Drilling data management systems market Report Scope & Overview:

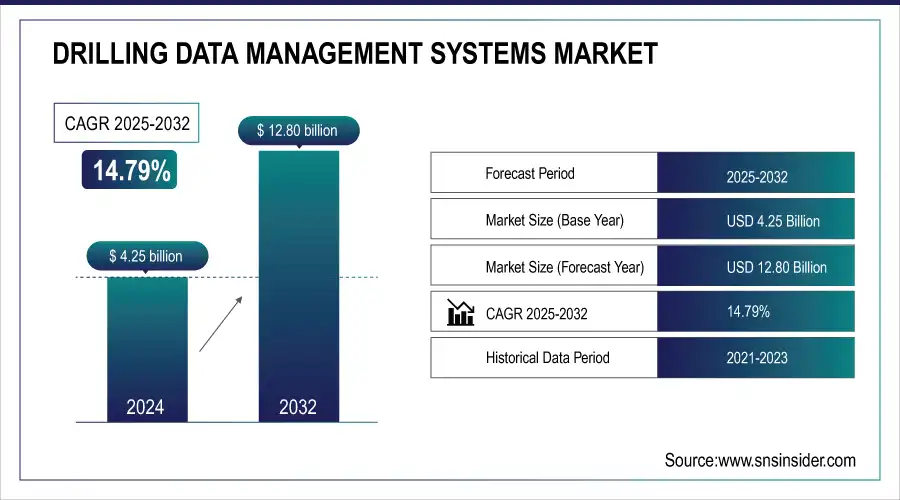

Drilling data management systems Market was valued at USD 4.25 billion in 2024 and is expected to reach USD 12.80 billion by 2032, growing at a CAGR of 14.79% from 2025-2032.

The Drilling Data Management Systems Market is witnessing higher adoption rates in onshore drilling compared to offshore operations, driven by cost efficiency and project volume. Hardware components continue to hold a dominant market share, supported by increased deployment across North America and the Middle East. Notably, data volume generated per well is rising sharply, especially in shale-rich regions like the U.S. and Canada. Additionally, the report highlights a growing demand for AI-integrated analytics and real-time data processing capabilities as a new emerging trend shaping the market’s next phase.

To Get more information on Drilling data management systems market - Request Free Sample Report

Market Size and Forecast

-

Market Size in 2024: USD 4.25 Billion

-

Market Size by 2032: USD 12.80 Billion

-

CAGR: 14.79% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Drilling data management systems Market Trends

-

Rising demand for efficient and accurate drilling operations is driving adoption of drilling data management systems.

-

Integration with IoT, AI, and real-time analytics is enhancing operational efficiency and predictive maintenance.

-

Growing focus on reducing non-productive time and drilling costs is boosting market growth.

-

Increasing use in onshore and offshore oil & gas exploration is expanding application scope.

-

Adoption of cloud-based and centralized data platforms is enabling better collaboration and decision-making.

-

Regulatory compliance and safety monitoring requirements are encouraging deployment.

-

Collaborations between drilling service providers, software vendors, and energy companies are accelerating innovation and implementation.

The U.S. Drilling data management systems Market was valued at USD 1.15 billion in 2024 and is expected to reach USD 3.40 billion by 2032, growing at a CAGR of 14.55% from 2025-2032. . This growth is driven by the increasing complexity of drilling operations, the need for real-time data analytics, and the adoption of advanced technologies such as AI and IoT to enhance operational efficiency.

Drilling data management systems Market Growth Drivers:

-

The need for immediate, data-driven decisions to enhance efficiency and prevent operational failures in complex drilling projects.

The growing complexity of drilling projects—particularly in unconventional oil and gas fields—is generating demand for real-time operational data that will improve decision-making and drilling efficiency. Operators are implementing modern drilling data management systems to track parameters such as pressure, temperature, and flow rates to avoid operational failures and maximize drilling performance. These systems provide instant alerts, predictive maintenance, reduce non-productive time, and improve overall safety. As shale gas exploration, offshore drilling in U.S. Gulf of Mexico, and Middle East investments, the need for real-time data-driven drilling operations continues to increase.

Drilling data management systems Market Restraints:

-

The significant upfront cost and difficulty in integrating advanced systems with existing, outdated infrastructure limit adoption

Despite the operational advantages, the adoption of drilling data management systems faces limitations due to high upfront costs and complexities in integrating with existing legacy infrastructure. Many operators in mature oilfields rely on conventional monitoring tools, making the transition to sophisticated data management platforms resource-intensive and technically challenging. Compatibility issues, cybersecurity risks, and training requirements further hinder market expansion, particularly for small and mid-sized enterprises. These financial and operational hurdles often delay digital transformation projects, especially in regions where capital expenditure constraints or volatile oil prices affect investment decisions, impacting the pace of technology adoption across the drilling sector.

Drilling data management systems Market Opportunities:

-

The increasing use of advanced technologies to optimize drilling processes, automate reporting, and enable predictive maintenance presents a strong growth opportunity.

The rising integration of AI, machine learning, and cloud-based analytics is creating significant growth opportunities in the drilling data management systems market. These advanced technologies enable operators to perform predictive analytics, automate reporting, and optimize drilling parameters for enhanced performance and safety. Cloud-based platforms also allow centralized data storage and multi-site collaboration, reducing operational costs and improving scalability. The growing trend of digital oilfields and increased investment in smart exploration projects in North America, the Middle East, and APAC offers fertile ground for AI-enabled drilling data management solutions, positioning them as critical enablers of operational agility and competitive advantage.

Drilling data management systems Market Challenge:

-

The increasing reliance on digital platforms for real-time data management makes drilling operations vulnerable to cyberattacks and data breaches.

As drilling operations increasingly rely on interconnected, real-time data management systems, cybersecurity has emerged as a major operational challenge. The continuous flow of sensitive operational data across digital platforms, remote monitoring tools, and cloud-based storage systems makes drilling operations vulnerable to cyberattacks, data breaches, and unauthorized access. The lack of standardized security protocols, especially in offshore and remote onshore operations, heightens these risks. Ensuring end-to-end data encryption, secure network infrastructures, and compliance with global data protection regulations requires significant investment and expertise, adding operational complexity and limiting technology adoption in regions with less mature cybersecurity frameworks.

Drilling data management systems Market Segment Analysis

By Component, Software segment dominates the Drilling Data Management Systems market, Services segment is expected to grow fastest.

The Software segment dominated the Drilling Data Management Systems market in 2024 and accounted for a significant revenue share, driven by the increasing reliance on advanced analytics, real-time monitoring, and automated reporting tools. The rising integration of AI and machine learning to optimize drilling processes further propels the software demand. Software platforms enable predictive maintenance, improve decision-making, and ensure operational efficiency.

The Services segment is expected to register the fastest CAGR due to the rising demand for consulting, integration, and managed services in the drilling data management sector. Companies are increasingly seeking specialized services to implement and optimize advanced drilling systems tailored to their needs. With a growing focus on enhancing data security, scalability, and operational efficiency, the demand for managed services and consulting is increasing.

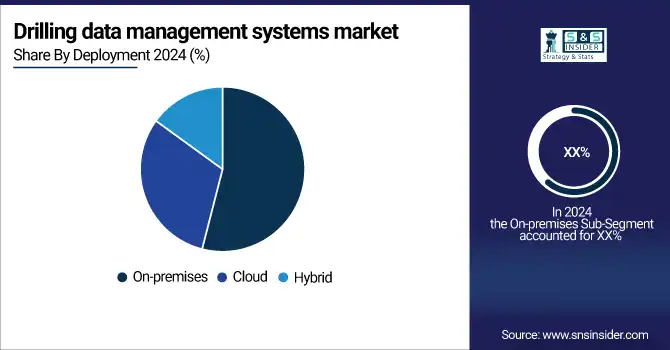

By Deployment, On-Premises deployment dominates the Drilling Data Management Systems market, Cloud deployment is expected to grow fastest.

The On-Premises segment dominated the Drilling Data Management Systems market in 2024 and accounted for significant revenue share, primarily because of the oil & gas industry’s preference for in-house infrastructure to maintain data control, security, and compliance, especially in critical upstream operations. Many established operators in regions like North America and the Middle East continue to rely on on-premises solutions due to concerns over data sovereignty, cybersecurity, and integration with existing legacy systems.

The Cloud segment is expected to register the fastest CAGR through 2032, driven by the increasing demand for scalable, cost-effective, and remotely accessible data management solutions in drilling operations. Cloud-based platforms enable real-time data sharing, multi-site collaboration, and advanced analytics, enhancing operational flexibility and reducing IT infrastructure costs. As digital oilfields and remote monitoring solutions gain traction, especially in offshore and unconventional projects, more operators are migrating to cloud-based systems.

By Application, Exploration & Production segment dominates the Drilling Data Management Systems market, Real-time Data Tracking is expected to grow fastest.

The Exploration & Production segment currently dominated the Drilling Data Management Systems market in 2024 and represented a significant revenue share due to the growing complexity of hydrocarbon exploration projects and the need for efficient data handling during drilling campaigns. With increasing investments in unconventional resources like shale gas and deepwater projects, E&P companies rely on advanced data management systems for operational insights, asset management, and regulatory compliance.

The Real-time Data Tracking segment is projected to register the fastest CAGR over the forecast period, fueled by the increasing need for immediate operational visibility and rapid decision-making in drilling operations. This segment benefits from the growing adoption of IoT sensors, cloud connectivity, and AI-driven analytics, which allow operators to monitor drilling parameters and equipment performance live. With rising operational risks in complex fields like offshore and ultra-deepwater, the emphasis on real-time data access for improved safety, efficiency, and cost control is accelerating the adoption of these systems, ensuring rapid market growth through 2032.

By End-Use, Oil & Gas Exploration segment dominates the Drilling Data Management Systems market, Renewable Energy segment is expected to grow fastest.

The Oil & Gas Exploration segment dominated the Drilling Data Management Systems market in 2024 and accounted for it, driven by the growing complexity of upstream operations and the need for efficient, real-time data management to reduce downtime and operational risks. With increasing global energy demand, continuous investment in unconventional resources like shale gas and deepwater fields is fueling the adoption of advanced drilling data systems. This segment is expected to retain its leading position through 2032 as operators prioritize digital tools for operational optimization, regulatory compliance, and improved decision-making in high-stakes drilling projects.

The Renewable Energy segment is projected to register the fastest CAGR in the Drilling Data Management Systems market, propelled by rising investments in geothermal energy and offshore wind projects that require precise subsurface data. As governments and energy companies expand renewable portfolios to meet sustainability goals, the need for reliable, real-time geological and drilling data management solutions grows.

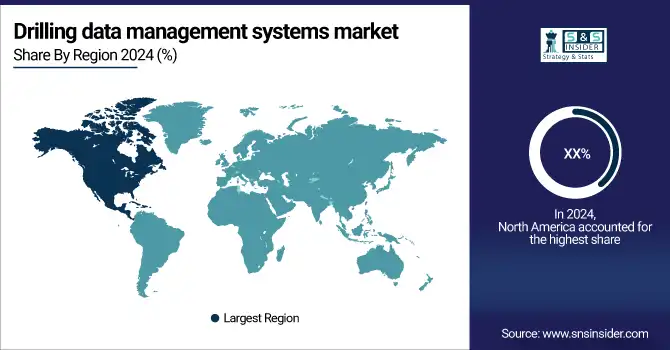

Drilling data management systems Market Regional Analysis

North America Drilling data management systems Market Insights

North America dominated the Drilling Data Management Systems market in 2024 and accounted for a significant revenue share, supported by extensive upstream oil & gas activities, particularly in the U.S. shale basins and Canadian oil sands. The region benefits from early digitalization, strong infrastructure, and high adoption of real-time data analytics and cloud-based drilling management platforms. With major oilfield service companies and technology providers headquartered here, continuous investment in advanced drilling technologies sustains market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Drilling data management systems Market Insights

Asia Pacific is projected to register the fastest CAGR in the Drilling Data Management Systems market, fueled by rising energy demand, growing oil & gas exploration in offshore regions, and expanding investments in renewable geothermal projects. Countries like China, India, Indonesia, and Australia are ramping up upstream activities, creating strong demand for advanced drilling data management tools to optimize performance and reduce operational risks.

Europe Drilling data management systems Market Insights

Europe holds a significant position in the Drilling Data Management Systems Market, driven by advanced digital infrastructure, stringent regulatory frameworks, and adoption of smart drilling technologies. Countries like the U.K., Norway, and Germany are leveraging AI, IoT, and cloud-based platforms to optimize drilling operations, enhance safety, and improve efficiency. Collaborative initiatives between technology providers and energy companies are accelerating innovation and supporting sustainable, data-driven drilling practices across the region.

Middle East & Africa and Latin America Drilling data management systems Market Insights

The Middle East, Africa, and Latin America are emerging markets in the Drilling Data Management Systems sector, supported by growing oil and gas investments, rising energy demand, and digital transformation initiatives. Countries like Saudi Arabia, UAE, Brazil, and Mexico are adopting cloud-based platforms, real-time monitoring, and analytics solutions to optimize drilling efficiency, ensure safety, and improve operational decision-making, positioning these regions as key contributors to global drilling data management growth.

Drilling data management systems Market Competitive Landscape:

BP

BP is a global energy leader, engaged in oil and gas exploration, production, refining, and renewable energy initiatives. The company emphasizes digital transformation, leveraging AI, advanced analytics, and automation to optimize upstream and downstream operations, enhance safety, and reduce costs. BP continuously invests in innovative technologies to improve drilling accuracy, operational efficiency, and sustainability, while maintaining a strong focus on reducing environmental impact and supporting global energy transition objectives.

-

March 2024: BP enhanced its drilling operations by integrating AI to steer drill bits and predict potential well issues. This initiative aims to increase the number of wells drilled annually and optimize capital allocation, reflecting BP's commitment to leveraging technology for operational efficiency.

Devon Energy

Devon Energy is a leading independent oil and natural gas exploration and production company, focused on North American operations. The company leverages cutting-edge technologies, including machine learning and real-time data analytics, to enhance drilling efficiency, improve reservoir management, and reduce operational risks. Devon Energy emphasizes innovation, sustainability, and operational excellence, aiming to optimize production performance while maintaining stringent safety, environmental, and regulatory standards across its shale and conventional assets.

-

March 2024: Devon Energy reported a 15% improvement in drilling efficiency through the deployment of machine learning models across its U.S. oil rigs. These models enable the company to gather information about geological faults and adjust drilling strategies accordingly, enhancing productivity and reducing operational risks.

Chevron

Chevron Corporation is a multinational energy company engaged in oil and gas exploration, production, refining, and marketing globally. The company focuses on integrating advanced technologies such as AI, robotics, and predictive analytics to enhance operational efficiency, reduce downtime, and improve safety. Chevron emphasizes sustainable energy practices, emissions reduction, and digital transformation across its upstream and downstream operations, while leveraging innovative solutions to optimize field performance and resource management.

-

March 2024: Chevron implemented AI-powered drones to monitor its shale operations in Texas and Colorado. These drones assist in detecting emissions leaks and other potential issues, leading to reduced downtime and improved maintenance scheduling.

Key Players

The major key players along with their products are

-

Schlumberger – Petrel E&P Software Platform

-

Halliburton – DecisionSpace Well Engineering

-

Baker Hughes – JewelSuite Subsurface Modeling

-

Emerson – Paradigm Geolog

-

Kongsberg Digital – SiteCom

-

Pason Systems – DataHub

-

Weatherford – Centro Digital Well Delivery

-

CGG – GeoSoftware

-

PetroVue – PetroVue Analytics Platform

-

Katalyst Data Management – iGlass

-

Peloton – WellView

-

IDS – DrillNet

-

DataCloud – MinePortal

-

TDE Group – tde proNova

-

NOV – NOVOS

-

Schlumberger – Techlog

-

Landmark – DecisionSpace E&P

-

ABB – Ability Ellipse

-

Aspen Technology – Aspen Well Operations

-

Yokogawa Electric Corporation – Exaquantum

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 4.25 Billion |

|

Market Size by 2032 |

US$ 12.80 Billion |

|

CAGR |

CAGR of 14.55 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Schlumberger, Halliburton, Baker Hughes, Emerson, Kongsberg Digital, Pason Systems, Weatherford, CGG, PetroVue, Katalyst Data Management, Peloton, IDS, DataCloud, TDE Group, NOV, Landmark, ABB, Aspen Technology, Yokogawa Electric Corporation |