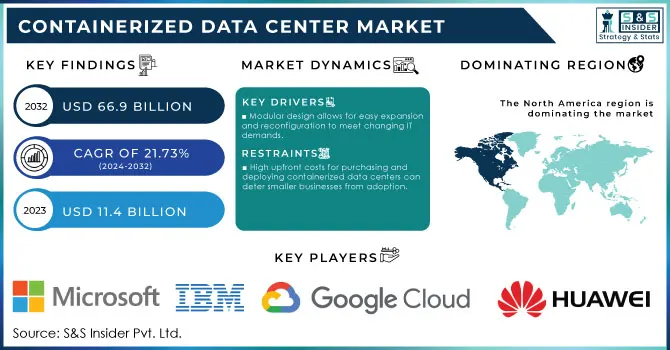

Containerized Data Center Market Key Insights:

The Containerized Data Center Market size was valued at USD 11.4 billion in 2023 and is expected to reach USD 66.9 Billion by 2032, with a growing at CAGR of 21.73% Over the Forecast Period of 2024-2032. The containerized data center market is experiencing rapid growth, driven by its scalability, flexibility, and cost-effectiveness, particularly in industries facing evolving IT needs. These modular data centers, housed within shipping containers, offer easy transport and quick deployment, making them essential in sectors like telecommunications, healthcare, and government, where efficient data management and rapid processing are crucial.

To Get More Information on Containerized Data Center Market - Request Sample Report

A key factor fueling this growth is the increasing demand for edge computing, which requires data to be processed near its source to minimize latency. For example, telecom companies are deploying containerized data centers in remote locations to support 5G networks. In 2023, the global rollout of 5G technology resulted in a 30% rise in demand for edge computing facilities, significantly boosting the adoption of containerized data centers. The oil and gas sector has also turned to these modular solutions for remote operations; BP, for instance, implemented a modular data center for its offshore activities in 2023, enhancing its data handling capacity by 40%.

Additionally, sustainability and energy efficiency are major contributors to market growth, as these data centers can incorporate advanced cooling systems and renewable energy sources to reduce their environmental footprint. According to survey, a 10% reduction in operational costs by the end of 2023 after outfitting its modular data centers with renewable energy, thereby improving energy efficiency.

Furthermore, companies are choosing containerized data centers to avoid the lengthy construction times and high costs associated with traditional data centers. In the financial services sector, Citibank announced its shift to containerized data centers in 2023 to meet the increasing data demands of its global operations, resulting in a 25% improvement in data processing speeds. These examples highlight the growing significance and adaptability of containerized data centers in industries that need scalable, efficient, and eco-friendly solutions.

Market Dynamics

Drivers

-

Modular design allows for easy expansion and reconfiguration to meet changing IT demands.

-

Containerized solutions can be deployed quickly, reducing setup time compared to traditional data centers.

-

Growing data generation from IoT and other sources necessitates efficient data processing and storage solutions.

One of the main factors boosting the requirement for faster data handling and storage is the massive increase in data created by Internet of Things (IoT) and other generators, mainly driving the containerized data center market. With the rise of connected devices, be it smart home appliances, industrial sensors or wearables, the amount of data generated is growing exponentially. Containerized data centers are a sleek solution that can meet this increasing demand for efficient data management, boasting modular and portable designs. Instead of conventional data centers, these units can be deployed near to the source of the data that needs to be processed for low latency. It's finding important use in applications that require real-time analytics such as autonomous vehicles and smart cities where timely data processing will help improve decision making and operational efficiency.

Furthermore, containerized data centers have an agile configuration which helps organizations quickly increase their infrastructure when necessary. As more IoT devices come online and generate data, businesses can quickly scale out additional containerized units to address rising data volumes without the months-long lag that comes with traditional data center buildouts. Such flexibility is a necessity in sectors such as healthcare, where processing information rapidly is crucial for constant monitoring and diagnostics of patients; or retail, where timely insight into consumer behavior can make the difference. In addition, due to the significant energy that large scale data solutions require and some of these containerized data centers will have advanced cooling systems and renewable energy systems integrated too. Not only does this focus help alleviate some of the environmental damage being done, but it also compliments many corporate initiatives in which businesses are trying to cut down their cost expenditure.

Conclusion, the explosive growth of data produced on these devices poses a challenge in terms of data storing and processing which needs to be met. Containerized data centres are a scalable, flexible, and sustainable solution to those demands, thus making them crucial in the developing landscape of data management.

Restraints

-

High upfront costs for purchasing and deploying containerized data centers can deter smaller businesses from adoption.

-

Modular designs may lack the flexibility for extensive customization compared to traditional data centers, restricting their appeal to some enterprises.

-

Intense competition from traditional data centers and other emerging technologies may hinder the growth of the containerized data center market.

Crushing competition from traditional data centers and nascent technologies is threatening the containerized data center market. Although this approach provides clear benefits over existing practices, especially with regard to modularity and portability for quick deployment, any option that is delivered as a container still needs to compete against traditional data center models which organizational buy-in was built over the years. Legacy data centers typically offer high degrees of customization and integration options, with solutions aimed at meeting the specific needs of large organizations. This has an impression of being more trusted as it consists of a long-time existing market with base infrastructure and operation forms. Due to such, organizations will often be reluctant to transition into containerized solutions out of fear for what events may arise during said transitional period, or whether modular systems are as effective compared with trusty data center implementations.

In addition, there is a significant threat from new technologies i.e., hyper-converged infrastructure HCI. HCI combines storage, compute and networking into a single system that allows users to store and use resources more efficiently. This can be attractive to those organizations that need high-performance capabilities but do not want the overhead of a traditional data center. On the other hand, cloud solutions provide scalability and flexibility, enabling businesses to pay as they go which attracts enterprises looking for cost-effective data management options. Moreover, the fast-evolving edge computing technology that focuses on moving data processing closer to its source also threatens containerized data centers. Edge computing offers similar latency reductions and fast-processing features as fog computing, making it appealing for real-time analysis-dependent industries such as telecoms and smart cities.

Consequently, organizations considering the data center options should balance the advantages offered by containerized solutions against data centers as proven and reliable platforms and new technologies. However, metal traditional data center vendors mention about it their strength becomes weakness in this competitive landscape is essentially sufficient to keep momentum of containerized data center market more cautiously rather than experience full comforting that those kind of technology will provide performance, reliability & cost benefits.

Segment Analysis

By Container Type

In 2023, the 40-foot container segment dominated the market, and represented over 47.4% of revenue share. Digital services are booming, especially in the Asia Pacific and Latin America regions on one hand, while a scalable data center infrastructure is needed to support this digital expansion. The features of containerized data centers make them a seamless fit for this requirement, where scalability and flexibility is just a matter of immediate deployment as per changing business needs. These emerging markets stand to gain a lot from 40-foot container - the higher capacity and low cost solution.

On the contrary, the bespoke container segment is expected to continue with highest CAGR during the forecast period. Standard containers may not fully satisfy some of the needs that drive demand in edge computing, telecommunications, military and remote operations so customization is a significant piece of this puzzle. Customized containers can also be built out of modular components and infrastructure so they can grow and scale over time to accommodate new or different demands.

By Organization Size

In 2023, the largest organizations segment held the maximum revenue share of over 59.7%. Well, organizations are using containerized data centers more and more within their hybrid and multi-cloud strategies. These modular data centers enrich hybrid cloud infrastructures by enabling seamless public cloud service connectivity and extending on-premises capabilities. It enables efficient workload placement across private and public cloud environments to optimize the overall data center footprint.

On the other hand, SMEs segment is projected to grow rapidly at a high CAGR during the forecast period. One of the major trends in the data center market is the increased adoption of containerized data centers by small and medium-sized enterprises over traditional brick and mortar set-ups. The modular nature of these solutions offers flexibility and cost-effectiveness, allowing companies to scale up or down their infrastructure based on changing requirements also without having to invest too heavily in traditional data centers.

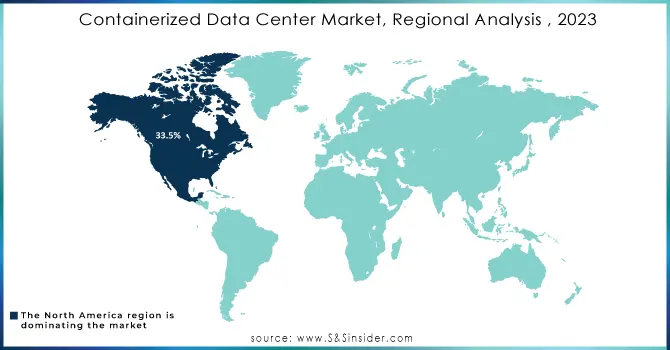

Regional Analysis

North America dominated the market and represented over 33.5% of the revenue share in 2023, mainly due to increasing digitization across industries throughout North America. This change forms an important part of this process in business sectors like healthcare, finance, retail and manufacturing where companies are relying on digital tools and platforms to streamline their operations while driving customer engagement along with increasing efficiency. This march into the digital revolution leads to data streams needing to be stored, processed, and analyzed in large volumes.

In contrast, the Asia Pacific region is expected to experience significant growth with a notable CAGR over the forecast period. In this region, governments are aggressively implementing containerized data centers through various smart city related projects focusing on making urban life better, boosting public service delivery and economic growth. Particularly, the containerized data centre market in Japan is expected to witness high growth over the next five years backed by innovative technological landscape of the country. The increasing reliance on such high-tech data centres highlights Japan's commitment to staying ahead in technology while adapting to the needs of the changing digital economy.

Do You Need any Customization Research on Containerized Data Center Market - Inquire Now

Key Players

The major key players with product

-

Dell Technologies - Dell Modular Data Center

-

Hewlett Packard Enterprise (HPE) - HPE Edge Center

-

Cisco Systems - Cisco Unified Computing System (UCS)

-

IBM - IBM Cloud Container Service

-

Microsoft - Azure Stack Edge

-

Google Cloud - Google Anthos

-

Schneider Electric - EcoStruxure Micro Data Center

-

Vertiv - Vertiv SmartMod

-

Rittal - Rittal Container Data Center

-

Mitsubishi Electric - iQ-R Series Control System

-

Huawei - Huawei Modular Data Center Solution

-

Fujitsu - Fujitsu Integrated System

-

NetApp - NetApp HCI

-

Siemens - Siemens Modular Data Center

-

Acer - Acer Modular Data Center

-

EdgeConneX - EdgeConneX Edge Data Center

-

NTT Communications - NTT Modular Data Centers

-

Supermicro - Supermicro Modular Data Center Solutions

-

Bull (Atos) - Bull Data Center on Demand

-

Digital Realty - Digital Realty’s Modular Data Center

B2B User

-

NASA

-

Deutsche Bank

-

AT&T

-

American Express

-

LinkedIn

-

Spotify

-

ExxonMobil

-

Facebook

-

BMW

-

Toyota

-

China Mobile

-

Panasonic

-

Verizon

-

Siemens Healthineers

-

Acer Cloud

-

Cox Communications

-

Samsung

-

Baidu

-

Airbus

-

Dropbox

Recent Developments

-

In November 2023, Vertiv Group Corp. introduced the Vertiv TimberMod, a prefabricated wooden data center module. As an extension of the Vertiv Power Module and Vertiv SmartMod families, the TimberMod represents a major advancement in sustainability for the data center sector. By utilizing mass timber in place of steel, this module effectively lowers its carbon footprint, offering customers a more eco-friendly alternative.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.4 Billion |

| Market Size by 2032 | USD 66.9 Billion |

| CAGR | CAGR of 21.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Container Type (20 Feet Container, 40 Feet Container, Customized Container) • By End-Use (IT and Telecommunications, BFSI, Healthcare, Retail and E-commerce, Aerospace & Defense, Energy & Utilities and Others) • By Organization size (Small & Medium Enterprise (SME) and Large Enterprise) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, IBM, Microsoft, Google Cloud, Schneider Electric, Vertiv, Rittal, Mitsubishi Electric |

| Key Drivers | • Modular design allows for easy expansion and reconfiguration to meet changing IT demands. • Containerized solutions can be deployed quickly, reducing setup time compared to traditional data centers. |

| RESTRAINTS | • High upfront costs for purchasing and deploying containerized data centers can deter smaller businesses from adoption. • Modular designs may lack the flexibility for extensive customization compared to traditional data centers, restricting their appeal to some enterprises. |