Cosmetic Antioxidants Market Report Scope & Overview:

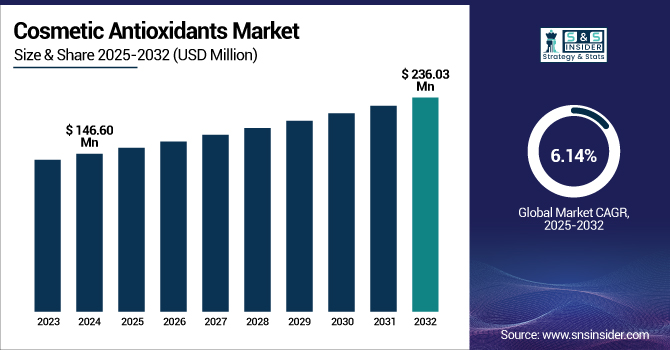

The Cosmetic Antioxidants Market size was valued at USD 146.60 million in 2024 and is expected to reach USD 236.03 million by 2032, growing at a CAGR of 6.14% over the forecast period of 2025-2032.

To Get more information on Cosmetic Antioxidants Market - Request Free Sample Report

The rise in demand for clean beauty and the adoption of natural and synthetic antioxidant-based skincare products to promote skin health is a primary factor driving the growth of the cosmetic antioxidants market. This has strengthened and offers promising growth for the cosmetic antioxidants market size with major trends including plant-derived ingredients, anti-aging products, and sustainable packaging. However, concerns regarding the medical impact of synthetic antioxidants are propelling the change towards Natural Antioxidants like vitamins C as well as E. Top leading companies in cosmetic antioxidants, including BASF SE and Evonik Industries, have started offering more products to meet this demand.

For instance, Evonik introduced its plant-based antioxidants like CapilAcid, Oleobiota in September 2024, addressing the signs of antioxidant skincare. Antioxidants are recognized by the U.S.

FDA for their UV protection advantages, which is anticipated to aid in adoption and growth of cosmetic antioxidants in cosmetic formulations. These are the essential factors maintaining the growth of the cosmetic antioxidants market share and its future direction.

Cosmetic Antioxidants Market Dynamics:

Drivers:

-

Growing Demand for Anti-Aging Products Enriched with Antioxidants Drive Market Growth

With the aging of the global population, the anti-aging boom is gaining ground. Growing skin aging awareness, combined with a rapid increase in disposable income, has led to demand for environmental stressor protection products, such as UV rays and pollution. Natural antioxidants including lactone, Vitamin C and E are vital in minimizing fine lines, wrinkles, and other manifestations of aging. This demand has been leveraged by cosmetic brands, who have included antioxidants into their anti-aging skincare ranges.

For instance, according to studies conducted by the American Academy of Dermatology, antioxidants neutralize free radicals that speed up skin aging.

Top companies including Evonik Industries and BASF SE in the cosmetic antioxidants market are developing novel antioxidants that these powerful ingredients can help as additives as the demand for anti-aging products are on the rise.

-

Increasing Preference for Natural Ingredients in Cosmetic Product Development Propel Product Demand

Increasing awareness about the side effects of synthetic chemicals on skin & hair in personal care products is driving the trend of natural antioxidants in cosmetic formulations. Natural antioxidants, especially vitamins C, E, and polyphenols have gained popularity due to their skin benefits, such as skin oxidative stress reduction and delaying skin maturity. Consumers are more in favour of products containing plant-based or organic ingredients. The movement is more than a passing fancy, scientific giants continue to solidify it, such as BASF SE and Croda International, both adding value to their natural antioxidant products. Antioxidants in skin care can decrease the damage caused by free radicals from prolonged exposure to UV.

According to the U.S. Food and Drug Administration. Due to the consumer preference for cleaner, safer, and more sustainable beauty products, the demand for natural antioxidants is likely to increase in the cosmetic antioxidants market over the period of time.

Restraints:

-

Lack of Standardization Across Global Cosmetic Antioxidant Ingredients Regulations Hinder Market Growth

The difference in regional regulations on the use of antioxidants poses a challenge to product uniformity. The U.S. FDA and the European Commission have created frameworks, regulatory variances around allowed antioxidant levels, and labeling standards that postpone global introductions. The absence of harmonization forces producers to reformulate for each market, contributing to compliance costs. These fragmented regulatory landscapes hinder smaller cosmetic antioxidant companies from effectively navigating the global market space, ultimately limiting their global competitiveness. As a result, roll-out speed of innovations is hampered, which in turn negatively affects the growth of the cosmetic antioxidants market. In addition, long approvals of new natural antioxidant compounds slow down significant cosmetic antioxidants market analysis and development for large companies globally.

-

Consumer Skepticism Toward Functional Claims in Antioxidant Products Can Impede Market Expansion

While antioxidant skincare has made its way into mainstream interest, consumers are still skeptical that cosmetic marketing will ever deliver on the promises of antioxidant efficacy. This is due to overdrawn assertion or non-transparent ingredient listings from brands. When shoppers demand results backed by clinical support, it takes a lot of credibility and a lot of scientific backing away. Scrutiny has been ramped up after the U.S. Federal Trade Commission issued warnings about misleading advertising in cosmetics. Such skepticism hampers the purchase intention and in turn, hinders the cosmetic antioxidants market growth. Without cosmeceutical antioxidant companies backing up their claims with transparent, third-party testing, the max potential of the market will remain extremely limited due to consumer trust.

Cosmetic Antioxidants Market Segmentation Analysis:

By Type

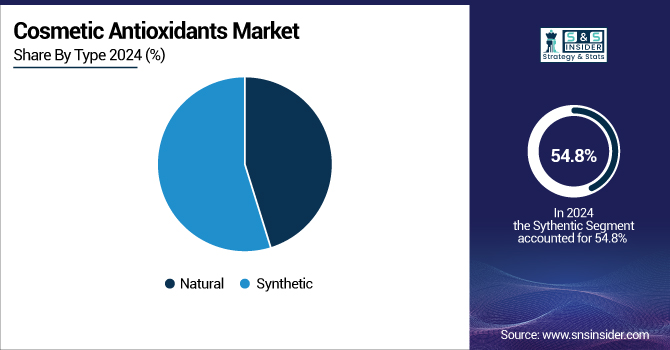

Synthetic antioxidants dominated and had the major share of the market for cosmetic antioxidant in 2024, accounting for 54.8%. This dominance is due to the cost-effective, stable, and widespread use of antioxidants in a variety of cosmetic formulations. Synthetic antioxidants, such as butylated hydroxytoluene (BHT) and butylated hydroxyanisole (BHA), have been the most widely applied antioxidants as they have been useful in effectively preventing food oxidation and increasing shelf life of food products. Furthermore, the common use in the industry is supported by the position of suspected allergens being generally regarded as safe (GRAS) when used in appropriate concentrations according to the U.S. Food and Drug Administration (FDA).

Natural antioxidants is the fastest-growing segments with a significant growth rate during the forecast period of 2025 to 2032. This growth is being fueled by the higher consumer demand for clean-label and sustainable beauty products. Natural origin ingredients, such as vitamin C, vitamin E, and green tea extract are preferred for skin due to their clinical and functional efficiency. The FDA highlights the potential role of natural antioxidants as moot protectors against oxidative stress and consumer demand for skin-personal care products that are both efficacious and safe.

By Function

In 2024, the anti-aging segment dominated with a 40.5% of the share in the market for cosmetic antioxidants. The rising geriatric population and rising awareness toward skin health has driven the demand product with anti-ageing properties. Retinol and coenzyme Q10 are antioxidants, which are often found in wrinkle and fine line creams. The FDA recognizes the importance of these antioxidants that help to maintain skin integrity and protect the skin from oxidative damage as a basis for use in anti-aging products.

On the other hand, UV protection is projected to be the fastest-growing function in the cosmetic antioxidants market, with a considerable growth rate during 2025 to 2032. This growth is driven by increased awareness of the damaging effects of UV rays and the need for sun protection. Antioxidants (vitamin E and ferulic acid) are included in some sunscreens and used in daily facial products to improve protection against UVs. Also, FDA emphasizes antioxidants in skin damage caused by the UVEGF to drive growth of this segment during 2024-2032.

By Application

In 2024, the skin care application dominated with a market share of 55.2% in the market. Rising prevalence of skin health and prevention against the signs of aging has escalated the demand of antioxidant skincare products. Things, such as niacinamide and resveratrol are known to protect and revitalize. Their inclusion in skincare formulations is well accepted, as the FDA also acknowledges the benefits of these antioxidants for skin.

From 2025 to 2032, hair care emerged as the fastest-growing application segment in terms of growth rate. With growing concern about hair health and environmental stressors, the demand for such products is increasing. Antioxidants, such as vitamin E and plant extracts, are included in shampoos and conditioners to protect hair from oxidative damage. Antioxidants can play a role in helping your scalp stay healthy, according to the FDA, which is one of the factors aiding in the growth of this segment.

Cosmetic Antioxidants Market Regional Outlook:

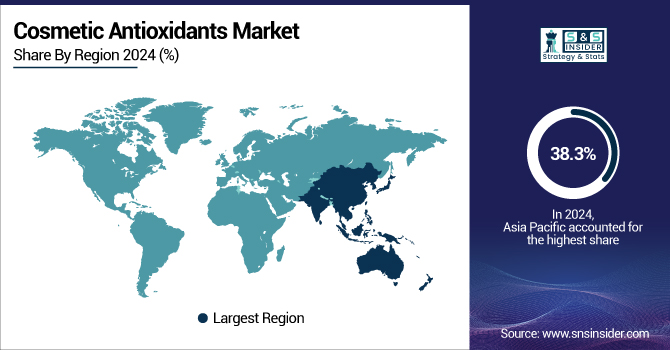

In 2024, Asia Pacific led by holding the largest cosmetic antioxidants market share accounting for 38.3%. The region’s growth is driven by the steady growth in the demand for skincare in China, Japan, South Korea, and other countries. High-end antioxidant skincare is gaining ground in China due to a rising middle class. With the innovative formulation of antioxidants including green tea and vitamin C to the formula, South Korea is still ahead of all the countries in Asia pacific. Government regulations support the safe use of anti-oxidants, and the trend toward natural and effective skin care drives the strong market presence of the region.

In 2024, North America is projected to be the fastest-growing region in the market for cosmetic antioxidants, accounting for 24.1% of the total share. In North America U.S. dominated the cosmetic antioxidants market with a market size of USD 24.87 Million in 2024 with a market share of 70%. Growing consumer concerns about aging and skin protection are boosting the demand for skincare products based on antioxidants. On the other hand, the U.S. market is led by major brands including Estée Lauder that also invest heavily in natural antioxidants, such as vitamin C and E, and macro-environmental variables, such as the FDA as regulator of cosmetic ingredients increase consumer confidence by ensuring the safety of cosmetic ingredients, further promoting market growth. The rapid development in the region reporting is also due to the increasing inclination towards clean beauty products.

The second highest share in the cosmetic antioxidants market was held by Europe with 27.5% in 2024. The demand for natural and anti-ageing skincare products is robust in countries, such as France, Germany and the U.K., making it a major driving factor of the market. In France, the cosmetic industry is dominated by players, such as L'Oréal, which practice beneficial antioxidants from natural material. The antioxidant usage in cosmetics is highly regulated by the EU to offer safety and efficiency, which in turn helps boost growth. European organic beauty offers antioxidant skin care solutions in abundance, as consumers strongly prioritize these products compared to traditional beauty.

Latin America accounted for 5.6% of the market share in the year 2024 with consistent growth predicted in the region, especially in Brazil, where consumers are increasingly aware of the benefits of using antioxidant skincare products for its anti-aging and environmental protection properties. Clean and sustainable cosmetic formulations are being increasingly adopted by local brands, such as Natura & Co.

The Middle East & Africa region is also growing gradually with a market share of 4.5%, especially for countries, such as UAE and Saudi Arabia. An increase in the disposable income of consumers, interest in quality antioxidant-based skincare, and government initiatives have all boosted demand for natural antioxidants for formulations in cosmetics in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major competitors in the cosmetic antioxidants market include BASF SE, Evonik Industries AG, Croda International Plc, Eastman Chemical Company, Ashland Global Holdings Inc., Wacker Chemie AG, Clariant AG, Koninklijke DSM N.V. (Royal DSM), Kemin Industries, Inc., and SEPPIC.

Recent Developments:

-

March 2025: Alfa Chemistry added a variety of cosmetic ingredients in its portfolio amid antioxidants, emulsifiers, UV absorbers and preservatives. The additions serve to improve the performance and safety of cosmetic formulations, in response to the increasing consumer demand for high-value skincare solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 146.60 Million |

| Market Size by 2032 | USD 236.03 Million |

| CAGR | CAGR of 6.14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Natural [Vitamins, Carotenoids, Polyphenols, Enzymes], Synthetic [Butylated Hydroxyanisole (BHA), Butylated Hydroxytoluene (BHT), Tert-Butyl Hydroquinone (TBHQ), Propyl Gallate (PG), Others]) •By Function (Anti-aging, Anti-inflammatory, UV Protection, Moisturizing, Hair Cleansing, Hair Conditioning, Others) •By Application (Skin Care, Hair Care, Make-up, Body Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Croda International Plc, Eastman Chemical Company, Ashland Global Holdings Inc., Wacker Chemie AG, Clariant AG, Koninklijke DSM N.V. (Royal DSM), Kemin Industries, Inc., SEPPIC |