Small Satellite Market Size Analysis:

The Small Satellite Market size was valued at USD 6.05 billion in 2025E and is expected to reach USD 20.58 billion by 2033, growing at a CAGR of 16.58% over the forecast period of 2026-2033.

Small satellite market trends are driven by growing deployment of satellite constellations, miniaturization, and reusable launch systems. Increasing demand from commercial sectors and advancements in payload technology also boost growth.

Small Satellite Market Size and Forecast:

-

Market Size in 2025: USD 6.05 Billion

-

Market Size by 2033: USD 20.58 Billion

-

CAGR: 16.58% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Small Satellite Market - Request Free Sample Report

The global small satellite market has witnessed significant growth due to the increasing demand for low-cost satellite missions, rapid advancements in miniaturized technologies, and expanding applications in Earth observation, communication, and scientific research. In addition, the adoption is being driven by the emerging satellite constellations planned for global coverage, especially in hard-to-reach area or remote regions. Besides, increased participation from private players, government backing for space programs and availability of reusable launch vehicles are driving down the launch cost and promoting small satellite launches at wearer prices and competent levels globally.

SpaceX’s Starlink program launched over 1,500 small satellites in 2024 alone, furthering the global constellation trend for broadband connectivity.

The U.S. Small satellite market size was valued at USD 1.84 billion in 2024 and is expected to reach USD 6.06 billion by 2032, growing at a CAGR of 16.02% over the forecast period of 2025-2032. The U.S. Small satellite market is growing due to strong government space initiatives, rising commercial demand for Earth observation and broadband services, and the presence of leading players, such as SpaceX, Planet Labs, and Rocket Lab.

Small Satellite Market Drivers:

-

Low-Cost Missions and Miniaturization Propel Growth in Global Small Satellite Market Across Diverse Applications

Although many of the small satellite trends are applicable to small and large satellites globally, the globally small satellite blueprint market is mainly supported by the rising demand for low-cost satellite missions, faster deployment of satellite constellations, and growing utilization of satellites for earth observation, communication and scientific research. Miniaturization of satellite components at hyper-accelerated pace and increasing defense interest in surveillance and reconnaissance applications, are other key driving factors. Improved reusability of launch vehicles has lowered costs and clustered satellite launches allowing more satellite launches for a dollar.

The average satellite development timeline for smallsats has been reduced to 12–18 months compared to 3–5 years for traditional large satellites.

Small Satellite Market Restraints:

-

Limited Payload and Lifespan of Small Satellites Pose Challenges for Advanced Space Mission Applications

The small satellites are with limited payload capability and operational lifetime that restrict the functionality of high-performance missions, which is the major restraint in the small satellite market. Much smaller than a standard “small” satellite, these satellites may have lower power, limited on-board data storage and lower resolution sensors than what is typically found on a larger satellite making them unsuitable for some advanced applications, such as deep space exploration or independent high-bandwidth communications.

Small Satellite Market Opportunities:

-

Emerging Markets and Tech Innovation Unlock New Opportunities in Remote Sensing and Global Satellite Connectivity

Remote sensing for climate monitoring, global internet coverage in underserved regions, and data analytics services enabled by satellite imagery are some of the new opportunities that are opening up in the small satellite industry. Public-private collaboration will continue to grow, space startups will look to attract more funding, and emerging space programs in the Asia-Pacific and Latin America are all likely to create new growth opportunities.

APAC expansion included India’s IN-SPACe approving more than 50 private space missions in 2024, many involving smallsats for IoT, imaging, and connectivity

Small Satellite Market Challenges:

-

Rising Orbital Congestion and Regulatory Gaps Challenge the Rapid Growth of Small Satellite Constellations

Space traffic management and orbital debris is another challenge. The proliferation of small satellite constellations has greatly increased the risk of collision and orbital congestion in Low Earth Orbit (LEO). Moreover, the lack of regulations surrounding spectrum allocation, satellite licensing, and cross-border coordination adds to operator headaches especially for startups and international companies looking to scale quickly in multiple geographies.

Small Satellite Market Segmentation Analysis

By Satellite Type, Mini Satellites Segment Dominates Small Satellite Market with 34.3% Share in 2025, Nano Satellites Segment to Record Fastest Growth during 2026–2033

The mini satellites segment (100–500 kg) accounted for the largest share of the small satellite market, holding approximately 34.3% in 2025. This dominance is attributed to their optimal balance between size, performance, and cost, making them highly suitable for Earth observation, telecommunications, and defense missions. Compared to micro and nano satellites, mini satellites offer higher payload capacity and greater onboard power, enabling the deployment of advanced sensors and sophisticated data-handling systems.

The nano satellites segment (1–10 kg) is expected to witness the fastest CAGR during 2026–2033, driven by their low development costs, shorter manufacturing timelines, and compatibility with rideshare launch programs. The increasing adoption of CubeSats by universities, startups, and commercial players for applications such as research, imaging, and IoT is significantly accelerating growth in this segment.

By Application, Communication Segment Leads Small Satellite Market with 34.5% Share in 2025, Expected to Grow at the Fastest CAGR through 2026–2033

The communication segment dominated the small satellite market with a 34.5% share in 2025 and is projected to register the fastest growth over the forecast period. This growth is driven by the rising global demand for broadband connectivity, particularly in rural and remote regions. The expansion of satellite internet constellations such as Starlink, OneWeb, and Amazon Kuiper continues to fuel large-scale deployment of communication-focused small satellites.

Additionally, increasing demand for Internet of Things (IoT) networks, maritime and aviation connectivity, and real-time data relay services from both commercial and government users is further strengthening the growth trajectory of the communication segment.

By End-User Industry, Commercial Segment Dominates Small Satellite Market with 46.0% Share in 2025, Government & Military Segment to Register Fastest Growth

The commercial end-user segment led the small satellite market with a 46.0% share in 2025, supported by rapid deployment of private satellite constellations for Earth observation, broadband connectivity, and data analytics. Leading companies such as SpaceX, Planet Labs, and Spire Global are driving commercial adoption across agriculture, transportation, and infrastructure monitoring applications.

The Government & Military segment is anticipated to experience the fastest CAGR during the forecast period, fueled by increased investments in satellite-based surveillance, secure communications, and reconnaissance missions. Growing emphasis on disaster management, climate monitoring, and national security, along with supportive policy initiatives and public-private partnerships, is expected to sustain strong demand from this segment.

By Orbit, Low Earth Orbit (LEO) Segment Dominates Small Satellite Market with 52.2% Share in 2025 and Records Fastest Growth

The Low Earth Orbit (LEO) segment accounted for approximately 52.2% of the small satellite market in 2025 and is projected to grow at the fastest rate during the forecast period. LEO’s dominance is driven by its suitability for Earth observation, low-latency communication, and high revisit rates, which are essential for real-time monitoring and data transmission.

Most planned small satellite constellations are being deployed in LEO due to lower launch costs, faster deployment cycles, and near-global coverage. These advantages make LEO particularly attractive for commercial, defense, and scientific applications requiring timely data and continuous connectivity.

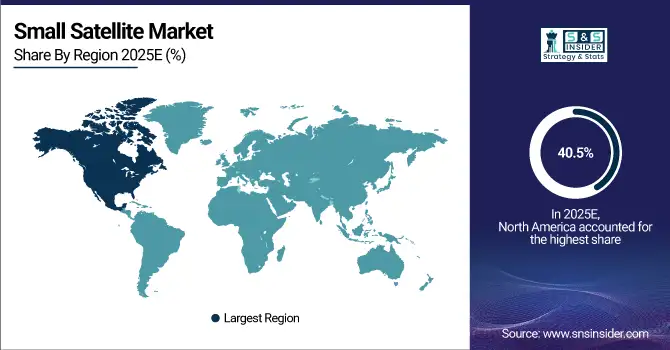

Small Satellite Market Regional Insights

North America Dominates Small Satellite Market in 2024

In 2024, North America accounted for approximately 40.5% of the global small satellite market, driven by strong government-led space programs, advanced launch infrastructure, and the presence of major commercial players such as SpaceX, Planet Labs, and Rocket Lab. The region benefits from robust public–private partnerships, high R&D investments, and a well-established ecosystem covering satellite manufacturing, launch services, and data analytics. Sustained demand for Earth observation, military surveillance, and broadband connectivity continues to reinforce North America’s leadership in the global small satellite market.

The United States dominates the North American market, supported by its advanced aerospace industry, substantial defense and space budgets, and technology exports. U.S.-based commercial space companies are at the forefront of innovation in small satellite design, constellation deployment, and launch capabilities, further strengthening the country’s market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is the Fastest-Growing Region in the Small Satellite Market

The Asia-Pacific (APAC) region is projected to grow at the highest CAGR of 17.48% during 2025–2032, fueled by rising government investments, increasing private sector participation, and growing demand for connectivity and Earth observation services. Countries across the region are actively developing small satellite missions for weather forecasting, remote sensing, national development, and security purposes. The expansion of low-cost manufacturing capabilities, supportive regulatory frameworks, and bilateral cooperation agreements continues to accelerate market growth, positioning APAC as a key future contributor to the global small satellite ecosystem.

China leads the Asia-Pacific small satellite market, supported by its aggressive satellite launch schedule and state-backed space programs. Significant investments in defense, communications, and Earth observation technologies are enabling China to maintain a dominant regional position and expand its influence in the global small satellite market.

Europe Small Satellite Market Insights, 2024

Europe represents a significant and steadily growing small satellite market, supported by the European Space Agency (ESA), national space programs, and a strong private sector. The region’s focus on Earth observation, climate monitoring, and secure communications is driving demand for CubeSats and small satellite constellations. Countries such as the United Kingdom, Germany, and France are investing heavily in satellite manufacturing, launch infrastructure, and space innovation. Public–private partnerships and cross-border collaborations continue to enhance competitiveness and innovation within Europe’s small satellite ecosystem.

Latin America and Middle East & Africa Small Satellite Market Insights

Latin America and the Middle East & Africa are emerging as promising small satellite markets, driven by applications in agriculture, disaster monitoring, environmental management, and connectivity. Countries such as Brazil, Mexico, and Argentina are advancing small satellite missions through national space agencies and academic institutions. Similarly, Middle Eastern nations including the UAE and Saudi Arabia are investing in satellite technologies for national security, infrastructure monitoring, and weather forecasting. Expanding collaborations, academic participation, and government-backed space initiatives are steadily increasing regional engagement in the global small satellite market.

Small Satellite Market key players:

-

Space Exploration Technologies Corp. (SpaceX)

-

Planet Labs Inc.

-

Airbus Defence and Space

-

Lockheed Martin Corporation

-

Northrop Grumman Corporation

-

Sierra Nevada Corporation

-

Thales Alenia Space

-

OHB SE

-

L3Harris Technologies, Inc.

-

RTX Corporation (Raytheon)

-

Rocket Lab USA, Inc.

-

Surrey Satellite Technology Ltd (SSTL)

-

MDA (MacDonald, Dettwiler and Associates)

-

Kuiper Systems (Amazon)

-

Capella Space Corp.

-

Spire Global, Inc.

-

Blue Canyon Technologies

-

GomSpace Group AB

-

NanoAvionics

-

Terran Orbital

Competitive Landscape of Small Satellite Market:

Space Exploration Technologies Corp. (SpaceX)

SpaceX is a U.S.-based aerospace and space transport company leading innovation in satellite deployment and launch services. It is best known in the small satellite market for its Starlink constellation, which aims to deliver global broadband internet. SpaceX designs and manufactures satellites while also providing launch services through its reusable Falcon 9 rockets, dramatically lowering costs and increasing launch cadence.

-

In 2025, SpaceX expanded its Starlink Gen2 rollout, introducing upgraded satellites with higher throughput and optimized global coverage. The company also achieved record annual launch numbers, reinforcing its leadership position in small satellite deployment.

Planet Labs Inc.

Planet Labs Inc. is a U.S.-based Earth observation company specializing in operating constellations of small satellites designed for high-frequency imaging. Its small satellites deliver global imagery used across agriculture, cartography, disaster response, environmental monitoring, and business intelligence. Planet’s agile satellite platform enables frequent revisit rates and rapid tasking, making it a key provider of actionable space-based data.

-

In 2025, Planet Labs launched its Planet Ultimate constellation, featuring next-generation satellites with higher-resolution imaging and improved data latency. The company also announced expanded commercial analytics services tailored to climate and sustainability applications.

Airbus Defence and Space

Overview:

Airbus Defence and Space, based in Europe, is a major manufacturer and integrator of small satellite platforms, servicing government, defense, and commercial customers. Its portfolio includes versatile satellites for Earth observation, telecom services, scientific missions, and constellation deployments. Airbus leverages its aerospace expertise to deliver both bespoke and scalable small satellite systems.

-

In 2024–2025, Airbus launched the OneSat constellation initiative, designed for flexible broadband and secure communications services. The program emphasizes modular satellite architectures that can adapt to evolving mission needs and offers interoperability with existing space infrastructure.

Lockheed Martin Corporation

Lockheed Martin is a U.S.-based defense and aerospace conglomerate with significant investments in small satellite technologies, mission systems, and space integration services. Its small satellite solutions support defense, civil, and commercial space use cases including secure communications, reconnaissance, and space domain awareness.

-

In 2025, Lockheed Martin unveiled its Rapid Space Integration Capability (RSIC) platform, which streamlines small satellite assembly, test, and launch preparation. The company also secured multiple government contracts to deploy defense-focused small satellite constellations supporting secure communications and tactical ISR missions.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.05 Billion |

| Market Size by 2033 | USD 20.58 Billion |

| CAGR | CAGR of 16.58% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Satellite Type (Mini Satellites (100–500 kg), Micro Satellites (10–100 kg), Nano Satellites (1–10 kg), Pico Satellites (<1 kg), and Femto Satellites (<100 g)) • By Application (Earth Observation & Remote Sensing, Communication, Scientific Research & Exploration, Technology Demonstration, Surveillance & Security, and Meteorology) • By End-User Industry (Commercial, Government & Military, Civil, and Academic & Research Institutions) • By Orbit (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Orbit (GEO), Sun-Synchronous Orbit (SSO), and Polar Orbit) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SpaceX, Planet Labs PBC, OneWeb, Sierra Space, Blue Canyon Technologies, L3Harris Technologies, AAC Clyde Space, Terran Orbital, Spire Global, NanoAvionics, Satellogic, ICEYE, Rocket Lab, Exolaunch, Tyvak, OHB SE, Axelspace, ISISPACE, D-Orbit, Pixxel. |