Electronic Drug Delivery Devices Market Report Scope & Overview:

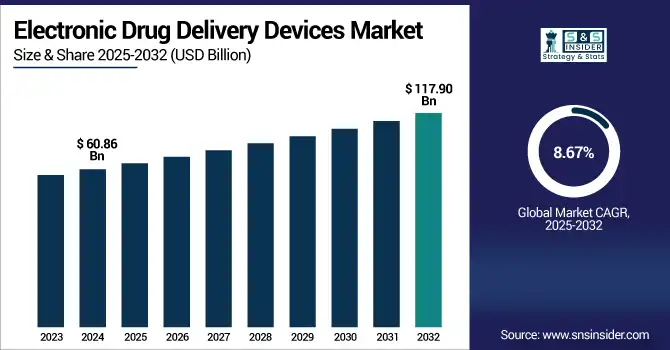

The electronic drug delivery devices market size was valued at USD 60.86 billion in 2024 and is expected to reach USD 117.90 billion by 2032, growing at a CAGR of 8.67% over the forecast period of 2025-2032.

The global electronic drug delivery devices market is growing on account of the increasing prevalence of chronic diseases, working across patient care settings, and the introduction of connected healthcare devices. Adopting IoT and smart sensors in drug adherence, remote monitoring, and treatment precision. Rising use of home care and convenient wearable devices would continue to provide market growth. Favorable regulatory landscapes and digital health investments are projected to drive growth through 2032 in diabetes, oncology, respiratory, and cardiovascular device subsegments.

To Get more information on Electronic Drug Delivery Devices Market - Request Free Sample Report

The U.S. electronic drug delivery devices market size was valued at USD 19.50 billion in 2024 and is expected to reach USD 36.85 billion by 2032, growing at a CAGR of 8.33% over the forecast period of 2025-2032.

The U.S. dominated the electronic drug delivery devices market due to the well-established healthcare sector, along with diabetes and asthma being well-penetrated, which are the major advantages that the North American sector has over all the other regions. Positive reimbursement environments and a rise in digital health investments also contribute to the country’s leadership in the market.

In January 2025, West Pharmaceutical Services introduced Daikyo PLASCAP Ready-to-Use Validated (RUV) closures, which are metal-free polypropylene closures with an integrated stopper for easy press-fit vial sealing in one step. These closures are packaged in response to the demand that they be offered to you in both the 13mm and 20mm vial sizes. The new design of the nested tray is engineered to directly support West’s Compact 10ml Nested CZ vials, along with select nested vials with a 20mm crown.

Market Dynamics:

Drivers:

-

Increasing Demand for Home-Based and Remote Patient Monitoring is Driving the Market Growth

Healthcare is moving away from hospital-based treatment to home-based treatment, especially in areas such as chronic diseases, such as diabetes, asthma, and hypertension. Patients are comfortable and prefer to manage their therapies at home, which saves hospital visits and costs. Available electronic delivery systems, including wearable infusion pumps and smart inhalers, appear to be highly appropriate for this context, given their precision dosing, convenient self-administration, and compatibility with telehealth modalities. This challenge is augmented by the increasing geriatric population and the requirement for long-term control of diseases at non-clinical locations.

RPM was utilized by more than 60 million people in the U.S. in 2024, demonstrating a fast-rising use of home-based care modalities.

In many states, Medicare and Medicaid pay for RPM installation and monitoring reimbursement, furthering homecare device and service integration.

As highlighted in the academic literature, AI-driven, IoT-based RPM offers significant value in managing chronic and elderly care1 by allowing early-onset detection of health decline and reducing hospital readmission rates.

-

Market Growth of Electronic Drug Delivery Devices is Stimulated by Technological Improvements

The current electronic drug delivery systems are becoming more and more Bluetooth-, Wi-Fi-, and smartphone-enabled and can provide real-time information from the patient to the physician. These intelligent functions aid monitoring adherence, reminder notification, dosage history recording, and even remote therapy adjustment. Such connectivity is not only beneficial to precision treatment and patient safety, but also to remote monitoring and digital health ecosystems. With increasing reliance on data in healthcare and the personalization of treatments, such technologies are significantly driving the electronic drug delivery devices market growth.

In March 2024, the FDA approved Adherium’s Hailie Smartinhaler (also known as Plug-in) for AstraZeneca Airsupra and Breztri inhalers, offering real-time medication adherence monitoring and technique feedback.

Industry collaborations are connecting SaMD platforms with injectors and inhalers– Aptar Digital Health collaborates with SHL Medical to strengthen real-time monitoring and clinician dashboards.

Restraints:

-

Data Privacy and Cybersecurity Concerns are Restricting the Market Growth

As electronic drug delivery devices become more networked, employing Bluetooth, Wi-Fi, and smartphone applications, they will relay sensitive health information, including dosage regimens, adherence logs, and patient-specific treatment details. This being a good thing for remote monitoring and online control, it also opens up the system to cyberattacks. Such unauthorized access, data theft, or hacking could potentially endanger patient safety and breach privacy-related laws. In addition, stringent data privacy regulations on HIPAA (U.S.) and GDPR (Europe) demand that their products include strong encryption, secure cloud storage, and compliance protocols, further adding to design complexity and operational expenses. Those concerns can sometimes slow the pace of adoption, particularly in areas that are sensitive to digital security.

Segmentation Analysis:

By Product

The implantable drug delivery devices segment dominated the electronic drug delivery devices market share in 2024 with a 31.29%, since drug release can be controlled over the long term for chronic diseases (cancer, cardiovascular diseases, and neurological diseases). These devices promote increased patient adherence, shorter dosing intervals, and better treatment results and are highly favored in hospital and specialty clinic environments. Furthermore, improvements in the biocompatibility of materials and miniaturization technology have significantly increased the reliability and reduced invasiveness of implantable devices, and, as a result, these are now being increasingly adopted in developed health care sectors.

The smart metered dose inhalers (inhalation devices) segment is expected to be the fastest-growing during the forecast period as the incidence of respiratory diseases, such as asthma and COPD, is increasing, especially in emerging countries. These developments incorporate conventional inhalation with intelligent systems, including dose monitoring, usage alerts, and links with mobile applications, resulting in a device offering enhanced drug compliance and the ability to monitor remotely. The increasing trend of patient-friendly, disposable, portable, and convenient drug delivery devices, coupled with the rising adoption of IoT and digital health platforms, is anticipated to drive the segment in homecare and clinical settings.

By Application

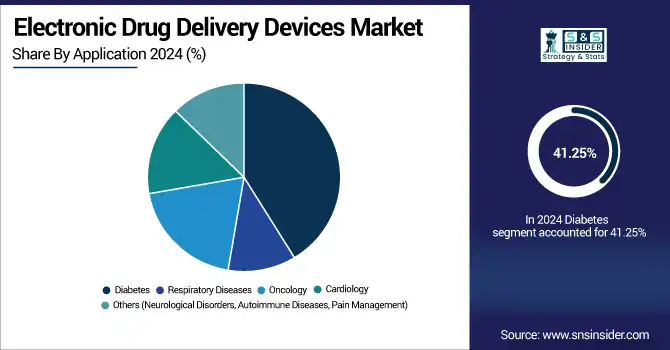

In 2024, the electronic drug delivery devices market was led by the diabetes segment with around 41.25% market share on account of the high prevalence of diabetes globally, and increasing adoption of electronic insulin delivery devices, such as smart insulin pumps and connected pen injectors. These systems provide accurate dosing, linkage to continuous glucose monitoring, and instantaneous feedback, which greatly improve adherence to regimen and glycemic control. Furthermore, rising awareness, well-established reimbursement systems, and a move toward home care for diabetes are other factors that drive users toward the adoption of electronic drug delivery systems by diabetes patients.

The oncology segment is projected to grow at the fastest CAGR during the forecast period, attributed to the increasing prevalence of cancer across the globe and the increasing demand for targeted, personalized, and minimally invasive treatment options. Electronic drug delivery modes-esp. The implantable and the infusion-based systems allow for to programming of controlled and continuous drug administration with chemotherapeutic agents, ultimately leading to better therapeutic results with fewer side effects. The growing adoption of these devices in cancer care has been further propelled by technology improvements, increased clinical trials on smart delivery platforms, and growing investment in precision oncology.

By Connectivity

The Bluetooth-enabled devices segment dominated the electronic drug delivery devices market share with a 46.2% on account of their provision of aggregated and real-time data transmission from the drug delivery device to the healthcare monitoring systems. Such products improve patient acceptability and clinical judgement with features including remote monitoring, dose counting, and missed dose alerts. The fact that they have been broadly adopted in existing healthcare environments, such as hospitals and home care, has made them the preferred choice for patients and healthcare providers looking for connected and reliable drug delivery solutions.

The smartphone-connected devices segment is expected to exhibit the fastest growth over the forecast period, driven by the increase in mobile health applications and dramatic growth in smartphone adoption, as hookup apps allow the smartphone to become a hub connecting integrated portable sensors that form part of data networks. The devices can be directly interacted with to receive dosage reminders, visualize health data, and communicate with care teams through mobile applications. Increasing penetration of smartphones globally, particularly in the emerging economies, and the need for convenient, portable, and user-friendly medical devices, are likely to stimulate quick uptake of smartphone-connected drug delivery devices in developed and developing countries.

By End-User

The hospitals & clinics segment held the largest share in 2024 in the electronic drug delivery devices market with around 55.40% market share, owing to the increasing patient population, presence of a large number of skilled physicians, and highly advanced medical infrastructure. Initiating and following the in-home care with electronic drug delivery systems are considered first-line treatment for a variety of acute and chronic diseases, including cancer, cardiovascular diseases, and post-surgical care. Moreover, in many cases, hospitals are the first point of care that patients report to, to receive diagnosis and treatment for chronic diseases, and that leads to an increasing need for safe, highly precise drug delivery systems.

During the forecast period, the fastest growth in the market will be in the homecare settings segment, driven by the growing adoption of decentralized and patient-centered care methodologies by the healthcare industry. Increasing patient inclination toward home-based treatment in chronic diseases, wearability and patient convenience of drug delivery devices, and incorporation of telemedicine and remote patient monitoring are driving the trend. Furthermore, increasing cost of healthcare and the desire to minimize re-hospitalization rates among providers and patients are driving the demand for smart drug delivery products, which help with better healthcare management away from hospitals.

Regional Analysis:

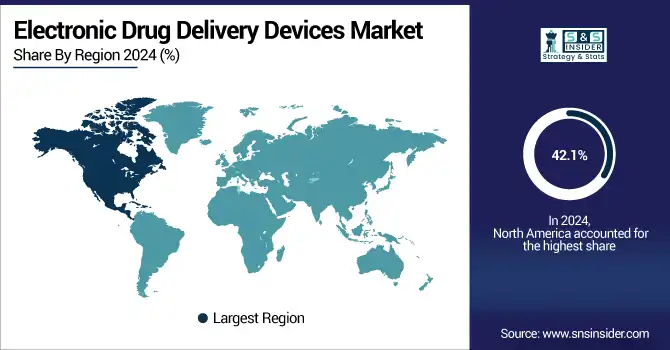

North America is leading the electronic drug delivery devices market with a 42.1% market share as it has an established healthcare system, greater healthcare expenditure, and high acceptance of the technologically advanced medical devices. It has a high burden of chronic diseases such as diabetes, asthma, and heart problems, and therefore, there is a high need for an innovative and efficient way to deliver drugs. Moreover, favorable reimbursement scenario, presence of major players, and rising adoption of IoT and smart technologies in healthcare systems are some of the factors that are likely to drive the growth of the market in the region.

The electronic drug delivery devices market analysis is growing fastest with a 9.21% CAGR over the forecast period due to an increase in healthcare awareness, growing burden of chronic diseases, middle-class population in the Asia Pacific is the main driver for the electronic drug delivery devices. Rapid urbanization is expected to pave the way for an increase in the drug delivery devices market. Demand for smart drug delivery will be further accelerated in lucrative markets owing to increasing healthcare infrastructure investment in urban areas, such as China, India, and Japan, among others. Additionally, the large patient pool in the region and increased access to mobile and digital health solutions will create lucrative growth prospects for connected and home-use drug delivery devices.

The electronic drug delivery devices market trends in Europe are growing owing to developed healthcare infrastructure, increasing geriatric population, and prevalence of chronic diseases, including diabetes, cancer, and respiratory diseases. While the government is backing digital health innovation, favorable regulations and increasing demand for home care are boosting the use of electronic drug delivery systems. Moreover, leading pharmaceutical and medtech players in countries such as Germany, the U.K., and France also play a significant role in propelling the market in the region.

Latin America and MEA are growing at a moderate rate in the electronic drug delivery devices market, owing to the rising healthcare facilities and increasing awareness of advanced drug delivery technologies. Among Latin American countries, there is an increase in the prevalence of chronic diseases and growth in healthcare investments. Rising urban population and increased access to digital health platforms are also adding value to the gradual adoption of the market.

In MEA, the electronic drug delivery devices market growth developments are backed by healthcare reforms initiated by the government and improvements in the medical systems. The fast-growing connected health solutions, such as the inhalable drug systems, are also being adopted at various levels by countries, such as the UAE and Saudi Arabia. The increasing healthcare expenditure, medical tourism, and partnerships with international medtech players are boosting the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The electronic drug delivery devices market companies are Medtronic, Insulet Corporation, Tandem Diabetes Care, Becton Dickinson and Company (BD), Novo Nordisk, Teva Pharmaceutical Industries, Propeller Health, Adherium, Vectura Group, Aptar Pharma, Ypsomed, Elcam Medical, West Pharmaceutical Services, Stevanato Group, Gerresheimer, Smiths Medical, Debiotech, Eli Lilly and Company, Phillips-Medisize, Bayer, and other players.

Recent Developments:

-

In March 2025Tandem Diabetes Care made available its next-generation Control-IQ+ automated insulin delivery algorithm. The new algorithm is an extension of Tandem's hybrid closed-loop technology and aims to further improve glycemic control. Control-IQ+ is integrated with both the t: slim X2 and Mobi insulin pumps, allowing a wider population of patients to take advantage of the new technology.

-

In November 2023, Medtronic plc informed that it had won the approval of the U.S. Food and Drug Administration (FDA) for its Symplicity Spyral renal denervation (RDN) system or the Symplicity™ blood pressure procedure. The system will be used to treat hypertension. After the FDA approval, Medtronic announced the immediate beginning of commercialization efforts in the United States.

Electronic Drug Delivery Devices Market Report Scope:

Report Attributes Details Market Size in 2024 USD 60.86 Billion Market Size by 2032 USD 117.90 Billion CAGR CAGR of 8.67% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Smart Infusion Pumps, Smart Metered Dose Inhalers, Implantable Drug Delivery Devices, Smart Transdermal Patches, Others)

• By Application (Diabetes, Respiratory Diseases, Oncology, Cardiology, Others)

• By Connectivity (Bluetooth-Enabled Devices, Smartphone-Integrated Devices, Standalone Devices)

• By End User (Hospitals & Clinics, Homecare Settings, Ambulatory Surgical Centers, Specialty Clinics, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Medtronic, Insulet Corporation, Tandem Diabetes Care, Becton Dickinson and Company (BD), Novo Nordisk, Teva Pharmaceutical Industries, Propeller Health, Adherium, Vectura Group, Aptar Pharma, Ypsomed, Elcam Medical, West Pharmaceutical Services, Stevanato Group, Gerresheimer, Smiths Medical, Debiotech, Eli Lilly and Company, Phillips-Medisize, Bayer, and other players.