Alzheimer’s Therapeutics Market Report Scope & Overview:

Get More Information on Alzheimer’s Therapeutics Market - Request Sample Report

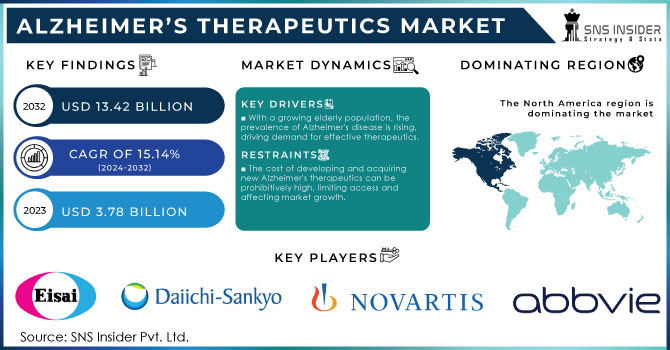

The Alzheimer’s Therapeutics Market Size was valued at USD 3.78 Billion in 2023 and will reach USD 13.42 Billion by 2032, with a growing CAGR of 15.14% during 2024-2032.

The rising prevalence of Alzheimer’s Disease is a significant factor that is boosting the Alzheimer’s therapeutics market. According to the National Institutes of Health, about 6.68 million Americans aged 65 and older suffered from Alzheimer’s in the US in 2023, a number that is projected to reach 13.8 million Americans by 2060. The higher incidence in women, as a result of their longer life expectancy, only intensifies the need for effective treatments. Currently, 1 in 9 people aged 65 and older has Alzheimer’s. and approx. two-thirds of Americans suffering from Alzheimer’s are women. The approval of disease-modifying therapies is another key factor contributing to market growth. Disease-modifying therapies offer hope for slowing disease progression, filling a huge gap in the current treatment landscape.

In addition, cloud-based cognitive assessment systems, for example, Cambridge Cognition’s Cantab Connect, make it easy for pharmaceutical companies to precisely measure the cognitive effects of their drugs, resulting in an increased likelihood of drug approval opportunities following the assessment of cognitive efficacy and safety. Constant work in research and development and related investments by pharmaceutical companies are also driving the market. Awareness of the disease and the number of diagnosed patients is increasing rapidly confirming the need for the development of therapeutics. Partnership efforts to develop novel treatments will also drive market growth. For instance, Genentech, a member of the Roche Group, collaborates with UCB to develop an anti-Tau antibody UCB0107, an ongoing clinical trial aimed at addressing the need for more effective approaches.

Alzheimer’s Therapeutics Market Dynamics

Drivers

-

With a growing elderly population, the prevalence of Alzheimer's disease is rising, driving demand for effective therapeutics.

-

Significant progress in understanding the pathophysiology of Alzheimer's disease is leading to the development of novel drugs and therapies.

-

Emerging technologies such as biomarkers and imaging techniques are enhancing early diagnosis and personalized treatment, fuelling the market.

-

Growing awareness and educational campaigns about Alzheimer's disease are leading to early diagnosis and a higher demand for therapeutic interventions.

The growth of the market is driven by the increasing prevalence of Alzheimer's disease. In the year 2023, about 55 million people were estimated to be affected with dementia in which Alzheimer's disease comprised 60-70% of all cases according to the World Health Organization (WHO). This is a significant rise in the number of people affected by Alzheimer's disease, as compared to previous years, thus, highlighting a growing public health concern. There are approximately 6.68 million people with Alzheimer's disease in the United States. The National Institute on Aging foresees the prevalence among older adults for Alzheimer's to nearly triple in just a period of the next 40 years due largely to the aging population. The increasing prevalence underlines the urgent need for effective therapeutic interventions and encourages intense investment in research and drug development programs. The upsurge in the number of Alzheimer's patients signals an increasing demand for advanced and effective treatment options, driving advancements within the global therapeutics market.

Restraints

-

The cost of developing and acquiring new Alzheimer's therapeutics can be prohibitively high, limiting access and affecting market growth.

-

Stringent regulatory requirements and lengthy approval processes can delay the launch of new drugs and impact market dynamics.

-

Many existing treatments offer only symptomatic relief and have limited effectiveness, which may impact patient and caregiver expectations.

High development and acquisition costs related to new Alzheimer's therapeutics mark one of the major restraints in the market. R&D for Alzheimer's drugs involve extensive clinical trials, testing on a wide scale, and regulatory mechanisms, which are usually resource-and time-consuming and costly. The treatment becomes less accessible to people, mainly those who do not have sufficient insurance coverage. the high cost of innovative drugs can strain healthcare systems and limit the adoption of new therapies. The economic barrier is compounded by the fact that many current therapies offer only modest benefits, further challenging the cost-benefit ratio and making it difficult for new, high-priced treatments to gain widespread acceptance.

Alzheimer’s Therapeutics Market Segment Analysis

By Product

The cholinesterase inhibitors held more than 48% revenue share in 2023 and leading product segment in the treatment of Alzheimer's due to its status as a standard of care. In March 2022, the U.S. FDA approved the Adlarity, donepezil hydrochloride a cholinesterase inhibitor from Corium Inc. for the symptomatic treatment of severe dementia in Alzheimer’s disease (AD). This transdermal patch provides a steady dosage of donepezil, and it represents the fourth cholinesterase drug approved in the U.S., which continues to reflect the reliance on this class of drugs in the management of AD.

The pipeline drugs segment is expected to witness the fastest growth in the coming years, driven by the imminent launch of several disease-modifying therapies. Major pharmaceutical companies such as F. Hoffmann-La Roche Ltd, Biogen/Eisai Inc., and Eli Lilly and Company have developed drug candidates that can bring a paradigm shift in the treatment of AD.

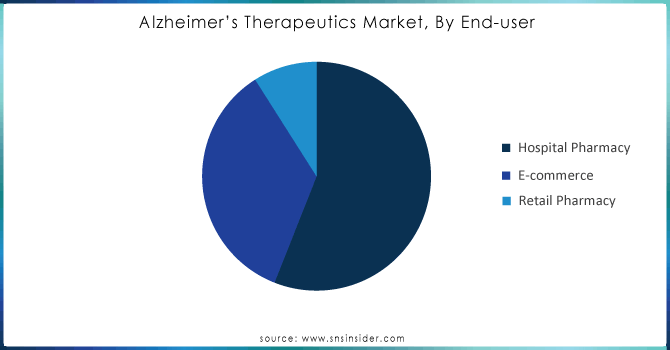

By End-user

The Alzheimer’s therapeutics market is led by hospital pharmacy segment with more than 56% revenue share in 2023, as an increase in geriatric population and rising patient of AD lead to a greater number of people getting hospitalized. In 2022, there are 518 hospitalizations per 1000 medicare beneficiaries or other dementias, compared to 234 hospitalizations per 1,000 medicare beneficiaries without these conditions. This disparity underscores the higher rates of hospitalization in Alzheimer's patients but, relative to overall disease prevalence levels, total numbers are relatively low.

E-commerce segment is projected to grow with significant CAGR over a period of forecast. This growth is accompanied by greater penetration of the internet and smartphones, enabling patients and their caretakers to order medicines more smoothly online. The convenience provided by the e-commerce platform, may be considered as some of the prominent factors for the growth of the segment, along with the expansion of the e-commerce services globally. This means that, with an increasing dependence on online channels to meet their healthcare requirements, the e-commerce segment is very likely to grow in significance as a distribution channel for Alzheimer's therapeutics in the future, offering access and convenience to an expanding patient-caregiver base. Moreover, this move toward digital platforms will imply wider availability of Alzheimer's medications, which will also continue to drive market growth in this space.

Need any customization research on Alzheimer’s Therapeutics Market- Enquiry Now

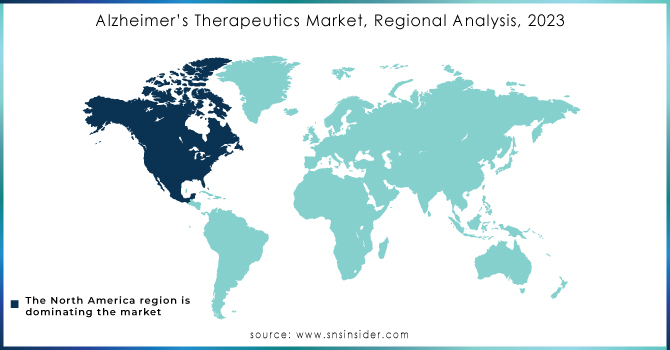

Alzheimer’s Therapeutics Market Regional Analysis

Intensive research activities and remarkable achievements concerning treatment made North America to dominate the Alzheimer's therapeutics market in 2023 which held more than 38% revenue share. In June 2021, the US FDA designated Breakthrough Therapy status to lecanemab (BAN2401) developed by Eisai Co., Ltd. and Biogen. An anti-amyloid beta protofibril antibody, it is intended for the treatment of Alzheimer's disease, therefore the region is committed to moving forward with the treatments. Besides, increasing government initiatives and funds are likely to further support market growth in the region of North America.

On the other side, the Asia Pacific is expected to grow with the fastest annual growth rate during the forecast period, due to the higher awareness about Alzheimer's disease and due to intense research activities oriented toward new therapeutic options. In fact, it is estimated by the Australian Institute of Health and Welfare that there were 411,100 people living with dementia in Australia alone in 2023, with this number expected to double by 2058. With dementia already being the second leading cause of death in the country at the moment, there is actually an urgent need for effective therapeutic solutions. This will be a crucial area of future demand and market expansion for treatments of Alzheimer's disease, as dementia is an increasingly prevalent factor throughout the Asia Pacific region.

Key Players

The major players in market are Eisai Co., Ltd., Daiichi Sankyo Company, Novartis AG, AbbVie Inc. (Allergan Plc.), Adamas Pharmaceuticals, Inc., H. Lundbeck A/S, F. Hoffmann La Roche Ltd., Biogen, TauRx Pharmaceuticals Ltd., AC Immune, Limited, Johnson & Johnson Services, Inc., And others in final report.

Recent Developments

-

FDA approved Eisai Co., Ltd.'s Leqembi for the treatment of Alzheimer's disease. The medication, lecanemab-irmb, was used to reduce amyloid-β plaques and, in addition, provide standard medical care to moderately delay cognitive decline in early Alzheimer's patients, In January 2023. Success with these treatments will be highly expected to lead to further market growth.

-

The deal to collaborate with Eisai Co. was extended in March 2022, in an attempt to better the possibility of opening new therapeutic avenues for Alzheimer disease too.

-

Positive results of a Phase III large-scale clinical study of its investigational anti-amyloid drug, Donanemab, were announced by Eli Lilly and Company in March 2023. The trial showed that Donanemab arrested cognitive and functional decline in sufferers of early Alzheimer's.

-

Biogen Inc. and Eisai Co. announced interim results from a Phase 3 trial for the Alzheimer's drug Aducanumab, targeting amyloid plaques, in June 2023. The data showed Aducanumab could have clinical benefits in early Alzheimer's disease and thus gave reason for discussing the regulatory approval.

-

August 2023, F.D.A. Approves New Combination Therapy for Alzheimer's Cholinesterase inhibitor/Nmda Receptor Antagonist: two-pronged strategy designed to attack the cognitive and functional components of Alzheimer's disease.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.78 Billion |

| Market Size by 2032 | USD 13.42 Billion |

| CAGR | CAGR of 15.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Cholinesterase inhibitors {Donepezil, Galantamine, Rivastigmine}, NMDA Receptor Antagonist, Pipeline Drugs, Combination Drug) • By End-user (Hospital Pharmacy, E-commerce, Retail Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe[ Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eisai Co., Ltd., Daiichi Sankyo Company, Novartis AG, AbbVie Inc. (Allergan Plc.), Adamas Pharmaceuticals, Inc., H. Lundbeck A/S, F. Hoffmann La Roche Ltd., Biogen, TauRx Pharmaceuticals Ltd., AC Immune, Limited, Johnson & Johnson Services, Inc |

| Key Drivers | • With a growing elderly population, the prevalence of Alzheimer's disease is rising, driving demand for effective therapeutics. • Significant progress in understanding the pathophysiology of Alzheimer's disease is leading to the development of novel drugs and therapies. |

| RESTRAINTS | • The cost of developing and acquiring new Alzheimer's therapeutics can be prohibitively high, limiting access and affecting market growth. |