Dispatch Console Market Report Scope & Overview:

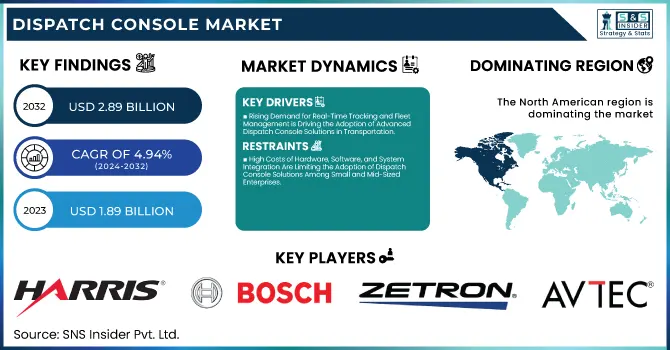

The Dispatch Console Market was valued at USD 1.89 billion in 2023 and is expected to reach USD 2.89 billion by 2032, growing at a CAGR of 4.94% from 2024-2032. This report includes a detailed analysis of key factors shaping the market, such as maintenance and support costs, technology adoption, usage metrics, and security and compliance trends. As industries increasingly rely on efficient dispatching systems, these factors play a critical role in market growth. With advancements in technology and a focus on meeting security requirements, the Dispatch Console Market is poised for steady expansion over the forecast period.

To Get more information on Dispatch Console Market - Request Free Sample Report

Dispatch Console Market Dynamics

Drivers

-

Rising Demand for Real-Time Tracking and Fleet Management is Driving the Adoption of Advanced Dispatch Console Solutions in Transportation.

The rapid growth of transportation and logistics networks is driving the need for effective communication and coordination systems. As freight movement and passenger transport volume increase, organizations need real-time monitoring, uninterrupted fleet management, and immediate communication to make operations more efficient. Dispatch consoles are vital to ensuring smooth coordination among drivers, dispatchers, and control centers, avoiding delay and enhancing safety. The emergence of intelligent transportation systems, connected cars, and automation also hastens the demand for sophisticated dispatch solutions. As logistics and public transport networks continue to grow, adoption of cloud-based and AI-based dispatch solutions is becoming indispensable for streamlining routing, managing vehicle performance, and providing dependable delivery of services.

Restraints

-

High Costs of Hardware, Software, and System Integration Are Limiting the Adoption of Dispatch Console Solutions Among Small and Mid-Sized Enterprises.

The implementation of sophisticated dispatch console systems requires heavy investment in money, posing a challenge to small and medium-sized businesses. Exorbitant prices of buying high-tech hardware, procuring expensive software, and installing systems in line with the infrastructure of existing facilities make it difficult for financially strapped companies to implement these systems. Maintenance, updates, and technical support on a regular basis add to the costs, pushing up the overall cost of ownership. Most organizations find it difficult to justify the return on investment, particularly when they are working in cost-sensitive markets. In the absence of scalable and affordable solutions, mass adoption is restricted, preventing businesses from tapping into real-time communication and fleet management efficiencies that dispatch consoles provide.

Opportunities

-

AI-Powered Analytics and Automation Are Enhancing Efficiency, Predictive Maintenance, and Decision-Making in Modern Dispatch Console Systems.

The integration of artificial intelligence and automation is transforming dispatch operations by improving efficiency, accuracy, and responsiveness. AI-driven analytics enable real-time data processing, predictive maintenance, and intelligent decision-making, helping organizations optimize resource allocation and minimize downtime. Automated workflows streamline communication between dispatchers and field personnel, reducing manual intervention and operational delays. With machine learning algorithms, dispatch consoles can predict demand patterns, optimize routing, and enhance fleet management. As industries seek to improve response times and operational effectiveness, the adoption of AI-powered dispatch solutions is gaining momentum. Businesses leveraging automation not only reduce costs but also enhance service reliability, making AI-driven dispatch systems a crucial component for future-ready communication and coordination platforms.

Challenges

-

Increasing Reliance on Cloud-Based Dispatch Systems Is Raising Cybersecurity Risks, Leading to Potential Data Breaches and Operational Disruptions.

With dispatch console solutions moving more and more to cloud and network-based structures, the threat of cyberattacks and data breaches poses a serious issue for companies. The interconnectedness of contemporary dispatch systems exposes them to hacking, unauthorized access, and data breaches that could result in compromised sensitive operational data. Companies dealing with vital communications for emergency response, transportation, and logistics must introduce strong security mechanisms in place to protect their systems. But maintaining end-to-end encryption, data protection law compliance, and ongoing monitoring comes with extra expense and expertise. In the absence of robust cybersecurity, companies are at risk for operational disruption, financial loss, and reputational harm, so data security must be a top priority in dispatch console implementations.

Dispatch Console Market Segment Analysis

By Type

IP-based dispatch console systems led the Dispatch Console Market in 2023 with the largest revenue share of about 67%. Their leadership is fueled by better scalability, smooth integration with contemporary communication networks, and improved reliability over legacy systems. The growing popularity of cloud-based solutions, VoIP technology, and real-time data transmission has also further strengthened their market dominance. Moreover, their cost savings and support for remote operations have also made them the industry choice.

TDM-based dispatch console systems are expected to grow at the fastest CAGR of approximately 6.25% during the forecast period of 2024-2032. This is driven by their sustained use in legacy infrastructure industries where it is still difficult to switch to IP-based systems. TDM technology is still used by most organizations for its reliability and dedicated voice channels, providing secure and uninterrupted communication, especially in mission-critical sectors like emergency response and defense.

By Application

The transportation segment dominated the Dispatch Console Market in 2023, holding the highest revenue share of approximately 32%. This dominance is driven by the increasing need for real-time fleet management, efficient route optimization, and seamless communication across logistics, aviation, and public transit. The rising adoption of intelligent transportation systems, coupled with the expansion of smart mobility solutions, has further propelled demand for advanced dispatch consoles in this sector.

The public safety segment is projected to grow at the fastest CAGR of about 6.53% from 2024 to 2032. This rapid growth is attributed to the increasing emphasis on emergency response efficiency, disaster management, and law enforcement coordination. Governments and public agencies are investing in advanced dispatch solutions to enhance communication, improve situational awareness, and ensure faster response times in critical situations, driving substantial market expansion in this sector.

By Functionality

In 2023, the real-time monitoring segment accounted for the largest revenue share of approximately 35% in the Dispatch Console Market. This dominance is primarily driven by the growing need for instant communication and situational awareness across sectors like public safety, transportation, and utilities. Real-time monitoring enables swift response to emergencies and operational anomalies, enhancing coordination and minimizing downtime. The integration of advanced technologies such as AI and IoT further strengthens its role, making it indispensable for mission-critical operations and centralized dispatch environments.

The incident management segment is anticipated to register the fastest CAGR of around 6.33% from 2024 to 2032 in the Dispatch Console Market. This rapid growth is attributed to the increasing demand for efficient handling of emergencies, threats, and service disruptions across industries. As organizations prioritize business continuity and resilience, the adoption of dispatch systems for streamlined incident detection, escalation, and resolution is accelerating. Rising investments in smart city infrastructure and public safety initiatives are also contributing to this segment’s robust expansion.

By Functionality

In 2023, the real-time monitoring segment accounted for the largest revenue share of approximately 35% in the Dispatch Console Market. This dominance is primarily driven by the growing need for instant communication and situational awareness across sectors like public safety, transportation, and utilities. Real-time monitoring enables swift response to emergencies and operational anomalies, enhancing coordination and minimizing downtime. The integration of advanced technologies such as AI and IoT further strengthens its role, making it indispensable for mission-critical operations and centralized dispatch environments.

The incident management segment is anticipated to register the fastest CAGR of around 6.33% from 2024 to 2032 in the Dispatch Console Market. This rapid growth is attributed to the increasing demand for efficient handling of emergencies, threats, and service disruptions across industries. As organizations prioritize business continuity and resilience, the adoption of dispatch systems for streamlined incident detection, escalation, and resolution is accelerating. Rising investments in smart city infrastructure and public safety initiatives are also contributing to this segment’s robust expansion.

Regional Analysis

The North American region held the maximum market share in terms of revenue, i.e., around 35% of the Dispatch Console Market in 2023. It is backed by the massive presence of large and established market players, matured communication infrastructure, and rapid take-up of digital dispatching solutions in transport, public safety, and defense sectors. Government spending in emergency response solutions, along with the extensive usage of cloud and IP-based dispatch consoles, have further supported growth in the market. Moreover, strict regulatory provisions for public safety and critical communication have fueled growth.

Asia Pacific is expected to grow at the fastest CAGR of approximately 7.31% during 2024-2032. This is driven by urbanization, growing investments in smart city programs, and growth in transportation and public safety infrastructure. The nations in the region are implementing cutting-edge dispatch technologies to improve emergency response systems and streamline logistics operations. The increasing need for affordable, cloud-based dispatching solutions and continued digitalization across sectors are major drivers of market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Motorola Solutions, Inc. (APX Radio System, CommandCentral)

-

Harris Corporation (P25 Radio System, OpenSky)

-

Bosch (Bosch Communication Systems, Video Surveillance Solutions)

-

Zetron, Inc. (Kenwood) (Max Dispatch, Acom Command Center)

-

Avtec Inc (Scout Console, Avtec Voice Dispatch Solutions)

-

Omnitronics, L.L.C. (Omnitronics Dispatch Console, Radio Management System)

-

Siemens Convergence Creators GmbH (AtoS) (AtoS Dispatch Solutions, Control Center 2.0)

-

Catalyst Communications Technologies, Inc. (VPM+ Dispatch Console, Catalyst X2)

-

EF Johnson Technologies (5120 Radio System, Interoperability Console)

-

Cisco (Cisco Webex Calling, Cisco Unified Communications Manager)

-

Ultra Electronics (Ultra Custom Communications Solutions, Advanced Signal Processing)

-

Raytheon Technologies Corporation (Radio Systems, C3I Systems)

-

Airbus (Tactilon Agnet, Tactilon Dabat)

-

Elbit Systems (MOTS Radio, Tactilon Dabat)

-

Thales Group (Thales Tetra Radio, Thales Dispatch Solutions)

-

Collins Aerospace (ARINC Voice Communication, ARINC Dispatch System)

-

BAE Systems (BAE Secure Communications, Tactical Radio System)

-

CurtissWright Corporation (Integrated Communication Systems, Tactical Data Solutions)

-

L3Harris Technologies (P25 Radio System, L3Harris Dispatch Solutions)

-

Leonardo S.p.A. (Leonardo Tetra Radio, Command and Control Solutions)

-

Lockheed Martin Corporation (LMRT Radio System, Tactical Communications)

-

Saab AB (Saab Tetra Radio, Command and Control System)

-

Northrop Grumman Corporation (Integrated Communications Solutions, Tactical Radios)

-

Honeywell International (Honeywell Command and Control Systems, Radio Integration Solutions)

-

Airbus DS Communications (Tactilon Agnet, Tactilon Dabat)

Recent Developments:

-

In August 2024, Motorola Solutions introduced SmartIncident, a broadband-enabled application that allows dispatchers to send critical incident information directly to first responders' APX NEXT or APX N70 smart radios, enhancing communication efficiency.

-

In 2023, Airbus introduced the Radio Console System 9500 (RCS 9500), a modern TETRA dispatching console that enables control room dispatchers to efficiently access TETRA communication features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.89 Billion |

| Market Size by 2032 | USD 2.89 Billion |

| CAGR | CAGR of 4.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (IP-based Dispatch Console, TDM-based Dispatch Console) • By Application (Government and Defense, Public Safety, Transportation, Utility, Healthcare, Others) • By Functionality (Real-time Monitoring, Incident Management, Resource Scheduling, Reporting and Analytics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Motorola Solutions, Inc., Harris Corporation, Bosch Sicherheitssysteme GmbH, Zetron, Inc. (Kenwood), Avtec Inc, Omnitronics, L.L.C., Siemens Convergence Creators GmbH (AtoS), Catalyst Communications Technologies, Inc., EF Johnson Technologies, Cisco, Ultra Electronics, Raytheon Technologies Corporation, Airbus, Elbit Systems, Thales Group, Collins Aerospace, BAE Systems, CurtissWright Corporation, L3Harris Technologies, Leonardo S.p.A., Lockheed Martin Corporation, Saab AB, Northrop Grumman Corporation, Honeywell International, Airbus DS Communications. |