Enterprise Asset Management (EAM) Software Market Key Insights:

To Get More Information on Enterprise Asset Management (EAM) Software Market - Request Sample Report

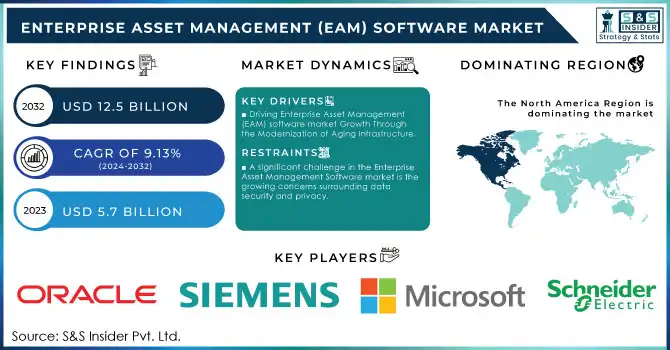

The Enterprise Asset Management (EAM) Software market size was valued at USD 5.7 Billion in 2023 and is expected to reach USD 12.5 Billion by 2032 and growing at a CAGR of 9.13% over the forecast period 2024-2032.

The Enterprise Asset Management (EAM) software market is growing rapidly as organizations worldwide prioritize asset optimization to reduce operational costs, enhance productivity, and extend asset lifecycles. Poorly managed assets lead to financial losses, operational inefficiencies, and cash flow challenges. EAMS solutions address these issues by enabling optimal asset utilization through metrics such as annual planned downtime, lost operational time, and production hours lost. The tangible benefits of EAM adoption are evident in industries like manufacturing, healthcare, and IT, which rely on efficient management of assets ranging from machinery and vehicles to intangible resources like intellectual property and software. MaintainX, for example, demonstrates the effectiveness of strategic asset management, achieving a 32% reduction in unplanned downtime, 30% savings on maintenance costs, and a 37% increase in mean time between failures (MTBF). These figures underscore EAM’s role in streamlining operations and improving return on investment (ROI).

Integration with advanced technologies such as IoT, AI, and predictive analytics further enhances EAMS systems, enabling proactive monitoring and maintenance to maximize asset performance. The rising demand for cloud-based solutions, offering scalability, cost-efficiency, and seamless integration, highlights a shift toward sustainability and digital transformation. This trend ensures continued market growth as businesses adapt to evolving challenges and prioritize asset value maximization while minimizing disruptions. EAMS solutions are increasingly indispensable for enterprises aiming to align operational efficiency with long-term profitability.

Market Dynamics

Drivers

- Driving Enterprise Asset Management (EAM) software market Growth Through the Modernization of Aging Infrastructure.

A significant driver of growth in the Enterprise Asset Management Software market is the increasing demand to modernize aging infrastructure in developed economies. Critical infrastructure sectors such as transportation, utilities, and manufacturing are facing the challenges of deterioration, creating a pressing need for efficient asset management to avoid costly downtime and repairs. For instance, the U.S. is confronted with a USD 2 trillion funding gap for infrastructure repairs, underscoring the urgency of implementing effective asset management strategies. Enterprise Asset Management Software market, enhanced by advanced technologies like AI, IoT, and predictive analytics, is playing a key role in enabling organizations to monitor asset conditions, predict potential failures, and optimize maintenance schedules. This not only helps reduce operational costs but also enhances efficiency across various industries. industries under regulatory compliance pressure are increasingly adopting EAMS solutions to meet stringent asset integrity standards. By tracking real-time asset performance, these solutions allow businesses to address issues proactively, minimizing the risk of expensive breakdowns. With infrastructure investment gaps growing, the adoption of EAMS systems is becoming crucial to extending the life of assets, boosting resilience, and supporting economic stability. As the demand for asset management solutions grows, EAMS technology is central to mitigating risks and ensuring cost-effective, reliable infrastructure management.

Restraints

- A significant challenge in the Enterprise Asset Management Software market is the growing concerns surrounding data security and privacy.

As EAMS systems increasingly adopt IoT and cloud-based technologies, vast amounts of sensitive data, including operational and financial details, are generated and stored. This creates serious cybersecurity risks, making EAS systems vulnerable to cyberattacks, data breaches, and unauthorized access. With the use of advanced technologies like artificial intelligence (AI) for predictive maintenance, the risks associated with handling sensitive data become even more pronounced. To address these concerns, businesses must invest heavily in robust cybersecurity measures such as encryption, multi-factor authentication, and secure cloud infrastructure. These investments add to the complexity and cost of implementing EAMS systems. Moreover, compliance with data protection regulations like GDPR and CCPA further increases the burden, as failure to meet these standards can result in hefty fines and damage to the company's reputation. The interconnected nature of IoT devices in Enterprise Asset Management Software market solutions amplifies vulnerabilities, making companies cautious about fully embracing these technologies without a thorough understanding of potential security risks. As a result, the Enterprise Asset Management Software market faces significant adoption challenges, especially in sectors that deal with sensitive information. Continued investment in cybersecurity is vital for addressing these concerns and enabling broader adoption of Enterprise Asset Management Software market solutions.

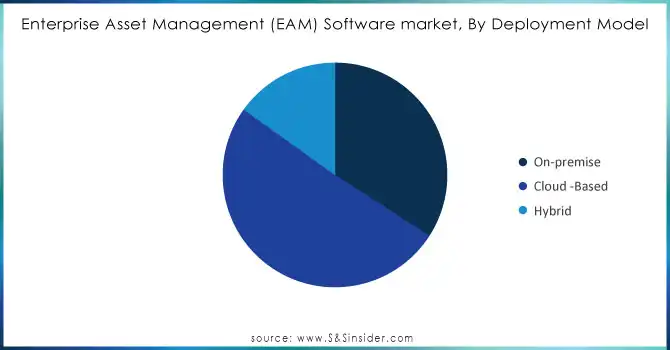

By Deployment Model

The cloud-based deployment model is the leading segment in the Enterprise Asset Management Software market, with an estimated market share of 51% in 2023. This growth is driven by the flexibility, scalability, and cost-efficiency of cloud solutions, allowing companies to better manage assets through real-time data access and seamless integration with other systems. Key product developments include IBM Maximo’s enhanced cloud features and SAP S/4HANA Cloud, which optimize asset management with IoT and AI for predictive maintenance.

Do You Need any Customization Research on Enterprise Asset Management (EAM) Software Market - Inquire Now

By Organization Size

In 2023, large enterprises dominated the Enterprise Asset Management Software (EAMS) market, holding around 60% of the share. This dominance stems from the complex asset management needs of large corporations in sectors such as manufacturing, energy, and transportation. These organizations require scalable, robust EAMS solutions to optimize asset performance, ensure compliance, and streamline maintenance schedules. The growing adoption of AI-powered predictive maintenance tools is reducing downtime and enhancing operational efficiency. Additionally, the shift to cloud-based systems helps lower IT infrastructure costs while improving flexibility and integration, driving further innovation and reducing maintenance expenses.

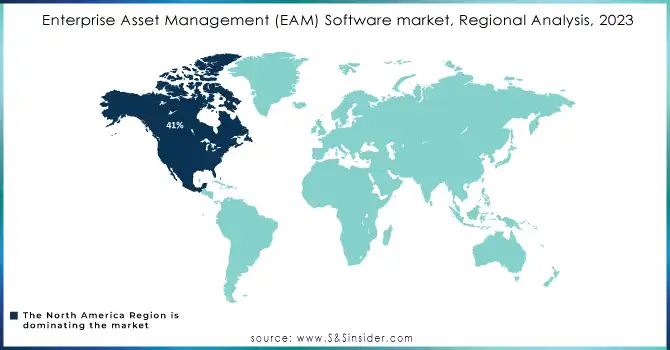

Regional Analysis

North America leads the Enterprise Asset Management software market, accounting for approximately 41% of the market share in 2023. This dominance is fueled by large enterprises, especially in the U.S. and Canada, driving digital transformation and the need for efficient asset management across industries such as manufacturing, energy, and transportation. Key factors include the adoption of cloud-based solutions, AI-driven predictive maintenance, and IoT for real-time monitoring. Additionally, strong government investments in infrastructure, smart city initiatives, and digitalization further boost demand. The region's shift towards cloud EAMS solutions, supported by platforms like AWS and Microsoft Azure, enables companies to optimize operations while reducing IT infrastructure costs.

Asia-Pacific is experiencing the fastest growth in the Enterprise Asset Management software market, driven by rapid industrialization and digital transformation across sectors like manufacturing, energy, and transportation. Countries like China, India, and Japan are leading the way, with government initiatives and technological advancements promoting the adoption of EAMS solutions. In China and India, the push for smart cities and Industry 4.0 is accelerating the demand for EAMS systems, while Japan focuses on optimizing asset performance through predictive maintenance. The shift to cloud-based solutions is particularly strong in India and Southeast Asia, driven by cost efficiency and scalability. Increased infrastructure investments and the rise of AI and automation are further fueling the EAMS market growth in the region.

Key Players

Some of the Major Players Enterprise Asset Management (EAM) Software Market with product:

-

IBM Corporation (IBM Maximo Asset Management)

-

SAP SE (SAP EAM)

-

Oracle Corporation (Oracle EAM)

-

Infor (Infor EAM)

-

IFS AB (IFS EAM)

-

ABB Ltd. (ABB Ability Asset Suite)

-

Siemens AG (Siemens COMOS)

-

Schneider Electric (Avantis EAM)

-

Microsoft Corporation (Microsoft Dynamics 365 Supply Chain Management)

-

Hexagon AB (HxGN EAM)

-

Bentley Systems, Incorporated (AssetWise)

-

GE Digital (Asset Performance Management)

-

Asset Works LLC (AssetWorks EAM)

-

eMaint Enterprises LLC (a Fluke Company) (eMaint CMMS)

-

Dude Solutions, Inc. (Asset Essentials)

-

Ultimo Software Solutions (Ultimo EAM)

-

Accruent (Maintenance Connection)

-

IBM Tririga (Tririga Facilities Management)

-

Ramco Systems (Ramco EAM on Cloud)

-

MPulse Software, Inc. (MPulse Maintenance Software)

List of potential companies that could benefit from adopting Enterprise Asset Management (EAM) software, segmented by industry:

1. Manufacturing

-

General Electric (GE)

-

Siemens AG

-

Toyota Motor Corporation

-

Tesla, Inc.

-

Foxconn Technology Group

2. Energy and Utilities

-

Exelon Corporation

-

Duke Energy Corporation

-

EDF Group

-

First Solar, Inc.

-

Veolia Environment SA

3. Transportation and Logistics

-

Delta Air Lines

-

United Parcel Service (UPS)

-

Maersk Group

-

BNSF Railway

-

FedEx Corporation

4. Healthcare

-

Mayo Clinic

-

Cleveland Clinic

-

Pfizer Inc.

-

Novartis AG

-

Medtronic plc

5. Oil and Gas

-

ExxonMobil Corporation

-

Chevron Corporation

-

Shell plc

-

BP plc

-

Total Energies SE

6. Government and Public Sector

-

US Department of Defense (DoD)

-

NASA

-

City of New York

-

United Nations (UN)

-

NATO

7. Retail and Consumer Goods

-

Walmart Inc.

-

Costco Wholesale Corporation

-

Procter & Gamble (P&G)

-

Unilever plc

-

Nestlé S.A.

8. Construction and Real Estate

-

Bechtel Corporation

-

Skanska AB

-

CBRE Group, Inc.

-

JLL (Jones Lang LaSalle Incorporated)

-

Turner Construction Company

9. Telecommunications

-

AT&T Inc.

-

Verizon Communications Inc.

-

Vodafone Group plc

-

American Tower Corporation

-

Ericsson

10. Aerospace and Defense

-

Boeing Company

-

Airbus SE

-

Lockheed Martin Corporation

-

SpaceX

-

Raytheon Technologies Corporation

Recent Developments

-

On October 2024, Verdantix in recognized IBM as a leader in the Enterprise Asset Management software (EAM) market their "Green Quadrant: Enterprise Asset Management Software 2024" report. IBM Maximo received top marks for its technical and functional capabilities, including high scores in platform interoperability, inspections, and energy management. The report highlights IBM Maximo's industry-leading functional capabilities and its innovative use of AI for predictive maintenance and performance integration.

-

October 2024: Ramco EAM has recently upgraded its cloud-based solution by integrating advanced AI and machine learning features. This development enhances predictive maintenance and asset performance optimization, allowing businesses to leverage real-time data more effectively and streamline their asset management processes across industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD5.7 Billion |

| Market Size by 2032 | USD 12.5 Billion |

| CAGR | CAGR of 9.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Model (On-Premise and Cloud-Based, Hybrid) • By Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises) • By Industry (Manufacturing, Utilities, Transportation, Oil and gas, Other industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, SAP SE, Oracle Corporation, Infor, IFS AB, ABB Ltd., Siemens AG, Schneider Electric, Microsoft Corporation, Hexagon AB, Bentley Systems, GE Digital, AssetWorks LLC, eMaint Enterprises LLC, Dude Solutions, Inc., Ultimo Software Solutions, Accruent, IBM Tririga, Ramco Systems, and MPulse Software, Inc. |