Autonomous Data Platform Market Report Scope & Overview:

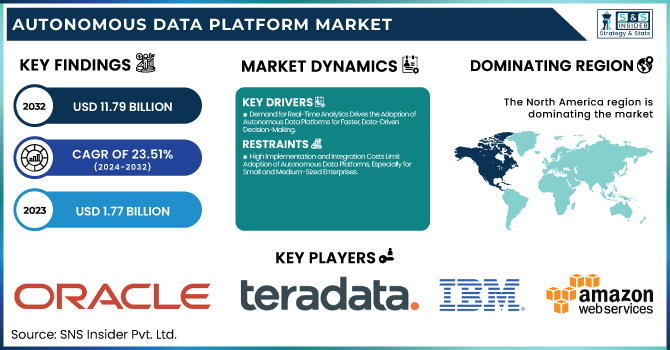

The Autonomous Data Platform Market was valued at USD 1.77 billion in 2023 and is expected to reach USD 11.79 billion by 2032, growing at a CAGR of 23.51% from 2024-2032.

To Get more information on Autonomous Data Platform Market - Request Free Sample Report

This growth is driven by key factors such as cross-platform integration, which supports effortless data handling across different systems. Trends in investment and funding are driving innovation, while AI-driven insights are improving decision-making. In addition, innovation and patent advancements spur the growth of the market through the provision of innovative solutions. Automation and data handling optimization result in cost savings, which are major advantages for adoption in numerous industries. The market is likely to see exponential growth as enterprises look for more scalable and intelligent data platforms for increased performance.

U.S. Autonomous Data Platform Market was valued at USD 0.46 billion in 2023 and is expected to reach USD 3.08 billion by 2032, growing at a CAGR of 23.45% from 2024-2032. The expansion of the U.S. Autonomous Data Platform Market is brought about by mounting demand for insights driven by data, analytics supported by AI, and automation by industries. Business enterprises look towards better decision-making abilities and budget-friendly data administration solutions, thereby autonomous platforms presenting simplified, expandable, and efficient alternatives. In addition, massive investments in AI, cross-platform advancements, and increasing requirements for real-time analysis are fueling adoption, making autonomous data platforms a must-have for contemporary business and digital transformation.

Autonomous Data Platform Market Dynamics

Drivers

-

Demand for Real-Time Analytics Drives the Adoption of Autonomous Data Platforms for Faster, Data-Driven Decision-Making.

The growing need for businesses to make rapid, data-based decisions has fueled the demand for real-time analytics solutions. Autonomous data platforms are well suited to fulfill this requirement by offering real-time insights without any human intervention. In the current competitive business environment, organizations need to process enormous amounts of data in real-time to react quickly to market changes, customer requirements, and operational issues. These platforms make data processing more efficient by automatically detecting patterns and trends, facilitating quicker decision-making. With digital transformation sweeping businesses, being able to make data analysis decisions on the fly, without any lag, is critical. Autonomous systems make a huge difference by cutting out manual labor, enabling businesses to tap into their data's full value and remain nimble in a rapidly changing landscape.

Restraints

-

High Implementation and Integration Costs Limit Adoption of Autonomous Data Platforms, Especially for Small and Medium-Sized Enterprises.

The use of autonomous data platforms usually involves a high-cost factor, mainly because of the large amount of money involved in setting up the system and integrating it. For small and medium-sized enterprises (SMEs), investing in such systems can be a big problem since the cost of these sophisticated solutions may be beyond their budgetary strength. Moreover, the integration of autonomous platforms with current IT infrastructure and legacy systems is potentially lengthy and complicated. The process of integrating these could involve specialized resources, again increasing the overall expense. Consequently, most companies may fear committing to such technology, particularly taking into account long-term cost sustainability. The combination of these costs and integration challenges can hold back the mass adoption of autonomous data platforms, especially by smaller organizations.

Opportunities

-

AI and Machine Learning Integration in Autonomous Data Platforms Enhances Data Insights, Predictive Analytics, and Decision-Making.

AI and machine learning integration within autonomous data platforms has a huge potential for companies to get greater insights out of their data. These technologies allow platforms to process large sets of data more effectively, spot patterns, and offer predictive analysis that can inform business decisions. Through the use of AI, these platforms can also enhance decision-making by streamlining complex tasks and making real-time recommendations. Machine learning builds on this by refining the accuracy of predictions as the system learns from new data over time. This capability to provide sophisticated, actionable insights enables businesses to remain competitive in fast-paced markets. As companies look for smarter solutions to handle their data, the implementation of AI and machine learning-driven autonomous platforms will transform industries with significant growth opportunities in the market.

Challenges

-

Ensuring Data Accuracy, Consistency, and Completeness in Autonomous Data Platforms is Critical for Reliable Insights and Decision-Making

Maintaining the accuracy, consistency, and completeness of data processed by autonomous data platforms is a complex task. As these platforms handle vast amounts of data from various sources, ensuring high-quality data becomes a critical factor for reliable insights. Poor-quality or inconsistent data can lead to inaccurate analysis, which, in turn, affects decision-making and business outcomes. Moreover, data from different systems and formats may not always align, causing issues in processing and interpretation. This can result in errors that compromise the platform’s effectiveness. Ensuring that data is cleaned, standardized, and validated before being processed by autonomous platforms requires significant effort and sophisticated tools. The inability to consistently manage and maintain high-quality data could limit the potential of autonomous platforms, hindering their growth in the market.

Autonomous Data Platform Market Segment Analysis

By Component

The Platform segment led the Autonomous Data Platform Market with the largest revenue share of around 70% in 2023. This is mainly because the demand for strong, scalable, and effective platforms that allow organizations to process, analyze, and handle huge sets of data independently is on the rise. These platforms provide imperative features such as real-time analytics, integration with AI, and automation, which give firms quicker decision-making ability and efficiency in operations, leading to their rapid adoption across sectors.

The Services segment is expected to grow at the fastest CAGR of approximately 24.93% during 2024-2032. The growth is spurred by the increasing need for consulting, implementation, and support services related to autonomous data platforms. With increasing adoption of these platforms by organizations, there is greater demand for specialized guidance in deployment, customization, and optimization. Support and maintenance services on a continuous basis also ensure seamless functioning and scalability of these platforms, driving the segment's high growth.

By Deployment

The On-premise segment held the largest revenue share of approximately 54% in 2023 in the Autonomous Data Platform Market. This is due to the option of large companies and organizations in highly regulated sectors for keeping total control over their data and infrastructure. On-premise solutions provide more security, customization, and adherence to strict regulatory compliance. They also provide stronger data privacy and performance, which makes them a top priority for organizations handling sensitive data.

The Cloud segment is anticipated to grow the fastest CAGR of approximately 24.45% during the period of 2024-2032. This is boosted by the rising demand for cloud-based options due to their flexibility, scalability, and affordability. Autonomous data platforms on the cloud enable enterprises to process huge amounts of data without investing in large-scale infrastructure. Furthermore, the trends toward remote work, digital transformation, and real-time analytics also boost the requirement for cloud-based platforms.

By Enterprise Size

The Large Enterprises segment led the Autonomous Data Platform Market with the largest revenue share of approximately 62% in 2023. Large businesses have usually immense data processing demands and intricate infrastructure needs, which prompt them to adopt autonomous data platforms early. The scalability, increased security, and automation such platforms offer help such organizations. Moreover, they tend to have the means and know-how to handle the integration and implementation of such sophisticated technologies, propelling their huge market share.

The SMEs segment will grow at the fastest CAGR of around 24.86% during 2024-2032. This growth is fueled by the rising affordability and availability of autonomous data platforms for smaller companies. With cloud-based solutions becoming increasingly common, SMEs are able to use these platforms without incurring substantial initial investments in infrastructure. Moreover, the requirement of real-time analytics and operational agility in SMEs is escalating, which is fueling their adoption of economical, automated data management solutions.

By End Use

The BFSI (Banking, Financial Services, and Insurance) segment dominated the Autonomous Data Platform Market with the highest revenue share of about 22% in 2023. This dominance is driven by the sector’s need for robust data management and analytics capabilities to handle vast amounts of financial data. Autonomous platforms help BFSI organizations enhance fraud detection, risk management, customer insights, and regulatory compliance, while improving operational efficiency and decision-making, making them crucial in this industry.

The Retail segment is expected to grow at the fastest CAGR of about 26.28% from 2024-2032. This growth is fueled by the increasing volume of customer data and the growing need for personalized experiences in retail. Autonomous data platforms enable retailers to analyze real-time customer behavior, optimize inventory, and enhance supply chain efficiency. As the retail sector embraces digital transformation, the demand for autonomous data solutions to improve customer engagement and operational efficiency will continue to rise.

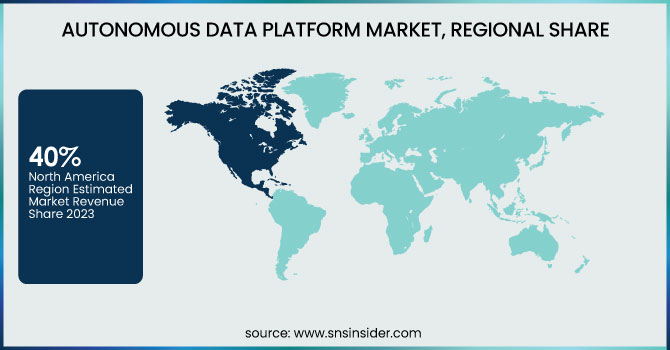

Regional Analysis

The North America region led the Autonomous Data Platform Market with the largest revenue percentage of around 40% in 2023. This leadership is due to the region's early adoption of cutting-edge technologies, powerful presence of prominent market players, and growing demand for automation in managing data across industries like BFSI, healthcare, and retail. Additionally, North America benefits from a well-established IT infrastructure, high investment in research and development, and a favorable regulatory environment, further driving market growth.

The Asia Pacific region is expected to grow at the fastest CAGR of approximately 25.20% during 2024-2032. This high growth is driven by the digital transformation projects in the region expanding, rising cloud technology adoption, and mounting demand for data-driven decision-making in sectors such as manufacturing, retail, and healthcare. Further, the emergence of SMEs and government initiatives to invest in technology infrastructure support the rising use of autonomous data platforms in the rapidly growing region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Oracle Corporation [Oracle Autonomous Database, Oracle Cloud Infrastructure]

-

Teradata [Teradata Vantage, Teradata IntelliCloud]

-

IBM Corporation [IBM Db2, IBM Cloud Pak for Data]

-

Amazon Web Services, Inc. [Amazon Redshift, AWS Data Pipeline]

-

Hewlett Packard Enterprise Development LP [HPE Ezmeral, HPE GreenLake]

-

Qubole, Inc. [Qubole Data Service, Qubole AI]

-

Cloudera, Inc. [Cloudera Data Platform, Cloudera Data Science Workbench]

-

Gemini Data [Gemini Data Cloud, Gemini Data Lake]

-

Denodo Technologies [Denodo Platform, Denodo Data Virtualization]

-

Alteryx, Inc. [Alteryx Designer, Alteryx Server]

-

Snowflake Inc. [Snowflake Data Cloud, Snowflake Data Marketplace]

-

Microsoft Corporation [Azure Synapse Analytics, Azure Data Factory]

-

Google LLC [BigQuery, Google Cloud Dataproc]

-

SAP SE [SAP Data Intelligence, SAP HANA Cloud]

-

Databricks [Databricks Unified Analytics Platform, Databricks Delta Lake]

-

Vertica [Vertica in Enterprise, Vertica in Eon Mode]

-

Informatica [Informatica Intelligent Cloud Services, Informatica Data Quality]

-

Hitachi Vantara [Hitachi Lumada DataOps, Hitachi Vantara Data Integration]

-

Domo, Inc. [Domo Business Cloud, Domo Data Governance]

-

Qlik [Qlik Sense, Qlik Data Integration]

Recent Developments:

-

In March 2025, AWS announced new advancements during AWS Pi Day, including Amazon Bedrock for generative AI, SageMaker Unified Studio, and Amazon S3 Tables, enhancing data integration and multi-agent collaboration for analytics and AI workloads.

-

In September 2024, Oracle announced the upcoming release of its Intelligent Data Lake as part of the Oracle Data Intelligence Platform, set for limited availability in 2025. This solution will offer a unified developer experience, integrating data orchestration, analytics, and AI.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.77 Billion |

| Market Size by 2032 | USD 11.79 Billion |

| CAGR | CAGR of 23.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Services) • By Deployment (On-premise, Cloud) • By Enterprise Size (Large Enterprises, SMEs) • By End Use (BFSI, Healthcare, Retail, Manufacturing, IT and Telecom, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle Corporation, Teradata, IBM Corporation, Amazon Web Services, Inc., Hewlett Packard Enterprise Development LP, Qubole, Inc., Cloudera, Inc., Gemini Data, Denodo Technologies, Alteryx, Inc., Snowflake Inc., Microsoft Corporation, Google LLC, SAP SE, Databricks, Vertica, Informatica, Hitachi Vantara, Domo, Inc., Qlik |