Zero Friction Coatings Market Report Scope & Overview:

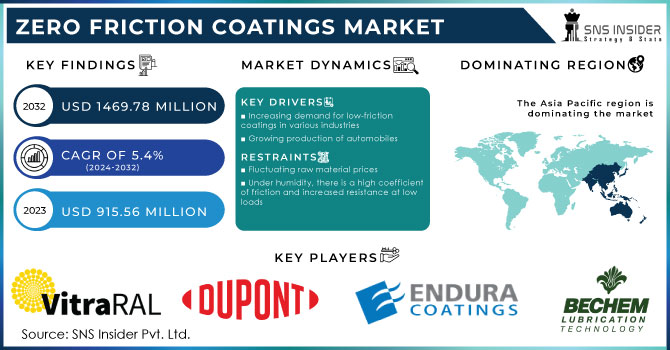

The Zero Friction Coatings Market Size was valued at USD 915.56 Million in 2023 and is expected to reach USD 1469.78 Million by 2032 and grow at a CAGR of 5.4% over the forecast period 2024-2032.

The growth of the zero friction coatings market is driven by the increasing demand for high-performance materials across various industries. These coatings find extensive applications in the automotive industry, aerospace, industrial, and medical sectors, among others. The rising need for reducing energy consumption, enhancing operational efficiency, and prolonging the lifespan of equipment has further fueled the market's expansion. Factors such as technological advancements, increasing research and development activities, and the growing awareness about the benefits of these coatings are driving the market's upward trajectory. Additionally, the rising demand for eco-friendly and sustainable solutions is likely to create lucrative opportunities for market players.

Get E-PDF Sample Report on Zero Friction Coatings Market - Request Sample Report

Zero friction coatings find extensive application in the automotive and aerospace industries owing to their property of lowering wear & tear of important engines, gears, and other moving components which will drive its global market throughout the forecast timeframe. Such coatings are integral in increasing performance, reducing fuel consumption, and also extending the life of mechanical components by keeping friction at a minimum. Decreasing energy loss due to friction is a key priority in both spaces because it has an immediate effect on fuel consumption and emissions.

Zero friction coatings are considered as the quest to serve the purpose of cleaner and harsher environmental demands, focusing on rethink global drive for minimizing CO2 emissions within acceptable norms. These coatings enhance engine and drivetrain efficiency in the automotive industry, and are applied to aircraft engines and systems in aerospace to ensure that they maintain high performance standards which require less maintenance at lower cost with greater reliability. This trend is expected to strengthen further as end-users’ sectors, over the years, remain focused on exploring advanced materials in re-enforcing sustainability and energy efficiency endeavors.

In 2023, Oerlikon Balzers expanded its portfolio with the launch of BALIFOR solutions, specifically targeting the automotive industry. These coatings reduce friction in automotive engines and transmissions, leading to improved fuel efficiency and reduced CO2 emissions. The company has focused on supporting the transition to electric vehicles (EVs) with these advanced friction-reducing solutions.

Zero Friction Coatings Market Dynamics

Drivers

-

Rising demand for low-friction coatings in various industries drives the market growth.

The significant market drivers include growing industries, demand in low friction coatings due to improved performance and energy efficiency the wear reduction ability to be provided by these coatings for critical applications etc. Low-friction solutions have gained traction in industries like automotive, aerospace and manufacturing due to their ability to increase operational efficiency while enhancing the durability of equipment. In 2021, for example, DuPont introduced its new Teflon™ Industrial Low-Friction coatings to enhance the performance of machinery used in manufacturing. The Xylan® family from Whitford Worldwide, enhance fuel efficiency and performance in the automobile as well as aerospace sectors with its unparalleled low-friction attributes.

In 2023, global coatings manufacturer Hempel added new coatings to its portfolio developed to reduce drag on marine vessels (and therefore fuel consumption). These tailor-made solutions from leading market participants underscore the adoption of low-friction coatings in order to comply with the need for enhanced efficiency, sustainability and performance as a facilitator in boosting the revenues generated by such technologies.

Moreover, according to the U.S. Department of Energy, improving energy efficiency in manufacturing can lead to energy savings of 20-30%, which is significantly enhanced through the use of low-friction coatings that reduce energy consumption and operational costs.

Restrain

-

Under humidity, there is a high coefficient of friction and increased resistance at low loads

An increase in humidity leads to the significant absorption of water molecules by certain zero-friction coatings. Consequently, these coatings expand in size and diminish their effectiveness as industrial lubricants. This, in turn, causes friction levels to rise, undermining the primary purpose of zero friction coatings and impeding market growth. Additionally, under high humidity conditions, these coatings become susceptible to corrosion, particularly when applied to metals.

Opportunities

Increasing adoption of PTFE-based Low Friction Coatings

PTFE coatings are extensively used in various applications, particularly in food-grade and nonstick coatings. These coatings possess exceptional release properties and can withstand temperatures as high as 500°F, surpassing other fluoropolymers in extreme heat resistance. They are commonly employed in applications that necessitate a sleek, low-friction, and corrosion-resistant coating.

Zero Friction Coatings Market Segmentation Overview

By Type

The molybdenum disulfide (MoS2) type segment dominated the zero friction coatings market with a revenue share of about 52% in 2023. This growth is owing to the exceptional properties exhibited by MoS2, including its high load-carrying capacity and excellent adhesion. MoS2 serves as a dry film lubricant, effectively preventing the occurrence of galling, fretting, and seizing. The utilization of MoS2 coating solutions is particularly prevalent in critical equipment and parts, where its protective qualities are highly sought after. Additionally, it finds widespread application in corrosion management due to its non-reactivity towards most corrosive agents.

By Formulation

The solvent-based coatings segment dominated the zero friction coatings market with a revenue share of about 48% in 2023. The growth is attributed to the inherent advantages of these coatings, which exhibit a reduced vulnerability to environmental conditions such as humidity and temperature during the curing phase.

By End-Use

Automobile and transportation segment held the largest market share was 38.5% revenue in 2023. This is mainly due to the urgent requirement of fuel efficient and performance improvement in vehicles owing to which stringent emission norms have been implemented by different regulatory bodies, addressing carbon emissions. The substantial reduction in frictional losses achieved during engine, transmission and bearing operation by applying low-friction coatings plays a remarkable role in improving the overall efficiency of major automotive components. The International Council for Clean Transportation recently reported that fuel economy advances from next-generation technologies, like low-friction coatings are required in order to meet targeted emission reductions.

Zero Friction Coatings Market Regional Analysis

Asia-Pacific held the largest share of about 51% in the global Zero Friction Coatings Market and is projected to experience a significant growth rate during the forecast period. This growth is attributed to the presence of thriving automotive manufacturing industries in countries such as Japan, South Korea, and China. Notably, the Association of Southeast Asian Nations (ASEAN) stands as the seventh-largest automotive manufacturing hub worldwide, having produced approximately 3.6 million vehicles in 2021 alone. This region boasts the presence of renowned automotive manufacturers, including Honda, Ford, BMW, Toyota, and others. As the automobile industry in the Asia-Pacific region continues to flourish, the demand for zero-friction coatings is predicted to surge in the coming years. This trend is driven by the need to enhance the performance and efficiency of automotive components, ultimately benefiting both manufacturers and consumers alike.

Europe is projected to experience a CAGR of 5.9% throughout the forecast period. This growth can be primarily attributed to the increasing adoption of renewable energy sources, such as wind turbines and solar panels. In order to prevent energy losses, zero friction coatings play a crucial role in these systems, enhancing the overall efficiency of renewable energy systems. As of 2023, Europe had an impressive 255 GW of installed wind capacity. Furthermore, the presence of renowned automobile manufacturers in Europe is also expected to contribute to the growth of the market in the region.

Key Players

-

DuPont (Teflon™ Industrial Coatings)

-

Bechem

-

Whiteford Worldwide (Xylan Coatings)

-

AkzoNobel (Interfine)

-

PPG Industries (PPS Coatings)

-

BASF (BASF Coating Solutions)

-

Thermal Spray Technologies (TST Coatings)

-

Krylon (Krylon Fusion for Plastic)

-

Sherwin-Williams (Sherwin-Williams High Performance Coatings)

-

Carboline (Carbotherm)

-

Rohm and Haas (Durethan)

-

Elementis (Elementis Specialty Coatings)

-

Covalent Coatings (Covalent Low Friction Coatings)

-

Nordson (Nordson Coatings)

-

IKV Tribology Ltd.

-

Dow Corning

-

GMM Coatings Private Limited

-

Poeton

-

Aremco Products (Aremco-Bond 870)

-

Ferro Corporation (Ferro Coatings)

-

Dürr AG (EcoClean)

Recent Development:

-

In 2023, DuPont launched an advanced version of its Teflon™ Industrial Coatings, enhancing its resistance to wear and tear while improving its low-friction properties for various industrial applications.

-

In 2023, Whitford introduced new formulations in its Xylan® Coatings line that offer improved thermal stability and reduced friction, making them suitable for high-performance automotive components.

-

In 2023, AkzoNobel developed a new Interfine® coating with enhanced low-friction characteristics aimed at the aerospace industry, allowing for increased performance and lower maintenance costs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 915.56 Billion |

| Market Size by 2032 | US$ 1469.78 Billion |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Polytetrafluoroethylene, Molybdenum Disulfide, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | VITRACOAT, Bechem, DuPont, Endura Coatings, ASV Multichemie Private Limited, IKV Tribology Ltd., Poeton, GMM Coatings Private Limited, Whitmore Manufacturing, Dow Corning |

| Key Drivers |

• Increasing demand for low-friction coatings in various industries |

| Market Restraints |

• Fluctuating raw material prices |