Emotion Analytics Market Report Scope & Overview:

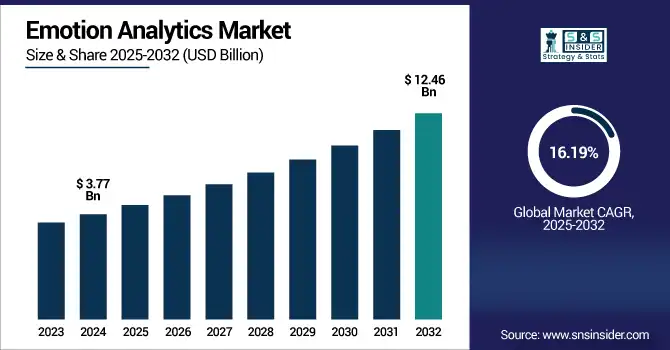

Emotion Analytics Market was valued at USD 3.77 billion in 2024 and is expected to reach USD 12.46 billion by 2032, growing at a CAGR of 16.19% over 2025-2032.

To Get more information on Emotion Analytics Market - Request Free Sample Report

The emotion analytics market is booming as enterprises find it highly beneficial to keep a finger on the pulse of human emotions for enhancing customer experience, product design, and marketing. By utilizing AI, machine learning, and facial recognition technology, determines emotional responses from collecting data from faces, tones of voice, and even physical signals. Healthcare, retail, automotive, and media are some of the major industries that fuel the demand. Real-time data processing capability and integration with other analytic platforms promote adoption even more. Using emotion analytics, organizations can personalize their interactions with empathy and find common ground with customers to increase the level of engagement.

As per research, the venture capital investment in AI-related technologies, such as emotion analytics that exceeded by USD 80 billion in Q1 2025, resulting in a 28% surge from the previous quarter. As the total number of deals dropped, average deal size expanded considerably, further highlighting increasing investor interest in transformative AI segments including emotion analytics. The fact that this trend has a lot of market opportunity and funding continues to flow to companies innovating in this space drives innovation and adoption of emotion analytics in every market vertical.

The U.S. Emotion Analytics Market was valued at USD 1.00 billion in 2024 and is expected to reach USD 3.28 billion by 2032, growing at a CAGR of 15.94% over 2025-2032. The Increasing use of AI and ML technologies in various industries including retail, healthcare, and entertainment, among others, quickly adapting to the suggestions and making precise decisions based on customer experience is driving the market. The U.S. will continue to lead in the North America region, as technological infrastructure is improving, R&D investments are increasing, and a huge number of companies exist in the emotion analytics market. Furthermore, there is a high demand for consumer data and strong regulatory support available in the region, which assists in the regional market expansion.

Market Dynamics:

Drivers:

-

Growing Adoption of Artificial Intelligence and Machine Learning Fuels Emotion Analytics Market Growth

The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies across diverse industries including retail, healthcare, and automotive. For instance, in March 2024, a major AI firm launched an improved emotion recognition system that enhanced the detection accuracy of subtle human emotions in real time. This newly introduced system enable businesses to analyze customer feelings and responses in an effective way, further allowing personalized marketing, enhanced product design, and improved customer service. As digital transformation accelerates globally, companies are integrating emotion analytics into customer experience management and smart devices. The rising use of virtual assistants and contactless interactions further encourages the need for emotional understanding to improve engagement. This widespread adoption of AI-driven emotion analytics is fostering innovation, driving investments, and expanding market opportunities worldwide.

Restraints:

-

Concerns Related to Privacy and Ethics Impede Emotion Analytics Market Expansion Globally

While machine learning (ML) and artificial intelligence (AI) solutions increase for different industries including healthcare, retail, and automotive, among others. For instance, in March 2024, the updated emotion analytics launched by a leading AI organization contain sensitive active personal information including facial expressions, biometric indicators, and voice intonations for use in the workplace. These are both serious issues with such data being collected and used without consent. Restrictions on data privacy and data protection, coupled with the consumer trust deficit over surveillance and misuse of speculative emotional data, are hampering the market growth. But organizations are stuck when it comes to transparency, compliance, and data preservation. Such problems are geolocated in ethical knots of manipulating emotions and biases in a potential AI model. These concerns require robust governance frameworks and crystal-clear data homogenization, thus increasing operational costs and delaying time-to-market velocity.

Opportunities:

-

Surging Number of Applications in Healthcare and Education Generate Lucrative Opportunities for Emotion Analytics

The emotion analytics market trends are growing due to the healthcare and education sector applications. For instance in February 2025, clinicians are now able to more accurately assess patient emotions during virtual consultations and this advancement enable early detection and improved treatment of mental health disorders. Similarly, emotion analytics has begun to be leveraged in educational settings for tracking student engagement and customize learning experiences for better results. As the world becoming highly aware of mental illness and transforming into an increasingly interconnected remote space, mental health and care have great room for growth. Here, as elsewhere, investments to promote ethics and efficacy in the development of emotion AI solutions are likely to hasten growth in the market across the globe.

Challenges:

-

Complexity of Emotion Data Interpretation and System Integration Challenges Market Growth

The inherent complexity of interpreting emotional data accurately and integrating it seamlessly into existing business systems. Emotions are subjective and culturally variable and context dependent, so building reliable AI models is a challenge in AI. The need for multi-modal emotion recognition, where facial, vocal, and physiological signal cues need to be incorporated, often demands sophisticated algorithms and high computational power. Several organizations are finding it difficult to integrate these technologies without affecting their existing workflow or IT platform. Data quality can be further influenced by environmental factors, such as lighting and background noise. Many smaller enterprises do not have the bandwidth to deal with this complexity, which limits widespread adoption.

Segmentation Analysis:

By Deployment

The On-cloud deployment segment leads the emotion analytics market with 64% revenue share in 2024, owing to its low cost and scalability compared to on-premises solutions. As of early 2024, firms, such as Microsoft and IBM released cloud-based emotion AI services to improve the processing and accessibility of real-time emotional information. Extended remote, multi-device access, and open integration with enterprise systems available from Cloud platforms can drive usage up throughout various industries. Such deployment mode is crucial for accelerating the growth of the emotion analytics market, as it allows faster innovation and larger reach.

By End User

In 2024, the Media & Entertainment sector holds the largest revenue share of 25% of the emotion analytics market due to the wide usage of emotional insights to optimize content and viewer engagement. Features like those launched through tools for streaming platforms leveraging deep facial emotion reading (that introduced by a company including Realeyes, which allows brands to target viewers with ads based on their likely reactions to a show and respond with custom content rapidly). The growing demand for real-time emotional response within media & entertainment is a strong factor accelerating the growth of this market.

Healthcare is the fastest-growing end-user segment with a CAGR of 18.45%, as emotion analytics improves patient diagnosis and therapy. Affectiva launched emotion-detection through telemedicine for remote mental-health monitoring in 2024. Emotion analytics has the ability to identify that the patient is in a good or bad mood, further supporting clinicians understand the emotions and ensuring better treatment outcomes and more personalized care. This growth is also driven by the increasing focus on mental health and the advent of digital health solutions, which further makes Healthcare one of the crucial contributors to the emotion analytics market growth globally.

By Technology

Artificial intelligence dominates with a 31% revenue share in 2024, powering emotion analytics through advanced algorithms for accurate emotional detection. Companies including Amazon Web Services launched new AI frameworks in 2024 that integrate emotion recognition with cloud analytics, boosting processing speed and scalability. AI’s ability to analyze multi-modal data streams (facial, voice, and text) enhances emotion analytics accuracy, driving adoption across industries and significantly contributing to market growth by enabling more sophisticated, real-time emotional insights.

The Biometrics & Neuroscience segment is growing rapidly at a CAGR of 19.41%, driven by innovations in physiological emotion detection. In 2024, NeuroSky launched wearable EEG devices capturing brainwave data for emotion analysis, enhancing healthcare and consumer research applications. This technology offers deeper emotional understanding beyond facial and vocal cues, unlocking new use cases in stress management and cognitive assessment. Its increasing integration with AI accelerates emotion analytics market growth by providing richer, scientifically grounded emotional data.

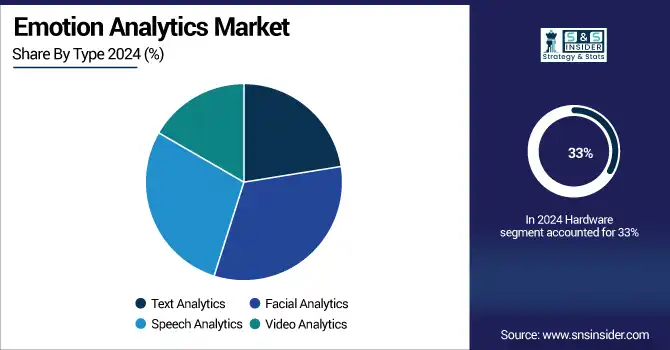

By Type

Facial analytics commands a 33% revenue share in 2024, due to its usage in a range of applications such as security, marketing, and customer experience. In 2024, Face++ and other companies introduced updated facial emotion detection APIs in their platforms to recognize emotions in various situations, angles, and lighting conditions. The non-intrusive and high accuracy associated with this technology promotes its adoption as a key element of emotion analytics solutions. The demand for fine emotional cues captured by facial analytics can speed up market growth, which is expected to increase engagement and decision-making in various sectors.

Speech analytics is the fastest-growing segment, with an 18.11% CAGR, which can be attributed to the increasing need for vocal emotion recognition in the call center and virtual assistant industries. In 2024, speech emotion detection tools were enhanced by adding sentiment analysis for customer support where companies including Nuance Communications were implementing these systems. To improve the quality of service and user experience, this technology helps to gain real-time insights of emotions from tone, pitch, and pace. As voice interfaces expand, speech analytics drives significant growth in the emotion analytics market by enabling deeper emotional engagement through audio data.

Regional Analysis:

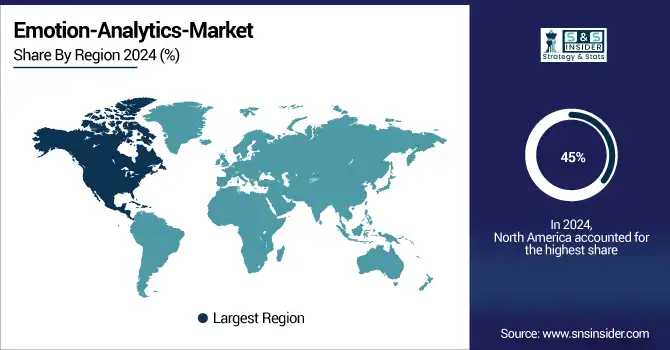

North America held a dominant Emotion Analytics Market Share of around 45% in 2024. Strong technology infrastructure and advanced artificial intelligence adoption help North America lead in the expansion of emotional analytics. With its innovation in artificial intelligence technology and significant investments in emotion analytics research and development, the United States is the most dominant nation in North America, owning the most share. Leading American tech businesses with headquarters have developed sophisticated emotion recognition technologies to hasten adoption in retail, entertainment, and healthcare. Strong laws supporting data privacy and great consumer data availability help to confirm the United States as the main market leader in the area.

Asia Pacific is the Growing Emotion Analytics Market Region with an estimated CAGR of 22.3% in 2024. Rapid digital revolution and rising smartphone adoption drive fast expansion in the emotional analytics industry of Asia Pacific. Driven by large investments in artificial intelligence research and growing use of emotional analytics in fields, such as e-commerce and smart cities, China leads the Asia Pacific area. Government programs encouraging artificial intelligence acceptance and a highly digitally linked population give the perfect setting for creativity. Furthermore, driving China's market domination and fast growth is its emphasis on enhancing consumer experience using emotion-based analytics in mobile apps and internet platforms.

Europe Emotion Analytics Market growth, in 2024, is driven by innovation and strong emphasis on data privacy and AI ethics, which further shapes Europe’s emotion analytics market development and adoption in 2024. Germany rules the European market because of its technology developments and rigorous GDPR compliance, which support ethical emotional analytics applications. Especially in the automobile and healthcare industries, German businesses are heavily funding artificial intelligence-driven emotional identification. Germany is the main driver of European market expansion since this emphasis on privacy-compliant innovation helps to increase the acceptance of emotion analytics technology and facilitates broader market acceptance.

The Middle East & Africa and Latin America regions are emerging markets for emotion analytics in 2024 due to growing digitalization and widening technological infrastructure development. Businesses in these areas are starting to use artificial intelligence-powered emotional analytics to increase customer involvement and advance medical diagnosis. Though still under development relative to other areas, rising government projects supporting digital transformation are increasing acceptance, therefore placing these areas for future expansion in the global emotional analytics market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The emotion analytics market companies are Affectiva Inc., RealEyes OU, IBM Corporation, Clarifai Inc., Sensum Co., Beyond Verbal, Noldus Information Technology (NIT), Sentiance NV, Lexalytics Inc., Deloitte Touche Tohmatsu Ltd., Gorilla Technology Group, and others.

Recent Developments:

-

In 2023, Noldus launched NoldusHub, a comprehensive research platform combining emotion, physiology, and behavior data for integrative human studies across healthcare, UX, and cognitive research fields.

-

In 2024, Realeyes and Kantar partnered 2024 to launch Verify, an emotion-based attention scoring solution designed to improve panel response quality by filtering inattentive or low-engagement participants.

-

In 2024, Noldus partnered with Blackrock Neurotech in October 2024 to develop emotion-aware neuroscience tools, integrating behavior analytics into next-gen brain-computer interfaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.77 Billion |

| Market Size by 2032 | USD 12.46 Billion |

| CAGR | CAGR of 16.19% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Text Analytics, Facial Analytics, Speech Analytics, Video Analytics) • By Technology (Pattern Recognition, 3D Modeling, Biometrics & Neuroscience, Artificial Intelligence, Record Management, Others) • By Deployment (On-Cloud, On-Premise) • By End-Users (Media & Entertainment, Automotive, IT & Telecommunication, BFSI, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Affectiva Inc., RealEyes OU, IBM Corporation, Clarifai Inc., Sensum Co., Beyond Verbal, Noldus Information Technology (NIT), Sentiance NV, Lexalytics Inc, Deloitte Touche Tohmatsu Ltd., Gorilla Technology Group |