Unidirectional Tapes (UD) Market Report Scope & Overview:

Get More Information on Unidirectional Tapes (UD) Market - Request Sample Report

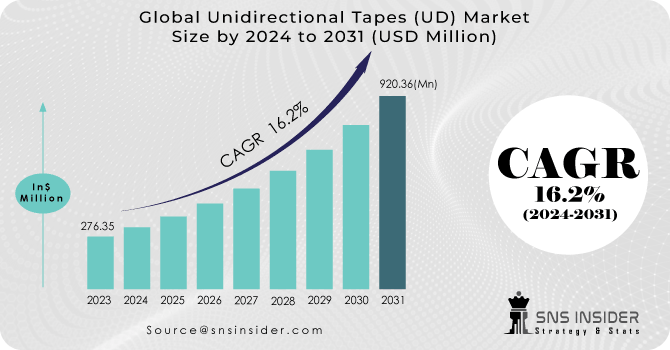

The Unidirectional Tapes Market Size was valued at USD 302.2 Million in 2023 and is expected to reach USD 906.1 Million by 2032, growing at a CAGR of 13.0% over the forecast period 2024-2032.

The growth of the Unidirectional Tapes Market is significantly driven by international sustainability targets and demand for lightweight high-performance materials. In the aerospace, automotive, and renewable energy sectors, advanced composites such as UD tapes are indispensable in lowering emissions and improving energy efficiency. As part of the 2023 agenda from the U.S. Department of Energy, it has noted that composite materials are critical to meet the new and tougher efficiency benchmarks being set for wind systems. Likewise, the European Union, through its Green Deal, has created billions of euros for materials research, including thermoplastic tapes, that are critical to lightweight transport applications.

Moreover, Asia-Pacific countries are increasing spending on composite technologies along with these initiatives. The same goes for other countries, such as China whose policy, Made in China 2025, has an advanced material development aspect driving both research and productive capabilities. UD tapes are gradually replacing traditional materials used in high-performance and lightweight automotive environments due to their cost efficiency, recyclability, and performance. Such tapes are also helping industries related to extending the products lifecycle, which in turn is fueling their global demand. Unidirectional tapes (UD tapes) are advanced composite materials that are highly engineered and come in a wide variety of fiber/resin combinations. These materials are great for a wide range of applications because they have great mechanical properties, chemical resistance, durability, and fire performance. UD tapes are used in places like the auto, sports, and aviation industries to get the job done with the least amount of materials and energy.

Unidirectional Tapes Market Dynamics

Drivers

-

Unidirectional tapes (UD tapes) are increasingly used in aerospace, automotive, and sporting goods due to their superior strength-to-weight ratio, which enhances fuel efficiency and performance.

-

Innovations such as Automated Tape Laying (ATL) and Automated Fiber Placement (AFP) have improved production efficiency and reduced costs, increasing the adoption of UD tapes across various applications.

-

The demand for UD tapes is rising in wind energy systems, particularly for turbine blades, and in composite materials for infrastructure and transportation.

One major factor in the rising use of unidirectional tapes (UD tapes) of prepreg formats in areas like aerospace, automotive, and sports equipment, is the growing focus on lightweighting. Lightweight materials are needed to boost fuel economy and performance without increasing carbon emissions. As an example, the automotive sector is feeling the heat with new emission regulations like the goal set by the EU to cut average CO₂ emissions from new vehicles down to 55 g/km by 2030. Despite their improving properties, the simplest UD tapes are still a work in progress but are being used in the structural components of electric vehicles (EVs) to offset the weight of heavy batteries thanks to high strength-to-weight ratios. Smart EV manufacturers such as Tesla have really started to use advanced composites including UD tapes, as part of their designs to enhance range and performance durability.

Similarly, in aerospace, the use of UD tapes in aircraft components, such as wings and fuselage sections, reduces fuel consumption. According to recent industry data, Boeing and Airbus have adopted composite materials extensively, with UD tapes being critical for lightweighting in their flagship models like the Boeing 787 Dreamliner and Airbus A350. Additionally, in the sporting goods industry, UD tapes are used in weight-sensitive products such as tennis rackets, bicycles, and skis, where the weight reduction can be translated into improved performance experience and competitive advantage. Such use across industries underscores the tactical role that UD tapes will perform in meeting sustainability and performance objectives.

Restraints

-

The manufacturing process for UD tapes, including material preparation and precision layering, remains cost-intensive, posing a challenge for broader market penetration.

-

Despite environmental benefits in applications, the lack of efficient recycling processes for composite materials poses challenges to sustainability efforts.

Highly advanced technologies such as Automated Tape Laying (ATL) and Automated Fiber Placement (AFP) are required to manufacture high-quality Unidirectional Tapes (UD tapes) using resource-intensive processes like precision layering and resin impregnation. Though such innovations help in generating better quality, they also lead to massive production costs. Take carbon fiber, which is a relatively common raw material in any UD tapes and can cost anywhere between $10 to $15 per pound, depending on grade and availability, making it costlier than traditional materials like aluminum or steel.

In addition, the high energy consumption in the manufacture of composite materials contributes to high costs. This price point limitations hampers adoption for cost-sensitive markets like small entry-level automotive use cases or developing countries. One of the challenges automation in developing nations, like India and Brazil, would face is justifying the UD tapes investment against cheaper alternatives. Reducing production costs through recycling and efficient material sourcing remains critical to addressing this restraint.

Unidirectional Tapes Market Segmentation Analysis

By Product

Thermoplastic UD tapes accounted for the largest share of the market, at 71% in 2023. This is mainly because thermoplastics are largely recyclable and possess an excellent balance of impact and environmental stress resistance, making them suitable for very demanding applications. Compared to their thermoset analogs, thermoplastics lend themselves to much faster manufacturing processes such as press forming, making them well-suited for scale. The use of thermoplastics has flourished in the automotive sector in particular, where auto manufacturers have been using these materials to comply with strict fuel efficiency standards.

Government policies encouraging the use of sustainable materials further improve the demand. Additionally, tax breaks for industries utilizing sustainable materials have attracted the attention of nations like the U.S. and Europe alike, and this will stimulate the growth of thermoplastic UD tapes. Urbanization and increases in transportation infrastructure projects are also boosting thermoplastic demand in fast-growing economies (like India and Brazil). As a result of innovation in resin formulations and production methods, these thermoplastic UD tapes are set to address a large number of industries.

By Fiber

In 2023, the dominant fiber segment was carbon fiber UD tapes, which accounted for the largest revenue share of 80% of the market. Due to their low weight, high strength, and corrosion-resistant properties, they have become indispensable in the aerospace and defense sector. These bills partly helped the initial acceleration of it with Governments being its main reason. The Federal Aviation Administration (FAA), for example, has promoted carbon composites to reduce weight for increased fuel efficiency and lower operating cost of the airplane. Moreover, carbon fiber composites play an essential role in the production of electric vehicles, which are backed by government support across the globe in the form of subsidies for EV manufacturers.

Carbon fiber UD tapes are also increasingly appealing for use in the renewable energy sector. Carbon fiber composites have found a growing role in wind turbine applications since these devices require materials with high stiffness-to-weight ratios and they are essential for the production of both large wind turbine blades and nacelles. Wind energy capacity increased by 15% globally this year according to the International Energy Agency, where carbon fiber composites have served as the foundation of blades. Carbon fibers that increase efficiency and durability are becoming even more significant as countries accelerate renewable energy initiatives.

By End-Use

In 2023, aerospace & defense was the largest end-use segment of the UD tapes market, with a 47% share of the market. This is mainly due to the demand for high-performance materials from this industry, which need to be durable and reduce weight. Due to the increase in demand for advanced military technologies across the globe, especially in North America and Asia-Pacific, the UD tapes have been adopted on a much higher scale which in turn is fueling the growth of the market. Governments are investing large amounts of money in the update of fleets and hardware. For instance, India allocated an unprecedented budget to aerospace advancements under its Make in India initiative in 2023.

Unidirectional Tapes Market Regional Overview

In 2023, North America emerged as the dominant region in the Unidirectional Tapes (UD) market, commanding a 47% revenue share. Multiple factors contribute to this leadership position, spanning from technological advancements, strong industrial growth, and large investments in aerospace and defense. This dominance has additionally been due to the region's strong automotive and wind energy sectors. The well-established aircraft manufacturing centers of this region, especially in the U.S., command a notable share of the aerospace industry, which is a major end-user of UD tapes. UD tapes are widely used by companies such as Boeing and Lockheed Martin because they are an ideal structure to meet the lightweight and high-strength properties needed to meet precise performance specifications. Additionally, the U.S. Department of Defense allocated record budgets in 2023 for modernizing military equipment, further driving the adoption of advanced composite materials like UD tapes.

Technological advancement in the area of Unidirectional Tapes (UD) is also making it a valuable quickening. Rapid industrialization, infrastructure enhancement, and the improvement of aviation and protection capacities are helping the Unidirectional Tapes (UD) market to go ahead in the Asia-Pacific region. Due to heavy investments in different countries for the development of advanced material technologies, the region is anticipated to account for the highest compound annual growth rate (CAGR) during the forecast period. This growth path is led by nations such as China, India, and Japan. China, with its "Made in China 2025" program, is now also attempting to build up local capacity in the production of advanced composites, such as UD tapes. The country’s investments in renewable energy infrastructure, particularly in wind power, are notable, as UD tapes play a crucial role in turbine blade manufacturing.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in Unidirectional Tapes Market

Service Providers / Manufacturers

-

Hexcel Corporation (HexPly®, HexTow®)

-

Toray Industries, Inc. (Torayca® Prepreg, Cetex®)

-

Teijin Limited (Tenax® UDT, Pyromex®)

-

Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Admer®, Milastomer®)

-

Celanese Corporation (Halar® UD, Fortron®)

-

SABIC (ULTEM™, EXTEM™)

-

Solvay (CYCOM® UD, APC-2®)

-

SGL Carbon (SIGRAFIL®, SIGRAPREG®)

-

Victrex plc (APTIV® Films, VICTREX® PEEK)

-

Avient Corporation (Polystrand™, OnForce™)

Key Users

-

Boeing

-

Airbus

-

Lockheed Martin

-

Toyota Motor Corporation

-

General Motors (GM)

-

Ford Motor Company

-

Siemens

-

GE Aviation

-

Bombardier Inc.

-

Northrop Grumman Corporation

Recent Developments

-

In January 2023, Victrex plc. achieved National Center for Advanced Materials Performance (NCAMP) approval for its new UD tape, VICTREX AETM 250-AS4, designed for aerospace applications. This material combines HexTow carbon fiber with Victrex's thermoplastic resin technology to enhance energy efficiency, reduce aircraft weight, and extend operational lifespan.

-

In June 2024, Cytec Solvay Group launched new thermoplastic UD tapes for next-generation aircraft based on the guidance of the European Union’s Clean Sky 2 initiative to lower emissions in aviation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 302.2 Million |

| Market Size by 2032 | US$ 906.1 Million |

| CAGR | CAGR of 13.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By fiber (Glass fibe, Carbon fiber) • By resin (Thermoplastic, Thermoset) • By end-use industries (Aerospace & Defense, Automotive, Sports & Leisure, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Teijin Limited, SGL Carbon SE, Evonik Industries AG, SABIC, Toray Industries, Inc, Celanese Corporation, Solvay S.A., Mitsubishi Chemical Carbon Fiber and Composites, Inc. |

| Drivers | • More UD tapes are being used in the main and secondary aircraft structures. • Making lighter vehicles is becoming more popular. • Plans by the Chinese and Indian governments |

| Restraints | • Concerns about being able to recycle • Costs of making and processing carbon fibre are high |