DWDM System Market Report Scope & Overview:

The DWDM System Market size was valued at USD 9.9 billion in 2024 and is expected to reach USD 18.6 billion by 2032, growing at a CAGR of 8.24% during 2025-2032.

The DWDM systems market growth is being propelled by factors such as the rising need for high-speed data transfer, the growing telecom infrastructure, and the increasing utilization of cloud-based services. Dense Wavelength Division Multiplexing (DWDM) is one of the most essential technologies powering bandwidth growth today and many modern communication networks. Reducing digitization, 5G rollout, and increasing data traffic in all sectors are the main growth engines. The DWDM System Market analysis indicates that major drivers for market growth include consistent investment in optical fiber networks and technological adaptation throughout the optical fiber networks. Further, positive government initiatives coupled with the growing need for data transport with security and scalability for enterprises are expected to drive the growth of the market. DWDM System Market trends overspecialize towards automation, the incorporation of AI in network management, and high-market penetration in emerging countries.

To Get more information on DWDM System Market - Request Free Sample Report

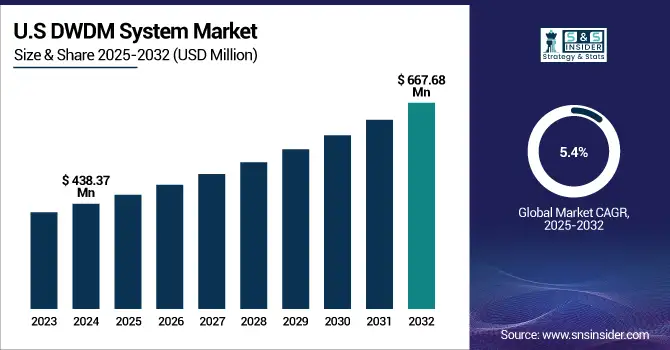

The U.S. DWDM System Market is projected to grow from $438.37 million in 2024 to $667.68 million by 2032, registering a CAGR of 5.4% during the forecast period 2024-2032. Factors like increased need for high-speed data transmission, deployment of 5G technology, and growing dependence on cloud-based services are aiding in this growth. Ongoing development of optical technology and booming large data centers are accelerating of demand in the market.

DWDM System Market Dynamics

Driver:

-

Rising Demand for High-Speed Data Transmission Is Causing Increased Adoption of DWDM Systems to Boost Network Capacity.

The increase in internet subscribers, video streaming, Internet of Things devices, and cloud computing is raising the level of data traffic spreading across worldwide networks. This uptick of demand needs enterprise and service provider infrastructure that can quickly scale and provide mega-capacity. These systems are also capable of supporting the transmission of multiple signals over a single optical fiber, which is even more bandwidth efficient, making DWDM systems the ideal solution for the requirements of modern communications. In addition, the increased reliance on digital services and also high–quality data transmission in real-time catalyzes DWDM technology implementation in data centers, telecom networks, and metropolitan area networks, propelling the market growth.

In 2024, global internet bandwidth increased by 22%, reaching a total of 1,479 terabits per second (Tbps), driven by the proliferation of data-intensive applications and services.

Restraint:

-

High Initial Investment and Deployment Complexity Are Causing Slower Adoption of DWDM Systems Among Smaller Players.

However, DWDM System Market systems require high capital investment, and this is one of the major restraints to DWDM System Market growth. DWDM systems require expensive optical components, including but not limited to multiplexers, demultiplexers, and high-quality fiber optics. Moreover, it requires a qualified workforce and accurate network planning for deployment, thus raising OPEX and CAPEX too. For some smaller telecoms or enterprises, it might be difficult to budget for such high-end technology. This could slow adoption, particularly in markets where the cost of computing is already expensive, or organizations without the technical expertise and financial power to deal with its complexity.

According to a 2024 report by the Fiber Broadband Association and Cartesian, deploying underground fiber costs a median of USD 18.25 per foot, nearly three times higher than aerial fiber at USD 6.55 per foot, with labor making up 60% to 80% of these costs.

Opportunity:

-

Expansion of 5G and Edge Computing Is Creating a Surge in Demand for High-Capacity DWDM Infrastructure.

With the deployment of 5G networks and the increasing popularity of edge computing, this creates a huge chance for DWDM system vendors. DWDM systems expand bandwidth capacity and light to eliminate bottlenecks where 5G technology demands ultra-low latency and the highest speeds. The increase of edge computing, which moves the processing of data as close to users of the data as possible, requiring short-haul high-capacity optical links, also drives such demand. DWDM is ideal for these requirements due to its ability to transport large amounts of data over great distances while minimizing loss. Over the next several years, this new breed of network architectures will continue to drive demand for next-generation DWDM infrastructure.

Challenge:

-

Integration with Legacy and Multi-Vendor Systems Is Leading to Interoperability Issues and Deployment Delays.

As DWDM systems are deployed over existing network infrastructures, the main challenge is to guarantee compatibility with legacy systems as well as with future technologies. Most organizations run a collection of optical and electronic components made by different vendors, which makes integrations difficult and can lead to interoperability challenges. In addition, specifically wavelength assignment and signal integrity, and power levels management across complex multi-vendor environments need specialized skills and tools. Lack of effective coordination will lead to underutilization of the complete span of DWDM solutions. To enable wider adoption and utilize the performance of the networks in different environments, these integration challenges need to be solved.

For instance, 49% of global insurance executives reported being behind schedule in modernizing legacy technology systems.

DWDM System Market Segmentation Analysis:

By Services

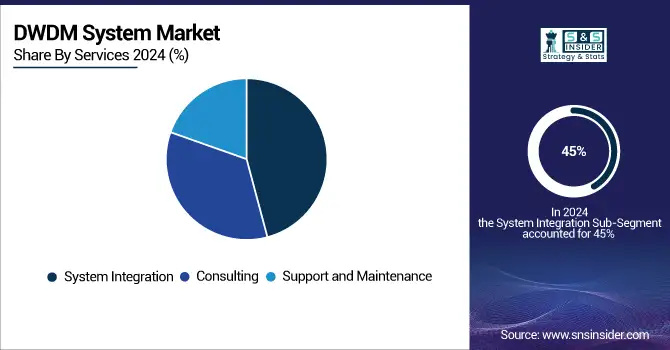

The System Integration segment dominated the market and accounted for 45% of the DWDM systems market share in 2024, and is the fastest-growing segment, and is set to record the fastest CAGR during 2025-2032. The growing demand to ensure utmost performance and reliability by easily incorporating DWDM systems into existing network infrastructures is further propelling the growth of the market. The demand is further driven by increasing telecom investments, growing network complexities, and rapid 5G rollout. Further, the evolution of automation-based integration tools and Artificial Intelligence-driven network management will facilitate deployment, tailor-made and cost-effective solutions, and operation of networks in different modes with both views across the forecast period. An expert analyzes the market in the latest voice on the subject.

By Product

The Transmitter and Receiver segment dominated the DWDM systems market in 2024 and accounted for 29% of revenue share, since it is an integral part of DWDM systems to transmit optical signals at different wavelengths and to detect optical signals. The demand for data traffic, cloud computing, and video streaming needs reliable high-speed optical communication driving the growth. Segment demand is further augmented by the accelerating deployment of larger-capacity backbone networks and by the transition to coherent transmission technologies.

In July 2024, researchers introduced a 2.4-THz bandwidth optical coherent receiver using a photonic crystal microring resonator, enhancing data capacity by efficiently managing growing optical communication demands.

The Transponders segment is anticipated to register the fastest CAGR during 2025–2032, on account of the increasing need for high-capacity data transmission and flexible wavelength conversion. Transponders have allowed for signal modulation, multiplexing, and protocol conversion as networks have scaled to form factor supporting 5G, cloud, and data centers traffic.

By Verticals

The IT and Telecom segment dominated the DWDM systems market. The growth is supported by the increasing internet traffic worldwide, 5G spread, cloud service, and data center expansion. DWDM technology delivers the high-capacity and low-latency optical networks these trends require. As a result, this vertical spend could drive the continuous growth of DWDM solutions, making the IT and Telecom vertical the more dynamically profit-making sector throughout the forecast period as it contains investments for further innovations in fiber-optic infrastructure, rapid digitalization, and rapid adoption of advanced telecom technologies.

The Healthcare segment is projected to register the fastest CAGR in the DWDM system market during 2025 to 2032. The increasing prevalence of telemedicine and digital health records, along with the adoption of AI-powered diagnostics, is fueling demand for secure, high-speed data transmission.

For Instance, in 2024, the use of 800G coherent pluggable optics has grown significantly, providing greater capacity per wavelength for data centers and metro to long-haul network applications.

DWDM System Market Regional Analysis:

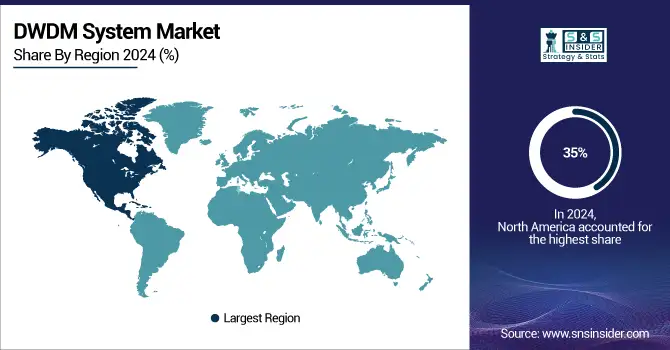

North America dominated the DWDM System Market and accounted for 35% of revenue share in 2024, owing to the facts such as the early adoption of 5G services, the advanced telecom infrastructure and the large number of cloud data centers. The market leadership is reinforced by strong investments on network upgrades and by the always-growing demand for ultra-fast data transmission in enterprises and service providers.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia-Pacific region is expected to register the fastest CAGR during the forecast period, due to the speedy digitalization process, together with large-scale 5G network deployments, and massive fiber-optic infrastructure initiatives within China, India, and the Southeast Asia region. The demand for DWDM systems extensively in the forecast duration owing to factors such as government initiatives, increasing internet penetration, and growing cloud adoption.

A growing business of data cabling, 5G rollout, and fierce data center investment boosts Europe´s DWDM market. The market will grow steadily through 2032 due to shifting focus towards establishing sustainable and energy-efficient networks and government assistance on the modernization of digital infrastructure.

The pioneers in adopting DWDM technology in Europe are the ever-prospering countries like Germany, which is rapidly building the telecom infrastructure across the country, owing to the vigorous industrial digitalization. Germany's DWDM market will continue to grow during the next decade due to continuous 5G rollout, smart city projects, and investment in cloud and data center facilities.

Key Players:

The major DWDM System Market companies are Cisco, Ciena, Huawei, Nokia, Infinera, ADVA Optical Networking, Fujitsu, NEC Corporation, ZTE Corporation, Coriant, and others

Recent Developments:

-

On September 23, 2024, Nokia deployed a high-performance cross-border DWDM network for International Gateway Company Limited (IGC) in Thailand. Utilizing Nokia’s latest Photonic Service Engine (PSE) chipset, the network enhances capacity and energy efficiency, supporting hyperscaler connectivity demands across regions.

-

On March 5, 2025 – ZTE, in collaboration with China Telecom, completed the world’s first C+L band integrated 80×800G WDM trial on a live network. The trial demonstrated flexible wavelength adjustment within a 12 THz ultra-wide spectrum and rapid wavelength switching in approximately 30 seconds.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 9.9 Billion |

|

Market Size by 2032 |

US$ 18.6 Billion |

|

CAGR |

CAGR of 8.24 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Services (System Integration, Consulting, Support and Maintenance) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

Cisco, Ciena, Huawei, Nokia, Infinera, ADVA Optical Networking, Fujitsu, NEC Corporation, ZTE Corporation, Coriant and others in report |