Customer Relationship Management (CRM) Market Report Scope & Overview:

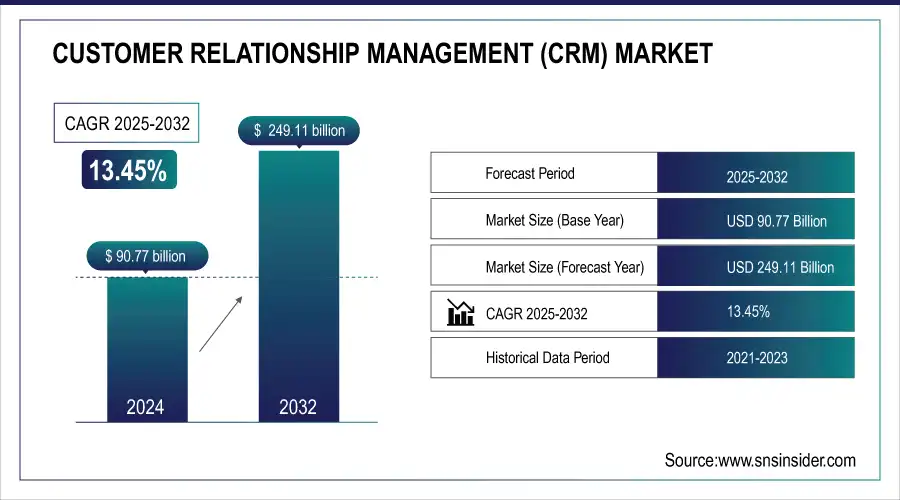

The Customer Relationship Management (CRM) Market was valued at USD 90.77 billion in 2024 and is expected to reach USD 249.11 billion by 2032, growing at a CAGR of 13.45% from 2025-2032.

To Get more information on Customer Relationship Management (CRM) Market - Request Free Sample Report

The CRM market is witnessing strong growth driven by the rising need for personalized customer experiences, streamlined business processes, and enhanced customer engagement. Organizations across industries are adopting customer-centric strategies to boost retention and satisfaction, making CRM systems indispensable. Advanced CRM solutions utilize AI, machine learning, and big data analytics for predictive insights, optimized decision-making, and targeted marketing campaigns. Cloud-based CRM adoption enhances scalability, flexibility, and cost-efficiency. Companies implementing CRM systems report a 29% increase in sales revenue and earn USD 8.71 for every USD 1 invested. Moreover, 65% of organizations with mobile CRM apps achieve their sales targets, compared to only 22% without mobile access.

Market Size and Forecast

-

Market Size in 2024: USD 90.77 Billion

-

Market Size by 2032: USD 249.11 Billion

-

CAGR: 13.45% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Customer Relationship Management (CRM) Market Trends

-

Rising demand for personalized customer experiences is driving CRM adoption across industries.

-

Integration with AI, analytics, and automation is enhancing lead management, sales forecasting, and customer insights.

-

Growing use of cloud-based CRM solutions is improving scalability, accessibility, and cost-efficiency.

-

Expansion of e-commerce, retail, BFSI, and healthcare sectors is boosting market growth.

-

Increasing focus on omnichannel engagement and customer retention strategies is shaping adoption trends.

-

Mobile-enabled and AI-powered CRM tools are enhancing real-time communication and productivity.

-

Collaborations between software vendors, technology providers, and enterprises are accelerating innovation and feature development.

Customer Relationship Management (CRM) Market Growth Drivers:

-

CRM Growth Driven by Compliance Needs and Privacy Laws Shaping Data Protection and Operational Efficiency

High compliance over regulatory framework and data protection laws is one of the main market drivers strengthening the growth of the Customer Relationship Management (CRM) market. The emergence of worldwide privacy laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) means organizations are held accountable above all for their data, especially the data of their customers. Features such as data encryption, access control, and detailed audit trails help businesses ensure compliance. Those tools help firms be transparent enough not to get fined by the authorities, and at the same time win their customers' trust. With changing regulatory landscapes, the need for CRM software with compliance management capabilities is likely to grow, aiding the growth of the market. By 2024, 73% of businesses will implement the use of CRM software to improve operations. With the advent of privacy laws, including GDPR and CCPA, 47% of companies have updated their privacy policy to comply. 80% of them have updated privacy policies several times during the year due to the requirements of the law.

-

CRM Tools Drive Efficiency and Innovation Across Industries with Mobile Integration and Personalized Solutions

As the necessity for personalized CRM tools arises for business verticals like Healthcare, Retail, Financial Services, and Education for their improvisation in operations and customer engagement, lending mobile applications allow their end-user to apply for loans using mobile. CRM platforms for example, healthcare providers utilize CRM software to manage patients and improve care delivery, whereas retail and e-commerce use these systems for inventory management and personalized marketing campaigns. CRM solutions that are specific to the industry help organizations improve efficiency, get a competitive edge, and provide outstanding experiences. Supporting this trend, new developments in technology are allowing vendors to create CRM systems with specific modules, templates, workflows, and other characteristics tailored to different industries. The proliferation of businesses looking to unlock maximum value from their CRM investments is expected to make the market for custom solutions a substantial portion of CRM growth overall. 32% of businesses with CRM solutions in 2024 are in the service industry. 68% of Millennials and 64% of Generation Z use mobile banking apps to manage accounts when it comes to the financial services sector.

Customer Relationship Management (CRM) Market Restraints:

-

Overcoming CRM Integration Challenges and Data Inconsistencies for Enhanced Adoption and Operational Efficiency

The customer Relationship Management (CRM) Market has some major restraints and challenges due to the data integration types and complications in the system. The problems are compounded since many organizations cannot effectively integrate their CRM platforms with existing legacy systems and disparate data sources, resulting in time-consuming implementations and inefficiencies within the organization. This problem is especially noticeable in industries where there is a more complex IT milieu and where uninterrupted information circulation is paramount for the maximum effectiveness of the CRM system. The issue of data accuracy and quality is still far from being resolved. Even CRM systems with a negative impact can have the opposite effect, providing unreliable insights or triggering missed opportunities arising from inconsistency in the information. Also, organizations usually experience problems with user adoption, as employees resist new technologies or require considerable training to use CRM platforms. Striking the right balance between sophisticated capabilities with usability is a perennial problem for CRM providers. Such constraints, intimately tied to CRM adoption, emphasize the need for extensive improvisations to identify and devise solutions that are not only broad but conceivable to a degree of actionability.

Customer Relationship Management (CRM) Market Segment Analysis

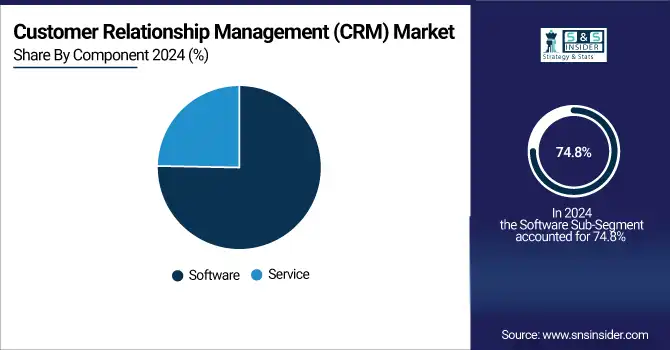

By Component, Software segment dominates the CRM Market. The Services segment is expected to grow fastest

Software owns the leading share of 74.8% of the overall Customer Relationship Management (CRM) market in 2024. It is the backbone of most modern customer management strategies, offering a complete suite of sales, marketing, analytics, and customer support tools. This dominance is being further propelled by the increasing adoption of cloud-based CRM solutions. As such, services can serve the evolving demands of businesses, especially in the present emergence of digital transformation globally, with their scalability, economy-related associated costs, and remote availability.

The service segment is expected to register the highest CAGR over the forecast period 2025-2032, owing to their demand for implementation, customization, and consulting services. With tailor-made devices, businesses frequently seek outside, expert help in configuring any number of the abovementioned activities and integrating the options into existing systems. Moreover, continuing maintenance and technical support as well as training services all play an important role in the success of CRM deployments over the long haul. As CRM solutions become increasingly complex and the demand for unique customer experiences continues to grow, demand will increase for added services that will fuel segment growth. The paired growth appreciated above between software and services exemplifies the holistic growth curve of the CRM market.

By Deployment, Cloud-based CRM dominates the market. On-premise CRM is projected to grow fastest

Cloud-based CRM solutions accounted for 58.7% market share in 2024 due to their flexibility, scalability, and cost-efficiency. Cloud Based CRM which allows access to customer data from anywhere and supports remote working and collaboration in real-time. This model saves significant on-site IT infrastructure and upfront capital expenditure and supports small and medium-sized enterprises (SMEs) to adopt CRM solutions more easily. In addition, the vendors providing cloud-based CRM systems frequently include updates and security at no additional cost, which also has contributed to the immense growth in popularity.

On-premise CRM is expected to grow fastest with a CAGR from 2025 to 2032 as more businesses have begun to generate demand for greater control over their data and customization of the software. The pillaring industries like banking, healthcare, and government need to handle sensitive information, so on-premise deployments are often preferable so that they can comply with strict data privacy regulations. Moreover, organizations that demand significantly customized CRM workflows or whose domain has less cloud infrastructure choose on-premise solutions. The feature-rich systems as a service will continue to suit the majority of customers and organizations will adopt SaaS solutions in droves, but there will always be the need for some organizations to run their own systems. As the capability of on-premise systems improves and their cost competitiveness becomes more attractive, it will become a growing choice for organizations wanting controlled and tailored customer management solutions. This two-growth dynamic reinforces how diverse business needs are changing the ever-evolving CRM market.

By Solution, Customer Service dominates the CRM Market. CRM Analytics is expected to grow fastest

Customer Service dominates the CRM market in terms of revenue, with a 24.2% share in 2024, supported by its important role in driving customer satisfaction, retention, and loyalty. CRM systems include modules for customer service that allow businesses to keep records of customer interactions, quickly resolve issues, and manage support requests. Customers now expect faster, personalized, and omnichannel support, which has created a need for strong customer service tools built into CRM platforms. They not only facilitate communication but also improve customer experience by offering agents complete customer histories and context, making them a must-have for many businesses that are trying to keep pace with customer satisfaction.

CRM Analytics is projected to witness the highest CAGR during the forecast period of 2025 to 2032, as data-driven decision-making is becoming increasingly important. At all times, businesses interact with customers via different touchpoints, and they end up creating a lot of customer data. CRM analytics tools enable organs to draw actionable insights out of this data. Such insights help companies anticipate customer behavior, customize marketing campaigns, optimize sales tactics, and enhance customer service experiences. As AI, machine learning, and predictive analytics become further embedded into the adoption of CRM analytics, businesses can make data-driven, timely, and relevant decisions. As they move towards data-centric strategies, the CRM analytics segment is seeing considerable growth as organizations invest in advanced solutions for understanding customers and increasing business growth.

By End-Use, Retail leads the CRM Market. IT & Telecom is expected to grow fastest

The CRM market share was led by Retail with 24.7% in 2024 due to the growing emphasis on increasing customer engagement and improving the sales process. CRM platforms help retailers collect and analyze customer information, customize their marketing campaigns, manage loyalty programs, improve inventory, and facilitate sales and customer support interactions. As e-commerce expands and omnichannel strategies become a necessity, the use of CRM (Customer Relationship Management) systems in retail businesses is gaining more popularity to understand consumers, improve customer experience, and boost sales. Integration of CRM solutions with e-commerce platforms, mobile apps, and social media channels makes the solution an integral part of retail.

The IT & Telecom sector is anticipated to witness the highest CAGR during the forecast period of 2025 to 2032, mainly as a result of the growing need for automation and customer management in the sector. The IT & Telecom industry is a highly competitive and customer-centric field that requires sophisticated CRM systems to handle millions of customer interactions across multiple channels. CRM solutions from this sector allow companies to manage service requests, simplify communication, and enhance customer experience, which is key to subscriber retention and handling complex service offerings. In addition, the widespread use of digital services, 5G networks, and customer self-service have increased the demand for predictive capabilities in CRM systems that are being used to analyze customer information and anticipate their future need to foster an increase in the overall CRM adoption within the sector.

Customer Relationship Management (CRM) Market Regional Analysis

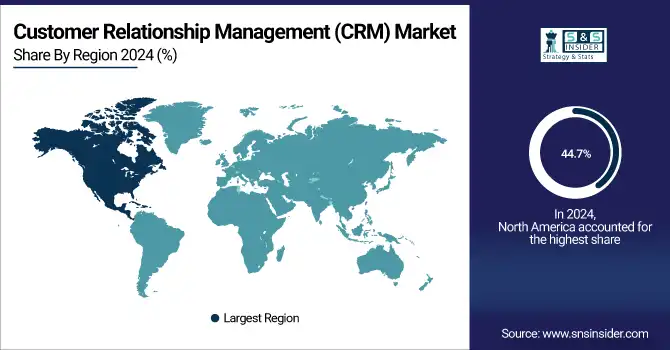

North America Customer Relationship Management (CRM) Market Insights

The CRM market in 2024 was led by North America, accounting for 44.7% of the market share, primarily due to the high adoption of advanced technologies in the region, the early adoption of cloud solutions in the region, and the presence of key CRM vendors such as Salesforce, Microsoft, and Oracle. With CRM tools scaling more and more customer engagement in the operational vertical, businesses in North America are heavily fixated on the utilization of Customer Relationship Management (CRM) tools through the booming centuries. In the retail sector, for instance, players like Amazon and Walmart integrate data collection, personalized shopping experiences, and omnichannel customer relationship management through CRM platforms. Likewise, customer relationship management solutions are the mainstay for industries in North America such as finance and healthcare to manage customer interactions, enhance service delivery, and comply with regulations. North America continues to dominate the set of CRM market due to the increasing customer experience, and data-driven decision-making for business growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Customer Relationship Management (CRM) Market Insights

Asia Pacific is anticipated to grow at the fastest CAGR throughout the forecast period from 2025 to 2032 owing to swift digitalization, emerging e-commerce space, and rising CRM solutions investment in various sectors. Emerging economies such as India and China are witnessing the growth of CRM platforms in order to meet the needs of an increasing consumer base and strengthen customer relationships. In China, both Alibaba and Tencent benefit from CRM systems by assessing user interests to feature the best suitable range of products while also managing the customer service experience across different channels. In the same way, Indian enterprises such as Tata Consultancy Services (TCS) and Reliance Industries have CRM solutions that facilitate the management of extensive client databases and provide better client services. Increasing demand for cloud-based customer relationship management (CRM) solutions in Asia Pacific due to rapid middle-class growth and the need to streamline customer interactions are boosting the services industry growth thereby driving the CRM adoption over the forecast period.

Europe Customer Relationship Management (CRM) Market Insights

Europe holds a significant position in the Customer Relationship Management (CRM) market, driven by widespread digital transformation, growing adoption of cloud-based CRM solutions, and increasing focus on personalized customer experiences. Advanced IT infrastructure, supportive regulatory frameworks, and investments in AI and analytics are accelerating CRM deployment. Countries such as the UK, Germany, and France lead in adoption, with enterprises leveraging CRM systems to enhance customer engagement, retention, and operational efficiency across industries.

Middle East & Africa and Latin America Customer Relationship Management (CRM) Market Insights

The Middle East & Africa and Latin America are emerging markets for Customer Relationship Management (CRM), fueled by increasing digitalization, growing smartphone penetration, and expanding e-commerce. Rising demand for personalized customer experiences, cloud-based CRM adoption, and government initiatives supporting technological advancement are driving growth. Countries such as Brazil, Mexico, UAE, and Saudi Arabia are witnessing increased CRM deployment across industries, enhancing customer engagement, sales efficiency, and overall business performance.

Customer Relationship Management (CRM) Market Competitive Landscape:

Salesforce

Salesforce is a global leader in Customer Relationship Management (CRM) solutions, offering cloud-based software for sales, service, marketing, and analytics. The company empowers organizations of all sizes to enhance customer engagement, streamline workflows, and drive revenue growth through AI, automation, and data-driven insights. Salesforce’s platforms are widely adopted across industries, enabling businesses to leverage advanced technologies for predictive analysis, personalized campaigns, and efficient customer service.

-

In June 2024, Salesforce launched the first-ever generative AI benchmark for CRM, assessing large language models (LLMs) on accuracy, cost, speed, and trust, helping businesses select the best AI solutions for sales and service tasks.

Oracle Corporation

Oracle Corporation is a multinational technology company providing database software, cloud solutions, and enterprise applications. Oracle enables organizations to manage operations efficiently, optimize customer experiences, and integrate AI, analytics, and cloud technologies for comprehensive enterprise solutions across multiple industries worldwide.

-

In August 2024, Oracle introduced an all-in-one Customer Experience (CX) management solution, combining marketing, sales, service, and commerce to drive revenue growth.

Oracle Corporation

Adobe Inc. is a leading software company specializing in creative, marketing, and document management solutions. Adobe Experience Cloud empowers organizations to deliver personalized, data-driven customer experiences, leveraging AI and analytics to optimize engagement, drive conversions, and enhance brand loyalty across digital platforms globally.

-

In December 2024, Adobe partnered with Amazon Web Services (AWS) to bring the Adobe Experience Platform (AEP) to brands, enabling enhanced customer engagement through deep insights. The collaboration aims to offer scalable, personalized experiences, set to be available via AWS Marketplace in 2025.

KEY PLAYERS

Some of the major players in the Customer Relationship Management (CRM) Market are:

-

Salesforce (Sales Cloud, Service Cloud)

-

Microsoft (Dynamics 365, Power BI)

-

SAP (SAP Customer Experience, SAP Commerce Cloud)

-

Oracle (Oracle CX Cloud, Oracle Service Cloud)

-

Adobe (Adobe Experience Cloud, Adobe Analytics)

-

HubSpot (HubSpot CRM, HubSpot Marketing Hub)

-

Zoho (Zoho CRM, Zoho Desk)

-

Pega (Pega Customer Service, Pega Marketing)

-

SugarCRM (Sugar Sell, Sugar Serve)

-

Freshworks (Freshsales, Freshdesk)

-

Insightly (Insightly CRM, Insightly Marketing)

-

Nimble (Nimble CRM, Nimble Social Insights)

-

Creatio (Creatio CRM, Creatio Marketing)

-

Copper (Copper CRM, Copper Marketing Automation)

-

Monday.com (Monday Sales CRM, Monday Marketing)

-

ServiceTitan (ServiceTitan CRM, ServiceTitan Service Management)

-

Keap (Keap CRM, Keap Marketing Automation)

-

Bitrix24 (Bitrix24 CRM, Bitrix24 Collaboration Tools)

-

Agile CRM (Agile CRM, Agile Marketing Automation)

-

Close (Close CRM, Close Calling)

Some of the Raw Material Suppliers for Customer Relationship Management (CRM) Companies:

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Samsung Electronics

-

Intel Corporation

-

NVIDIA Corporation

-

Micron Technology

-

SK Hynix

-

Foxconn

-

LG Electronics

-

ASE Technology Holding

-

Qualcomm Incorporated

| Report Attributes | Details |

|---|---|

|

Market Size in 2024 |

USD 90.77 Billion |

|

Market Size by 2032 |

USD 249.11 Billion |

|

CAGR |

CAGR of 13.45% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Service) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Salesforce, Microsoft, SAP, Oracle, Adobe, HubSpot, Zoho, Pega, SugarCRM, Freshworks, Insightly, Nimble, Creatio, Copper, Monday.com, ServiceTitan, Keap, Bitrix24, Agile CRM, Close. |