Crystal Oscillators Market Size:

Get more information on Crystal Oscillators Market - Request Sample Report

The Crystal Oscillators Market Size was valued at USD 3.35 billion in 2023 and is expected to reach USD 4.07 billion by 2032 and grow at a CAGR of 2.01% over the forecast period 2024-2032.

The demand for crystal oscillators has risen due to the emergence of high-precision frequency control needs across wireless devices and enhanced industrial equipment. In the age of digitalization, crystal oscillators have become crucial to the ongoing operation and synchronization of clock signals for many electronic products. The market for smaller, efficient crystal oscillators to growing alongside demand for miniaturized electronics.

An increase in the adoption of IoT devices with advanced mechanisms and technological advancements such as lesser timings with lower energy consumption has driven growth for this market. There is also an even larger opportunity with the rollout of 5G, which 6G networks will follow as both require precise frequency control in the telecommunication industry. However, the 5G devices will surpass the mark of 14.4 billion worldwide, with an increase in the use of smartphones. Seiko Epson Corporation has launched the SG2520EGN series of high-frequency, low-phase noise crystal oscillators designed for networking equipment and other fields with strong demand for high-speed communication. Due to the stringent requirements of today's communication technologies, these oscillators have gained wide popularity as tiny form factors and yet high-performance components.

The rising electric vehicle (EV) brings market opportunities and also raises demand for the crystal oscillators market for better fuel-efficient power conversion. The display on an EV charger is powered by crystal oscillators, usually TCXOs. Working at frequencies of 32,768 kHz, they deliver a power-efficient way for EVs, without hampering their main processor. The global electric vehicles market is forecasted to see sales of around 17.50 million in 2024. Asia's EV market, with sales rising at an average of 25% per year between 2024 and 2028. China is expected to be the dominant region of electric vehicles, accounting for over 66% of the 115 million EVs projected to be sold worldwide in the next five years.

Various researchers are also working to come up with much better and cost-effective solutions and materials that can make the crystal oscillator market more affordable. Mergers and acquisitions are also happening to make the market stronger and improve growth opportunities. For instance, Murata Manufacturing Co., Ltd. purchased Vectron International, a company that focuses on precision oscillators such as crystal oscillators. The acquisition happened to expand Murata's product offering, especially in the high frequency and precision oscillator market, by joining hands with Vectron International's unique advanced technology and base of customers hence reinforcing its presence on a worldwide scale.

Supply chain disruptions and fluctuations in raw material prices can impact production costs and lead to temporary shortages. However, with the increasing demand for high-performance electronics and the critical role crystal oscillators play in ensuring their functionality, the market is well-positioned for sustained growth in the foreseeable future. The increasing environmental concerns are driving the manufacturers to adopt lead-free and RoHS-compliant crystal oscillators, providing an extra scope for growth.

Crystal Oscillators Market Dynamics:

Drivers

-

The continuous growth of the consumer electronics industry is demanding advanced oscillators.

Crystal Oscillators are a very important part of the production of consumer electronics like smartphones, tablets, laptops, TVs, etc. It enhances the resolution of the screen and connectivity of the products. For Example, Euroquartz in June 2022 is a miniature surface mount Temperature-compensated Crystal oscillator (TCXO) suitable for embedded systems within consumer electronics.

-

Increasing Deployment of 5G technology in smartphones and the revolution towards 6G

The initial deployment phase for the ultra-fast 5G network calls for extremely stable, precise timing sources such as crystal oscillators. They are used to achieve highly accurate data transmission timing and reduce signal errors. The crystal oscillator market is expected to grow as the development of 6G networks moves forward.

-

The growing need for making technologically advanced Automotive Applications is driving the market

The recent automobile market thrives on crystal oscillators for crucial functions such as anti-lock braking systems (ABS), airbags, and tire pressure monitoring systems (TPMS). Increased regulatory focus on safety standards and the rising complexity of automotive electronics are fuelling a strong demand for reliable crystal oscillators in the Automotive industry.

Restraints

-

Crystal oscillator dominance faces a challenge with the emergence of MEMS resonators

Microelectromechanical systems (MEMs) oscillators are a more modern technology providing benefits such as reduced size and lower power consumption. MEMS oscillators may also be used as a substitute for crystal resonators in some applications because they provide the same level of performance and consume less space and power which makes them efficient particularly for those devices that have limitations in the area such as battery-driven gadgets.

-

Crystal oscillators experience minor frequency variations over time due to temperature or vibrations.

Crystal oscillators are affected by environmental parameters such as temperature changes, shock, and vibrations. This can cause frequency drift, which will impact the device's performance. Several manufacturers continue to make improvements in terms of making the oscillator more temperature stable, but some applications will still require an enclosure.

-

The crystal oscillators are creating Environmental Issues creating a major disadvantage for the market.

The extraction and processing of raw materials for crystal oscillators can generate environmental concerns. Manufacturers are seeking sustainable options for material use and investigating how some materials can be ethically sourced.

Crystal Oscillators Market Segment Overview:

BY TYPE

Voltage-Controlled Crystal Oscillators growing at the fastest CAGR making the segment dominating for the provided forecast period. The rising acceptance of wireless technologies including 4G, 5G & Wi-Fi has also fueled the interest for VCXO crystal oscillators.

VCXOs can help to generate a good quality clock in base stations and mobile phone communication systems when required with signal integrity. For Example, Epson announced the availability of their ESV-32S series VCXOs which includes ultra-low noise and excellent stability for precision timing applications like mobile communication base stations.

BY MOUNTING SCHEME

Surface mount crystals are cheaper to manufacture due to less material and simpler production processes which is the dominating segment for the crystal oscillator market. These oscillators are very small and compact which makes them appropriate for miniaturized electronics in today's consumer devices.

While Through-Hole offers better reliability in applications with extreme environments or requiring high ruggedness, the overall market trend leans towards smaller, more cost-effective solutions, propelling Surface Mount to be both the dominant and fastest growing segment.

BY CRYSTAL

Based on Crystal, the SC Cut has accounted for more than 60% in 2023 making it the segment leader. Its increasing category growth is led by its heat-performing competent solution that can be used in high temperatures. SC Cut crystals are the best choice for applications that require high-frequency stability over a larger temperature spectrum and those that do not need to withstand heavy vibration. Installed in the telecommunication base stations, GPS equipment, and other critical infrastructure sectors. These oscillators are used in Defense and aerospace, where the components can have temperature variations over a wide range of temperatures, and mechanical vibrations as well

Get Customized Report as per your Business Requirement - Request For Customized Report

Crystal Oscillators Market Regional Analysis:

The Asia Pacific crystal oscillator market is dominant over other regions by a market share of around 34% in 2023, owing to the rising electronics manufacturing industry in countries such as China, Japan South Korea, and Taiwan. The automotive electronics market is a key area of growth, here driven by the trend toward ever-increasing electronic equipment in vehicles with crystal oscillators used in engine controls, airbags, and driver assistance systems.

North America is growing at a very steady rate due to its markable presence in electronics and semiconductors, making the United States one of the largest consumers & innovators. As an increase in technology and 5G network adoption was observed, this will likely lead to Europe experiencing the fastest growth led by Germany and the UK.

KEY PLAYERS:

Some of the major players in the Crystal Oscillators Market are Nihon Dempa Kogyo, TXC Corporation, Hosonic Technology, Seiko Epson Corporation, Daishinki Corporation, Kyocera Corporation, SiTime Corporation, Murata Manufacturing, SiWard Crystal Technology, Rakon Ltd, and others.

RECENT DEVELOPMENT

-

In April 2024, KYOCERA AVX celebrated the beginning of construction on its new facility in Erie. The new facility will make high-quality quartz crystals, which have very stable frequency and hence low noise output; they form the timing reference that drives everything from the time of day to an automotive ECU.

-

In March 2024, Nuvoton Technology Corporation announced the M433 low-power MCU series. The new MCUs are higher performing (144MHz Arm Cortex-M4F core) and more than 50% lower power in deep power-down mode waking from hibernate to active system states within a few microseconds, targeting battery-powered devices in IoT, industrial, and consumer markets.

-

In June 2023, Abracon launched the AS3115 Series, the ultra-miniature devices feature a package footprint of just 1.6 mm x 0.8mm, and consume low power at an average current. They are perfectly suited for wearable & IoT applications demanding small size and battery life challenges.

-

In March 2024, SiTime Corporation launched a MEMS oscillator that offers best-in-class shock resistance and ultra-low phase noise required for industrial automation equipment and high-performance computing applications that need durable timing stability.

-

In February 2023, Fox Electronics introduced the FX700 series featuring a wide frequency range, 1 MHz to several GHz works across numerous functions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.35 Billion |

| Market Size by 2032 | US$ 4.07 Billion |

| CAGR | CAGR of 2.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

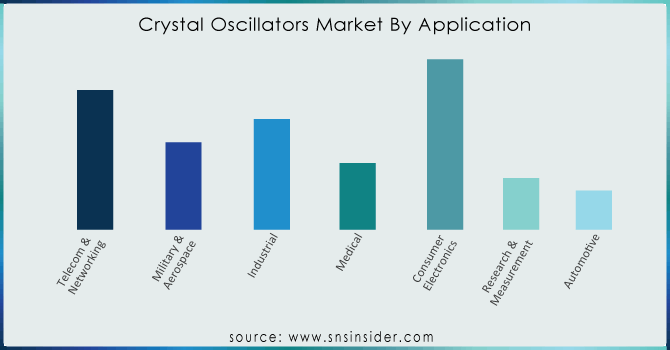

| Key Segments | • By Type (Simple Packaged Crystal Oscillator, Voltage-Controlled Crystal Oscillator, Oven-Controlled Crystal Oscillator, Temperature-Compensated Crystal Oscillator, Frequency-Controlled Crystal Oscillator, Others) • By Mounting Scheme (Through-Hole, Surface Mount) • By Crystal (AT Cut, SC Cut, BT Cut, Others) • By Application (Telecom & Networking, Military & Aerospace, Industrial, Medical, Consumer Electronics, Research & Measurement, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Seiko Epson Corporation, Kyocera Crystal Device Corporation, Murata Manufacturing, SiTime Corporation, Rakon Ltd, TXC Corporation, Daishinku, Microchip Technology, Hosonic Electronic and SiWard Crystal Technology. |

| Key Drivers | • The continuous growth of the consumer electronics industry is demanding advanced oscillators. • Increasing Deployment of 5G technology in smartphones and the revolution towards 6G • The growing need for making technologically advanced Automotive Applications is driving the market |

| RESTRAINTS | • Crystal oscillator dominance faces a challenge with the emergence of MEMS resonators. • Crystal oscillators experience minor frequency variations over time due to temperature or vibrations. • The crystal oscillators are creating Environmental Issues creating a major disadvantage for the market. |