Enterprise Connectivity and Networking Market Size & Overview:

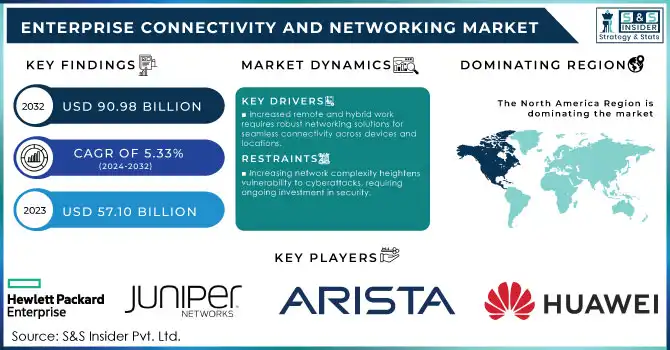

The Enterprise Connectivity and Networking Market was valued at USD 60.14 billion in 2024 and is expected to reach USD 91.12 billion by 2032, growing at a CAGR of 5.33% from 2025-2032.

To Get More Information on Enterprise Connectivity and Networking Market - Request Sample Report

The Enterprise Connectivity and Networking Market is growing rapidly due to the increasing demand for remote work capabilities, cloud-based applications, and enhanced data security. With an increasing number of organizations adopting hybrid work, dependable networking solutions have become critical, ensuring the connectivity of multi-device and multi-location. SD-WAN, 5G connectivity, and Wi-Fi 6 (now rapidly rolling out to bolster wireless transfer speeds) are among the technologies facilitating data movement and operational flexibility, and analysts project SD-WAN market growth for businesses to reach USD 8 billion as enterprises are increasingly investing in tools for better bandwidth utilization and more secure data pathing.

Global digital transformation has been one of the main drivers in the market as an enterprise spends on digital transformation, more than 90% of enterprises are engaged in this transition which depends on the scalable, high-speed network IoT application, video conferencing, and virtual desktop. With the expansion of 5G networks, low-latency connections and faster data transfer, which is key for use-cases in real-time scenarios of healthcare, manufacturing, etc. It includes 5G connectivity for telemedicine and real-time patient monitoring in the healthcare sector that improves the service and enhances patient care.

Market Size and Forecast

-

Market Size in 2024: USD 60.14 Billion

-

Market Size by 2032: USD 91.12 Billion

-

CAGR: 5.33% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Enterprise Connectivity and Networking Market Trends

-

Growing digital transformation initiatives across industries are fueling the enterprise connectivity and networking market.

-

Rising adoption of cloud computing, IoT, and edge technologies is driving demand for robust and scalable networking solutions.

-

Increasing need for secure, high-speed, and reliable connectivity is pushing investments in advanced infrastructure.

-

Expansion of hybrid and remote work models is boosting the adoption of SD-WAN, VPNs, and unified communication systems.

-

Integration of AI and automation in network management is enhancing efficiency and reducing downtime.

-

Rising cybersecurity threats are increasing focus on secure networking architectures.

-

Collaborations between telecom providers, cloud service companies, and enterprises are strengthening market growth opportunities.

Enterprise Connectivity and Networking Market Growth Drivers:

-

Increased remote and hybrid work requires robust networking solutions for seamless connectivity across devices and locations.

-

Rising use of cloud-based applications necessitates scalable networks for efficient data management and access.

-

Deployment of 5G enables low-latency, high-speed connectivity essential for real-time applications in various industries.

The introduction of 5G technology has become a game changer in the Enterprise Connectivity and Networking Market, with ultra-low latency and faster speeds that offer a new level of efficiency, flexibility, and innovation for industries around the globe. The low latency characteristic of 5G technology benefits real-time applications that require fast data transfer such as telemedicine, autonomous manufacturing, augmented reality (AR) in training, and teleoperated applications in various industries in the healthcare, industrial automation, and logistics sectors. In healthcare, the possibilities of 5G-powered telemedicine enable real-time patient monitoring and diagnosis, remote surgery with greater precision, and the ability for doctors to collaborate, regardless of their locations. It is only possible because 5G has the last word to transmit high-resolution data from one place to another instantaneously, decreasing the distance between healthcare providers and patients. F

For organizations that operate data-heavy enterprise cloud apps, 5G validates that governance, architecture, and some other features of critical data flow at optimal speed, and security to facilitate enterprise cloud access and workload gains. With this, it becomes easier for businesses to make a multi-cloud strategy, thus avoiding the vendor lock-in issue and assuring maximum network redundancy and resilience. As hybrid work environments become more common, 5G allows employees to remotely connect to desktop-quality, seamless corporate networks. This helps with reliable and fast video conferencing, accessing enterprise applications, and collaboration that enhances real-time productivity and employee experience.

| Benefits of 5G in Enterprise Connectivity and Networking | Description |

|---|---|

| Enhanced IoT Connectivity | Connects large numbers of IoT devices, providing data insights and operational efficiencies. |

| Improved Remote Access | Allows seamless, high-quality remote connectivity, ideal for hybrid work environments. |

| Enhanced Reliability | Reduces network downtime, critical for mission-critical applications and business continuity. |

Enterprise Connectivity and Networking Market Restraints:

-

Increasing network complexity heightens vulnerability to cyberattacks, requiring ongoing investment in security.

-

Compliance with stringent data privacy laws across regions adds operational challenges and limits data flow flexibility.

-

Growing data demands may strain existing network bandwidth, leading to connectivity issues and latency.

The emerging needs of data demands are challenging to the Enterprise Connectivity and Networking Market and can overload the current infrastructure of network bandwidth resulting in connectivity failures, and latency. The enterprise demand for data-intensive applications such as cloud computing, video conferencing and real-time analytics has increased exponentially the amount of data transferred within the network. However, this increase in data traffic can easily outpace the existing bandwidth capabilities, which is especially an issue in large companies where lots of people and devices are connected at once.

Business processes suffer from lack of bandwidth. For example, during times of peak usage, a network may have difficulty accommodating all that data transfer: downloads and uploads may take longer than usual. Such delay can hinder crucial business processes like providing live customer support, virtual collaboration, and accessing cloud resources. Enterprises built upon real-time applications — think financial trading platforms, manufacturing operations, or telemedicine — require immediate performance, and even minor latency can result in operational inefficiencies or worse, lost revenue.

Enterprise Connectivity and Networking Market Segment Analysis

By Component, hardware segment dominates the Enterprise Connectivity and Networking Market, software segment is the fastest-growing.

The hardware segment dominated the Enterprise Connectivity and Networking Market and represented a significant revenue share of 45.25% . This is due to the high demand for physical infrastructure such as routers, switches, and access points, enabling secure and reliable data transmission across enterprise networks. As companies expand their network capacities to accommodate remote work, IoT devices, and cloud services, investments in hardware remain essential. Furthermore, advancements in 5G and Wi-Fi 6 technologies are driving hardware upgrades, as businesses adopt next-generation equipment to support faster and more resilient connections. In the future, the hardware segment is expected to continue its dominance as organizations modernize infrastructure to support high-speed data flow, low-latency applications, and secure connectivity amid growing cybersecurity concerns.

The software segment registers the highest CAGR of 6.45% within the Enterprise Connectivity and Networking Market. Growth is driven by the rise of software-defined networking (SDN) and SD-WAN, which allow companies to optimize network traffic management and prioritize essential applications. Additionally, as cloud adoption accelerates, software solutions that enhance network performance, monitor security, and support multi-cloud strategies are in high demand. Future growth in this segment will be fueled by increased investment in artificial intelligence and machine learning for predictive network management, enabling enterprises to address issues and improve operational efficiency proactively. As organizations prioritize flexibility and security, software solutions will be crucial in enhancing network resilience and supporting digital transformation.

By Enterprise Type, large enterprises segment dominates the Enterprise Connectivity and Networking Market, SMEs segment is the fastest-growing.

The large enterprises segment dominated the enterprise connectivity and networking market and represented a significant revenue share of 79.89%, Characterised by extensive networking infrastructure requirements and high data demands surrounding and running through these enterprises of large size. Most large companies work in more than one point, so they need a strong and scalable connectivity solution to move a lot of information, communicate, and protect elements across departments and countries. As the digital transformation narrative continues to play out, large enterprises spend billions of dollars on various advanced networking solutions such as 5G and SD-WAN, and also many cloud applications to improve productivity and customer service.

The SMEs segment is expected to grow at the highest CAGR of 6.26% from 2024-2032, in the Enterprise Connectivity and Networking Market. For small and medium-sized enterprises, remaining competitive and connected is becoming increasingly essential. SMEs are transitioning to cloud services, digital collaboration, and remote work models that drive the need for agile, economical networking capabilities. Instead, many are turning to software-based networking tools, such as SD-WAN, that can maximize available bandwidth and minimize the risk of cyber-attacks without the costly deployments of traditional infrastructure. Growth in this segment will also be supported by an increasing number of SMEs adopting digital transformation initiatives to enable higher levels of productivity and customer connectedness while keeping pace with increasingly dynamic market environments, and by government initiatives promoting the use of digital solutions in this segment, as well as lower-cost networking solutions which can be tailored to the specific needs of SMEs and quickly scaled-up to be capable of supporting the rapid growth expected for this segment in the coming years.

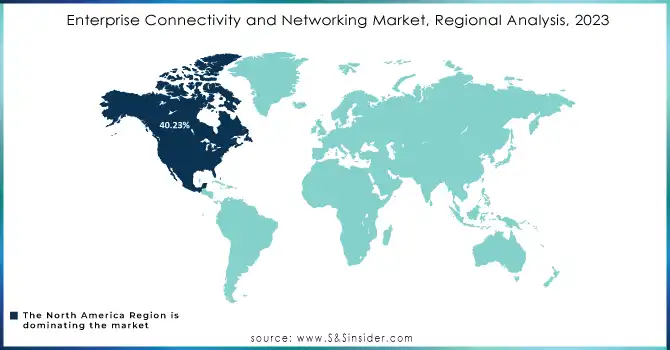

Enterprise Connectivity and Networking Market Regional Analysis

North America Enterprise Connectivity and Networking Market Insights

North America is the largest region in the Enterprise Connectivity and Networking Market with a revenue share of 40.23%, with large technology company presence, high levels of digitalization, and strong infrastructure. In particular, advanced networking solutions such as SD-WAN, 5G, and cloud technologies are leading the charge in the U.S., and the potential benefits for both U.S. businesses and the economy are enormous. Moreover, the region is a dense hub of many large enterprises, and SMEs that are looking to upgrade their networks for greater reliability and security. Continuing broader digital transformation across verticals and the development of 5G and smart cities with government investments also act as growth accelerators. North America will maintain its dominance as enterprises will demand upgrades to next-generation technologies to enable remote working, artificial intelligence (AI)-based solutions, and high-level cybersecurity in the future.

Asia Pacific Enterprise Connectivity and Networking Market Insights

The Asia-Pacific region is projected to witness the highest growth (CAGR) of 7.47% from 2024-2032 in the Enterprise Connectivity and Networking Market, attributed to rapid urbanization, increased internet penetration, and the growth of SMEs in this region. As organizations continue with their digital transformation, countries such as China, India, Japan, and South Korea are experiencing high adoption of cloud-native networking solutions, 5G connections, and SD-WAN. Demand for high-speed, reliable connectivity is being driven by the region's strong manufacturing, telecom, and technology sectors.

On top of that, the emergence of government initiatives like 'Made in China 2025' and India’s 'Digital India' will further speed up the acceleration of next-generation networks of deployment. Asia-Pacific is expected to sustain its rapid growth in the coming years due to the rapid modernization of its infrastructure and the expansion of digital services.

Europe Enterprise Connectivity and Networking Market Insights

Europe in the Enterprise Connectivity and Networking Market is witnessing strong momentum, driven by digital transformation, Industry 4.0 initiatives, and rapid 5G adoption. Enterprises across manufacturing, healthcare, and BFSI sectors are investing in advanced connectivity solutions to enhance efficiency, security, and scalability. Cloud-based networking, IoT integration, and software-defined networking (SDN) are gaining traction, while regional policies supporting data protection and cybersecurity strengthen adoption, fueling sustained market growth across Europe.

Middle East & Africa and Latin America Enterprise Connectivity and Networking Market Insights

Middle East & Africa and Latin America in the Enterprise Connectivity and Networking Market are experiencing steady growth, supported by rising digital infrastructure investments and expanding internet penetration. Governments and enterprises are adopting cloud-based networking, SD-WAN, and cybersecurity solutions to modernize operations. Increasing mobile workforce, 5G rollouts, and demand for reliable enterprise connectivity are accelerating adoption, while collaborations with global vendors are enhancing regional capabilities and driving long-term market opportunities.

Do You Need any Customization Research on Enterprise Connectivity and Networking Market - Enquire Now

Enterprise Connectivity and Networking Market Competitive Landscape:

Cisco Systems

Cisco Systems, founded in 1984, is a global leader in networking, cybersecurity, and enterprise collaboration technologies. The company provides a broad portfolio of products and services that enable organizations to securely connect, manage, and optimize their IT infrastructure. With strong expertise in AI-driven networking, cloud, and IoT solutions, Cisco continues to play a pivotal role in shaping next-generation digital transformation across industries.

-

2025: Cisco unveiled a new network architecture for campus, branch, and industrial networks designed for AI workloads offering unified management, advanced security, and devices optimized for performance under massive traffic demands.

-

2025: Cisco announced Agile Services Networking at Mobile World Congress: architectures and innovations enabling service providers to deliver AI-connected experiences at scale with real-time visibility, resilient infrastructure, and monetizable network services.

-

2025: Cisco will expand enterprise networking and cybersecurity deployments with six additional NFL franchises deploying high-density Wi-Fi 7, hybrid firewalls, and secure infrastructure to support AI-ready stadium operations.

Arista Networks

Arista Networks, founded in 2004, is a leading provider of cloud networking solutions, renowned for its high-performance platforms in data centers, campus, and enterprise environments. The company specializes in software-driven networking, delivering scalability, automation, and reliability to meet modern computing demands. With its strong focus on AI-driven infrastructure and cloud-native approaches, Arista empowers enterprises and service providers to support mission-critical applications with secure, efficient, and adaptive networking architectures.

-

2024: Arista announced Etherlink AI Networking Platforms, enhancing network performance for demanding AI workloads across campus, cloud, data center, and routing domains.

Key Players

The Major Key players are along with their products:

-

Cisco Systems: Catalyst 9000 Series Switches

-

Hewlett Packard Enterprise (HPE): Aruba 500 Series Access Points

-

Juniper Networks: MX Series 5G Universal Routing Platforms

-

Arista Networks: 7280R Series Universal Leaf and Spine Switches

-

Huawei Technologies: CloudEngine 16800 Data Center Switch

-

Dell Technologies: PowerSwitch S5248F-ON

-

Extreme Networks: ExtremeWireless Wi-Fi 6 Access Points

-

Fortinet: FortiGate 6000F Series Next-Generation Firewalls

-

Palo Alto Networks: PA-3200 Series Next-Generation Firewalls

-

Check Point Software Technologies: Quantum Security Gateways

-

NETGEAR: Nighthawk Pro Gaming XR1000 WiFi 6 Router

-

Ubiquiti Networks: UniFi Dream Machine Pro

-

Ciena Corporation: 6500 Packet-Optical Platform

-

Riverbed Technology: SteelHead SD WAN Optimization

-

VMware: NSX-T Data Center

-

Zebra Technologies: FX9600 Fixed RFID Reader

-

CommScope: Ruckus R750 Wi-Fi 6 Access Point

-

ADTRAN: Total Access 5000 Series

-

TP-Link: Omada SDN Controller

-

Mellanox Technologies: Spectrum SN2100 Switch

| Report Attributes | Details |

| Market Size in 2024 | US$ 60.14 Billion |

| Market Size by 2032 | US$ 91.12 Billion |

| CAGR | CAGR of 5.33% from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Enterprise Type (SMEs, Large Enterprises) • By Industry Vertical (BFSI, Manufacturing, IT & Telecom, Retail & Ecommerce, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Hewlett Packard Enterprise, Juniper Networks, Arista Networks, Huawei Technologies, Dell Technologies, Extreme Networks, Fortinet, Palo Alto Networks, Check Point Software Technologies, NETGEAR, Ubiquiti Networks, Ciena Corporation, Riverbed Technology, VMware, Zebra Technologies, CommScope, ADTRAN, TP-Link, Mellanox Technologies |