Durable Medical Equipment Market Size & Trends:

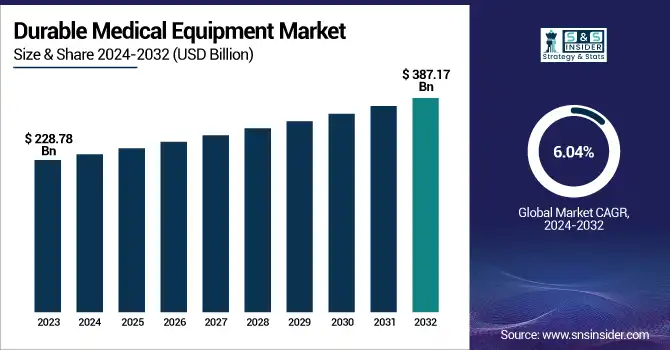

The Durable Medical Equipment Market was USD 228.78 billion in 2023 and is expected to reach USD 387.17 billion by 2032, growing at a CAGR of 6.04% over the forecast period of 2024-2032.

To Get more information on Durable Medical Equipment Market - Request Free Sample Report

This report highlights the key statistics of the Durable Medical Equipment (DME) market and the latest trends in the increasing incidence and prevalence of chronic ailments that are increasing the demand for DME. It underscores regional prescription patterns, as more countries are seeing increased usage and demand for DME in both developed and emerging economies. The report also looks at device volume growth, in addition to spending characterized by government, private insurers, and out-of-pocket contributions. This segment investigates the extent of home healthcare, drawing attention to its growing movement from clinical to non-clinical application. The report also provides insights into how smart technology is embedded in the DME, with connectivity and remote monitoring reshaping the way a device functions and enabling greater efficiency in patient care. Some key factors that are driving the demand for the durable medical equipment (DME) market include the growing prevalence of chronic diseases, the increase in the geriatric population, and overall improvement in healthcare infrastructure.

U.S. Durable Medical Equipment Market Analysis

The U.S. Durable Medical Equipment (DME) market has been continually growing, from USD 63.26 billion in 2023 to USD 106.01 billion by 2032 and others are expected in the future and throughout the forecast period. This reflects a robust compound annual growth rate (CAGR) of 5.93%, fuelled by the rising prevalence of chronic diseases, an enlarging aging population, and a strong pull towards home health solutions. The growth indicates continued spending and demand in both the public and private healthcare sectors. Amid increasing healthcare expenses in the U.S. which accounted for USD 4.9 trillion in 2023 which accounts for a 7.5% increase, the adoption rate for high-quality medical equipment for home healthcare solutions and home diagnosis has increased significantly. In 2023, over 35% of the global DME market share was accounted for by the U.S. due to the country’s strong infrastructure regarding healthcare and its favorable reimbursement policies.

Durable Medical Equipment Market Dynamics

Drivers:

-

The increasing prevalence of chronic diseases, such as cardiovascular disorders, is significantly boosting the demand for DME, including monitoring and therapeutic devices.

The escalating prevalence of chronic diseases, notably cardiovascular conditions and diabetes, is a significant driver for the durable medical equipment (DME) market. These conditions often necessitate continuous monitoring and management, leading to increased demand for devices such as blood pressure monitors, glucose meters, and mobility aids. Globally, cardiovascular diseases are the leading cause of mortality, responsible for over 18 million deaths annually. High blood pressure, a major contributor to these diseases, affects approximately 1.3 billion people worldwide, with nearly half unaware of their condition. In India, the situation is particularly concerning. A 2023 survey published in The Lancet revealed that 11.4% of Indians have diabetes, equating to 101 million individuals, and 35.5% suffer from hypertension, affecting 315 million people. These figures represent a significant increase from previous years, highlighting a rapidly growing health challenge. The rising incidence of these chronic conditions underscores the necessity for effective management solutions. For instance, individuals with diabetes require regular blood glucose monitoring to prevent complications, driving the demand for glucometers and related supplies. Similarly, those with hypertension benefit from home blood pressure monitors to track and manage their condition proactively. The increased need for such DME not only aids in better disease management but also reduces the burden on healthcare facilities by enabling home-based care.

Restraint

-

High costs associated with DME products pose a significant barrier, limiting accessibility for individuals with limited financial resources.

The high cost of durable medical equipment (DME) remains a significant barrier to accessibility for many patients, particularly those with limited financial resources. Advanced medical devices, such as motorized wheelchairs and home oxygen systems, often come with substantial price tags, making them unaffordable for a large segment of the population. For instance, in the United Kingdom, health authorities spent over £2 million in 2024 on specialized equipment to manage the increasing number of obese patients, including £250,000 for reinforced ambulance chassis and £91,000 on slings for moving heavy patients. These expenditures highlight the financial strain on healthcare systems and the challenges individuals face in accessing necessary medical equipment. Additionally, the process of obtaining DME can be prolonged and cumbersome, exacerbating accessibility issues. In a notable case, a disability advocate in Berkeley, California, experienced a 14-month delay in receiving a new wheelchair due to insurance complications and supply chain disruptions. Such delays not only hinder timely medical support but also underscore systemic inefficiencies that can further inflate costs. Addressing these financial and procedural challenges is crucial to enhance patient access to essential durable medical equipment.

Opportunity

-

Technological advancements, such as the development of wireless and remote monitoring technologies, present significant opportunities by facilitating easier patient monitoring and reducing the need for frequent hospital visits.

The increase in new technology development, particularly wireless and remote monitoring technologies, is also driving growth in the Durable Medical Equipment (DME) market as these technologies help with the efficient management of patients by minimizing the need for regular visits to hospitals. This provides immediate monitoring of crucial health markers, enabling providers to manage medical conditions from afar. A prime example of the impact of home blood pressure monitors on government resources would be in Scotland, implementing home blood pressure monitors led to the freeing up of about 400,000 general practitioner appointments and a significant reduction in cost to the National Health Service (NHS).

Rising cases of chronic diseases like diabetes and cardiovascular diseases have surged the demand for RPM devices. Companies like Dexcom and Abbott Laboratories are expanding their continuous glucose monitoring (CGM) offerings to cater to both diabetic and non-diabetic individuals interested in metabolic health. Abbott wants its Libre glucose monitor franchise to reach $10 billion in annual sales by 2028. However, there is a significant lack of awareness among consumers regarding the benefits of personal medical devices, despite their obvious benefits. A survey revealed that while 80% of respondents owned at least one medical device, only 40% correctly identified these devices as tools for tracking health information. The integration of advanced technologies like artificial intelligence (AI) and 5G connectivity is further propelling the RPM market. These advances make data more secure, improve the interoperability between devices, and allow for quicker decision-making by healthcare providers.

Challenge

-

Addressing supply chain vulnerabilities has become critical, as disruptions can lead to significant delivery issues and impact the availability of essential medical equipment.

The DME market is currently facing severe supply chain challenges, affecting healthcare providers and patients alike. A prominent example is Hurricane Helene, which crippled Baxter International’s manufacturing plant in North Carolina. This plant accounted for roughly 60% of the intravenous (IV) solutions used in U.S. hospitals. The ensuing shortage led healthcare providers to put off elective surgeries and search for other ways to hydrate patients. Beyond natural disasters, geopolitical tensions have further strained the supply chain. Wars in Ukraine and the Middle East have cut off the supplies of crucial components and raw materials needed for DME manufacture. Sanctions imposed over the Ukraine war, for example, have affected the supply of metals and minerals critical to making medical devices. These supply chain disruptions produce real-world consequences. A recent survey states that in 2024, 67% of healthcare providers stated that they spend more than 10 hours a week managing supply chain issues and product shortages. Almost 40% also reported having to cancel or reschedule procedures at least quarterly because of these shortages. Financially, a medium-sized health system (comprising five hospitals and 650 beds) faces an average annual increase of up to $3.5 million in care costs and $350,000 in lost revenue due to supply shortages

Durable Medical Equipment Market Segmentation Analysis

By Product

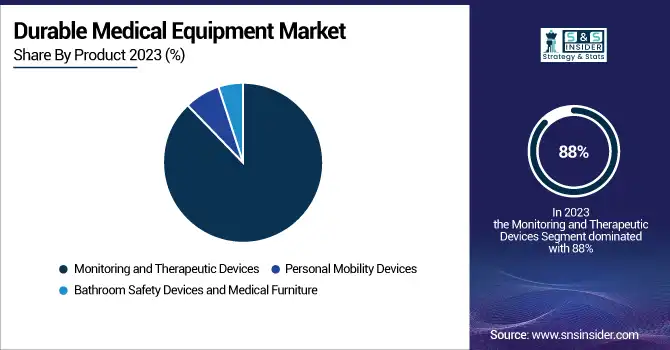

The monitoring and therapeutic devices segment dominated the durable medical equipment (DME) market in 2023, accounting for an impressive 88% of total revenue. This dominance is mainly due to the increasing burden of chronic diseases, including diabetes, cardiovascular diseases, and respiratory disorders. As an example, the World Health Organization (WHO) stated that around 17.9 million people lose their lives to cardiovascular diseases every year, leading to a need for uninterrupted monitoring devices such as ECG machines and wearable trackers. By comparison, the International Diabetes Federation found that 537 million adults around the world were living with diabetes in 2023, fueling demand for glucose monitors and insulin pumps. Technological advancements have further fueled growth in this segment. Innovations such as wireless monitoring devices, wearable health trackers, and AI-integrated systems have enhanced remote patient care and personalized healthcare solutions. Smartwatches and other activity bands now provide real-time data on vital statistics, like heart rate, oxygen saturation, and temperature. These technologies are particularly beneficial for elderly patients and those requiring long-term care.

Government efforts also have been a significant factor. The Centers for Medicare & Medicaid Services proposed to broaden reimbursement policies for home-use DME in 2023, furnishing patients with products like nebulizers and CPAP machines encourages patient adoption of therapeutic devices. Moreover, the emphasis on preventive healthcare has increased the adoption rates of therapeutic devices designed to minimize hospital visits and enhance patient outcomes. The growth of the segment demonstrates a transition to decentralized healthcare systems where monitoring and therapeutic devices are being used within home settings more often. This trend is expected to continue as healthcare providers prioritize cost-effective solutions that enhance patient comfort while reducing hospital stays.

By End-Use

The hospitals segment emerged as the dominant end-use category in the DME market in 2023 due to its comprehensive infrastructure and ability to cater to high patient volumes. Hospitals are equipped with advanced medical technologies required for intensive care and post-operative recovery, making them indispensable for patients with severe chronic conditions or those undergoing complex surgeries. For example, ventilators, infusion pumps, dialysis machines, and robotic-assisted rehabilitation devices are widely used in hospitals to ensure optimal patient care. One key driver of this segment’s dominance is government support through reimbursement policies. In many countries, including the United States, insurance coverage for hospital-based DME usage has been expanded significantly in recent years. This ensures that patients receive access to high-quality equipment without incurring excessive costs. Furthermore, hospitals often act as innovation hubs for cutting-edge DME technologies due to their partnerships with manufacturers and research institutions.

Hospitals led in the DME market in 2023, owing to their comprehensive infrastructure and capacity to serve high patient volumes. Hospitals have the medical technologies necessary for intensive care, post-operative recovery, and more complex chronic conditions. For instance, these include ventilators, infusion pumps, dialysis machines, and robotic-assisted rehabilitation devices, which are prevalent in hospitals to provide optimal patient care. Government support in the form of reimbursement policies is one of the primary factors contributing to the dominance of this segment. Hospital-based DME use has been gradually expanded to include most payer reimbursements in many parts of the world, including the United States, over the last few years. It ensures patients can be provided with high-quality equipment at no excessive cost. In addition, hospitals are at the forefront of innovative DME technologies that are developed through partnerships between hospitals, manufacturers, and research institutions.

Post-surgery care is another critical factor contributing to this segment’s growth. This investment trend is also driven by the desire to keep patients comfortable during recovery and to reduce the rate of readmission, leading hospitals to invest in durable medical equipment. For example, when a post-operative patient comes home, they are commonly provided with mobility aids, such as wheelchairs, and therapeutic devices, such as compression pumps. Hospitals also achieve cost savings by purchasing durable medical equipment at scale. The end-user segment such as home healthcare or ambulatory surgical centers cannot provide bulk purchases of advanced devices at significant discounts, allowing them to foster partnerships and strong demand from providers.

Durable Medical Equipment Market Regional Insights

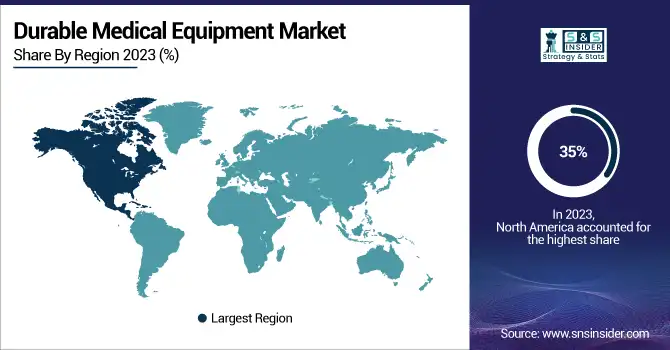

In 2023, North America held the largest share of the global DME market 35%. Factors such as advanced healthcare infrastructure, high healthcare expenditure, and positive reimbursement policies, have contributed to this leadership. A Honing and Ageing Population Based on 2023 data from the U.S. Census Bureau, over 55 million Americans were aged 65 or older in 2023, an age demographic that typically uses DME like mobility aids and homecare devices the most. In addition to this, the rising incidence of chronic diseases such as diabetes and cardiovascular diseases is aggressive and drives demand for monitoring and treatment equipment in this region. After North America, Europe accounted for a significant share of the market on account of its well-established healthcare reimbursement plans and widespread public coverage policies. Germany, France, and the UK already have inter-operable systems in place to enable access to rented or purchased durable medical equipment for hospitals and homecare settings. Demands for environmental sustainability are defining Europe's market too as the use of green sterilization and refurbishment practices maximize product lifecycle among firms.

The Asia-Pacific region is expected to experience a significant Compound Annual Growth Rate (CAGR) throughout the forecast period 2024–2032. Increasing investments in emerging economies including China, India, and Japan governments in the healthcare infrastructure will drive the growth of the global hospital hardware market. India, for example, has launched initiatives to enhance home healthcare services to elderly patients undergoing surgery, including subsidization of DME. The increasing disposable incomes and urbanization in the Asia-Pacific countries, along with the enhancement of technologically advanced DME products, is also fueling the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Durable Medical Equipment Market

-

Medtronic plc (Wheelchairs, Patient Lifts)

-

Stryker Corporation (Hospital Beds, Stretchers)

-

Invacare Corporation (Power Wheelchairs, Mobility Scooters)

-

Hill-Rom Holdings, Inc. (Now part of Baxter) (Hospital Beds, Respiratory Therapy Devices)

-

Drive DeVilbiss Healthcare (Walkers, CPAP Machines)

-

GF Health Products, Inc. (Commodes, IV Stands)

-

Sunrise Medical LLC (Manual Wheelchairs, Pediatric Mobility Devices)

-

ArjoHuntleigh (part of Arjo) (Patient Transfer Aids, Pressure Relief Mattresses)

-

ResMed Inc. (CPAP Devices, Ventilators)

-

Cardinal Health, Inc. (Hospital Furniture, Exam Tables)

Key Users

-

Mayo Clinic

-

Cleveland Clinic

-

HCA Healthcare

-

Kaiser Permanente

-

Ascension Health

-

Veterans Health Administration (VHA)

-

Fresenius Medical Care

-

CVS Health (includes Aetna and MinuteClinic)

-

UnitedHealth Group (Optum)

-

Encompass Health Corporation

Recent Developments

-

In January 2025, GE Healthcare announced partnerships with hospitals across North America to expand access to robotic-assisted rehabilitation equipment.

-

In July 2024, Philips introduced portable oxygen concentrators designed specifically for home use, enhancing patient mobility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 228.78 Billion |

| Market Size by 2032 | USD 387.17 Billion |

| CAGR | CAGR of 6.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Personal Mobility Devices, Monitoring and Therapeutic Devices, Bathroom Safety Devices and Medical Furniture) • By End Use (Hospitals, Nursing Homes, Home Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic plc, Stryker Corporation, Invacare Corporation, Hill-Rom Holdings Inc., Drive DeVilbiss Healthcare, GF Health Products Inc., Sunrise Medical LLC, ArjoHuntleigh, ResMed Inc., Cardinal Health Inc. |