Tensor Processing Unit Market Report Scope & Overview:

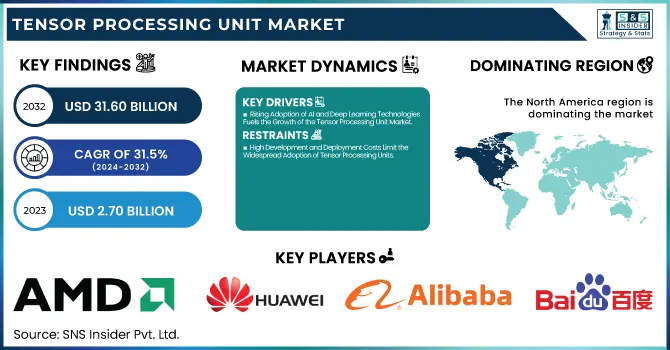

The Tensor Processing Unit Market Size was valued at USD 2.70 Billion in 2023 and is expected to reach USD 31.60 Billion by 2032 and grow at a CAGR of 31.5% over the forecast period 2024-2032.

To Get more information on Tensor Processing Unit Market - Request Free Sample Report

The Market is rapidly growing due to rising demand for AI acceleration in deep learning and machine learning. TPUs, optimized for neural network computations, are widely used in cloud computing, autonomous vehicles, healthcare, and finance. Tech giants like Google, NVIDIA, and Intel are enhancing TPU efficiency, speed, and energy consumption. Cloud providers such as Google Cloud TPU, AWS, and Microsoft Azure are integrating TPUs for faster processing and lower latency. With increasing edge AI applications in smart surveillance, robotics, and IoT, along with advancements in quantum computing and AI chipsets, the market continues to evolve.

Tensor Processing Unit Market Dynamics

Key Drivers:

-

Rising Adoption of AI and Deep Learning Technologies Fuels the Growth of the Tensor Processing Unit Market

The increasing demand for AI-driven applications, deep learning, and machine learning algorithms is a major driver for the Tensor Processing Unit (TPU) Market. As industries shift towards AI-powered automation, data analytics, and natural language processing (NLP), TPUs are becoming essential for accelerating neural network computations. Major cloud service providers like Google Cloud, AWS, and Microsoft Azure are integrating TPUs into their AI infrastructures to deliver higher efficiency, lower latency, and improved scalability. Sectors such as healthcare, finance, autonomous vehicles, and robotics are increasingly utilizing TPUs to enhance computing capabilities. Additionally, the rise of generative AI, including large language models (LLMs) like ChatGPT and Bard, has driven the need for high-performance AI accelerators. As AI adoption continues to expand across industries, the demand for TPUs will grow exponentially, making them a critical component in the future of AI-driven computing.

Restraint

-

High Development and Deployment Costs Limit the Widespread Adoption of Tensor Processing Units

Despite their efficiency, the high cost of designing, manufacturing, and deploying Tensor Processing Units (TPUs) remains a significant barrier to market growth. TPUs require specialized hardware architectures, making them expensive to develop compared to traditional GPUs and CPUs. Additionally, integrating TPUs into existing AI infrastructure demands high initial investment, preventing small and medium-sized enterprises (SMEs) from adopting these advanced AI accelerators. Cloud-based TPU services help reduce upfront costs, but the long-term subscription and operational expenses remain high. Moreover, TPUs require optimized software and AI models, making it necessary for businesses to invest in training and development for AI professionals. The lack of open-source TPU alternatives and compatibility issues with certain AI frameworks further slows adoption. While TPUs offer unparalleled speed and efficiency, their high costs and implementation challenges continue to restrict broader market penetration.

Opportunity:

-

Growing Demand for Edge AI and IoT Solutions Expands the Tensor Processing Unit Market

The rising demand for Edge AI and IoT-based applications presents a significant growth opportunity for the Tensor Processing Unit (TPU) Market. As industries focus on real-time processing, reduced cloud dependency, and faster AI-driven insights, TPUs are becoming essential for edge computing. Smart surveillance, autonomous drones, robotics, and healthcare monitoring systems are key sectors benefiting from TPU-powered AI acceleration at the edge. Companies like Google, NVIDIA, and Intel are investing in compact and energy-efficient TPUs to enable AI processing closer to the data source. The integration of TPUs in consumer electronics, self-driving cars, and industrial automation further expands their market potential. As AI inference at the edge gains momentum, TPUs will play a crucial role in enhancing real-time decision-making, security, and operational efficiency. The push toward low-latency AI processing will continue to drive TPU adoption in next-generation IoT ecosystems.

Challenge:

-

Limited Availability of Skilled AI Professionals Slows the Adoption of Tensor Processing Units in Various Industries

The lack of skilled AI professionals and engineers proficient in TPU-based architectures and software frameworks remains a major challenge for market expansion. Unlike traditional GPU and CPU-based AI processing, TPUs require specialized programming skills and knowledge of frameworks like TensorFlow and JAX. Many businesses struggle to integrate TPUs into their existing AI infrastructure due to a shortage of trained personnel capable of optimizing AI models for TPU acceleration. Additionally, limited TPU-specific educational resources and training programs hinder the widespread adoption of TPUs across industries. Companies investing in AI-driven solutions need to allocate significant resources to workforce training, software development, and TPU-specific optimization. As demand for high-performance AI processing grows, addressing the talent gap and skill shortage in TPU deployment and management will be crucial for accelerating adoption and maximizing AI-driven innovation.

Tensor Processing Unit Market Segments Analysis

By Application

In 2023, the Artificial Intelligence (AI) and Machine Learning (ML) segment held the largest revenue share of 58% in the Tensor Processing Unit (TPU) Market, driven by the rising demand for AI-driven automation, deep learning models, and generative AI applications. TPUs, designed specifically for handling complex neural network computations, have become the preferred choice for accelerating AI model training and inference tasks. Companies such as Google, NVIDIA, and Intel have continuously advanced TPU technology to optimize AI workloads. For instance, Google introduced TPU v5e, enhancing efficiency and affordability for large-scale AI training and inferencing. NVIDIA also launched its AI Supercomputing platform, incorporating TPU-like AI accelerators to boost machine learning applications in cloud environments.

The Data Analytics segment is projected to grow at the highest CAGR of 33.11%, fueled by the increasing reliance on real-time data processing, predictive analytics, and AI-driven business intelligence. TPUs play a crucial role in enhancing large-scale data analysis, enabling organizations to process vast datasets with improved efficiency and lower computational costs. The demand for high-performance computing in financial modeling, healthcare analytics, and fraud detection has accelerated TPU adoption. Tech giants like Google Cloud, Amazon Web Services (AWS), and Microsoft Azure have expanded their cloud-based TPU offerings to cater to businesses requiring faster and more accurate data insights. In 2023, Google launched TPU-powered AI solutions for big data processing, optimizing data analytics pipelines in enterprise environments.

By End Use

In 2023, the IT & Telecom segment held the largest revenue share in the Tensor Processing Unit (TPU) Market, driven by the growing demand for AI-driven network optimization, real-time data processing, and enhanced cybersecurity solutions. The increasing deployment of 5G, cloud computing, and edge AI has accelerated TPU adoption in IT infrastructure. TPUs, known for their ability to process massive AI workloads efficiently, are revolutionizing telecom operations, predictive maintenance, and customer analytics. In 2023, Google Cloud launched TPU v5e, offering scalable AI acceleration for network automation and intelligent traffic management.

Meanwhile, NVIDIA integrated TPU-inspired AI processors into its telecom cloud platforms to enhance network performance and predictive analytics. As IT firms and telecom providers embrace AI-powered automation, TPUs will play a pivotal role in optimizing data center performance, strengthening cybersecurity frameworks, and enabling faster AI-driven decision-making.

The Finance and Banking segment is expected to grow at the highest CAGR, fueled by the rising adoption of AI-driven financial analytics, fraud detection, and algorithmic trading. TPUs are becoming a critical component in enhancing real-time risk assessment, transaction monitoring, and predictive financial modeling. With the increasing volume of digital payments, cryptocurrency transactions, and AI-based investment strategies, financial institutions are leveraging TPUs to accelerate deep learning algorithms for fraud prevention and credit risk analysis. In 2023, Google Cloud introduced AI-based fraud detection models using TPUs, providing banks with real-time anomaly detection and security enhancements.

Additionally, JPMorgan Chase integrated AI-powered risk assessment models into its financial services infrastructure, improving decision-making accuracy and operational efficiency.

Regional Analysis

In 2023, North America led the Tensor Processing Unit (TPU) Market, accounting for the largest market share, primarily driven by the strong presence of AI-driven enterprises, advanced cloud computing infrastructure, and significant investments in AI hardware. The dominance of tech giants such as Google, NVIDIA, Intel, and Microsoft, which continuously innovate and develop AI-accelerated processors, has strengthened the region’s leadership. Google’s Cloud TPU advancements have enhanced AI workloads across industries such as healthcare, finance, and autonomous vehicles. The increasing adoption of AI in data centers, edge computing, and machine learning applications has further fueled TPU demand.

Additionally, the U.S. government's focus on AI-driven defense and cybersecurity applications has contributed to market growth. With AI and deep learning becoming integral to various industries, North America continues to be the hub for TPU development and deployment, solidifying its leadership in the market.

Asia Pacific is the fastest-growing region in the Tensor Processing Unit Market, projected to grow at a high CAGR in the forecasted period 2024-2032, driven by the rapid adoption of AI, cloud computing, and digital transformation initiatives. Countries like China, Japan, South Korea, and India are investing heavily in AI research, semiconductor manufacturing, and data centers, boosting TPU deployment. China’s Baidu and Alibaba Cloud have expanded their AI-based cloud services, incorporating TPU-powered solutions for deep learning applications. Similarly, India’s focus on AI in fintech, healthcare, and smart cities is driving TPU demand. In 2023, Google partnered with various Asian enterprises to provide TPU-based cloud AI solutions, enhancing AI model training efficiency.

Additionally, the region’s growing investments in autonomous vehicles, IoT, and edge AI computing have accelerated TPU integration. With AI adoption surging across diverse industries, Asia Pacific remains the fastest-growing TPU market, poised for continued expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Tensor Processing Unit Market are:

-

AMD (AMD Instinct MI300 Series, ROCm Open Software Platform)

-

Huawei (Ascend 910 AI Processor, MindSpore AI Framework)

-

Alibaba (Hanguang 800 AI Chip, Alibaba Cloud Machine Learning Platform)

-

Baidu (Kunlun AI Accelerator, PaddlePaddle Deep Learning Framework)

-

Synopsys (DesignWare AI Accelerator IP, Synopsys TensorFlow Processor)

-

Arm (Arm Ethos-N78 NPU, Arm Mali GPU AI Acceleration)

-

Amazon Web Services, Inc. (AWS Inferentia, AWS Trainium)

-

Google Inc. (Google TPU v4, TensorFlow Processing Units)

-

Graphcore (IPU-Machine, Poplar Software Stack)

-

IBM Corporation (IBM Telum Processor, IBM Power10 AI Acceleration)

-

Intel Corporation (Intel Habana Gaudi, Intel Xeon with DL Boost)

-

Micron Technology (HBM2E High-Performance Memory, LPDDR5 AI Memory)

-

Microsoft Corporation (Azure AI Accelerator, Project Brainwave)

-

NVIDIA Corporation (NVIDIA H100 Tensor Core GPU, NVIDIA Jetson AGX Orin)

-

Qualcomm Technologies (Qualcomm Cloud AI 100, Qualcomm Snapdragon Neural Processing Engine)

-

Xilinx Inc. (Xilinx Versal AI Core, Xilinx Alveo U50 Accelerator)

Recent Trends

-

November 2024: Google Cloud announced significant upgrades to its AI infrastructure with the introduction of the Trillium Tensor Processing Unit (TPU). The Trillium TPU offers a fourfold increase in training speed and a threefold improvement in inference performance compared to its predecessor, enhancing the efficiency of AI workloads.

-

September 2024: NVIDIA showcased its latest advancements in AI technology, including the unveiling of the Blackwell GPU at the IBC Show 2024. The Blackwell GPU is designed to support the growing integration of AI into everyday applications, reflecting NVIDIA's commitment to maintaining rapid revenue growth through continuous innovation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.70 Billion |

| Market Size by 2032 | US$ 31.60 Billion |

| CAGR | CAGR of 31.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Artificial Intelligence and Machine Learning, High-Performance Computing, Data Analytics, Autonomous Systems) • By Deployment Mode (Cloud-Based, On-Premises) • By End Use (IT & Telecom, Healthcare, Automotive, Finance and Banking, Retail and E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AMD, Huawei, Alibaba, Baidu, Synopsys, Arm, Amazon Web Services, Inc., Google Inc., Graphcore, IBM Corporation, Intel Corporation, Micron Technology, Microsoft Corporation, NVIDIA Corporation, Qualcomm Technologies, Xilinx Inc. |