Polypropylene Catalyst Market Report Scope & Overview:

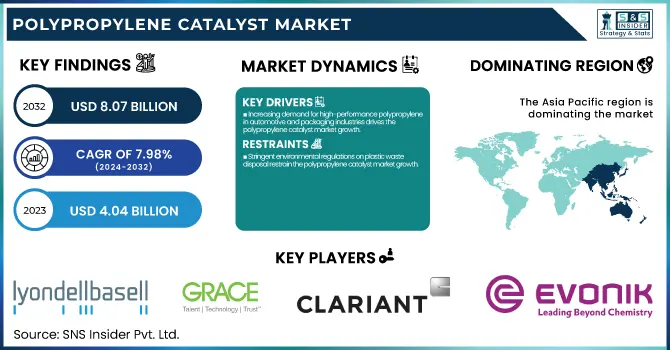

The Polypropylene Catalyst Market size was USD 4.04 billion in 2023 and is expected to reach USD 8.07 billion by 2032 and grow at a CAGR of 7.98% over the forecast period of 2024-2032. The Report offers a comprehensive analysis of key insights and trends shaping the industry. It examines production capacities and utilization rates by country and type for 2023, providing a detailed overview of global manufacturing dynamics. The report delves into feedstock price variations across different regions, highlighting economic factors influencing production costs. It assesses the impact of regulatory frameworks on the market, exploring how policies affect operations and compliance. Environmental metrics, including emissions data, waste management practices, and sustainability initiatives, are evaluated by region, reflecting the industry's commitment to environmental responsibility. The report also highlights innovations and R&D activities by type, showcasing advancements driving the market forward. Additionally, it explores the adoption rates of specialized software in the chemicals and materials sector, analyzing key features and regional adherence to regulations, underscoring the role of technology in enhancing efficiency and compliance.

To Get more information on Polypropylene Catalyst Market - Request Free Sample Report

The U.S. held the largest market share of 78% in the Polypropylene Catalyst Market, with a market size of USD 468 million, driven by its strong manufacturing infrastructure, advanced technological capabilities, and high demand from key end-use industries. The country has a well-established polymer and petrochemical sector, with major players investing in research and development to enhance catalyst efficiency and polypropylene production. The growing demand for lightweight, high-performance plastics in automotive, packaging, and consumer goods industries further supports market expansion. Additionally, stringent environmental regulations have encouraged the adoption of advanced catalyst technologies that improve process efficiency and reduce emissions. The presence of leading catalyst manufacturers, such as BASF, W.R. Grace & Co., and LyondellBasell, along with substantial investments in production facilities, strengthens the U.S. position as the dominant market for polypropylene catalysts.

Polypropylene Catalyst Market Dynamics

Drivers

-

Increasing demand for high-performance polypropylene in automotive and packaging industries drives the polypropylene catalyst market growth.

The rising demand for lightweight, durable, and cost-effective plastic materials in the automotive and packaging industries is significantly driving the polypropylene catalyst market. The automotive sector increasingly relies on polypropylene-based components to reduce vehicle weight, enhance fuel efficiency, and comply with stringent emission norms. Additionally, packaging applications, including food containers, medical packaging, and consumer goods, are witnessing rapid expansion due to polypropylene's excellent moisture resistance, durability, and recyclability. The advancements in catalyst technology, such as metallocene and Ziegler-Natta catalysts, have improved polypropylene properties, further fueling market growth. Key players like LyondellBasell and Clariant are continuously innovating high-efficiency catalysts to enhance production yield. This growing demand for superior polypropylene materials across multiple industries drives the need for advanced catalyst solutions, boosting market expansion.

Restrain

-

Stringent environmental regulations on plastic waste disposal restrain the polypropylene catalyst market growth.

The polypropylene industry faces increasing regulatory pressure due to growing environmental concerns regarding plastic waste and pollution. Governments worldwide, especially in Europe and North America, are implementing strict laws and sustainability mandates to curb plastic waste accumulation. Regulations like the European Green Deal and the U.S. Plastics Pact promote recyclability and biodegradable alternatives, posing challenges for conventional polypropylene production. Additionally, carbon emission reduction policies require industries to adopt eco-friendly catalysts, increasing production costs. Several regulatory bodies, including the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), impose strict guidelines on catalyst compositions and emissions, limiting market growth. Manufacturers must invest in research and development (R&D) for sustainable catalyst technologies, which adds to the overall operational expenses, further restraining market expansion.

Opportunity

-

The development of bio-based and sustainable polypropylene catalysts presents significant growth opportunities.

The rising focus on sustainability and green manufacturing has created immense growth opportunities in the polypropylene catalyst market. Companies are shifting toward bio-based catalysts to meet environmental regulations and consumer demand for sustainable products. The emergence of renewable feedstock-based polypropylene production, such as bio-naphtha and recycled polypropylene, has increased the need for eco-friendly catalysts. Innovations in catalyst efficiency, including the development of single-site metallocene catalysts, enable the production of high-performance polypropylene with improved recyclability. Key industry players like BASF and W. R. Grace & Co. are investing heavily in sustainable catalyst research to cater to this growing demand. With governments offering incentives for green manufacturing, companies focusing on bio-based polypropylene catalysts are well-positioned for long-term growth.

Challenge

-

Fluctuating raw material prices and supply chain disruptions pose a challenge for the polypropylene catalyst market.

The polypropylene catalyst market is highly dependent on the availability and pricing of raw materials, including metals like titanium, aluminum, and magnesium, which are key components of catalyst formulations. Fluctuations in the prices of these raw materials due to geopolitical tensions, trade restrictions, and supply chain disruptions significantly impact production costs. Additionally, the COVID-19 pandemic and the Russia- Ukraine conflict have further strained global supply chains, causing delays in raw material procurement. Manufacturers face difficulties in maintaining stable production volumes, leading to increased operational expenses. Furthermore, fluctuating crude oil prices directly affect polypropylene production, influencing catalyst demand. Companies must diversify their raw material sources, implement efficient supply chain strategies, and invest in alternative catalyst formulations to mitigate these challenges and ensure market stability.

Polypropylene Catalyst Market Segmentation Analysis

By Product

The polypropylene catalyst market is dominated by Ziegler-Natta catalysts, which are expected to hold 72% revenue share in 2023 as they provide low cost & high yield polypropylene. Innovations in this segment are being driven by the likes of LyondellBasell and W. R. Grace & Co. Clariant, which announced the PolyMax 600 Series catalysts for more efficient polypropylene production. These catalysts allow for the manufacture of high-performance polypropylene grades for automotive, packaging, and construction applications, further solidifying the growth path of the market.

By Manufacturing Process

The gas phase process occupies 48% of the market share for the development of sustainable energy resources because of its energy efficiency, low production cost, and environmental advantages Advanced catalysts for gas phase polypropylene process, for examples W. R. Grace & Co. and BASF have provide now a more stable process and different kinds of polymers. Grace's patent-protected Unipol PP process is widely used, making it scalable and cost-effective with high output and low waste. The growth of next-generation catalysts in the gas phase (a development that warrants further investments, given this cost-effective and scalable manufacturing strategy) is aiding market growth as well.

By End-Use Industry

Injection molding has a 28% market share owing to its immense application in automotive, packaging, consumer goods. LyondellBasell and Mitsui Chemicals have introduced high-performance polypropylene grades with advanced catalysts that improve mechanical strength and durability. LyondellBasell's Hostalen PP Injection Molding series, part of a family of polypropylene grades, enables lightweight and high-impact-resistant components with high flow properties, commonly employed in automotive interiors and food packaging. Catalyst innovation that provides high-performance polypropylene parts to a variety of industries helps to highlight expressive growth from the segment.

Polypropylene Catalyst Market Regional Outlook

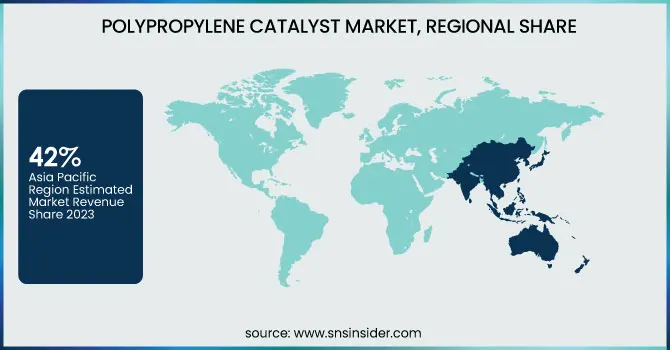

Asia Pacific held the largest market share, around 42%, in 2023. It is owing to rapid industrialization with high demand for end products based on polypropylene and continual investments in petrochemical infrastructure. Major polypropylene manufacturers such as Sinopec, Mitsui Chemicals, and LyondellBasell expanded their production capacities in the region to meet growing demand from end-use industries such as automotive, packaging, and construction. Furthermore, the rising manufacturing sector and increasing disposable incomes in China and India are expected to increase demand for polypropylene shortly. The dominance in the region is further complemented by the cost-effective labor and raw material along with excellent government initiatives in the region in supporting the petrochemical industry. The ongoing development of catalyst technology, along with the emergence of key market players from Japan and South Korea, drive the market in the region, such as Asia Pacific, which continues to be a frontrunner in the innovation and production of polypropylene catalysts.

North America held a substantial share in the Polypropylene Catalyst Market owing to well-established petrochemical industry, advanced manufacturing processes, and high demand for high-performance polypropylene products. Through the presence of all these major industry players, such as ExxonMobil, Dow, and LyondellBasell, the introduction of new exploration innovations and the expansion of large-scale production capacity have all been possible. Additionally, growing demand for polypropylene in automotive, packaging, and healthcare application in the region; stringent environmental regulations to maximize catalyst utilization are expected to bolster future growth of the market. Geographically too, both are well-positioned to continue benefitting from the availability of vast natural resources, sophisticated R&D infrastructure, and favorable chemical policies and innovation establishments. The United States is bolstered by strategic partnerships and improved betterness in catalyst technology that have resulted in this nation evolving to become a determine in the worldwide marketplace for polypropylene catalysts.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

LyondellBasell Industries (Avant ZN, Avant Metallocene)

-

W. R. Grace & Co. (Polytron 300, Polytron 400)

-

Clariant AG (PolyMax 600, PolyMax 700)

-

China Petrochemical Corporation (SinoPP 100, SinoPP 200)

-

Mitsui Chemicals, Inc. (Mitsui CX, Mitsui AX)

-

BASF SE (Lupotech T, Lupotech G)

-

Evonik Industries AG (VESTOPLAST 206, VESTOPLAST 408)

-

Univation Technologies, LLC (XCAT Metallocene, Prodigy Bimodal)

-

Sumitomo Chemical Co., Ltd. (Sumitomo PP 1100, Sumitomo PP 2200)

-

INEOS Group Holdings S.A. (Innovene PP, Innovene S)

-

ExxonMobil Chemical (Achieve Advanced PP, Vistamaxx)

-

Japan Polypropylene Corporation (Novolen PP, JPP Catalyst)

-

Reliance Industries Limited (Relene PP, RIL PP 100)

-

Borealis AG (Borstar PP, Borceed PP)

-

Wacker Chemie AG (VINNAPAS PP, WACKER PP 300)

-

Albemarle Corporation (Albemarle PP Ziegler, Albemarle PP Metallocene)

-

UOP LLC (UOP PPQ, UOP PolyMax)

-

Shell Chemicals (Shell PP Catalyst, Shell Metallocene PP)

-

SABIC (SABIC PP 500, SABIC PP 700)

-

Axens SA (Axens PP Catalyst, Axens Metallocene PP)

Recent Development:

-

In July 2023, Dow introduced an innovative polypropylene catalyst designed to enhance polymer purity, which has been rapidly adopted across the industry.

-

In November 2023, Johnson Matthey expanded its catalyst manufacturing facilities to accommodate the increasing demand for sustainable chemical solutions.

-

In September 2023, Axens entered into a technology licensing agreement with a leading refiner to integrate its advanced polypropylene production catalysts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.04 Billion |

| Market Size by 2032 | USD 8.07 Billion |

| CAGR | CAGR of 7.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Ziegler-Natta Catalyst, Metallocene Catalyst, Others) • By Manufacturing Process (Bulk Phase, Gas Phase, Others) • By Application, (Injection Molding, Blow Molding, Film, Fiber, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LyondellBasell Industries, W. R. Grace & Co., Clariant AG, China Petrochemical Corporation, Mitsui Chemicals, Inc., BASF SE, Evonik Industries AG, Univation Technologies, LLC, Sumitomo Chemical Co., Ltd., INEOS Group Holdings S.A., ExxonMobil Chemical, Japan Polypropylene Corporation, Reliance Industries Limited, Borealis AG, Wacker Chemie AG, Albemarle Corporation, UOP LLC, Shell Chemicals, SABIC, Axens SA |