Animation Software Market Size & Overview:

Get More Information on Animation Software Market - Request Sample Report

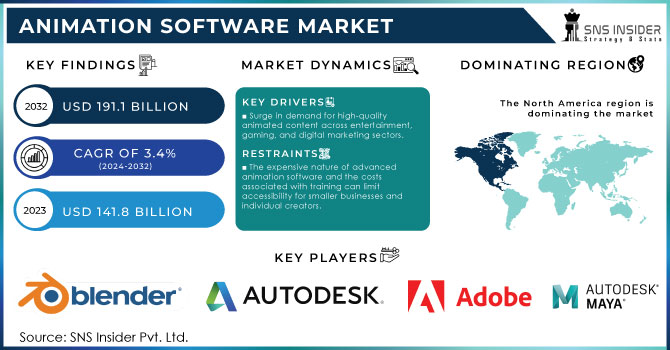

Animation Software Market Size was valued at USD 141.8 Billion in 2023 and is expected to reach USD 191.1 Billion by 2032, growing at a CAGR of 3.4% over the forecast period 2024-2032.

The significant growth of the Animation software market can be attributed to technological developments and the growth of the sector with the need for animation across various industries. Statistics from the U.S. Bureau of Labor Statistics show that employment in the motion picture and video industries alone will grow by 11% from 2022 to 2032, a rate that is higher than the average for all occupations. This high growth meaning a high demand can be observed from the increase in the production of animated films, video games, and advertisements. This becomes a clear illustration of the great reliance on animation among contemporary media, with other benefits coming from the growth in the demand for online and streaming services globally. Since digital platforms are taking over the way people watch content, creators, including photographers and videographers, need to rely more on the software credited with the high need for it. Moreover, it is not only the artists and creators who are investing in the software; the government has also noticed how useful and highly efficient animation can be for both education and the creation of public campaigns increasing the budget allocation for the same. As an illustration, the U.S. Department of Education recently awarded some grants in support of the development of educational animation tools since the country has developed an interest in ensuring seamless and optimally functioning academic experiences. This convergence of technological advancements, industry growth, and governmental support is poised to propel the animation software market to new heights.

Animation software is thriving because of the rise in online video platforms and the growth in VR and AR with more immersive experiences. There is a great demand for visually appealing and immersive content. Moreover, the growth is ensured by advancements in visual effects (VFX) followed by high demand since they can be easily integrated with live-action footage and the ease in rendering that relies on real-time and GPU capacities, growing with the need for gamer animation tools since they are all in search of high animation content build realistic environments and attracting detailed character animations. Innovations such as 3D animations and 4K content cater to adult gamers, enhancing both gameplay and storytelling, which further accelerates the adoption of advanced animation tools.

Animation Software Market dynamics

Drivers

-

Surge in demand for high-quality animated content across entertainment, gaming, and digital marketing sectors.

-

Innovations in AI and machine learning are enhancing the capabilities of animation software, allowing for faster production and more complex designs.

One of the reasons driving the growth of the Animation Software Market is the growing demand for high-quality animation in various sectors. The expansion of digital platforms and the general need for engaging forms of visual storytelling require more and more businesses to make use of these formats. For instance, social media platforms, such as Instagram and TikTok, see more animated posts and videos circulating these days. Usually, such content tends to be more engaging for the users of social media, with recent studies showing up to 1200% growth in user action rates. In addition, many other sectors, such as education and corporate training, are increasingly introducing animations to simplify the explanation of more complex concepts and engagement of their intended audiences. For example, companies and institutions, such as Khan Academy and Coursera, augment their instructional videos with animated pictures to enhance memorization and understanding on the part of their audiences. In addition, it is noteworthy that the popular demand for exquisite graphics is essential for the growing gaming industry, which keeps investing in certain forms of software to make visuals more realistic and engaging as the level of sophistication of stories multiplies. Also, the technology of virtual reality and augmented reality are more and more dependent on sophisticated animations to provide realistic and immersive experiences.

Restraints

-

The expensive nature of advanced animation software and the costs associated with training can limit accessibility for smaller businesses and individual creators.

-

Many animation tools have intricate features that can be overwhelming for new users, which may deter adoption among non-professionals.

One significant restraint in the animation software market is the complexity of its use. Many animation programs feature advanced functionalities that can be challenging for new users to navigate. This complexity can create a steep learning curve, discouraging those without technical expertise from fully utilizing the software. Consequently, individuals and smaller businesses may opt for simpler alternatives or avoid animation altogether, limiting their creative potential. Additionally, the intricate nature of these tools often requires substantial training and practice to achieve proficiency. This necessity for dedicated time and resources can be a barrier for those looking to quickly adopt animation in their projects. As a result, the perception that animation software is only suitable for experienced professionals may further inhibit broader adoption and innovation in the field.

Animation Software Market Segment Analysis

By Product

The 3D animation segment captured the largest revenue share of about 45% in 2023. The increased use of 3D animations in gaming, film production, as well as virtual reality, among others, has been the main factor that makes 3D appear dominant. Many industries and animation professionals are opting for 3D animation due to its ability to create more realistic and often more engaging perspectives than 2D. However, the 2D animation segment may record a significant CAGR from 2024 to 2032, influenced by the revival of traditional animation and the increased popularity of mobile applications that mainly apply 2D graphics. For instance, according to the National Endowment for the Arts, the production of 2D animated films in the U.S. has doubled since 2015, which may indeed be a strong indicator of the revitalization of 2D animation. Essentially, 2D animation has substantially grown due to its ability to reduce costs, making it highly efficient and appropriate for small startups and individual professionals. As technology continues to evolve, the animation software market is expected to adapt, offering diverse tools for both 2D and 3D animation, thereby catering to the varying needs of creators.

By End-use

The media and entertainment segment was the largest revenue-generating segment in 2023. The significant increase in the demand for animated films and series is the key factor driving the market. The market for animation in the entertainment industry is expected to expand the most, as well as streaming platforms’ increased investments into animation. In 2023, the media and entertainment sector held a significant share animation software market, underscoring its critical role in shaping industry trends. It is assumed that it had the biggest impact on the trends of the industry.

On the other hand, the healthcare and life sciences segment is projected to expand at the highest CAGR. As per the government’s statistics, digital tools for the healthcare sector, including animation software for patient education and training, are expected to reach an estimated spent of $200 billion by 2030. According to the Centers for Medicare & Medicaid Services, a significant portion will be spent on digital tools. This may be caused by the fact that animation makes complex medical concepts easy and understandable for patients. It is effective in education as it ensures the visual representation of the processes. As more industries recognize the value of animation in enhancing communication and engagement, the animation software market is set to witness robust growth across various end-use sectors.

Comparison of Animation Software Types

| Software Type | Key Features | Target Users | Advantages | Limitations |

|

2D Animation Software |

Frame-by-frame animation, vector drawing tools |

Independent animators, small studios, educational users |

Easy to learn, less resource-intensive, suitable for simple animations |

Limited depth and realism compared to 3D animation |

|

3D Animation Software |

3D modeling, rigging, texturing, rendering |

Professional studios, game developers, filmmakers |

Creates realistic animations, versatile for various industries |

Steeper learning curve, requires powerful hardware |

|

Stop-Motion Software |

Supports frame capturing from camera, onion skinning |

Hobbyists, indie filmmakers, educational projects |

Allows unique, handcrafted animation style, easy setup |

Time-consuming, requires physical models and sets |

|

Flipbook Animation |

Frame-by-frame drawn animations, traditional approach |

Artists, students, educational users |

Simple technique, no need for complex software |

Labor-intensive, limited to basic animations, time-consuming |

Regional Analysis

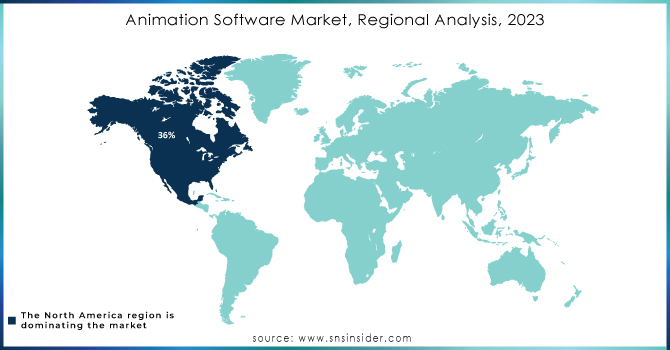

North America dominated the animation software market in 2023 and held a market share of around 36%. The dominance of the North American market can be attributed to the presence of major animation studios and the growing ordered-animated content demand of the entertainment vertical. According to the Motion Picture Association, the U.S. film and television industry generated more than $72 billion in revenue in 2022, of which the contribution of animation was significant. Further, the government is in support of the creative arts with initiatives that support and value creativity. The National Endowment for the Arts is getting involved in investing in numerous programs. One such program involves the integration of technology with the arts. Such initiatives are contributing to the growth and expansion of the animation software market. The market in North America is also profitable owing to the region’s advanced technology infrastructure and the high disposable income of people. This allows the animators to make more significant investments in animation production. As the competition across the globe increases, the other regions are expected to catch up, but since North America has been the launching place, innovation-wise, and market presence, it gives a competitive edge. U.S. animation software market is anticipated to register substantial growth during the forecast period, 2024 to 2032, driven by rising demand for animation solutions in sectors like media & entertainment, advertising, gaming, education, and healthcare.

Asia Pacific is expected to witness the highest CAGR in the animation software market from 2024 to 2032. This is largely owing to the increased adoption of animation technology in Japan, China, and South Korea, which is attributed to the thriving media and entertainment industry and the rising pace of industrial development. The market in India is expected to expand at a substantial rate during the forecast period, 2024 to 2032, owing to the high demand for VFX and 3D animation, Including healthcare and manufacturing. Meanwhile, China held a significant market share in 2023, thanks to a booming economy that drives demand for visual effects and immersive content consumption via ultra-high-definition TVs, smartphones, and tablets.

Need any customization research on Animation Software Market - Enquiry Now

Key Players

-

Adobe Systems Incorporated (Adobe Animate, Adobe After Effects)

-

Autodesk, Inc. (Autodesk Maya, Autodesk 3ds Max)

-

Toon Boom Animation Inc. (Toon Boom Harmony, Toon Boom Storyboard Pro)

-

Blender Foundation (Blender, Grease Pencil)

-

Maxon Computer GmbH (Cinema 4D, Redshift)

-

Corel Corporation (Corel Painter, CorelDRAW)

-

Houdini Software (Houdini, Houdini Apprentice)

-

Cinema 4D by Maxon (Cineware, Bodypaint 3D)

-

Smith Micro Software, Inc. (Moho Pro, Poser)

-

OpenToonz (OpenToonz, Toonz Premium)

-

Krita Foundation (Krita, Krita Gemini)

-

Daz 3D (Daz Studio, Daz 3D Bridge)

-

Unity Technologies (Unity, Unity Pro)

-

Epic Games (Unreal Engine, MetaHuman Creator)

-

Pencil2D Animation (Pencil2D, Pencil2D Editor)

-

Dragonframe (Dragonframe, Dragonframe Lite)

-

TVPaint Animation (TVPaint Animation 11, TVPaint Animation Pro)

-

Cacani (Cacani 2D Animation, Cacani Mobile)

-

CrazyTalk Animator (Cartoon Animator 4, CrazyTalk 8)

-

Maya by Autodesk (Maya, Maya LT) and others.

Latest News in the Animation Software Market

-

In June 2024, Adobe launched Adobe Animate 2024 with unprecedented features for 2D animation and AI tools integration. The upgrades were tailored to facilitate the process of animation and improve user experience.

-

In April 2024, Vizrt has launched a free graphics packages library for Viz Flowics, its solution of a cloud-native HTML5-based platform. This SaaS product is used for live production in various industries, such as esports, sports, broadcasting, and corporate events. Viz decided to help its customers to streamline the production process and boost the interaction with their audiences.

-

In July 2024, Autodesk announced the upcoming release of a new version of Maya, its solution for 3D animation. The updated version would come with improved rendering tools and a new simple and flexible interface to support the cooperation of the animation teams.

-

In August 2024, Blender Foundation released Blender 4.0 with the focus on simulation tools and a new asset library. This instrument, supporting both amateurs and professionals, was created to maintain and develop the open-source animation community.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 141.8 Billion |

| Market Size by 2032 | USD 191.1 Billion |

| CAGR | CAGR of 3.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (2D Animation, 3D Animation, Flipbook Animation, Stop Motion) • By Solution (Software, Services) • By Deployment (On-premise, Cloud-based) • By End-use (Media & Entertainment, Architecture & Construction, Automotive, Healthcare & Life Sciences, Education & Academics, Government & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe Systems Incorporated, Autodesk, Inc., Toon Boom Animation Inc., Blender Foundation, Maxon Computer GmbH, Corel Corporation, Houdini Software, Cinema 4D by Maxon, Smith Micro Software, Inc., OpenToonz, Krita Foundation, Unity Technologies, Epic Games |

| Key Drivers | • Surge in demand for high-quality animated content across entertainment, gaming, and digital marketing sectors • Innovations in AI and machine learning are enhancing the capabilities of animation software, allowing for faster production and more complex designs |

| RESTRAINTS | • The expensive nature of advanced animation software and the costs associated with training can limit accessibility for smaller businesses and individual creators. • Many animation tools have intricate features that can be overwhelming for new users, which may deter adoption among non-professionals |