Digital Textile Printing Market Size Analysis:

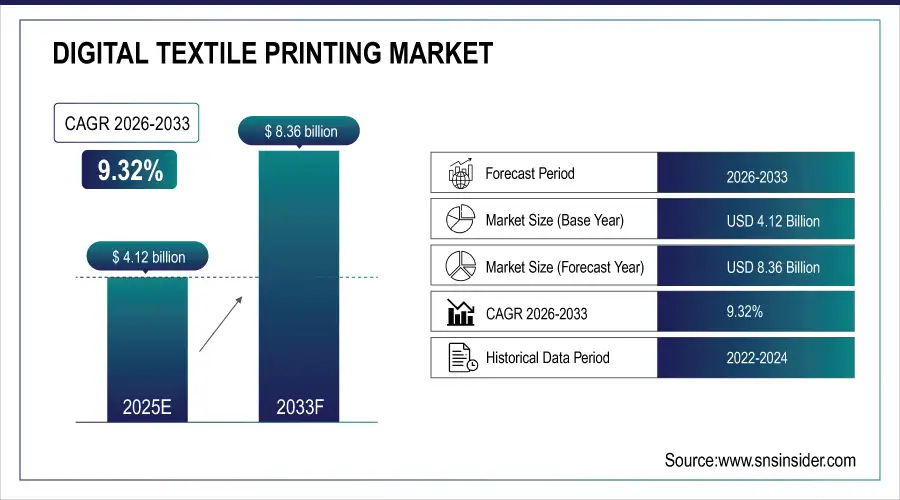

The Digital Textile Printing Market size was valued at USD 4.12 billion in 2024 and is expected to reach USD 8.36 billion by 2032, growing at a CAGR of 9.32% over the forecast period of 2025-2032.

Digital textile printing market trends are shifting toward eco-friendly inks, automation, and short-run production. Advancements in pigment technology and on-demand fashion are driving adoption across apparel, signage, and home textiles.

Increased demand for customization and on-demand textile products among the fashion, home décor, and signage sectors is contributing to the growth of the Digital textile printing market. Due to this speed, flexibility and ability to produce short-run records cost-effectively, brands are embracing digital printing. Market expansion is also receiving a boost from the shift toward more sustainable printing solutions including water-based, and pigment inks. Moreover, it is also the technological innovations in the high speed printers, better coloured, and automation, which are making it a lot more productive as well as dynamic to the requirements of productivity of consumers and designers.

To Get more information on Digital Textile Printing Market - Request Free Sample Report

According to FESPA (2024), over 68% of textile printers reported increased demand for personalized apparel and home textiles.

On-demand fashion platforms like Printful and TeeSpring have expanded globally, with Printful alone fulfilling over 60 million custom orders by 2024.

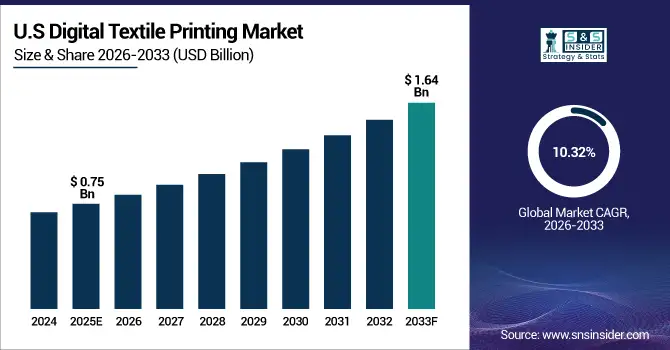

The U.S Digital textile printing market size was valued at USD 0.75 billion in 2024 and is expected to reach USD 1.64 billion by 2032, growing at a CAGR of 10.32% over the forecast period of 2025-2032. The growing trend of consumers demanding personalized and on‑demand apparel and home textiles, the rapid production for fast-fashion brands, eco‑friendly water‑based inks helping to reduce the environmental impact of printing, and the advancement of high-speed, AI-enabled printing systems to improve precision and flexibility drive the growth of the U.S. Digital textile printing market.

Digital Textile Printing Market Dynamics:

Drivers:

-

Customization Demand, Sustainability, and Tech Innovations Fuel Growth in Global Digital Textile Printing Market

The global Digital textile printing market growth is driven by the increasing demand for customized and on-demand textile products, particularly in the fashion, home décor, and soft signage applications. Cost-efficient short-run production, less waste and speedy turnaround are accelerating the transition from analogue to digital printing. The growing environmental concerns are also expected to increase the adoption of sustainable, water-based, and pigment inks. Current technological innovations in high-speed printers, automation as well as AI-based design tools are the ones boosting factories productivity and precision.

Digital printing cuts water usage by up to 95% and energy consumption by around 30% compared to conventional dyeing.

Facilities using digital printing report 30% less material waste and 50% fewer carbon emissions than traditional methods

Restraints:

-

Fabric Limitations and Ink Durability Challenges Restrain Broader Adoption of Digital Textile Printing Solutions

The Digital textile printing market is primarily hindered by its incompatible use on some fabrics, particularly natural fibers such as wool and silk, which often need to be pre-treated and utilize special inks. Also, the durability and color fastness of ink can be less than with traditional methods, which will impact the durability of the product in some forms of usage such as outdoor textiles, or heavy use apparel.

Opportunities:

-

Emerging Markets and E-commerce Growth Unlock New Opportunities for Digital Textile Printing Worldwide

There are opportunities in emerging economies where the textile manufacturing boom is active, particularly in the Asia-Pacific region. Moreover, the growing number of ecommerce platforms catering to customized clothing and the increasing usage of digital printing in sportswear, upholstery and promotional textiles offer noteworthy opportunities for industry participants worldwide.

Adidas announced in 2025 that over 25% of its sportswear line uses digitally printed performance fabrics to enable faster design iterations.

Over 40% of promotional merchandise companies in the U.S. adopted direct-to-garment and dye-sublimation printing between 2024 and 2025 to meet faster turnaround and personalization needs.

Challenges:

-

Challenges in Skilled Workforce, Regulations, and Scalability Hinder Widespread Adoption of Digital Textile Printing

A further hindrance is the non-existence of qualified manpower and technical expertise, especially in developing areas, which limits the efficient operation and maintaining of machines. In addition, the tightening of environmental regulations on chemical environmental regulations are increasing the compliance burden on manufacturers from the use of chemicals, and from chemical discharge to wastewater. Digital systems are primarily designed for short-to-mid-run jobs, and scalability issue in high volume production continues to be a concern.

Digital Textile Printing Market Segmentation Analysis:

By Printing Process

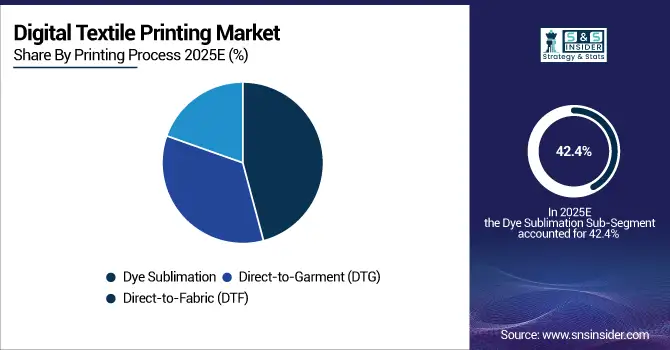

Dye Sublimation held the largest market share of 42.4% in 2024 and is projected to grow at the fastest CAGR between 2025 and 2032. This printing technology is popular due to the high-resolution and colorful output, ability to do printing on polyester fabrics thereby making it suitable for sportswear, soft signage and fashion applications. The process eliminates the need for water as part of the printing process making it fit well with the current trend of increased focus on sustainability. Further driving adoption is the growing need for custom and on-demand textile products. Dye sublimation printers, with their improved functionality due to rapidly evolving technology faster print heads, longer color fastness, are improving efficiency on the production side.

By Ink Type

In 2024, sublimation emerged as the leading technology in the digital textile printing ink market by accounting for a 37.3% share, due to high penetration of system in polyester based applications like sportswear, soft signage and fashion. It is a preferred option for short- to mid-volume production runs due to its capability to provide rich color, sharp image, and long-lasting prints. In addition to this, the waterless nature of the sublimation process and one of sustainable development has made a significant contribution to the ability of sublimation to gain greater market recognition.

During 2025 to 2032, the fastest CAGR growth is anticipated for pigment ink. This growth is driven by its ability to bond with a number of fibers, especially cotton, natural and blended fabrics. Pigment inks need little, if any, pre- or post-treatment, are very good at withstanding fading, and are becoming an important factor in both direct-to-garment and home textiles usage.

By Application

In 2024, the Digital textile printing market was dominated by Clothing & Apparel with a 51.4% share, being fueled by the greater need for personalized fashion, rapid fashion cycle, and on-demand garment manufacturing. With the ability to offer high-quality designs in shorter times without incurring a lot of waste, the segment serves perfectly T-shirts with personalization, sport, and fashion apparel. As consumer preferences and sustainable production goals continue to evolve, both leading brands and independent designers are using digital printing to help enable their vision.

Soft Signage is projected to be the fastest-growing sub-segment through 2025 to 2032, mainly due to its higher adoption rate in retail displays, banners, trade show graphics, and event backdrops. Digital printing allows for bright, lightweight, portable and inexpensive eco-friendly signage that can be a viable alternative to traditional signage materials.

By Substrate Material

The polyester held the leading share of 39.2% in 2024, and is estimated to witness the highest CAGR during 2025–2032. It is in extensive demand as it is compatible with dye sublimation printing, and is mainly used in sportswear, soft signage, and fashion apparel. Excellent durability, quick-dry and strong color retention makes polyester perfect for high performance, and decorative purposes. Polyester dominance in Digital textile printing market is further fueled by the rising shift towards synthetic fabrics and sustainable, waterless printing processes.

Due to increasing demand for compact, flexible, and non-invasive medical devices, the Healthcare sector will grow at the highest CAGR. IME empowers the next-generation healthcare solutions such as wearable health monitors, diagnostic patches and intuitive medical equipment, with improved patient comfort, continuous data tracking and critical form factors.

Digital Textile Printing Market Regional Outlook:

The growth of the Asia Pacific region in the Digital textile printing market, dominating with a 30.4% share in 2024, was attributed to the presence of a huge textile manufacturing base, increased demand for customized garments, and the quick shift to digital printing technologies. The presence of renowned exporters, growing investments on high-end printing, and favorable government regulations driven towards innovation on textile help the region. Moreover, the rapid expansion of e-commerce, quick fashion, and domestic manufacturing in nations like China, India, and Bangladesh is propelling market development in apparel, home textiles, and soft signage uses.

Get Customized Report as per Your Business Requirement - Enquiry Now

Backed by its dominating textile sector, large-scale manufacturing, and huge export-oriented demand, China accounted the largest share of the Asia Pacific Digital textile printing market.

The Digital textile printing market is growing in North America at the fastest CAGR of 10.04% during 2025-2032 due to the increasing consumer demand for customized apparel, growing adoption for eco-friendly printing solutions, and improved on-demand printing technologies. There is high penetration of DTG and dye sublimation printing for fashion, sportswear, home décor and promotional textile applications in this region. The growth of this region can be attributed to increasing consumer preference towards sustainable and customized products, since here in this region there are major e-Commerce platforms and tech-savvy printing companies are present.

The North American Digital textile printing market share was dominated by the U.S., due to the supportive role played by e-commerce, higher adoption of advanced printing technologies, and strong demand for fashion and promotional applications in the region.

Due to its in-place established textile industry, higher adoption of sustainable practices, and demand for high-quality, customized products, Europe is in a strong position for the digital textile printing growth. A combination of advanced printing technologies, strict environmental regulations that encourage the use of eco-friendly inks, and robust fashion and home décor industries contribute to the notable position of this region. Market expansion is driven by the innovation frontrunners countries which are Italy, Germany and Netherlands. Digital textile printing is also well suited to the European climate for short-run, fast-turnaround printing.

Ensuring steady growth in the Digital textile printing market, Latin America and the Middle East & Africa are burgeoning regions, which, owing to growing discretionary transitioning towards luxury lifestyle applications for fashion and home décor, complemented with easy accessibility of digital textile printing, are expected to remain opportunities-rich in the years to come. Brazil and Mexico are using digital printing to produce economical small-volume clothing and promotional textiles in Latin America. On the other hand, gradual adoption is being witnessed in the Middle East & Africa, especially in countries such as UAE and South Africa, as customization patterns are shifting towards higher demand for printed garments, signage for living and work spaces, and sustainable printing solutions, aligning with investments in textile innovations.

Digital Textile Printing Companies are:

The Key Players are Digital textile printings Market are Kornit Digital, Durst, EFI, Mimaki, Roland DG, Epson, Ricoh, Brother, Mutoh, SPGPrints, Konica Minolta, DGI, Dover (MS), Aeoon, ColorJet, ATPColor, Sawgrass, Jetcol, Zimmer Austria, and Inèdit Software.

Recent Developments:

-

In March 2024, Kornit showcased its latest innovations: the Atlas MAX PLUS (for vivid polyester and poly-blends), MAX Transfer (a new direct‑to‑film solution), and the Apollo system for scalable on‑demand production.

-

In September 2024, Roland DG launches the TY‑300 Direct‑to‑Film (DTF) printer, a next-generation solution offering superb image quality, high productivity, and eco-certified S‑PG2 inks; initial sales in Japan.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.12 Billion |

| Market Size by 2032 | USD 8.36 Billion |

| CAGR | CAGR of 9.32% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Printing Process (Direct-to-Garment (DTG), Dye Sublimation, and Direct-to-Fabric (DTF)) • By Ink Type (Sublimation, Pigment, Reactive, Acid, and Disperse) • By Application (Clothing & Apparel, Home Textile, Soft Signage, and Industrial Textiles) • By Substrate Material (Cotton, Silk, Polyester, Nylon, and Wool) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Kornit Digital, Durst, EFI, Mimaki, Roland DG, Epson, Ricoh, Brother, Mutoh, SPGPrints, Konica Minolta, DGI, Dover (MS), Aeoon, ColorJet, ATPColor, Sawgrass, Jetcol, Zimmer Austria, and Inèdit Software. |