will fall by 10%, by 2023. It is expected that the recession will have a negative effect on construction activities, in turn leading to a reduction in demand for building materials. Due to the recession and the less construction activities across globe it is expected that the global construction tape market will shrink by 2% by 2023. During recession there are chances that the people may lose jobs due to which they avoid spending money unnecessary. In 2023, AIA estimates a 3% drop in the amount of construction expenditure on non-residential buildings.

KEY MARKET SEGMENTS

By Backing Material

-

Polyethylene

-

Polyvinyl Chloride

-

Polypropylene

-

Paper

-

Foam

-

Foil

-

Others

Due to extensive usage of the material in applications such as heating, cooling and air conditioning (HVAC) requirement for an increased product strength, demand for foils backed products is expected to become USD 650.4 million by 2030.

By Product

-

Duct Tapes

-

Double Sided Tapes

-

Masking Tapes

-

Other Tapes

In view of the increasing adoption of masking tapes during paint and temporary protection, it is estimated that demand will grow at a rate of 5.2 % in terms of revenue. Moreover, the growth in this segment over the forecasted period is expected to benefit from the availability of these products in a variety of backing materials and colours.

By Function

-

Glazing

-

Bonding

-

Insulation

-

Sound Proofing

-

Protection

-

Cable Management

By Distribution Channel

-

Direct

-

Third Party

The producers of products participate directly in the direct sales through a wide network consisting of select distributors who are dedicated to providing consumers with their product. As a result, in 2023 about 75.8% of total product sales were done via Direct channels, which was more than twice as high as the volume used by third parties.

By End Use

-

Industrial

-

Residential

-

Commercial

By Application

-

Doors

-

Flooring

-

Building Envelope

-

Windows

-

HVAC

-

Roofing

-

Walls & Ceiling

-

Plumbing

-

Electrical

REGIONAL ANALYSIS

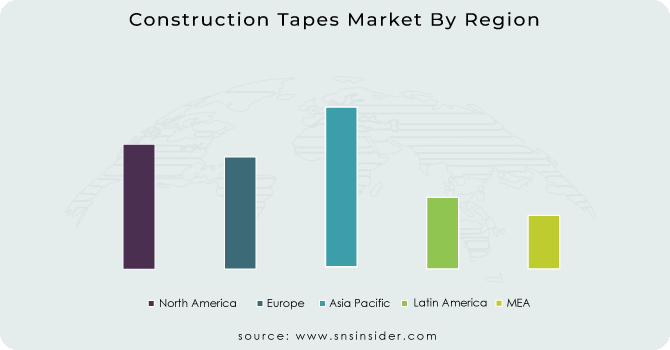

According to our research it is expected that Asia Pacific will be dominating the global construction tape market. There is huge demand for the construction tape due to rising urbanization and industrialization activities taking on. India is one of the fastest growing economies due to which Asia Pacific region will see growth in the market.

Due to the increasing use of double-sided products, which are used extensively in different building applications, Asia Pacific is expected to witness an increased demand for foam backing material. In view of its properties such as resistance to heat and dimensional stability, PVC backing material has been shown to have a strong volume growth which in turn contributes to the growing construction sector in this part of the world.

North America is expected to witness a huge demand for the construction tape over the forecast period. The construction industry is the major contributor to the total US economy. Increasing investment in public infrastructure, such as roads and airports is giving demand for the construction tape market in North American region. The North American demand for construction tapes is expected to reach a compound annual growth rate of 6.8 % in the residential segment.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major key players in the Construction Tapes market are 3M Company, Tesa SE, Scapa Group plc, Berry Global Inc, Spartan Paperboard, Avery Dennison Corporation, DuPont, Saint-Gobain Performance Plastics Corporation, Lintec Corporation, San Deigo Paper Box Company and other players.

Scapa Group plc-Company Financial Analysis

RECENT DEVELOPMENT

-

In the Indian market, Bostik has launched two new innovation products in the area of tape and labelling as one of the largest manufacturers of adhesive solutions worldwide for industry, construction and consumer markets.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.02 Bn |

| Market Size by 2031 | US$ 4.34 Bn |

| CAGR | CAGR of 4.64 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Backing Material (Polyethylene Terephthalate, Polyethylene, Polyvinyl Chloride, Polypropylene, Paper, Foam, Foil, Others) • by Product (Duct Tapes, Double Sided Tapes, Masking Tapes, Other Tapes), by Function (Glazing, Bonding, Insulation, Sound Proofing, Protection, Cable Management) • by Distribution Channel (Direct, Third Party), by End Use (Industrial, Residential, Commercial) • By Application (Doors, Flooring, Building Envelope, Windows, HVAC, Roofing, Walls & Ceiling, Plumbing, Electrical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3M Company, Tesa SE, Scapa Group plc, Berry Global Inc, Spartan Paperboard, Avery Dennison Corporation, DuPont, Saint-Gobain Performance Plastics Corporation, Lintec Corporation, San Deigo Paper Box Company |

| Key Drivers | • Increasing industrialization and urbanization • Growing popularity of DIY and Home Improvement Trends. |

| Market Opportunities | • Adoption of Green and sustainable building practices and demand for eco-friendly tapes • Huge increasing demand for the fire-resistant tapes for the construction industry |