Data Protection Market Analysis & Overview:

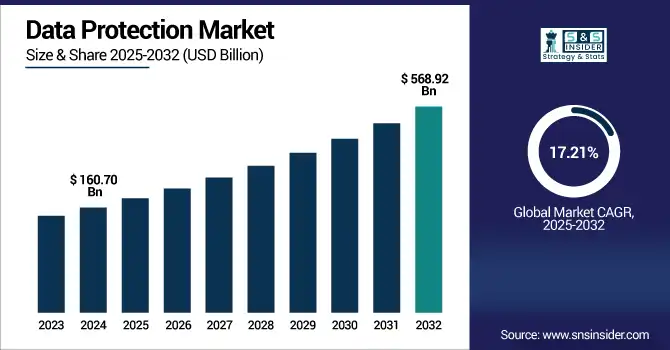

Data Protection Market size was valued at USD 160.70 billion in 2024 and is expected to reach USD 568.92 billion by 2032, growing at a CAGR of 17.21% from 2025-2032.

To Get more information on Data Protection Market - Request Free Sample Report

The Data Protection Market growth is due to rising cyber threats, strict data privacy regulations, increasing cloud adoption, and digital transformation across industries. Businesses are investing in advanced security solutions to protect sensitive data, ensure compliance, and maintain customer trust, driving significant demand for robust data protection technologies and services.

According to IBM's annual Cost of a Data Breach Report 2023 (IBM.com), the global average cost of a data breach in 2023 was $4.45 million, up 2.3% from the previous year.

Additionally, Microsoft’s 2024 Digital Defense Report emphasizes that 85% of organizations increased security spending due to rising cyberattacks and cloud migration.

Microsoft tracks over 1,500 unique threat groups, including more than 600 nation-state actors and 300 cybercrime groups, highlighting the complexity of the current cyber threat environment.

U.S. Data Protection Market size was valued at USD 44.00 billion in 2024 and is expected to reach USD 153.40 billion by 2032, growing at a CAGR of 16.90% from 2025-2032.

The U.S. Data Protection Market growth is driven by increasing cyberattacks, stringent data privacy laws like CCPA, widespread cloud adoption, and growing awareness among businesses to safeguard sensitive information and ensure regulatory compliance, boosting demand for data protection solutions.

The average cost of a data breach in the United States reached $9.36 million in 2023, approximately four times higher than the global average.

Additionally, the U.S. Census Bureau reported a 38% increase in cloud adoption since 2021, with federally authorized cloud-hosted systems and applications growing from 71 to 115.

Data Protection Market Dynamics

Drivers

-

Surge in cyberattacks and data breaches across industries is compelling businesses to prioritize advanced data protection solutions globally.

Growing ransomware, phishing, and malware attacks push up enterprises to spend on data protection technologies. To help ensure that businesses can continue while protecting sensitive data, organizations are utilizing encryption, secure backups, and threat detection tools. The demand is pushed by regulatory mandates like GDPR and CCPA. In fields like finance, healthcare and e-commerce, the situation is changing quickly as cybersecurity infrastructure evolves against breaches, risk and customer trust is built on strong data protection strategies.

The FBI’s Internet Crime Complaint Center (IC3) reported over 847,376 complaints in 2023, with losses exceeding USD 10.3 billion due to cybercrime including ransomware and phishing.

The U.S. Department of Health and Human Services (HHS) Office for Civil Rights (OCR) recorded over 700 healthcare data breaches affecting 500+ individuals in 2023, highlighting the sector’s vulnerability.

The National Institute of Standards and Technology (NIST) encourages adoption of encryption, secure backups, and threat detection via its Cybersecurity Framework, adopted widely in sectors like finance and healthcare.

Restraints

-

Complex integration with legacy systems and existing IT infrastructure slows down the deployment of modern data protection solutions across enterprises.

Outdated IT architecture prevents the synergy of contemporary data protection tools, leading to system conflicts, service outages, and longer deployment timelines. The problem is exacerbated by the deep embedding of many legacy systems in sectors like manufacturing and government. The newfound lack of interoperability, renders an upgrade to security unpleasant and thoroughly delayed. And then you have the problem that businesses need tailored solutions and specialist consultation for the same, driving their costs and complexity up. These integration barriers hamper adoption, causing data protection upgrades to stagnate as market momentum grinds to a slow crawl.

Opportunities

-

Adoption of hybrid and multi-cloud environments is creating expansive demand for scalable and agile data protection solutions worldwide.

With organizations moving toward hybrid and multi-cloud strategies, safeguarding their data across heterogeneous environments assumes more importance. The growing need for platform-agnostic protection tools is driven by increased data mobility. Dynamic cloud setups require enterprises to overcome silos and have a single unified solution for real-time monitoring, backup, and recovery. This is where vendors can leverage cloud-native security frameworks. The increase in cloud adoption particularly in the wake of remote work and digital transformation has created a tremendous opportunity to gain new market opportunities with flexible, cloud-ready data protection technologies.

A 2024 survey by the SANS Institute revealed that 55% of organizations are utilizing multiple cloud service providers to achieve greater agility, flexibility, and scalability.

According to the Cloud Security Alliance, 75% of organizations have either implemented or plan to implement Cloud-Native Application Protection Platforms (CNAPPs) to safeguard their multi-cloud environments.

Additionally, the U.S. Senate's Multi-Cloud Innovation and Advancement Act of 2023 emphasizes the need for federal agencies to adopt multi-cloud computing technologies to enhance innovation and streamline operations.

Challenges

-

Evolving threat landscape with advanced persistent attacks challenges even the most secure data protection frameworks and requires constant innovation.

Cybercriminals have advanced to using AI to set zero-day exploits and APTs to bypass conventional security, prompting the providers to change continuously. This entails large R&D spends and quick updates that mostly eclipse the enterprise from being able to adopt the tech. No matter how sophisticated the systems, they become outdated almost immediately, revealing new vulnerabilities. This has led to persistent squeezing of vendors as well as users. All protection frameworks, even the hottest ones, run the risk of obsolescence without the power of continued development, and that presents a vital long-term data security challenge for every sector.

Data Protection Market Segmentation Analysis

By Enterprise Type

Large enterprises dominated the data protection market share in 2024 with approximately 65%, due to their substantial data volumes, stringent compliance needs, and larger cybersecurity budgets. Such organizations focus on deploying better protection solutions to protect sensitive customer, financial, and operational data. Owing to their high exposure to cyber threats and nature of global operations, these organizations need comprehensive and scalable security frameworks leading to considerable investments in data protection technology and infrastructure.

Small and mid-sized enterprises (SMEs) are projected to grow at the fastest CAGR of 18.40% from 2025 to 2032, mainly due to growing awareness of cyber threats and increasing adoption of digital platforms. These businesses are adopting cloud services, e-commerce lead them to increased data exposure, thus, affordable, scalable protection solutions have been a vital need. The rapid adoption of SMEs is fueled by government incentives and cloud-based security innovations.

By Solution

Data Loss Prevention (DLP) led the data protection market in 2024 with around 24% revenue share due to their significant capability in monitoring and limiting unauthorized data transmission. DLP tools provide real-time monitoring of data transfer and policy enforcement around data, key aspects that organizations struggle with when it comes to insider threats, regulatory compliance issues, and protecting sensitive data. Enterprise security strategies today are greatly defined by its integration over the email, cloud and endpoint systems.

Data encryption, tokenization, and masking are expected to register the fastest CAGR of 19.54% from 2025 to 2032, due to the increasing focus of the organizations towards data privacy and cloud security. These methods make sensitive data unreadable to unauthorized users and support new compliance requirements, such as GDPR and HIPAA. The growing dependence on multi-cloud situations and remote accessibility additional fuels the need to have for data-centered protection measures.

By Industry

The BFSI sector dominated the data protection market in 2024 with about 24% revenue share due to its high-risk profile with complex regulatory conditions. With billions of sensitive customer and transaction data, banks, insurers, and financial institutions are easy targets for cyberattacks. Ongoing conformance to standards such as PCI-DSS and data security frameworks, has translated into massive investments in sophisticated protection systems.

The manufacturing sector is forecasted to grow at the fastest CAGR of 20.97% from 2025 to 2032, driven by rapid shift towards digitization and Industrial IoT integration. However, the more manufacturers that choose to convert to smart factories and install connected devices and vehicles, the more likely they are to be exposed to cyber risks. It is essential to protect the intellectual property, operational data, and supply chain information. The digitalization of business demonstrates the necessity of enterprise-grade data protection remedies that are real-time, in nature.

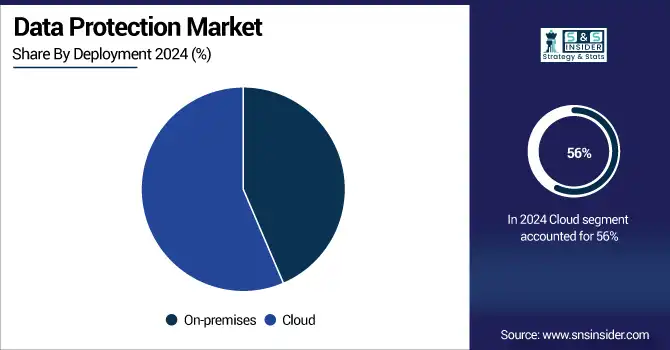

By Deployment

Cloud segment dominated the data protection market in 2024 with a 56% revenue share and is projected to grow at the fastest CAGR of 17.99% from 2025 to 2032 due to the rising adoption of organizations across various industries. Heavy workloads are increasingly shifted to cloud environments by organizations for reasons such as scalability, cost-effectiveness, and remote access. That change makes for even greater demand for nimble, sophisticated data protection. The global impetus is also buoyed by cloud native security tools, regulatory compliance requirements, and the escalating multi-cloud strategies.

Data Protection Market Regional Outlook

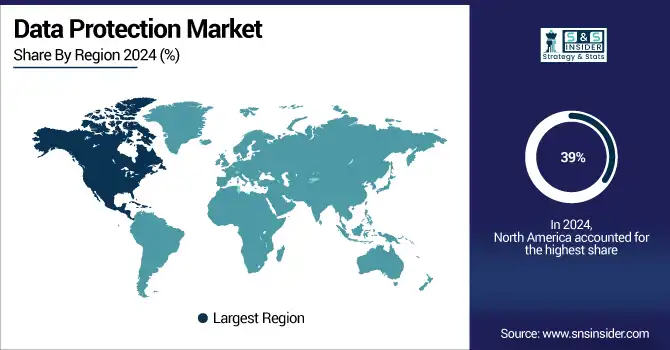

North America dominated the data protection market in 2024 with a 39% revenue share due to early technology adoption, strict regulatory frameworks, and high cybersecurity awareness. The maturity of digital infrastructure within the region and the availability of a number of the global players in data protection space adds to market leadership. These regions have a greater prevalence of information security spending across sectors, such as BFSI, healthcare, and retail, and this, in turn, increases the regional demand for advanced protection solutions.

The U.S. dominated the data protection market due to stringent regulations, high cyberattack frequency, advanced IT infrastructure, and strong enterprise security investments.

Asia Pacific is expected to grow at the fastest CAGR of 19.25% from 2025 to 2032, driven by rapid move to digital transformation, growing adoption of cloud, and the rise of cyber threats in emerging economies. Governments bringing in stringent data privacy regulations, SMEs and big enterprises increasing spending on cyber security. Internet penetration and e-commerce growth trend across China, India, and Southeast Asia only deepens the urgency for scalable, targeted data protection solutions.

China is dominating the data protection market trends in Asia Pacific due to rapid digital expansion, strong government mandates, and massive enterprise investment in cybersecurity technologies.

Europe holds a significant position in the data protection market due to stringent regulations like GDPR, high data privacy awareness, and widespread adoption of advanced cybersecurity solutions across industries such as finance, healthcare, and manufacturing.

Germany is dominating the data protection market in Europe due to strong regulatory compliance, advanced industrial digitalization, and significant investments in cybersecurity infrastructure and solutions.

In the Middle East & Africa and Latin America, growth in the data protection market is driven by increasing cyber threats, rising digital adoption, and emerging regulatory frameworks pushing enterprises to invest in modern data security and compliance solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Data Protection Market companies include Hewlett Packard Enterprise (HPE), Symantec (Broadcom Inc.), CA Technologies (Broadcom Inc.), McAfee, Oracle Corporation, Quest Software, NetApp, Veeam, Acronis, Amazon Web Services, Inc., Dell EMC, Commvault Systems, Inc., Quantum Corporation, Veritas Technologies, Carbonite, Inc., IBM and others.

Recent Developments:

-

May 2025: HPE introduced new guarantees for HPE Alletra Storage MP B10000, enhancing cyber resilience and eliminating data loss. Additionally, new entry-level HPE StoreOnce backup appliances were launched to simplify data protection for small and medium-sized businesses.

-

February 2025: Quest introduced advancements in Identity Threat Detection and Response (ITDR) and disaster recovery, setting new standards for proactive defense and rapid recovery.

-

September 2024: Oracle introduced OCI Zero Trust Packet Routing, enabling organizations to separate network security from architecture to prevent data breaches caused by human error.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 160.70 Billion |

| Market Size by 2032 | USD 568.92 Billion |

| CAGR | CAGR of 17.21% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Data Archiving and eDiscovery, Data Encryption, Tokenization and Masking, Data Backup and Recovery, Data Authorization and Access, Data Governance and Compliance, Disaster Recovery, Data Loss Prevention (DLP), Others) • By Deployment (On-premises, Cloud) • By Enterprise Type (Small & Mid-sized Enterprises (SMEs), Large Enterprises) • By Industry (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Government, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | HPE, Symantec, CA Technologies, McAfee, Oracle Corporation, Quest Software, NetApp, Veeam, Acronis, Amazon Web Services, Inc., Dell EMC, Commvault Systems, Inc., Quantum Corporation, Veritas Technologies, Hewlett Packard Enterprise Company, Carbonite, Inc, IBM |