Crypto Security Market Report Scope & Overview:

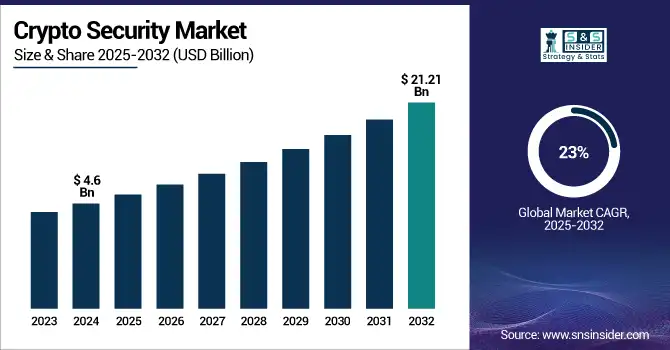

The Crypto Security Market size was valued at USD 4.6 billion in 2024 and is expected to reach USD 21.21 billion by 2032, expanding at a CAGR of 23% over the forecast period of 2025-2032.

With the increasing adoption of digital assets by individuals, businesses, and institutions, the crypto security market is experiencing rapid growth. Need for solutions, such as secure custody, risk assessment, AML compliance, and incident response due to increasing cyber threats, growing blockchain investments, and stringent regulations draft or adoption. To protect their crypto assets, organizations will deploy cloud-based and on-premise security systems. It is not surprising to see advanced protection measures pursued by large enterprises and institutional investors, and accessible, affordable tools embraced by small users. The largest market is North America, and the fastest-growing market is in Asia Pacific. This brings more innovation and partnerships, which will also improve the trust and resilience of this emerging digital property landscape.

To Get more information on Crypto Security Market - Request Free Sample Report

According to research, DeFi platforms propel more than 40% of blockchain security expenditure in the financial services industry, while 50% of firms incorporate blockchain into cybersecurity to provide users with advanced data privacy and identity management.

The U.S. crypto security market size reached USD 1.08 billion in 2024 and is expected to reach USD 5.28 billion in 2032 at a CAGR of 21.83% during 2025-2032.

The early adoption of cryptocurrency in the country, a mature regulatory environment, and the availability of key players in the security market, including Fireblocks, Chainalysis, BitGo, and Anchorage Digital, make the U.S., the pathfinder in this market. Highly developed digital infrastructure, institutional funds management, coupled with government focus on digital asset compliance & cyber security, create a native environment for this market. The U.S. is setting a new standard for crypto security market, enterprise-grade security, and regulatory clarity that anywhere else in the world.

Moreover, the strength of the blockchain throughout the ecosystem strengthens the innovation of blockchain security technologies, and the collaboration between fintech companies.

Crypto Security Market Dynamics:

Drivers:

-

Rising Institutional Adoption and Regulatory Clarity Drive Demand for Advanced Security Solutions

The increasing participation of institutional investors in the crypto market has accelerated the demand for robust security protocols. With new regulations around the corner and an increasing number of digital assets that need protection, institutions will require complex security tools for asset protection. These and other such derivatives, including the USD2.9 billion Coinbase Deribit acquisition amid oversubscription for institutional encrypted goods, point to the need for more secure exchanges.

In addition, the interest of regulatory bodies, such as the Financial Conduct Authority of the U.K., to have a clear regulatory environment, which will not only strengthen investor confidence but also contribute to the adoption of uniform security frameworks.

Restraints:

-

High Implementation Costs and Technical Complexity Hinder Widespread Adoption of Security Solutions

Hiring advanced security solutions in crypto demands a heavy price tag and bits and pieces of tech-savvy. Small and medium-sized enterprises may not be thrilled about finding the time and resources needed to create a resilient security infrastructure. In addition, the complexity of security protocol integration with existing systems prevents organizations from using essential measures and leaving them vulnerable to cyberattacks. Compounded by the ever-changing nature of security technology, this leads to a hodgepodge of varied solutions across the different segments, which ultimately makes the learning curve steeper and the entry barrier higher for many potential adopters.

Opportunities:

-

Integration of Artificial Intelligence and Machine Learning Enhances Proactive Threat Detection and Response

AI and ML have an important role to play in enhancing the capacity of crypto security market systems for threat detection and response. They enable very large data sets to be examined and manipulated when there is a need to identify suspicious activities and potential compromises to security in real-time. This helps organizations detect and respond to security threats early before they turn serious, speeds up the response, and improves the overall resiliency of the systems.

Challenges:

-

Lack of Standardized Regulations and Global Frameworks Create Compliance Challenges and Market Uncertainty

The lack of standardization of regulatory standards in different jurisdictions. This can quickly complicate compliance, and the cost of compliance, as organizations cross borders, each with their own regulatory structure. Such regulatory fragmentation may also stifle the development and effective execution of coherent security strategies while causing confusion that could hinder investment and innovation in the industry. While there are initiatives seeking to create global frameworks, the current lack of harmonisation and the profusion of their diversity remain a huge challenge for stakeholders.

Crypto Security Market Segmentation Analysis:

By Service Type

In 2024, the Security Regulations & Standards will capture the largest report revenue share of 52.10%, and Security Consulting Services will independently lead with a rising demand for advisory services that are able to help organizations navigate through the entire maze of regulations and help set up a robust security framework. Chainalysis and competitor ConsenSys have grown their consulting divisions to offer advice on how organizations could mitigate those risks and plan for compliance. Increasing cyber-attacks and expanding blockchain-based applications in several sectors require professional consulting and services to operate projects securely and in compliance.

The Training and Education Services segment is anticipated to experience the fastest crypto security market growth with a 23.41% CAGR as demand for trained crypto security professionals increasingly broadens. Binance Academy and Coinbase Learn, for instance, have done a great job translating best practices for crypto security for the general audience. With organizations increasingly understanding that user awareness is the biggest factor in stopping attacks, training programs are a key addition to larger security programs.

By Deployment

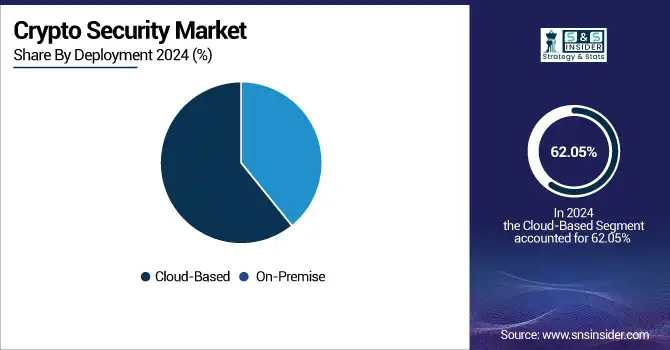

Cloud-based deployment models hold the maximum crypto security market share, accounting for 62.05% of the total revenue, as they are more scalable, flexible, and cheaper by nature. To meet the requirements of the evolving crypto landscape, AWS and Microsoft Azure seem to have sharpened their toolset a notch higher to support and secure cloud ecosystems to safely hold and manage digital assets. The trend of remote work and decentralized operations has also paved the way for the cloud era, allowing organizations to handle crypto assets in a secure and effective manner.

According to research, Cloud-based crypto security solutions accounted for 65% of the global market share in 2024, a trend driven by scalability and remote work practices.

The on-premises deployment segment is projected to register a CAGR of 23.65%, owing to the need for organizations to retain more control over their security infrastructures. Some industries that work on sensitive data including finance and healthcare prefer on-premise solutions due to compliance. IBM and Oracle have deep, enterprise-grade on-premises security features for the crypto market. This increased usage of infrastructure-as-a-service (IaaS) indicates that organizations want to be in control through a configurable and secure environment that meets organizational policies and regulatory requirements.

By Enterprise Size

In 2024, Large Enterprises will hold a 22.51% revenue share, reflecting the heavy expenditure of this enterprise segment on crypto security solutions. The large scale and complexity of operations require robust security cover to safeguard the digital assets. Companies, such as BitGo and Fireblocks provide enterprise-grade security platforms focused on the specific needs of large organizations. This indicates adopting sophisticated security protocols in these enterprises to protect them from complex related hacking.

small enterprises segment is expected to grow fastest with a CAGR of 24.63%. Now, the most modest of enterprises can represent crypto with dignity due to the abundance of inexpensive and scalable security products. If the scale of adoption grows in the future, well-built security solutions are out there, such as Trezor and Ledger, but they are targeted at the more hands-on security operations. It signifies an opening up of crypto security for smaller players in support of safe digital asset transactions, and ultimately, a democratization of crypto security.

By End-User

Business users lead the market at 40.57% of the revenues in 2024, enabled by businesses using crypto transactions as part of their operations. As organizations begin to adopt cryptocurrency for payments, investments, and even the supply chain, they will need strong security frameworks to protect themselves. Services from crypto security market companies, such as Anchorage Digital and Paxos Trust Company provide enterprises with secure services for digital assets. As organizations embrace crypto within their processes, this also signifies the pressing need to have heightened security measures in place.

As institutional users expect to grow at a CAGR of 23.73% during the projected period. As institutional investors pour into the market, there is an increasing need for complex security solutions to store volumes of digital assets. Coinbase's recent purchase of Deribit reflects just how strategic institutions are being in bulking up their crypto bags. This positive growth pattern reflects the fact that crypto assets have cemented themselves, in particular niche markets, and this requires them to have sophisticated security infrastructures on which to operate.

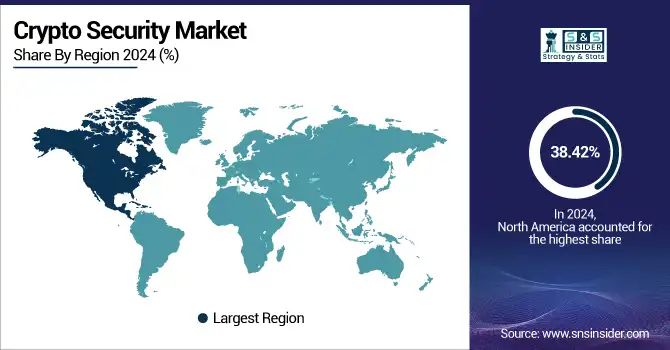

Regional Analysis:

North America dominates the market, which contributed to 38.42% of the share, is led by the early adoption of cryptocurrency, the presence of a wide variety of leading security providers, and the demand for stringent regulatory frameworks. It is also characterized by robust institutional adoption and investment in blockchain security infrastructure, complemented by government compliance initiatives and innovation hubs in all major cities.

The region is led by the U.S., benefiting from a high degree of digital infrastructure, highly supportive venture capital, and market leaders, such as Fireblocks, Chainalysis, and Coinbase.

Europe is witnessing rapid growth in crypto security adoption, where the growth trend of crypto security adoption is quite fast, primarily due to the application of certain regulations such as MiCA and the emergence of a new breed of digital asset custodian. Banks and other financial institutions in Germany, France, and Switzerland are gradually embedding safe crypto services within their offerings, already leading to high demand for strong compliance and risk assessment solutions.

Germany has been a leader in this region, with overbroad crypto regulations, overwhelming fintech innovations, and government-backed blockchain adoption programs.

Asia Pacific leads as the fastest-growing region with a CAGR of 23.77%, driven by large-scale digital adoption, a growing number of cryptocurrency users, and growing awareness of cybersecurity. In nations, such as Japan, Singapore, and South Korea, government bodies are actively encouraging the provision of regulatory certainty and infrastructure development to maintain a safe space for crypto.

Singapore remains the leader in the region as it is one of the most competitive places globally for regulatory frameworks, fintech ecosystem, and a commitment to supporting blockchain innovation and startups focused on compliance-driven security solutions.

Crypto security market trends in the Middle East & Africa and Latin America regions are steady and driven by fintech adoption, digital transformation, and financial inclusion. Creative regulatory approaches, such as crypto-friendly policies and gradual changes to existing regulations, in combination with the push for safe blockchain and DeFi infrastructure toward a secure economic future, have placed the UAE and Brazil ahead of their peers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major players in the crypto security market are Anchorage Digital, CertiK, Elliptic, Paxos Trust Company, Thales Group, Ledger SAS, Fireblocks, Chainalysis, BitGo, CipherTrace (Mastercard), and others.

Recent Developments:

-

In December 2024, with 2024 signifying a new phase of its evolution, Anchorage Digital launched Porto, a hot wallet for institutions for self-custody, and Atlas, a global crypto settlement network. The firm also received a New York BitLicense and has broadened its custody availability for tokenized assets and partnered with 21 Shares for the U.S. spot crypto ETFs, solidifying its position at the forefront of regulated digital asset services.

-

In June 2024, Ledger and Crypto.com integrated to allow users to buy 300+ cryptocurrencies in Ledger Live via Crypto.com Pay, enhancing security and user experience with no extra fees.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.06 Billion |

| Market Size by 2032 | USD 21.21 Billion |

| CAGR | CAGR of 23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Service Type (Risk Assessment and Auditing Services, Incident Response and Recovery Services, Security Consulting Services, Training and Education Services, Others) •By Deployment (Cloud-based, On-premise) •By Enterprise Size (Small Offices, Small Enterprises, Medium-sized Enterprise, Large Enterprises, Very Large Enterprises) •By End-user (Individual Users, Institutional Users, Business Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ledger SAS, Fireblocks, Chainalysis, BitGo, CipherTrace (Mastercard), Anchorage Digital, CertiK, Elliptic, Paxos Trust Company, Thales Group and others. |