Critical Illness Insurance Market Report Scope & Overview:

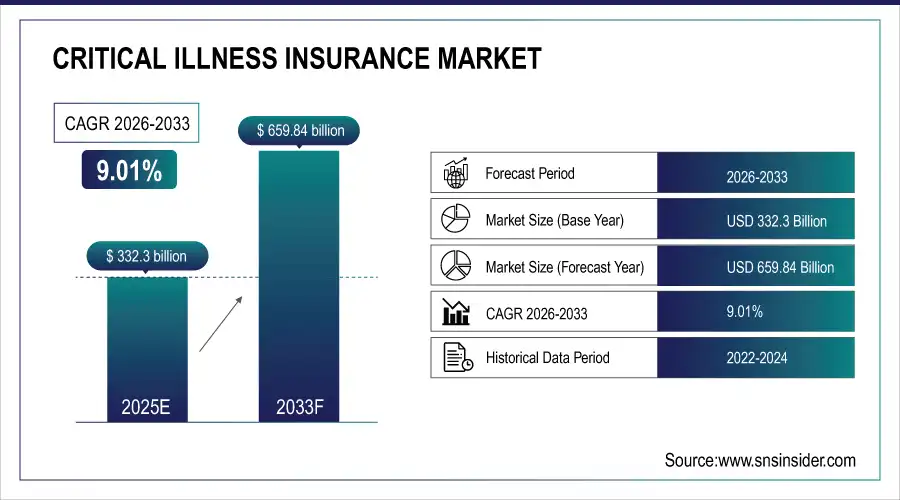

The Critical Illness Insurance Market size was valued at USD 332.3 Billion in 2025E and is projected to reach USD 659.84 Billion by 2033, growing at a CAGR of 9.01% during 2026-2033.

The Critical Illness Insurance Market is growing due to rising healthcare costs, increasing prevalence of lifestyle-related diseases such as cancer, heart attack, and stroke, and growing awareness about financial protection against high medical expenses. Additionally, the expansion of digital distribution channels and employers offering health coverage benefits are driving greater adoption of critical illness policies globally.

Market Size and Forecast:

-

Market Size in 2025E USD 332.3 Billion

-

Market Size by 2033 USD 659.84 Billion

-

CAGR of 9.01% From 2026 to 2033

-

Base Year 2024

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information On Critical Illness Insurance Market - Request Free Sample Report

Key Critical Illness Insurance Market Trends

-

Increasing integration of AI and digital tools in underwriting, claims processing, and customer support.

-

Growing adoption of employer-sponsored critical illness insurance as part of employee wellness programs.

-

Rising demand for personalized and flexible insurance products tailored to individual health profiles.

-

Expansion of online insurance distribution platforms improving accessibility and transparency.

-

Strengthening insurer–healthcare–fintech partnerships to enhance service delivery and product innovation.

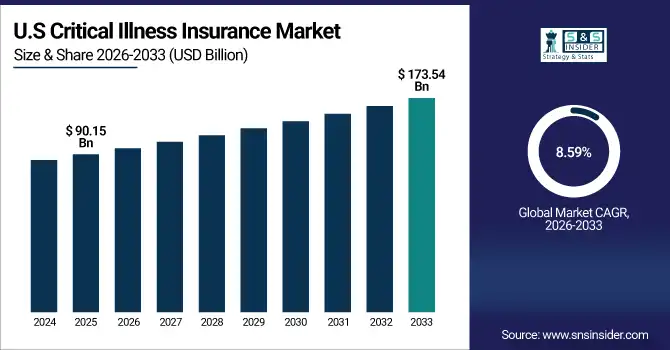

The U.S. Critical Illness Insurance Market size was valued at USD 90.15 Billion in 2025E and is projected to reach USD 173.54 Billion by 2033, growing at a CAGR of 8.59% during 2026-2033. The U.S. Critical Illness Insurance Market is growing due to rising healthcare expenses, increasing incidence of chronic and lifestyle-related diseases, greater consumer awareness about financial protection, and expanding employer-sponsored benefit programs that include supplemental critical illness coverage for employees.

Critical Illness Insurance Market Growth Drivers:

-

Rising Disease Burden and Digital Advancements Drive Strong Growth in the Global Critical Illness Insurance Market

The global Critical Illness Insurance Market is primarily driven by the increasing prevalence of severe health conditions such as cancer, cardiovascular diseases, and stroke, which create a strong need for financial security. Rising healthcare costs and the burden of out-of-pocket medical expenses are prompting individuals to seek insurance coverage that provides lump-sum payments upon diagnosis. Growing awareness about critical illness protection, coupled with government and private sector initiatives to promote health insurance adoption, further accelerates market demand. The increasing penetration of health and life insurance companies across emerging economies and the integration of advanced digital tools for policy management and claims processing are enhancing accessibility and customer experience.

In India in 2024, out-of-pocket (OOP) healthcare spending remained high: though it declined, it stayed under ~40 % of total health expenditure highlighting the burden of medical costs on households

Critical Illness Insurance Market Restraints:

-

Regulatory Challenges and Low Awareness Limit Growth Potential in the Global Critical Illness Insurance Market

The Critical Illness Insurance Market faces restraints such as limited awareness about policy benefits, complex claim procedures, and lack of standardized definitions for covered illnesses across insurers. Additionally, stringent regulatory requirements, delayed claim settlements, and miscommunication regarding policy exclusions often lead to consumer distrust. The limited availability of comprehensive coverage in rural and low-income regions also hinders widespread adoption of critical illness insurance.

Critical Illness Insurance Market Opportunities:

-

Technological Innovation and Global Partnerships Unlock New Growth Opportunities in the Evolving Critical Illness Insurance Market

The market presents significant opportunities through technological advancements and innovative policy offerings. The rise of online insurance platforms and AI-based underwriting processes allows insurers to deliver personalized coverage at lower operational costs. There is also growing potential in employer-sponsored insurance programs, as corporations adopt critical illness plans as part of comprehensive employee benefit packages. Furthermore, developing regions in Asia-Pacific and Latin America offer untapped potential due to increasing disposable incomes and expanding awareness of financial wellness. Strategic partnerships between insurers, healthcare providers, and fintech firms are expected to create new growth avenues in the coming years.

A survey found that nearly 90% of insurance executives consider artificial intelligence a top strategic initiative for 2025.

Critical Illness Insurance Market Segment Analysis

-

By Policy Type, Individual dominated with 63.55% in 2025E, and Group is expected to grow at the fastest CAGR of 9.71% from 2026 to 2033.

-

By Coverage Type, Cancer dominated with 34.68% in 2025E, and Heart Attack is expected to grow at the fastest CAGR of 9.63% from 2026 to 2033.

-

By Distribution Channel, Insurance Brokers/Agents dominated with 39.75% in 2025E, and Online Platforms is expected to grow at the fastest CAGR of 10.35% from 2026 to 2033.

-

By End-User, Individuals dominated with 68.45% in 2025E, and Corporates / Employers is expected to grow at the fastest CAGR of 9.72% from 2026 to 2033.

By Policy Type, Individual Policies Dominate 2025 Critical Illness Market as Group Coverage Gains Momentum for Future Growth

In 2025E, the Individual policy type dominates the Critical Illness Insurance Market due to higher consumer awareness, flexible premium options, and increasing preference for personalized financial protection plans. Individuals are increasingly purchasing standalone policies to cover major illnesses amid rising healthcare risks. However, the Group segment is expected to witness the fastest growth from 2026–2033, driven by expanding employer-sponsored health benefits, corporate wellness initiatives, and insurers partnering with organizations to provide affordable collective coverage options.

By Coverage Type, Cancer Coverage Leads 2025 Critical Illness Market as Heart Attack Segment Gears Up for Rapid Growth

In 2025E, the Cancer coverage segment dominates the Critical Illness Insurance Market due to its high global incidence rate and growing awareness of cancer’s financial impact on patients and families. Insurers are offering specialized cancer coverage with comprehensive benefits. However, the Heart Attack segment is projected to grow fastest from 2026–2033, driven by increasing cardiovascular disease prevalence, sedentary lifestyles, and rising demand for early financial protection against heart-related conditions.

By Distribution Channel, Insurance Brokers Lead 2025 Critical Illness Market as Digital Platforms Set Stage for Rapid Growth

In 2025E, Insurance Brokers/Agents dominated the Critical Illness Insurance Market, owing to their strong customer trust, personalized advisory services, and wide distribution networks that simplify complex policy structures. Their role in guiding clients through coverage and claim procedures remains crucial. However, Online Platforms are projected to witness the fastest growth from 2026–2033, driven by rising digitalization, AI-based policy comparison tools, and consumer preference for seamless, quick, and transparent policy purchases.

By End-User, Individuals Lead 2025 Critical Illness Insurance Market as Employer-Based Plans Poised for Rapid Future Growth

In 2025E, Individuals dominated the Critical Illness Insurance Market due to rising health awareness, increasing lifestyle-related diseases, and growing demand for financial protection against critical medical expenses. Personalized and flexible insurance plans further fueled individual adoption. However, Corporates/Employers are expected to register the fastest growth from 2026–2033, as organizations increasingly include critical illness coverage in employee benefit programs to enhance workforce well-being, retention, and productivity in a competitive job environment.

Critical Illness Insurance Market Report Analysis

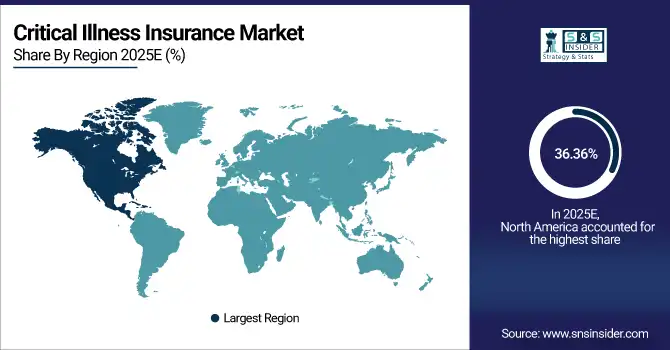

North America Critical Illness Insurance Market Insights

North America dominated the Critical Illness Insurance Market in 2025E with 36.36% share, driven by high healthcare costs, strong consumer awareness, and well-established insurance infrastructure. The region benefits from widespread employer-sponsored health programs and advanced digital underwriting systems. Increasing prevalence of chronic diseases such as cancer and cardiovascular disorders, along with growing demand for financial security, continues to strengthen market expansion across the United States and Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Critical Illness Insurance Market Insights

The United States dominated the North American Critical Illness Insurance Market in 2025E, supported by high healthcare expenditure, advanced insurance penetration, and a large working population seeking financial protection against critical diseases such as cancer, stroke, and heart attack.

Europe Critical Illness Insurance Market Insights

Europe accounted for 24.87% of the global Critical Illness Insurance Market in 2025E, driven by increasing awareness of serious health conditions and strong regulatory frameworks promoting health coverage. The region benefits from a mature insurance ecosystem, advanced digital claim management, and rising adoption of comprehensive health protection plans. Growing demand for customized and multi-disease coverage policies, coupled with supportive government initiatives for healthcare reform, continues to enhance market growth across both individual and group segments.

United Kingdom Critical Illness Insurance Market Insights

The United Kingdom dominated the European Critical Illness Insurance Market in 2025E due to its well-established private insurance sector, high consumer awareness, and increasing adoption of critical illness riders in life insurance policies. Favorable regulations and digitalization further support market expansion.

Asia Pacific Critical Illness Insurance Market Insights

The Asia-Pacific Critical Illness Insurance Market is expected to grow at the fastest CAGR of 9.85% from 2026 to 2033, driven by rapid urbanization, improving healthcare infrastructure, and rising awareness of financial protection against severe diseases. Increasing disposable income, expanding middle-class populations, and digitalization of insurance services are further fueling adoption. Additionally, government initiatives promoting health coverage and partnerships between insurers and healthcare providers are strengthening market penetration across emerging economies in the region.

China Critical Illness Insurance Market Insights

China dominated the Asia-Pacific Critical Illness Insurance Market in 2025E, supported by its vast population, rising healthcare expenditure, and strong presence of domestic insurers. The country’s rapid digital transformation and increasing awareness of health coverage have further accelerated market adoption.

Latin America (LATAM) and Middle East & Africa (MEA) Critical Illness Insurance Market Insights

Latin America and the Middle East & Africa Critical Illness Insurance markets are witnessing gradual growth driven by rising awareness of health protection, increasing chronic disease cases, and improving healthcare infrastructure. Expanding insurance penetration, supportive government initiatives, and growing adoption of digital distribution channels are fostering market expansion across both regions. Emerging economies are focusing on enhancing financial literacy and health coverage accessibility to strengthen long-term growth potential.

Competitive Landscape for Critical Illness Insurance Market:

Aegon N.V. is a leading multinational insurer offering life, health, and critical illness insurance solutions. The company focuses on digital transformation and personalized protection products, addressing rising healthcare risks and expanding its presence across key global insurance markets.

- In June 2024, Aegon announced that its UK individual protection business including life, critical illness, and income protection policies had been transferred to Royal London Mutual Insurance Society Limited.

Aflac Incorporated is a U.S.-based Fortune 500 insurance company specializing in supplemental health and life protection products, including lump-sum critical illness coverage that aids policyholders with cash benefits upon diagnosis of serious conditions.

- In February 2025, Aflac partnered with American Cancer Society to promote early-detection and proactive wellness for cancer, noting in its 2024 survey that 77% of Americans delayed important health check-ups and 60% admitted to avoiding cancer screenings.

Critical Illness Insurance Market Key Players:

Some of the Critical Illness Insurance Market Companies

- Aegon N.V.

- Aflac Incorporated

- Allianz SE

- American International Group, Inc. (AIG)

- Aviva plc

- AXA Group

- Bajaj Allianz Life Insurance Co. Ltd.

- Cigna Corporation

- China Life Insurance Company Limited

- Dai‑ichi Life Holdings, Inc.

- Legal & General Group plc

- Manulife Financial Corporation

- MetLife, Inc.

- Ping An Insurance (Group) Company of China, Ltd.

- Prudential plc

- Sun Life Financial Inc.

- UnitedHealth Group Incorporated

- Zurich Insurance Group Ltd.

- China Pacific Insurance (Blue) – China Pacific Insurance Company Limited

- New China Life Insurance Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 332.3 Billion |

| Market Size by 2033 | USD 659.84 Billion |

| CAGR | CAGR of 9.01% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Policy Type (Individual, and Group) • By Coverage Type (Cancer, Heart Attack, Stroke, and Other Critical Illnesses) • By Distribution Channel (Bancassurance, Insurance Brokers/Agents, Direct Sales, and Online Platforms) • By End-User (Individuals, and Corporates / Employers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Aegon, Aflac, Allianz, AIG, Aviva, AXA, Bajaj Allianz Life, Cigna, China Life, Dai-ichi Life, Legal & General, Manulife, MetLife, Ping An, Prudential, Sun Life, UnitedHealth, Zurich Insurance, China Pacific Insurance, New China Life. |