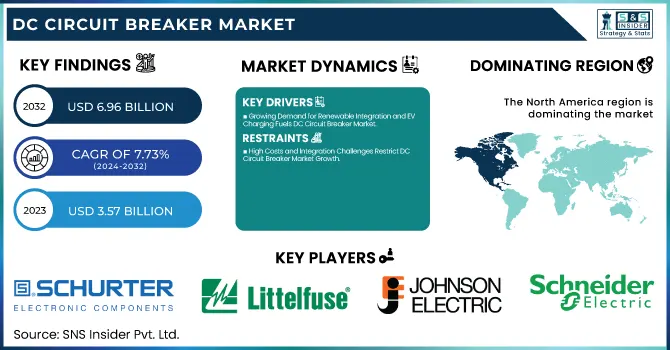

DC Circuit Breaker Market Size & Growth:

The DC Circuit Breaker Market Size was valued at USD 3.57 billion in 2023 and is expected to reach USD 6.96 billion by 2032, growing at a CAGR of 7.73% over the forecast period 2024-2032. The adoption of several DC Circuit Breaker technologies is primarily being driven by an increase in operational efficiency and performance metrics such as enhanced breaking capacity, faster switching speeds, and improved energy efficiency which are essential to some degree for the integration of renewable energy and smart grid application. Trends in industry and technology adoption indicate a move to solid-state and hybrid breakers due to their small footprint and high reliability.

To Get more information on DC Circuit Breaker Market - Request Free Sample Report

Supply chain and distribution exercise show issues in obtaining the parts for producing most critically referred to as properly as in virtual income structures experiencing a rising role. The patent analysis and innovation index suggests steady research and development investment in environmentally sustainable insulation technologies and advanced circuit protection solutions, paving the way for technology evolution in the market.

DC Circuit Breaker Market Dynamics

Key Drivers:

-

Growing Demand for Renewable Integration and EV Charging Fuels DC Circuit Breaker Market

Increasing demand for renewable integration and EV charging infrastructure to drive the DC circuit breaker market. The rise of renewable energy sources, such as solar and wind, creates high demand for efficient power transmission and distribution, consequently driving demand for reliable DC circuit breakers. In addition, the rise of electric vehicles requires large-volume charging networks, which catalyzes the market propagation. This demand is also being aided by urbanization and industrialization in emerging economies. However, initiatives and regulations implemented by the government, to encourage the utilization of energy-efficient electrical components are expected to increase the adoption of DC circuit breakers in residential, commercial, and industrial applications.

Restrain:

-

High Costs and Integration Challenges Restrict DC Circuit Breaker Market Growth

The significant cost of advanced DC circuit breaker systems can be a key restraint for the DC Circuit Breaker market, especially for small and medium-sized enterprises. Low-voltage DC systems are more complex to design and maintain than AC systems, further limiting their more widespread adoption. Bridging the integration gap: Integration is complicated by compatibility issues with existing infrastructure. Additionally, the absence of uniform regulations in different geographies creates a climate of uncertainty that hampers market growth. For example, economic downturns and budget constraints within certain sectors can also hinder investment in power infrastructure upgrades.

Opportunity:

-

Growing Renewable Integration and Smart Grids Create Opportunities for DC Circuit Breaker Market

With the long-distance power transmission and interconnection of renewable energy grids, the DC circuit breaker, especially the high-voltage DC circuit breaker, will face significant growth opportunities. The increasing trend towards smart grid infrastructure and digitalization in power systems also presents valuable opportunities for market players. Technological innovations in lightweight, lightweight, and sustainable insulation materials are likely to improve product performance, opening doors for manufacturers. Moreover, rising infrastructure construction and development investments, especially in the Asia Pacific and Middle Eastern countries, create massive opportunities for growth. Further market opportunities are seen to be stimulated through collaborations and strategic partnerships for regional expansion and technology advancement.

Challenges:

-

Technical Challenges and Environmental Concerns Hinder DC Circuit Breaker Development

One relatively important restriction upon the development implementation of circuit-breakers capable of switching high voltage DC currents would be the technical obstacles of maintaining arc extinction, and insulating strength inside the Breakers. High DC currents are difficult to interrupt reliably and efficiently, necessitating advanced technology to reap the benefits of DC while also adding to the complexity and cost of developing a product. Another issue is the scarcity of professionals who are skilled in designing and maintaining DC systems. Moreover, the pressure from existing well-established AC circuit breakers and the continuous demand for innovation for carrying complete energy demand renders challenges to the manufacturers. Market growth is hampered due to environmental hazards caused by the use of specific insulation gases which is in more need for environment-friendly alternatives.

DC Circuit Breaker Market Key Segments

By Type

The Hybrid DC circuit breaker accounted for the largest share of 54.6% in the DC circuit breaker marketing in 2023, owing to its reliability, fast switching characteristics, compact design, and high cost-effectiveness. They indeed serve as a hybrid of mechanical and electronic devices and play an important role, especially in power distribution systems, as an efficient and improved solution for providing protection. The ability to implement them for renewable energy integration and electric vehicle charging infrastructure also played a large role in propelling their market share.

Solid State DC circuit breakers are expected to grow at the fastest CAGR from 2024 to 2032. They get adopted quickly because of the requirement for systems that are compact, maintenance-free, and offer very good efficiency. As we cannot forget, solid-state breakers provide comparatively high switching speed, energy-efficient performance, and greater reliability than thermal breakers, making them suitable for futuristic smart grid and electric mobility applications.

By Insulation

Vacuum DC circuit breakers accounted for a whopping 61.7% of the market share in 2023, due to favorable attributes such as high reliability, safety, and efficient arc extinction. These proved their worth in industrial and commercial setups through sturdy performance for medium and high-voltage applications with minimal maintenance. Increasing demand for renewable energy integration and modernization of the power grid also helped them cement their position in the market.

Gas DC circuit breakers will witness the highest CAGR during the forecast period from 2024-2032. Such growth is attributed to their high insulation properties and high voltage applications. Moreover, the surging investments for the smart grid infrastructure and long-distance power transmission systems are further elevating the demand for gas-insulated DC circuit breakers, thereby making it one of the major growth segments in the market.

By Voltage

Medium Voltage DC circuit breakers had the largest market share of 47.8% in 2023 owing to their high usage in industrial, commercial, and renewable energy applications. Due to their low maintenance, affordability, and ability to manage moderate power loads, they were the preferred option for power distribution networks and infrastructure projects. Rising urbanization and the development of smart grid systems also helped to hold a dominant position in the market.

High Voltage DC circuit breakers are expected to grow at the fastest CAGR from 2024 to 2032. The increasing need for long-distance power transmission and interconnection of renewable energy sources is driving this growth. They are important to high-voltage direct current (HVDC) systems due to their superior performance in high-power applications and increased safety. Furthermore, the high-voltage DC circuit breaker is witnessing a rise in demand due to government investments aimed at upgrading decrepit power infrastructure including efficient electric vehicle charging network deployment.

By End Use

Transmission & Distribution Utilities accounted for more than 43.6% share of the DC circuit breaker industry in 2023 owing to reliable power distribution, and grid stability. Their leadership in the market can be attributed to the modernization of aging infrastructure and the expansion of smart grid networks. They had a vital role in enabling efficient power flow and help in avoiding outages and this made them irreplaceable across residential, commercial as well as industrial sections.

Renewables are also poised to experience the highest compound annual growth rate (CAGR) between 2024 and 2032. This growth is driven by the increasing volume of solar and wind energy installations that necessitate effective DC power management and connection solutions to the grid. The demand for advanced direct current circuit breakers in the sector is gaining traction due to growing investments in renewable energy projects and government incentives for clean energy penetration. The renewables sector will emerge as an important growth factor for the DC circuit breaker market, with the world moving towards sustainable energy.

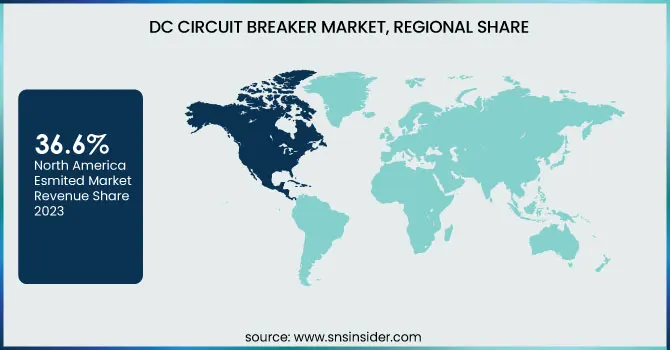

DC Circuit Breaker Market Regional Overview

North America accounted for the largest share of the DC circuit breaker market in 2023, with a share of 36.6%. The growth of North America's DC circuit breaker market is attributed to the developed power infrastructure, high penetration of renewable energy, and investments in smart grid. This was followed by the increasing modernization of aging electrical networks and EV charging infrastructure that complemented market growth in the region. As an example, the Infrastructure Investment and Jobs Act of the U.S. government setting aside huge funds to modernize the grid and develop renewable energy has accelerated the demand for advanced DC circuit breakers. In North America, the market is being driven by the replacement of power distribution systems by large utility companies such as Pacific Gas and Electric (PG&E) and Duke Energy.

Asia Pacific is projected to exhibit the fastest compound annual growth rate (CAGR) over the forecast period from 2024 to 2032, owing to rapid urbanization and industrial-based economies along with rising capacity for renewable energy. China in addition to India, and Japan trends toward integrating renewable energy and super-high voltage electricity networks. Examples include China account expansion ultra-high voltage (UHV) DC transmission projects to enable integration of remote renewables. In the same way, India's Green Energy Corridor project focuses on strengthening the power transmission system for renewable energy. These developments are resulting in high growth opportunities for Asia-Pacific DC circuit breaker manufacturers in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the DC Circuit Breaker Market are:

-

Schurter (Fuses, Circuit Breakers for Equipment)

-

Littelfuse (Fuses, Electronic Switches)

-

Square D (Safety Switches, Circuit Breakers)

-

Hager Group (Residual-Current Circuit Breakers, Miniature Circuit Breakers)

-

Hawker Siddeley Switchgear (Overhead Line Equipment, Indoor Switchgear)

-

Johnson Electric (Circuit Breakers, Electronic Switches)

-

ABB (SACE Tmax PV, Emax 2)

-

Eaton (DC Circuit Breakers, Photovoltaic Circuit Breakers)

-

Siemens (5SY Series, 3KC Series)

-

Schneider Electric (Acti 9 iC60, Compact NSX)

-

Mitsubishi Electric (WS-V Series, NF Series)

-

Legrand (DX³ Series, DPX³ Series)

-

Fuji Electric (BW Series, CP Series)

-

Hitachi (HWB Series, HCV Series)

-

Toshiba (V Series, G Series)

Recent Trends

-

In August 2024, Mitsubishi Electric and Siemens Energy partnered to co-develop DC Switching Stations and DC Circuit Breaker specifications, advancing Multi-terminal HVDC systems for renewable energy integration.

-

In March 2024, Schneider Electric launched the MasterPacT MTZ Active, a low-voltage air circuit breaker that enhances power distribution with real-time energy monitoring and advanced safety features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.57 Billion |

| Market Size by 2032 | USD 6.96 Billion |

| CAGR | CAGR of 7.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solid State, Hybrid) • By Insulation (Vacuum, Gas) • By Voltage (Low Voltage, Medium Voltage, High Voltage) • By End Use (Transmission & Distribution Utilities, Power Generation, Renewables, Railways) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schurter, Littelfuse, Square D, Hager Group, Hawker Siddeley Switchgear, Johnson Electric, ABB, Eaton, Siemens, Schneider Electric, Mitsubishi Electric, Legrand, Fuji Electric, Hitachi, Toshiba. |