Digital Badges Market Report Scope & Overview:

To Get More Information on Digital Badges Market - Request Sample Report

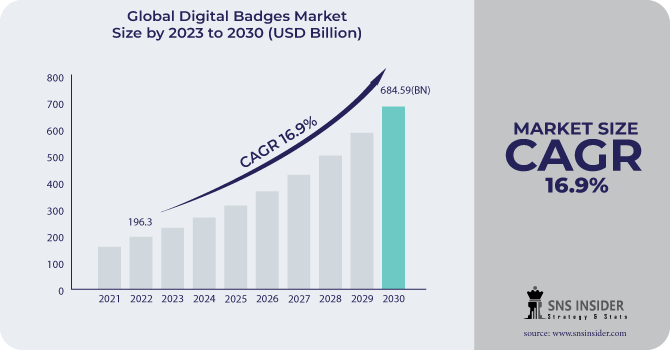

The Digital Badges Market Size was valued at USD 208.05 Million in 2023 and is expected to reach USD 921.78 Million by 2032 and grow at a CAGR of 18.01% over the forecast period 2024-2032.

The digital badges market is rapidly expanding within the broader landscape of digital credentials and e-learning. With educational institutions and industries embracing online learning platforms for professional development, digital badges have become essential for validating and showcasing skills in a seamless, standardized manner. The surge in online education, now favored by 70% of students globally, and its widespread adoption among corporate entities are driving the demand for tools that track and certify achievements. Online learning, with benefits like higher retention rates and up to 60% reduced learning time, has transformed both education and corporate training. In the U.S. alone, 63% of students engage daily in online learning, reflecting a significant shift towards digital ecosystems, which directly supports the growth of the digital badges market. Digital badges provide a flexible and interactive alternative to traditional certificates and diplomas, aligning with the global trend toward lifelong learning. By enhancing learner motivation and engagement, these badges enable measurable performance improvements. For organizations, implementing digital badges can boost employee productivity by 25% through effective online training programs.

In the corporate sector, digital badges are pivotal for workforce development and upskilling initiatives. Companies leverage these tools to validate employee training, recognize achievements, and promote a skills-based culture. For instance, IBM and Microsoft utilize digital badges to certify expertise in high-demand areas like cloud computing, AI, and cybersecurity, motivating employees while enabling employers to identify skill gaps and design targeted training programs. As industries such as technology, healthcare, and finance increasingly prioritize continuous skill development to stay competitive, the demand for digital credentialing solutions like digital badges is expected to grow exponentially. These badges bridge the gap between education and employment, making them a cornerstone in the evolution of online learning and workforce training.

Digital Badges Market Dynamics

Drivers

-

There is a growing emphasis on skills-based hiring and employee development which drives the market growth.

Employers and schools are more and more interested in finding methods to acknowledge and verify particular skills and achievements on a smaller scale. Typical certificates and diplomas frequently lack sufficient information about a person's particular skills and abilities. Digital badges address this issue by providing a comprehensive, verified, and personalized display of a learner's accomplishments. They provide a more complete look at an individual's skills, helping potential employers evaluate candidates based on relevant abilities. Digital badges have been widely adopted in different sectors like education, healthcare, technology, and business due to the capability to showcase, distribute, and confirm credentials online. The increasing need for accurate credentialing is a significant factor in the growth of the digital badges market.

-

The increasing shift toward online learning and e-learning platforms has significantly contributed to the digital badges market.

As more educational institutions, corporations, and independent learners turn to online learning for training, development, and certification, there is a growing need for a reliable and recognized way to demonstrate the competencies acquired. Online courses, webinars, and virtual workshops are often short-term and highly specialized, making traditional accreditation methods less relevant. Digital badges allow learners to showcase their specific skills and achievements in these non-traditional settings, providing both immediate recognition and long-term value. With the rise of platforms such as Coursera, Udemy, LinkedIn Learning, and others, the need for digital badges to validate the skills gained from these platforms has skyrocketed, driving the market forward. This trend is further accelerated by the increasing integration of digital badge systems with learning management systems (LMS) and course delivery platforms, making it easier for users to earn and share badges as they progress through educational content.

Restraints

-

Integrating digital badge systems with existing learning management systems (LMS), can pose significant technical challenges.

Many educational institutions and businesses have established systems in place for tracking certifications, qualifications, and professional development, and the transition to digital badges may require significant investment in new technologies and infrastructure. Additionally, the process of issuing, managing, and verifying digital badges can be complex, particularly if different organizations or industries are using different badge platforms. For example, a learner may earn multiple badges from different providers, but these badges might not be compatible with each other or easy to share across platforms. The lack of seamless integration between badge systems and existing infrastructure could be a deterrent for organizations considering the adoption of digital badges, thus restraining market growth.

Digital Badges Market Segmentation Analysis

By Type

In 2023, the certification badges segment led the digital badges market with a 38% market share. These badges authenticate an individual's proficiency or knowledge in a specific skill or subject, making them essential in industries like IT, healthcare, and education. Organizations like Coursera and Credly use certification badges to verify skills gained through their courses. IT companies, such as Microsoft and Cisco, leverage certification badges to validate expertise in software, hardware, or networking technologies, boosting employee credentials. Additionally, universities and training platforms integrate certification badges into their programs, ensuring students and professionals receive industry-recognized qualifications.

Achievement badges segment is expected to have the fastest CAGR during 2024-2032, due to their role in motivating and rewarding performance. These badges celebrate milestones, such as completing a challenging project or excelling in a competition. Educational platforms like Khan Academy and corporate training solutions such as SAP SuccessFactors employ achievement badges to incentivize users to achieve goals. In gaming, companies like Epic Games and Blizzard Entertainment use these badges to enhance user engagement by acknowledging gaming accomplishments. The growth is driven by increasing gamification trends in education and corporate environments, where organizations aim to drive productivity and engagement.

By Offering

The services segment held a 38% market share and led the market in 2023. Services encompass implementation, integration, training, support, and maintenance offered by solution providers to help organizations efficiently deploy and utilize digital badge platforms. These services ensure smooth adoption and effective utilization of badges for credentialing, employee recognition, and learning programs. Educational platforms such as Coursera rely on such services to design and issue badges for their courses. The demand for professional guidance and seamless platform deployment has contributed to this segment's dominance.

The platform segment is expected to be the fastest-growing in the digital badges market during 2024-2032, driven by advancements in SaaS and cloud-based solutions. These solutions are increasingly adopted by businesses, educational institutions, and certification providers seeking scalable, automated, and cost-effective systems for credentialing. In the education sector, institutions like Harvard University deploy badge platforms to certify course completions. The scalability and innovation in platform capabilities ensure their rapid adoption and integration into diverse organizational structures.

Digital Badges Market Regional Overview

North America led the digital badges market in 2023 with a 38% market share, primarily driven by advancements in education technology, corporate training, and e-learning platforms. The United States and Canada are key contributors, with extensive adoption in sectors such as education, IT, healthcare, and professional certifications. Companies in North America, such as Credly, Badgr, and Pearson, leverage digital badges to support skills verification and employee upskilling programs. Corporate training initiatives focus on gamification and micro-credentialing to improve workforce capabilities. Education institutions like MIT and Stanford use digital badges for credentialing and recognizing student achievements. Moreover, the region benefits from robust IT infrastructure and partnerships between EdTech companies and enterprises to integrate badge systems into Learning Management Systems (LMS).

APAC is anticipated to become the fastest-growing region during 2024-2032, fueled by the rapid digitization of education and increasing demand for skill recognition in emerging economies like India, China, and Southeast Asia. Governments and organizations are promoting digital credentials to enhance employability and bridge skills gaps. Companies like Accredible and Forall Systems are expanding their presence to cater to the region's growing need for e-learning tools. Schools and universities are integrating digital badges into online learning platforms to encourage participation and track progress. For example, Coursera and Edmodo collaborate with institutions in APAC to deliver badge-enabled courses.

.png)

Do You Need any Customization Research on Digital Badges Market - Enquire Now

Key Players in Digital Badges Market

The major key players in the Digital Badges Market are:

-

Credly (Acclaim, Learning Paths)

-

Badgr (Badges, Skill Paths)

-

Pearson (Acclaim, Digital Badges)

-

Accredible (Blockchain-Verified Badges, Certificates)

-

Canvas by Instructure (Digital Badges, Mastery Pathways)

-

openbadges (Open Badges, Open Badge Exchange)

-

Tribal Habits (Custom Badges, eLearning Courses)

-

Top Hat (Badges, Course Engagement Tools)

-

YouEarnedIt (Employee Engagement Badges, Rewards)

-

Skillshare (Teacher Badges, Course Completion Badges)

-

Moodle (Course Badges, Completion Badges)

-

Classcraft (Achievement Badges, Classroom Engagement Badges)

-

Adobe (Adobe Certified Expert, Adobe Badges)

-

Salesforce (Trailhead Badges, Certifications)

-

Microsoft (Microsoft Learn Badges, Certifications)

-

IBM (IBM Digital Badges, Certifications)

-

Parchment (E-Certificates, Digital Badges)

-

FutureLearn (Course Completion Badges, Learning Achievements)

-

Coursera (Course Completion Badge, Specialization Badges)

-

edX (Verified Certificates, MicroMasters Badges)

Companies Using Digital Badges:

-

IBM

-

Salesforce

-

Microsoft

-

Accenture

-

PwC

-

Unilever

-

Cognizant

-

Capgemini

-

SAP

-

LinkedIn

Recent Development

-

March 2024: IBM launched the Mainframe Skills Council at the SHARE conference in Orlando this week, aiming to create a platform for global organizations to develop a capable, varied, and long-lasting workforce for the mainframe industry.

-

March 2024: The ATD Certification Institute chose to use Credly's Acclaim platform to provide digital badges to certify recipients as a recognition of their demonstrated skills and knowledge.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 208.05 Million |

| Market Size by 2032 | USD 921.78 Million |

| CAGR | CAGR of 18.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Platform, Services) • By Type (Certification Badges, Recognition Badges, Participation Badges, Achievement Badges, Contribution Badges) • By End User (Academic, Corporate, Government, Non-profit Organizations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Credly, Badgr, Pearson, Accredible, Canvas by Instructure, openbadges, Tribal Habits, Top Hat, YouEarnedIt, Skillshare, Moodle, Classcraft, Adobe, Salesforce, Microsoft, IBM, Parchment, FutureLearn, Coursera, edX |

| Key Drivers | • In today's competitive job market, there is a growing emphasis on skills-based hiring and employee development which drives the market growth. • The increasing shift toward online learning and e-learning platforms has significantly contributed to the digital badge market. |

| RESTRAINTS | • Integrating digital badge systems with existing learning management systems (LMS), can pose significant technical challenges. |