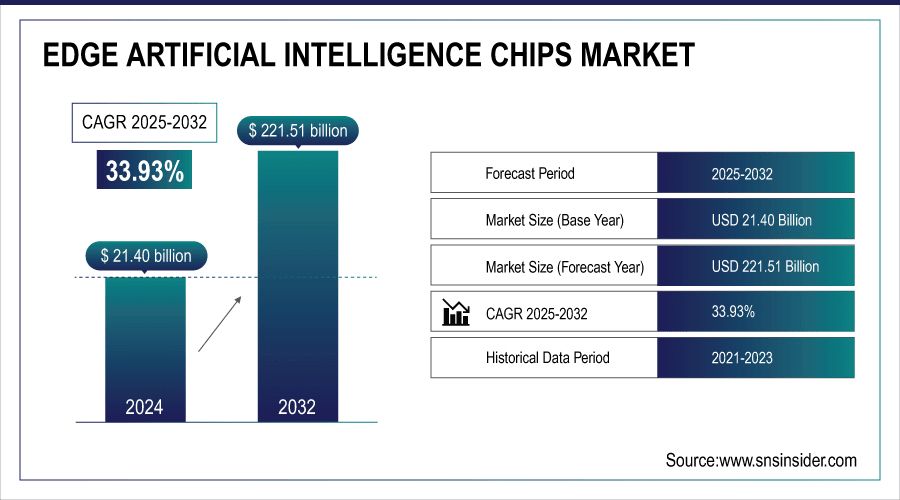

Edge Artificial Intelligence Chips Market Size & Growth:

The Edge Artificial Intelligence Chips Market size was valued at USD 21.40 billion in 2024 and is projected to reach USD 221.51 billion by 2032, growing at a CAGR of 33.93% during 2025 to 2032.

Edge AI Chips market is booming as there is a growing demand for real-time, low-latency processing in edge devices, such as smartphones, autonomous vehicles, and smart cameras. These chips allow AI work to be done locally, decreasing dependence on cloud computing systems and making things faster, more private, and more energy efficient. Key growth drivers are the increasing use of IoT, NPUs and ASICs, and the adoption of AI in other sectors, such as automotive, healthcare, and industrial automation. Though consumer dominates, enterprise is finally starting to move forward.

Microsoft backs OpenAI with USD 14B as Oracle powers its AI training, while rising demand drives chipmakers to develop edge AI for on-device tasks in robotics and smartphones.

To Get More Information On Edge Artificial Intelligence Chips Market - Request Free Sample Report

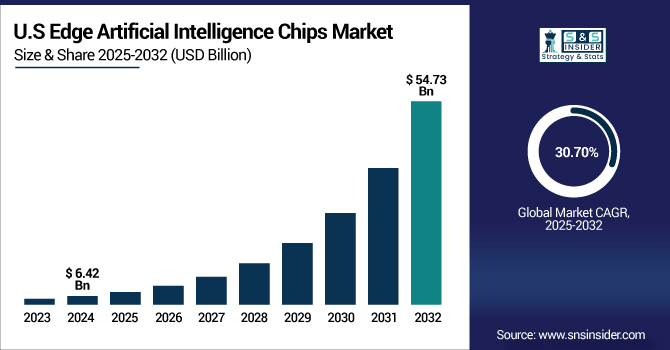

The U.S. Edge Artificial Intelligence Chips Market size was valued at USD 6.42 billion in 2024 and projected to reach USD 54.73 billion by 2032 expanding at a CAGR of 30.70%. The growth is driven by the increasing need for real-time data processing and on-device intelligence among various sectors is boosting the market growth. The dominance of the market has been instrumental by the U.S. being a leader in tech innovation and robust investment in AI research, and a greater adoption of edge computing across industries such, as the healthcare, automotive, and IoT drive the quick development and proliferation of edge artificial intelligence chips.

Edge AI Chips Market Dynamics:

Drivers:

-

IoT Devices Drive Growth in the Edge Artificial Intelligence Chips Market

Edge artificial intelligence chips market growth is primarily driven by the growing demand for low-latency AI computing on edge devices in IoT. These devices, from smart home appliances to industrial environmental sensors and wearable devices all require low power and high performance chipsets to handle local data. This results in faster decision-making, along with lesser reliance on cloud, which improves the user experience. As IoT devices become more and more pervasive across different sector, the Edge AI Chipset Industry is anticipated to be able to generate performance gains, which aids in the growth of the market at a rapid pace over the forecast period.

IoT growth is driven by edge artificial intelligence chips processors, such as Arm’s Cortex-M55, Hailo-8, Intel’s Movidius VPU, and Kneron’s KL520, enhancing AI in edge devices. These chips offer high performance, low power, and improved machine learning. They are vital for powering IoT innovations and post-pandemic economic recovery.

Restraints:

-

Fragmented Ecosystem and Limited Support Hinder Growth of Edge Artificial Intelligence Chips Globally

The limited ecosystem for edge artificial intelligence chips, involving diverse chip vendors, toolchains, and support infrastructures, presents a challenge for developers. This fragmentation complicates the creation of seamless, end-to-end solutions, as companies must integrate various hardware and software components to build effective edge AI systems. The lack of standardized and unified frameworks can lead to increased development time and costs, slowing the advancement of edge AI technologies and hindering faster market adoption and innovation in this space.

U.S. chip export restrictions on AI companies including Nvidia and AMD create uncertainty, slowing edge artificial intelligence chips growth. Apple's AI struggles, including Siri limitations and iPhone 16 delays, showcase how regulatory challenges impact the AI ecosystem.

Opportunities:

-

5G Networks Boost Edge AI Deployment for Real-Time Decision-Making and Industry Innovation

The rise in 5G networks is giving impetus to the edge artificial intelligence chips trends by enabling quick and low latency data processing close to the source. This synergy allows real-time decisions in industries ranging from driverless cars, smart manufacturing, to healthcare diagnostics. With improved bandwidth and connectivity, 5G enables edge devices to process complex AI tasks without cloud dependence. This allows industries with intelligent and decentralized computing models to enhance effectiveness while expanding market opportunities.

Intel launches AI Edge Systems, Edge AI Suites, and Open Edge Platform to accelerate edge AI adoption across industries, such as retail and smart cities. These solutions enhance deployment efficiency, providing up to 5x better performance per dollar while simplifying integration with existing infrastructure.

Challenges:

-

Overcoming Regulatory Compliance Challenges the Edge Artificial Intelligence Chips Market Growth

Regulatory compliance in the edge artificial intelligence chips market is a significant challenge, especially in sectors, such as healthcare and finance. Companies need to navigate stringent data protection laws, industry-specific regulations, and emerging AI governance frameworks to ensure compliance. In such environments, AI chips must be designed with built-in security and transparency features, which can increase development costs and timelines. Balancing innovation with regulatory requirements is crucial for successful market adoption and long-term sustainability.

Edge Artificial Intelligence Chips Market Segmentation Analysis:

By Chipset

The CPU (Central Processing Unit) segment dominated the market in 2024, accounting for 55% of the total edge artificial intelligence chips market share. This dominance is driven by the CPUs' versatility in the types of AI tasks they can compute, and their high computation power, flexibility, and scalability. Their efficacy in edge devices is enabling real-time AI applications, such as smart factories and autonomous systems and pushing the industry to look for powerful, energy-efficient chips that are integral parts of advanced edge computing solutions.

The Application-Specific Integrated Circuit (ASIC) segment is experiencing the fastest growth in the market, with a projected CAGR of 38.98% during the forecast period. ASICs are super specialized chips made for certain AI jobs, and they are more efficient, giving better performance, and consume less power than general-purpose processors, such as CPUs and GPUs. This makes them great for edge AI applications, where fast, near real-time processing is important, for things including self-driving cars, smart cities, and IoT devices. They owe their spread to accelerating specific AIs workloads.

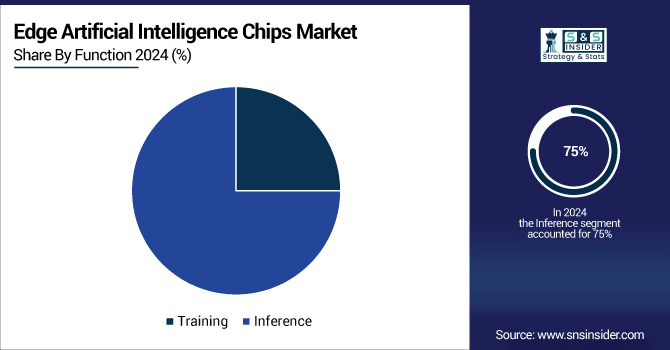

By Function

In 2024, the inference segment leads the market with around 75% of total revenue, driven by the growing demand for real-time AI processing. Inference chips are specifically optimized to run trained models efficiently, playing a critical role in autonomous systems, smart devices, and edge computing where low-latency performance is essential.

The training segment is expected to grow at the highest CAGR of 36.57%, driven by rising AI R&D investments and the need to process complex datasets. Training chips are vital for developing advanced machine learning models across healthcare, automotive, and robotics as AI adoption accelerates in edge computing applications.

By Devices

The consumer devices segment held a dominant edge artificial intelligence chips market share of around 70% in 2024. This growth is driven by the increasing integration of AI chips in smartphones, wearables, and smart home devices, enabling enhanced features including voice recognition, personalized experiences, and real-time data processing.

The enterprise devices segment is projected to experience fastest growth in the market during 2025-2032, at a CAGR of 35.86%. This expansion is powered by the increasing adoption of AI-based solutions in sectors as varied as manufacturing, logistics, and healthcare, where edge AI chips add real-time decision-making capabilities, improved automation, and operational productivity. Growing need for intelligent connected products from enterprises is also accelerating the market growth.

Edge AI Chips Market Regional Outlook:

North America dominated the market with a substantial revenue share of approximately 44% in 2024. This leadership is driven by strong technology infrastructure, broad-based AI adoption in industries, and ongoing advances in edge computing. The presence of industry giants and AI R&D investments also bolster the region’s influence. The U.S is the most influential country in the North American market as it brings rapid development and innovation in the North America.

OpenAI, valued at USD 300 billion, is set to release GPT-5, while Meta, Google, Anthropic, and xAI push forward with advanced AI models, while China’s DeepSeek intensifies the global AI race amid growing U.S.-China tech tensions.

The Asia Pacific region is the fastest-growing region in the market, and is projected to expand at a CAGR of 36.02% during 2025 to 2032. This growth is attributed to the growing industrial automation, increasing adoption of smart devices, development of 5G infrastructure, and government initiatives for AI in countries, such as China, Japan, and India.

In 2024, China held a substantial share of the market due to its strong investments in AI R&D. The country’s focus on tech independence has fueled the growth of domestic AI chip production and deployment.

Europe emerged as a promising region in the edge artificial intelligence chips market in 2024 due to the increasing AI adoption and high focus on data privacy policies and strong government support. Rapid market growth in the U.K. is due the growing use of IoT applications across industries and growing need for real-time processing in autonomous systems such as drones and autonomous driving.

The Latin America (LA) and Middle East & Africa (MEA) regions are witnessing steady growth in the edge artificial intelligence chips market. This development is driven by step-by-step digitalization, growing investments in smart city projects, and the proliferation of IoT solutions. While some of them will see market growth driven by the expansion of AI use in applications, such as retail, manufacturing, public safety and others, the trend of infrastructure construction and AI applications will continue to lead to growing demand for edge AI chips and thus ensure these regions witness stable market growth over the forecast period.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Key Players in the Edge Artificial Intelligence Chips Market are:

The edge artificial intelligence chips market companies include NVIDIA, Intel, Qualcomm, AMD, Apple, Google, Samsung, Horizon Robotics, MediaTek, Arm, and Others.

Recent Developments:

-

In April 2025, Nvidia plans to invest USD 500 billion over the next four years to manufacture AI chips in the U.S., by partnering with TSMC, Foxconn, and others to produce its Blackwell chip and infrastructure. This move strengthens supply chains and boosts U.S. manufacturing, creating hundreds of thousands of jobs.

-

In April 2025, Intel partners with AI firm Model Best and chip designer Black Sesame to enhance smart car systems, addressing the rising demand for advanced computing power in China's electric vehicle market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.4 Billion |

| Market Size by 2032 | USD 221.51 Billion |

| CAGR | CAGR of 33.93%% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chipset (CPU, GPU, ASIC, Others) • By Function (Training, Inference) • By Devices (Consumer Devices, Enterprise Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Key players in the Edge Artificial Intelligence Chips Market Companies include NVIDIA, Intel, Qualcomm, AMD, Apple, Google, Samsung, Horizon Robotics, MediaTek, Arm and Others. |