Electronic Accessories Market Report Scope & Overview:

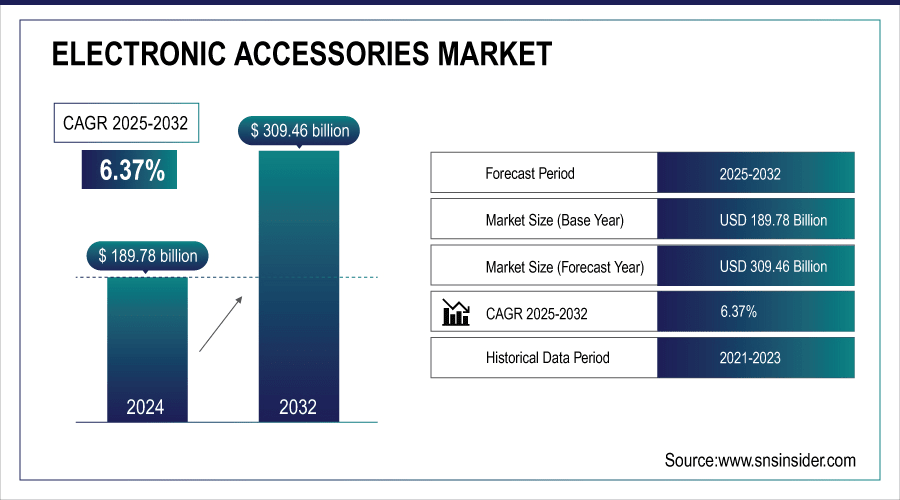

The Electronic Accessories Market size was valued at USD 189.78 Billion in 2024 and is projected to reach USD 309.46 Billion by 2032, growing at a CAGR of 6.37% during 2025-2032.

The global market includes a detailed Electronic Accessories Market analysis by market segmentation, regional analysis, competitive landscape with insights on market dynamics drivers, restraints, and opportunities. The growing usage of smartphones, laptops, and wearable and connected gadgets is increasing the demand for accessories such as chargers, headphones, speakers, and smart devices. Robust growth is also driven by technological advancements and the growing preference of consumers for convenience, portability, and multifaceted products. All these trends, in combination, lead to expansion of the global electronic accessories market.

-

More than 60% of consumers prefer accessories with portability, fast charging, or multifunctionality.

-

Over 50% of audio accessory buyers now prioritize noise-cancellation and wireless features.

To Get More Information On Electronic Accessories Market - Request Free Sample Report

Key Electronic Accessories Market Trends

-

Increasing sales of electronic accessories via e-commerce and digital retail platforms are boosting market growth.

-

Buyers favor online shopping due to convenience, competitive pricing, diverse product options, and easy return policies.

-

Companies leverage online platforms to target wider geographic regions and tap into new markets.

-

AI and AR technologies enable virtual try-ons, personalized recommendations, and tailored product experiences, improving adoption rates.

-

Online promotions, discounts, and special offers incentivize purchases and enhance revenue opportunities.

-

Support Growth: Quick delivery and efficient logistics strengthen consumer satisfaction and encourage repeated purchases, further driving market expansion.

Electronic Accessories Market Report Highlights

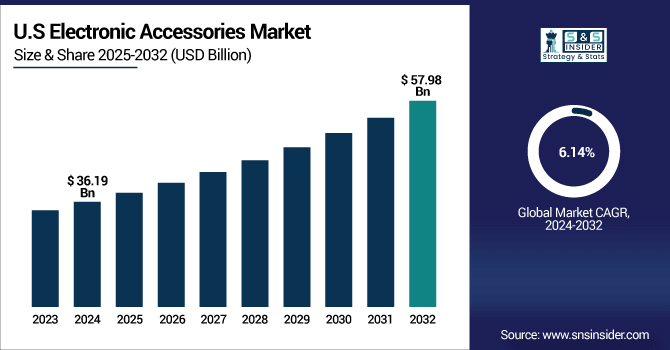

The U.S. Electronic Accessories Market size was valued at USD 36.19 Billion in 2024 and is projected to reach USD 57.98 Billion by 2032, growing at a CAGR of 6.14% during 2025-2032. The U.S. market growth is propelled by the growing smartphone penetration, increasing adoption of smart homes and connected devices, and innovations in smart wearables and audio accessories. Consumers spend more on durable and versatile electronic accessories that are also stylish. Additionally, the rise of online shopping portals offers easy buying alternatives, increasing reach and options for the consumers. These factors cumulatively lead to a healthy growth, even positioning the U.S. electronic accessories market as one of the most prospective ones for the upcoming years.

Electronic Accessories Market trends are mainly covered by high adoption rates of smartphone, laptop, and wearable devices and Smart gadgets along with growing need of end-users for convenience, portability, and innovative multifunctional electronic accessories.

Electronic Accessories Market Growth Drivers:

-

Rising E-Commerce Penetration and Online Retail Channels Expands Market Reach

The electronic accessories market is majorly being driven by the fast-expanding e-commerce platforms and online retail channels. Consumer preferences have increasingly been for flash shopping due to reasons such as convenience, affordable pricing, and diversity in products offered. Digital companies are targeting their products and services on a larger geographical region than before which facilitated through quick delivery and easy return process. The provision of online promotions, discounts and product personalization attracts more customers. Augmented reality brings in its own part to help in virtual try-ons and smash recommendations and help in the purchase decision. Such factors together enhance accessibility and uptake of products there by reinforcing revenue opportunities and market growth prospects across the regions.

-

Over 60% of consumers now prefer wireless headphones or earbuds for convenience and mobility.

-

Around 55% of smartphone users utilize fast-charging accessories for improved efficiency.

Electronic Accessories Market Restraints:

-

Intense Competition and Rapid Product Obsolescence Affects Market Expansion

The market for electronic accessories is fiercely competitive, plagued by rival firms providing comparable products. Accelerating technology leads to increasing product life cycles trimmed and obligating companies to innovate continuously. Consumers regularly swap out their vintage accessories for newer versions, creating intense pricing and differentiation pressure. Also, counterfeit and shoddy goods can touch brand reputation and sales. The rapidly changing dynamics of the market environment mandates the very high investment in research and development, advertising and distribution. This intense competition curtails profit margins and impacts the long-run growth of participants in the market, presenting a significant impediment to the growth of the sector.

Electronic Accessories Market Opportunities:

-

Expansion of E-Commerce Platforms and Digital Retail Channels Drives Market Potential

A growing sale of electronic accessories via e-commerce and digital retail channels could act as a prominent factor to accelerate the growth of the market through the forecasted period. Which enhances customer engagement through convenience, competitive pricing, and exposure to a larger product assortment. Companies can tap in to new markets, provide tailored solutions and even implement digital marketing techniques to increase sales. Consumers are drawing more towards AI and AR combined launch for personalized experiences and with speedy delivery of logistics. This enables manufacturers and retailers to reach a global audience, fuel growth, drive adoption, and take advantage of changing buying patterns of best such consumers.

-

Over 65% of laptop users connect external accessories such as wireless mice, keyboards, or docking stations.

-

Around 70% of smart home device users control gadgets via mobile apps or voice assistants.

Electronic Accessories Market Segment Analysis

-

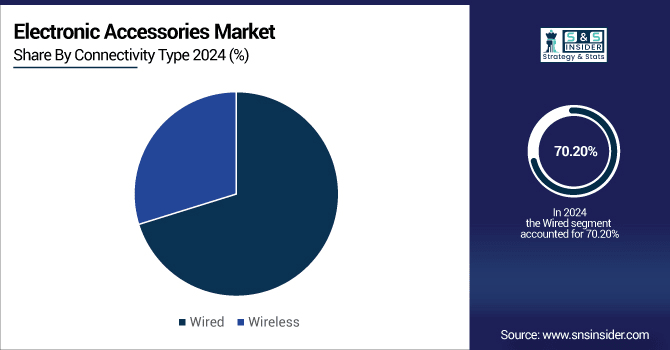

By connectivity type, wired accessories dominated the market with ~70.20% share in 2024, whereas wireless accessories are projected to grow at the fastest pace with a CAGR of 6.50% over 2025–2032.

-

By product type, mobile accessories led the market with ~35.20% share in 2024, while audio accessories are expected to be the fastest growing segment during 2025–2032, registering a CAGR of 8.22%.

-

By distribution channel, offline sales accounted for the largest share of ~70.80% in 2024, while online channels are anticipated to witness the fastest growth at a CAGR of 6.26% during the forecast period 2025–2032.

-

By end-user, the residential segment led the market with ~71.50% share in 2024, whereas the commercial segment is expected to register the fastest growth at a CAGR of 6.56% during 2025–2032.

By Connectivity Type, Wired Dominate While Wireless Shows Rapid Growth

In 2024, the market was dominated by the wired connectivity segment, which held a 70.20% revenue share due to consumers prioritizing reliable performance, rapid charging, and cost-effective and robust charging solutions. In particular, wireless accessories can expect to develop most rapidly with a CAGR of 6.50%, as they easily enable mobility, convenience, and integration with smart devices. Continual productivity in Bluetooth and Wi-Fi technology and AI-enabled connectivity boosts adoption. Anker Innovations is also a global leader in industry-proven wired and wireless solutions for the professional, residential, and gaming markets.

By Product Type, Mobile Accessories Leads Market While Audio Accessories Registers Fastest Growth

In 2024, the electronic accessories market share was dominated by the mobile accessories with a revenue share of 35.20% owing to high mobile pool, high device upgrade ratio and need for personal styling further protection of mobile similar devices. Technological advancements, including quick chargers, protective cases, and aesthetics, gained traction within the segment. The audio accessories segment is anticipated to hold the fastest CAGR of 8.22% over the forecast period owing to rising adoption of music streaming, gaming, and home entertainment among the consumers. Premium mobile and audio accessories bolsters this segment in part and via part from Apple Inc., which draws in a loyal and tech-savvy consumer base across the globe.

By Distribution Channel, Offline Lead While Online Registers Fastest Growth

In the year 2024, offline channels held a leading revenue share of 70.80%, aided by the presence of well-established retail stores, after sales support services, and consumer trust associated with reputed brands. This category is supported by the accessibility of product, in-store demos, and availability for immediate access. Convenience, competitive pricing, a wide range of product selection, and marketing strategies in the digital environment are rapid factors for the growth of online distribution. The rapid delivery, customized suggestions, and individualized solution offered by Amazon ensure that this trend is made possible, helping businesses to gain access to newer markets, improve engagement, and continue to shift with the changing patterns of consumer purchasing behavior.

By End-User, Residential Lead While Commercial Grows the Fastest

in 2024, the residential holding accounted for a revenue share of 71.50%, owing to personal consumer usage of smartphones, laptops, gaming, and smart home devices. Increased consumption of digital content, high frequency of device upgrading and demand for accessories that offer multifunctional features are driving growth. Commercial segment will register profit fastest CAGR of 6.56% owing to digitalization of workplace, remote collaboration, and adoption of enterprise technology. Logitech International supports commercial growth by offering high-quality peripherals and collaborative tools that transform offices, coworking spaces, and enterprises into productivity-enhancing premium destinations that help work groups adopt innovative electronic accessories.

Asia-pacific Electronic Accessories Market Insights

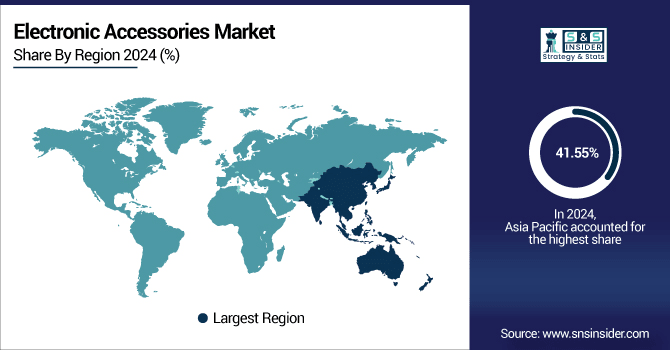

In 2024, Asia Pacific held a major portion of revenue share in the electronic accessories market, estimated at 41.55% and this region is estimated to grow at a CAGR of 7% during 2024-2032. The demand is driven by high smartphone penetration, rapid urbanization and a large tech-savvy consumer base. This area is an important producing base of electronic gadgets accessories with price benefit and product diversity. This is driven by the fast transition to smart appliances, gaming consoles, and wearables. The increasing number of retail chains, the boom in e-commerce, and increasing disposable income also boost the growth of the market. This consolidation is largely attributed to China, India, and Japan further solidifying the global electronic accessories market and corresponding share of Asia Pacific.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Electronic Accessories Market Insights

The North America electronic accessories market is driven by high penetration of smartphones, growing adoption of smart home devices, and rising adoption of wearables and audio accessories. The growth is propelled by technology, e-commerce setup and consumer willingness to pay for multi-functional high-end products. Major media producers such as Apple Inc. and Logitech International define the market and consumer preferences as they evolve.

Europe Electronic Accessories Market Insights

The Europe electronic accessories market is expanding due to increasing smartphone and consumer durable adoption, growing requirement for high-fidelity audio and other mobile accessories, coupled with increasing digitalization of homes and workplaces. While continued e-commerce penetration, mature retail infrastructure, and the introduction of newer wireless and smart accessories categories provide additional impetus for this growth. Major players including Samsung Electronics and Sony Corporation promote market development and changing consumer choices.

Latin America (LATAM) and Middle East & Africa (MEA) Electronic Accessories Market Insights

The Middle East & Africa and Latin America electronic accessories markets benefit from increase in adoption of smartphones and other connected devices, and expansion of digital infrastructure. The rising e-commerce growth and high demand for premium multifunctional accessories fuel the sales of the headset in which large corporations such as Samsung Electronics, Apple Inc., and Sony Corporation expand their reach in these regions.

Electronic Accessories Market Competitive Landscape:

Apple Inc. is one of the most dominant technology companies globally known for its consumer electronics, software, and services. The electronic accessory portfolio of the company includes iPhone Chargers, which are quick-charging, long-lasting, and perfectly compatible, and AirPods, wireless earphones with premium audio, noise cancellation, and device integration. The loyalty that Apple attracts from consumers stems from a few different places, but its penchant for premium design, seamless ecosystem connectivity, and willingness to embrace new technology, allow the global electronic accessories market to grow further each year.

-

In September 2024, Apple Inc. unveiled AirPods 4 feature an open-ear design for improved comfort and Active Noise Cancellation. They also introduce a hearing health experience, including Hearing Protection, Hearing Test, and Hearing Aid features, marking a significant advancement in wearable audio technology.

Samsung Electronics is a global consumer electronics, smart device, and semiconductor giant. In its electronic accessories are Galaxy Wireless Chargers that allow more than a single device to be charged at once, fast and efficiently while the line of Galaxy Buds, wireless earphones with crisp sound quality, extended battery life, and a comfortable feel that helps you stay connected through phone calls and easily switch sounds better than most earphones have offered before. Samsung can penetrate different consumer types and markets across the globe by focusing on its unique strength of innovative technologies, general quality service, and global distribution capabilities.

-

In August 2024, Samsung Electronics Co., Ltd. launched the Galaxy Buds3 Pro which offers high-resolution audio with SSC HiFi and UHQ audio codecs, providing 24bit/96KHz sound quality. They also feature AI Real-Time Interpreter for seamless multilingual conversations, catering to a global user base.

Electronic Accessories Market Key Players:

Some of the Electronic Accessories Market Companies are:

-

Apple Inc.

-

Samsung Electronics

-

Sony Corporation

-

Logitech International

-

Xiaomi Corporation

-

Anker Innovations

-

Belkin International

-

Bose Corporation

-

HP Inc.

-

Dell Technologies

-

Sennheiser

-

Harman International

-

AmazonBasics

-

Portronics Digital Private Limited

-

Boat

-

Garmin Ltd.

-

Mophie

-

UGREEN

-

Baseus

-

HyperX

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 189.78 Billion |

| Market Size by 2032 | USD 309.46 Billion |

| CAGR | CAGR of 6.37% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Mobile Accessories, Computer Accessories, Audio Accessories, Wearable Accessories, Automobile Accessories, Camera Accessories and Others) • By Connectivity Type (Wired and Wireless) • By Distribution Channel (Online and Offline) • By End-User (Residential and Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics, Sony Corporation, Logitech International, Xiaomi Corporation, Anker Innovations, Belkin International, Bose Corporation, HP Inc., Dell Technologies, Sennheiser, Harman International, AmazonBasics, Portronics Digital Private Limited, Boat, Garmin Ltd., Mophie, UGREEN, Baseus and HyperX. |