Corporate E-learning Market Report Scope & Overview:

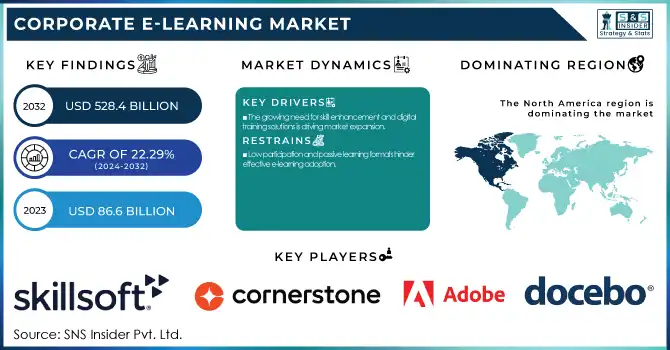

The Corporate E-learning Market was valued at USD 86.6 Billion in 2023 and is expected to reach USD 528.4 Billion by 2032, growing at a CAGR of 22.29% from 2024-2032.

To get more information on Corporate E-learning Market - Request Free Sample Report

The Corporate E-learning Market is undergoing rapid transformation, fueled by digital advancements and the growing demand for workforce upskilling. Learner Engagement Metrics, 2023 shows increasing participation, with gamified and interactive content enhancing knowledge retention. Adoption Rate by Industry, 2023 highlights significant growth in IT, healthcare, and BFSI, where continuous learning is essential. Training Effectiveness and ROI, 2023 emphasize cost efficiency and productivity improvements, solidifying e-learning as a preferred alternative to traditional methods. Additionally, E-learning Platform Preferences, 2023 indicate a rising demand for AI-driven, cloud-based, and mobile-friendly solutions that offer personalized learning experiences.

Corporate E-learning Market Dynamics

Drivers

-

The growing need for skill enhancement and digital training solutions is driving market expansion.

The Corporate E-learning Market is primarily driven due to the rising requirement for employee upskilling & reskilling. Many organizations are addressing this issue by investing in digital learning solutions to up-skill their employees as per the changing nature of technologies and industry trends. This interest grows with the increased focus on professional development, compliance training, and leadership programs. And the increase in remote and hybrid work models means the need for immediate, flexible, and on-demand learning is greater than ever. With features such as AI-powered personalized learning experiences, microlearning modules, and interactive content, e-learning is boosting engagement and retention rates while proving itself an economically feasible and highly scalable alternative to traditional training methods.

Restraints

-

Low participation and passive learning formats hinder effective e-learning adoption.

Low employee engagement and motivation one of the biggest challenges for the Corporate E-learning Market is one of the major challenges. Online training often fails to fully engage employees, who become distracted by online distractions, and loss of real-time interaction, which combined with more passive learning formats, make it more difficult for employees to stay engaged. Many e-learning courses are simply not engaging enough and do not provide the same level of experience we have in any other training, which leads to less completion of the course than we would probably like. In addition, organizations might encounter resistance from workers already conditioned to traditional training techniques. To counter this challenge, companies are combining gamification, VR-based training, and AI-enabled adaptive learning to make corporate training programs more interactive and engaging.

Opportunities

-

Advanced technologies are improving engagement, personalization, and interactive learning experiences.

there is a great opportunity for the Corporate E-learning Market by the merging of Artificial Intelligence, Virtual Reality, and Gamification. AI-powered learning platforms can make changes to the training modules based on the progress and performance of individual learners to improve engagement and knowledge retention. On the other hand, VR-based simulation offers practical experiences where individuals can enhance their skills in a more interactive manner, which is particularly beneficial in sectors such as healthcare, manufacturing, and aviation. Using gamification methods like leaderboards awards and interactive games raises learner motivation and stimulates healthy competition. These technologies are bringing the transformation of corporate training to a dynamic, interactive, and more efficient learning experience, driving the energy for innovative e-learning solutions.

Challenges

-

Rising cyber threats and compliance issues pose risks to corporate e-learning platforms.

As the Corporate E-learning Market has now gone through a digital transformation, Data privacy, and cyber security concerns are one of the major challenges that need to be looked into. E-learning platforms house a large amount of employee information of a sensitive nature, including performance history and assessment scores, making them a prime target during a cyber-attack. Challenges to Trust: Unauthorized access, data breaches, and compliance risks can cripple organizational trust and prevent e-learning from going ahead. Companies need to adopt strong cybersecurity tools like encryption, multi-factor authentication, and secure cloud storage, for safeguarding sensitive data. Data protection regulations, such as GDPR and CCPA, are also necessary compliance measures that critically underpin digital learning platforms.

Corporate E-learning Market Segmentation Analysis

By Learning Type

In 2023, the distance learning segment dominated the market and accounted for a significant revenue share. Such growth is fueled by the demand for flexible learning solutions that meet the needs of the heterogeneous, geographically dispersed workforce in contemporary organizations. Distance education provides accessibility to employees to train from wherever they are, at any time, without the burden of traveling.

The instructor-led training segment is expected to register the fastest CAGR during the forecast period. Instructor-led training continues to thrive because it provides personalized, interactive, and perhaps one of the best ways to delve deeper into complex and highly technical subjects.

By Organization Size

The largest enterprises segment dominated the market with 72% of revenue share in 2023. The growth of Talent Development is because of the increasing need for organizations to pay significant attention to developing the workforce. E-learning is highly effective, especially for large enterprises with a variety of teams located in several geographical locations is why large enterprises can save lots of money and employ it effectively when using e-learning for employee training.

The SME segment is expected to experience rapid growth over the forecasted period. This growth is indicative of how SMEs are realizing the growing strategic role that employee training plays as they try to keep up with an ever-changing business environment. Due to constrained budgets and resources, SMEs normally opt for skill enhancement and compliance training through the most affordable means namely, e-learning.

By Vertical

In 2023, the IT segment dominated the market and held the highest market revenue share. The main reason behind this growth is the rapid advancements in technology that need constant upskilling and reskilling of the IT workforce. With professionals quickly needing to get up to speed on new technologies such as cloud computing, artificial intelligence, blockchain, and cybersecurity, e-learning platforms offer effective and affordable solutions to train employees.

The BFSI is expected to register the fastest CAGR during the forecast period. The rapid growth can be attributed to the fact that the BFSI sector has become highly reliant on digital transformation and employees have to get trained and acquire new skills to adopt technologies like Blockchain, Artificial Intelligence, Cybersecurity, etc. As regulatory compliance becomes more pressing, and as ongoing professional development becomes the New Normal, financial institutions are turning to e-learning platforms to meet compliance requirements and improve service.

Regional Landscape

In 2024, North America dominated the market and accounted for a revenue share of over 36% of the market. The corporate eLearning Market in North America is booming due to various technological advancements and changes in the workforce and corporate training requirements. As remote and hybrid workspace has gained traction, the demand for online corporate training programs also soared.

Asia-Pacific is expected to register the fastest CAGR during the forecast period, A key development witnessed by the corporate e-learning industry in the Asia-Pacific region is the emergence of the hybrid learning model. Investment in e-learning. As there is digitization going on across all sectors, Companies are opting for e-learning for training their employees in new technologies and tools as a part of their digital transformation strategies from Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Skillsoft – Percipio

-

Cornerstone OnDemand – Cornerstone Learning

-

SAP SE – SAP Litmos

-

Adobe Inc. – Adobe Learning Manager

-

Blackboard Inc. – Blackboard Learn

-

D2L Corporation – Brightspace

-

Docebo – Docebo Learning Suite

-

Udemy – Udemy Business

-

Coursera Inc. – Coursera for Business

-

Pluralsight – Pluralsight Skills

-

LinkedIn Corporation – LinkedIn Learning

-

360Learning – 360Learning Platform

-

Infor – Infor Learning Management

-

Absorb Software – Absorb LMS

-

G-Cube – G-Cube LMS

Recent Developments

-

December 2024 – Learning Technologies Group (LTG) Agreed to an £802.4 million acquisition by U.S. private equity firm General Atlantic, aiming to enhance corporate training tools amidst the evolving AI landscape.

-

December 2024 – SweetRush Recognized with a Gold award for Best E-learning Content Development Company by eLearning Industry, highlighting its innovative and engaging learning solutions.

-

October 2024 – Guild Education Acquired Nomadic Learning to expand its corporate training offerings, focusing on enhancing employee education programs.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 86.6 Billion |

|

Market Size by 2032 |

USD 528.4 Billion |

|

CAGR |

CAGR of 22.29% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Learning Type (Distance Learning, Instructor-led Training, Blended Learning) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Skillsoft, Cornerstone OnDemand, SAP SE, Adobe Inc., Blackboard Inc., D2L Corporation, Docebo, Udemy, Coursera Inc., Pluralsight, LinkedIn Corporation, 360Learning, Infor, Absorb Software, G-Cube |