Architectural, Engineering, And Construction Services Market Report Scope & Overview:

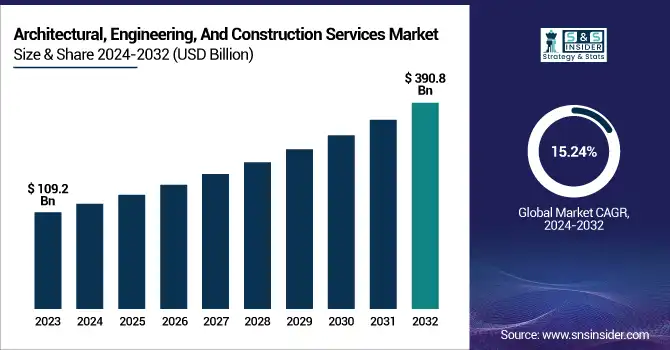

The Architectural, Engineering, And Construction Services Market was valued at USD 109.2 billion in 2023 and is expected to reach USD 390.8 billion by 2032, growing at a CAGR of 15.24% from 2024-2032.

To Get more information on Architectural, Engineering, And Construction Services Market - Request Free Sample Report

This report consists of an analysis of key trends in the Architectural, Engineering, and Construction Services Market, focusing on technological advancements and sustainability. BIM adoption rates vary by region, with developed markets leading in digital transformation while emerging economies are gradually integrating the technology. Construction project digitalization differs by sector, with commercial and industrial projects leveraging AI, IoT, and cloud-based collaboration tools. Sustainable construction material usage is increasing, with regional differences driven by regulations and green building initiatives. Infrastructure investment trends from 2020 to 2025 highlight government and private sector spending priorities. The report also explores AI-driven design automation, modular construction growth, and advancements in smart infrastructure solutions.

The U.S. Architectural, Engineering, and Construction Services Market is growing due to BIM adoption, sustainable construction demand, and smart infrastructure investments. Advancements in AI, IoT, and digital twins enhance efficiency and reduce costs. The market is expected to grow at a CAGR of 14.89% through 2032, driven by urbanization, infrastructure modernization, and modular construction trends.

Architectural, Engineering, And Construction Services Market Dynamics

Driver

-

Increasing use of BIM, AI, IoT, and digital twins enhances efficiency, collaboration, and project management.

The increasing integration of Building Information Modeling, AI, IoT, and digital twin technologies is revolutionizing the Architectural, Engineering, and Construction Services Market. These technologies improve project planning, streamline workflows, and enhance collaboration among stakeholders, reducing errors and construction delays. The growing demand for cloud-based collaboration platforms and automation further accelerates digital transformation in the sector. Additionally, government mandates and incentives for BIM adoption are driving widespread implementation, particularly in large-scale infrastructure projects. As companies prioritize efficiency and sustainability, the adoption of smart construction technologies continues to grow, leading to cost savings, optimized resource allocation, and improved project outcomes.

Restraint

-

The high cost of digital tools and workforce training limits adoption, especially for small and mid-sized firms.

Although digital technologies offer various benefits, the hefty price of BIM software, AI-based applications, and IoT infrastructure acts as a major hurdle in wide-scale adoption. Budget restrictions make it hard for small and medium-sized construction firms to spend on cutting-edge technologies. Furthermore, there is a significant degree of practical training required for employees to move from conventional construction approaches to digital platforms, which can be expensive and lengthy. Adoption rates are also hindered by resistance to change and the complexity of integrating or layering new technologies over existing systems. This is causing widespread digital transformation hurdles, which, in developing territories, should be noted that financial barriers and skilled labor lack are the most serious barriers to overcome.

Opportunity

-

Rising demand for eco-friendly materials and energy-efficient buildings drives innovation and regulatory support.

The introduction of sustainable tools would help this AEC Servicing Market grow vigorously as upcoming demand for the services for green building products, energy-efficient layouts, and net-zero carbon initiatives. The world's governments are now regulating strictly as well as incentivising the use of greener methods to build, leading to an increase in the adoption of more sustainable practices. The industry is evolving to reduce waste and improve cost efficiency with technologies like 3D printing, prefabrication, and recycled materials. Moreover, the trend for LEED-certified buildings and smart cities is further propelling innovation in sustainable construction. Since consumers and businesses are increasingly focusing on sustainability, the green building market is predicted to grow, paving the prospect of new revenue streams for AEC firms.

Challenge

-

A lack of skilled workers and the need for digital expertise hinder project execution and market growth.

The Architecture, Engineering, and Construction industry has been plagued with a labour shortage for several years, characterized by an increasing disconnect between the demand for skilled workers and the skilled labour pool. The problem is worse because of an aging labor force that is not being replaced by sufficient new talent entering construction-related fields. Moreover, the rapid adoption of advanced construction technologies necessitates expertise in BIM modeling, AI-driven analytics, and automation, leading to a skill gap in the industry. Construction companies are putting money into worker training interventions and apprenticeships to tackle this, but the shortfall is still a significant challenge. The lack of a skilled workforce can cause the market to slow down, causing delays, increasing costs, and inefficiencies.

Architectural, Engineering, And Construction Services Market Segmentation Analysis

By Service

The digital services segment dominated the market and held the largest revenue share in 2023. One of the key factors contributing to the growth of the digital services market in the AEC is cloud computing. Cloud-based solutions provide real-time access to project data, allowing architects, engineers contractors to collaborate, communicate, and share information remotely. These tools facilitate better project transparency, version control, and easy access to updated designs or documents, which in turn accelerates decision-making and execution of the project.

The city planning services segment is expected to experience significant growth in the years 2024 to 2032 due to growing urbanization. While most emerging economies undergo rapid urbanization, it remains uncertain how population growth across cities translates into urban population growth. The United Nations projects that more than two-thirds of the world’s population will live in urban areas by 2050, and city planning will need to adapt to integrate all aspects of urban life, infrastructure, housing, transportation, and all public services.

By Sector

The real estate segment dominated the market and held the largest share of revenue in 2023. Technology plays a major role in enhancing the real estate industry. Technologies such as Building Information Modeling, virtual reality, and artificial intelligence are utilized to enhance the design, planning, and management of real estate projects. For example, BIM enables more precise design and construction, minimizing the chances of expensive mistakes and rework.

The data centers sector is estimated to expand at a significant CAGR during the forecast period. Cloud computing and digital transformation initiatives across various industries are among the major drivers of data center development. With companies transitioning to the cloud for their operations and storage needs, the number of massive data centers is increasing.

By transportation Infrastructure

In 2023, the highways segment dominated the market and accounted for 41% of revenue share, owing to heavy government investment in highway infrastructure worldwide. Many nations are launching massive projects to update and expand their road systems. The U.S. Infrastructure Investment and Jobs Act allocated USD 128 billion in highway and bridge formula funds in March 2024, resulting in the start of over 70,200 new projects.

The aviation segment is expected to register the fastest CAGR during the forecast period, driven by Use of Advanced technologies in airport operations is revolutionizing the aviation sector. Automated baggage handling systems, biometric identification, and smart security screening are also in the works to improve the experience of traveling through the airport and the operational scalability of the airport process.

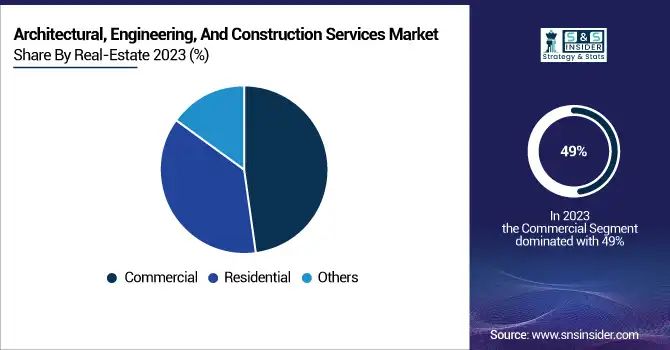

By Real-Estate

The commercial segment dominated the market and accounted for 49% revenue share, in 2023. The commercial real estate segment is undergoing a fundamental transformation, though the sector that is transforming the most is retail, all thanks to e-commerce. Where traditional brick-and-mortar stores have struggled, logistics and distribution center demand has boomed — serving as an extension of the e-commerce supply chain. AEC firms are taking a more active role in delivering last-mile distribution centers, warehouses, and mixed-use retail locations that couple stores with e-comm fulfillment.

Residential segment is projected to witness the fastest CAGR growth from 2024 to 2032. Urban renewal and redevelopment projects to breathe new life into aging neighbour hoods and expand housing are being pursued by cities across the state. These projects often involved the renovation of existing structures or land that is underutilized, opened up new spaces for residential growth and attracted private investment and public interest.

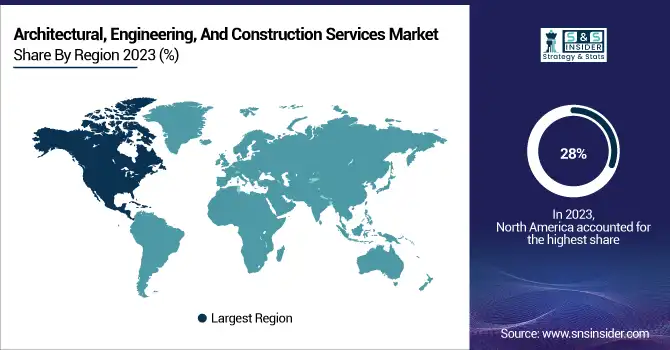

Regional Landscape

North America dominated the market and accounted for 28% of revenue share in 2023, The AEC industry is using technology more and more to enhance productivity and coordination. These tools include Building Information Modeling, project management software, and virtual reality, which are increasingly used to improve design accuracy and streamline workflows.

Asia Pacific is expected to register the fastest CAGR during the forecast period, driven by Rapid urbanization in many countries, especially developing economies like India, Indonesia, and Vietnam, which translates to significant growth in the Asia Pacific region. With populations moving towards metropolitan areas in pursuit of better opportunities, the need for housing, commercial establishments, and infrastructure are rapidly increasing. Governments and private developers are investing in new housing, transportation networks, and public utilities to support this urbanization trend, resulting in strong demand for AEC services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

AECOM – AECOM Construction Management Services

-

Bechtel Corporation – Bechtel EPC Services

-

Fluor Corporation – Fluor Design-Build Services

-

Jacobs Engineering Group – Jacobs Digital Twin Solutions

-

Turner Construction Company – Turner Building Solutions

-

Skanska AB – Skanska Green Building Solutions

-

Kiewit Corporation – Kiewit Infrastructure Engineering

-

HDR, Inc. – HDR Sustainable Design Services

-

Stantec Inc. – Stantec BIM Consulting

-

SNC-Lavalin Group – SNC-Lavalin Project Management

-

Arup Group – Arup Smart Cities Solutions

-

Perkins and Will – Perkins and Will Architectural Design

-

HOK Group, Inc. – HOK Sustainable Architecture

-

Gensler – Gensler Interior Design Solutions

-

Thornton Tomasetti – Thornton Tomasetti Structural Engineering

Recent Developments

-

In June 2024, New Mountain Capital acquired Consor Holdings, a civil infrastructure planning and engineering design firm, aiming to enhance its presence in transportation and water markets.

-

In May 2024, Tower Engineering Professionals (TEP) acquired Piedmont Utility Group, a provider of utility construction services, to expand TEP's expertise in fiber optics and meet growing telecom infrastructure demand.

-

In May 2024, GAI Consultants acquired Creighton Manning, a transportation engineering and planning firm, to bolster GAI's capabilities in highway and bridge design.

-

In April 2024, Godspeed Capital acquired Infrastructure Consulting & Engineering (ICE), establishing ICE as their new transportation-focused engineering and consulting services platform.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 109.2 Billion |

|

Market Size by 2032 |

US$ 390.8 Billion |

|

CAGR |

CAGR of 15.24 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Service (Digital Services, Sustainability Services, Technical Engineering, City Planning Services, Built Environmental Advisory) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

AECOM, Bechtel Corporation, Fluor Corporation, Jacobs Engineering Group, Turner Construction Company, Skanska AB, Kiewit Corporation, HDR Inc., Stantec Inc., SNC-Lavalin Group, Arup Group, Perkins and Will, HOK Group Inc., Gensler, Thornton Tomasetti |