Data Science Platform Market Key Insights:

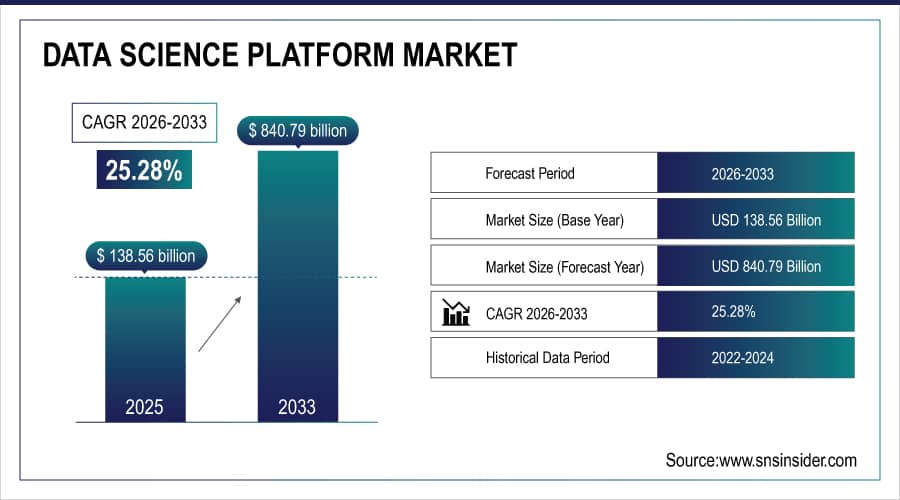

The Data Science Platform Market was valued at USD 138.56 billion in 2025E and is expected to reach USD 840.79 billion by 2033, growing at a CAGR of 25.28% from 2026-2033.

The Data Science Platform Market is growing due to the rising adoption of advanced analytics, AI, and machine learning across industries. Increasing data volumes, demand for predictive insights, and the need for automation in decision-making are driving growth. Additionally, cloud-based deployment, enhanced data integration capabilities, and the push for digital transformation in enterprises are fueling market expansion. The trend toward self-service analytics and data democratization further accelerates adoption globally.

To Get More Information On Data Science Platform Market - Request Free Sample Report

Data Science Platform Market Size and Forecast

-

Market Size in 2025E: USD 138.56 Billion

-

Market Size by 2033: USD 840.79 Billion

-

CAGR: 25.28% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Data Science Platform Market Trends

-

The market is growing due to the rising adoption of advanced analytics, AI, and machine learning across enterprises seeking data-driven decision-making.

-

Increasing volumes of unstructured and semi-structured data from digital interactions, IoT devices, and cloud environments are boosting the need for scalable data science tools.

-

Organizations are investing in platforms that unify data preparation, modeling, deployment, and monitoring to improve productivity and reduce time-to-insight.

-

Cloud-based data science platforms are witnessing rapid growth due to their flexibility, cost-efficiency, and ease of integration with existing enterprise systems.

-

Growing demand for automation in analytics workflows, including AutoML and MLOps, is also accelerating market expansion.

-

Industries such as BFSI, healthcare, retail, manufacturing, and IT are leading adoption to enhance customer insights, optimize operations, and strengthen predictive capabilities.

Data Science Platform Market Growth Drivers:

-

The growing volume of data generated by businesses is driving the demand for advanced analytics and data science platforms to efficiently process and extract valuable information.

The increasing volume of data generated by businesses is one of the primary drivers behind the growing demand for data science platforms. In today's digital age, organizations across all sectors are producing vast amounts of data through various sources such as customer interactions, social media, sensor data, transactions, and more. This massive influx of data, often referred to as "big data," presents both opportunities and challenges. While data offers valuable insights into consumer behavior, market trends, and operational efficiencies, it can be overwhelming to manage and analyze manually.

Moreover, these platforms help businesses unlock hidden insights that traditional data processing methods may miss. As the volume of data continues to grow exponentially, organizations are increasingly turning to advanced data science tools to make sense of it all, improve decision-making, and maintain a competitive edge. The need for more efficient, scalable solutions to manage and extract value from data is pushing the demand for data science platforms higher, fueling growth in this market.

-

Cloud adoption enables companies to leverage scalable, cost-effective data storage and advanced analytics tools, driving the growth of data science platforms.

The adoption of cloud technologies has significantly transformed the landscape of data science platforms. As businesses increasingly move their data storage and computing needs to the cloud, they gain access to scalable, flexible, and cost-effective solutions for data analysis. Cloud adoption allows organizations to process vast amounts of data in real-time without the need for on-premises infrastructure, which often comes with high costs and maintenance challenges.

According to research, the global public cloud services market was forecasted to grow to USD 832.1 billion in 2025, highlighting the increasing reliance on cloud-based solutions. Cloud adoption has also led to reduced time-to-market for data-driven solutions, allowing companies to make faster decisions and gain a competitive edge. Consequently, the shift to cloud-based data science platforms has become a critical factor in the acceleration of analytics capabilities for businesses across various industries.

Data Science Platform Market Restraints:

-

High implementation costs, including infrastructure, tools, and skilled resources, can hinder small to medium-sized enterprises (SMEs) from adopting data science platforms.

High Implementation Costs of data science platforms pose a significant challenge, especially for small and medium-sized enterprises (SMEs). Implementing a data science platform requires substantial upfront investment in both infrastructure and tools. The platform itself needs a robust technological foundation, including data storage systems, processing capabilities, and network infrastructure, which can be expensive to set up.

Cloud-based platforms may offer more affordable subscription models, but even these can be expensive over time, especially if businesses need to scale. With these barriers, SMEs may find it difficult to justify or afford the investment in a comprehensive data science platform. This high initial cost can prevent many businesses from realizing the potential benefits of advanced analytics, ultimately limiting the adoption of data science technologies in smaller companies, which are essential for innovation and competitive advantage.

Data Science Platform Market Segment Analysis

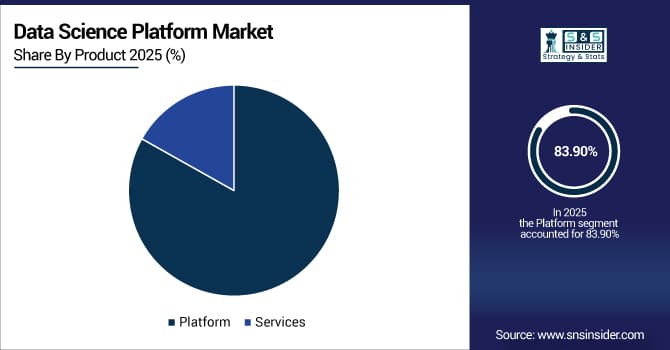

By Product, Platform segment dominated the Data Science Platform Market

In 2025, the platform segment dominated the market with a revenue share of 83.90%. This growth is largely driven by technological advancements, including data mining, advanced computing, and robotics, which enable data scientists to develop, train, scale, and share machine learning algorithms more efficiently. Automation is gaining traction across various industries, making data science platforms essential for industrial progress by streamlining tasks like model training, design, and scaling.

By Application, Marketing and Sales led the Data Science Platform Market

In 2025, the marketing and sales segment dominated the market share over 35.08%. Data science platforms play a pivotal role in equipping marketing and sales teams with deeper insights into customer behavior. Through data analysis, businesses can better understand customer preferences, predict emerging trends, and refine their marketing strategies. Marketing professionals use data insights to make informed decisions about resource allocation, assess campaign performance, and target customer segments with precision.

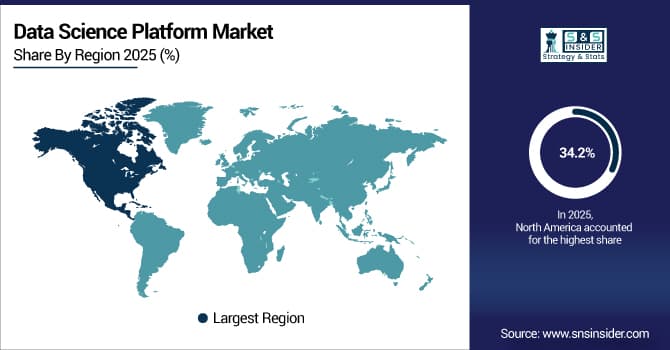

Data Science Platform Market Regional Analysis

North America Data Science Platform Market Insights

In 2025, North America region dominated the market share over 34.2%, driven by its robust technology infrastructure and high concentration of data science talent. The presence of major tech hubs and skilled professionals supports a strong demand for advanced data science solutions as businesses across sectors aim to leverage data-driven insights for strategic advantage. The U.S. remains at the forefront of this trend, especially as sectors like finance, healthcare, and retail increasingly adopt data science to optimize operations and refine decision-making.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Data Science Platform Market Insights

The Asia-Pacific region is experiencing fastest growth in data science adoption, driven by digital transformation and rapid economic progress, particularly in China and India. Government initiatives promoting digital economies, AI, and smart cities further boost data science demand. With rising internet and smartphone usage, vast data generation requires advanced data analysis tools for better decision-making. In India, data science is increasingly essential across sectors like finance, healthcare, and retail, as businesses seek insights for improved efficiency.

Europe Data Science Platform Market Insights

The Europe Data Science Platform Market is expanding rapidly, driven by growing adoption of AI and machine learning across finance, healthcare, and manufacturing. Increasing investments in cloud-based analytics, predictive modeling, and automation solutions are boosting demand. Government initiatives supporting digital transformation and data-driven decision-making further accelerate growth. Additionally, the rising focus on self-service analytics, advanced data visualization, and scalable platforms is strengthening the market’s regional presence and adoption.

Middle East & Africa and Latin America Data Science Platform Market Insights

The Middle East & Africa and Latin America Data Science Platform Market is witnessing steady growth due to rising digital transformation initiatives and increased adoption of AI and machine learning across key sectors like banking, healthcare, and retail. Expanding cloud infrastructure, government support for data-driven strategies, and growing demand for predictive analytics and automation are driving market expansion. Additionally, the focus on scalable, cost-effective data science solutions is enhancing regional adoption.

Data Science Platform Market Competitive Landscape:

SAS Institute

SAS Institute is a global leader in advanced analytics, AI, and data-management software, serving enterprises in finance, healthcare, government, retail, manufacturing, and other regulated industries. Its flagship SAS Viya platform offers end-to-end capabilities for data preparation, machine learning, governance, and model deployment. SAS is recognized for its strong focus on responsible AI, privacy-preserving analytics, and scalable cloud-native workflows, enabling organizations to build, govern, and operationalize enterprise-grade AI solutions efficiently and securely.

-

2025: SAS introduced major SAS Viya innovations such as SAS Data Maker, a synthetic-data generator, along with expanded AI-agent support to improve developer productivity, accelerate model development, and strengthen secure enterprise AI and data-science workflows.

Amazon Web Services (AWS)

Amazon SageMaker, part of Amazon Web Services, is an integrated machine-learning platform designed to help enterprises build, train, deploy, and scale AI models quickly. It supports diverse workloads including generative AI, predictive modeling, analytics, MLOps, and data preparation. The platform integrates deeply with AWS cloud, enabling secure, highly available, and cost-efficient ML development. SageMaker is widely adopted for enterprise AI modernization, operational simplification, and unified ML lifecycle management across industries.

-

2024: AWS launched the next-generation SageMaker, combining data, analytics, and AI into a unified development environment featuring data-lakehouse integration, ML training, analytics, and generative-AI tools in one platform.

Databricks

Databricks is a leading data-intelligence and AI platform built on a unified lakehouse architecture that combines data engineering, analytics, governance, and machine learning in a single environment. It enables organizations to manage structured and unstructured data, build scalable AI models, and streamline data pipelines with strong security and compliance. Databricks supports enterprise-level workloads with collaborative workspaces, open-format data, and automation that accelerates the development of production-ready AI applications.

-

2024: Databricks introduced a streamlined deployment experience on AWS Marketplace, making it easier for enterprises to launch and scale data-science and AI workspaces with reduced setup complexity.

-

2025: Databricks expanded its global footprint by committing to deploy infrastructure in Indonesia (AWS Asia-Pacific Jakarta region), increasing regional access to its data-intelligence services and supporting local digital-transformation initiatives.

Microsoft

Microsoft Fabric is an integrated data-and-AI platform designed to unify data engineering, analytics, real-time intelligence, business intelligence, and machine learning under one architecture. It brings together Power BI, Synapse, Data Factory, and AI capabilities into a single SaaS-based environment, enabling seamless data movement, governance, and analytics automation. Fabric helps enterprises simplify data-estate consolidation, accelerate AI adoption, and scale workloads across hybrid and cloud environments with strong security and performance.

-

2024: Microsoft introduced Fabric Databases, unifying transactional and analytical workloads within Fabric to streamline data-science workflows and improve integration across enterprise data and AI development teams.

Key Players

Some of the major key players of Data Science Platform Market

-

Microsoft Corporation (Azure Machine Learning, Power BI)

-

SAS Institute Inc. (SAS Viya, SAS Visual Data Mining and Machine Learning)

-

Fair Isaac Corporation (FICO) (FICO Analytic Cloud, Decision Management Suite)

-

International Business Machines Corporation (IBM Corporation) (IBM Watson Studio, IBM SPSS)

-

SAP SE (SAP Analytics Cloud, SAP Leonardo)

-

Teradata Corporation (Teradata Vantage, Teradata Aster)

-

Alteryx, Inc (Alteryx Designer, Alteryx Server)

-

Dataiku SAS (Dataiku DSS - Data Science Studio)

-

RapidMiner Inc. (RapidMiner Studio, RapidMiner AI Hub)

-

MathWorks Inc. (MATLAB, Simulink)

-

Google LLC (Google Cloud AI, TensorFlow)

-

Amazon Web Services, Inc. (AWS) (Amazon SageMaker, AWS Data Pipeline)

-

TIBCO Software Inc. (TIBCO Data Science, TIBCO Spotfire)

-

Cloudera, Inc. (Cloudera Data Science Workbench, Cloudera Machine Learning)

-

Databricks Inc. (Databricks Lakehouse, Databricks Machine Learning)

-

H2O.ai (H2O Driverless AI, H2O Open Source)

-

Anaconda, Inc. (Anaconda Distribution, Anaconda Enterprise)

-

Oracle Corporation (Oracle Data Science, Oracle Autonomous Data Warehouse)

-

Datarobot, Inc. (DataRobot AI Platform)

-

Domino Data Lab, Inc. (Domino Enterprise MLOps Platform)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 100.09 Billion |

| Market Size by 2033 | USD 760.03 Billion |

| CAGR | CAGR of 25.28% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Platform, Services) • By Application (Marketing and Sales, Logistics, Finance and Accounting, Customer Support, Others) • By Vertical (IT & Telecommunication, Healthcare, BFSI, Manufacturing, Retail, Energy and Utilities, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft Corporation, SAS Institute Inc., Fair Isaac Corporation (FICO), International Business Machines Corporation (IBM), SAP SE, Teradata Corporation, Alteryx, Inc., Dataiku SAS, RapidMiner Inc., MathWorks Inc., Google LLC, Amazon Web Services, Inc. (AWS), TIBCO Software Inc., Cloudera, Inc., Databricks Inc., H2O.ai, Anaconda, Inc., Oracle Corporation, Datarobot, Inc., Domino Data Lab, Inc. |