Bone Graft And Substitutes Market Report Scope & Overview:

Get more information on Bone Graft Market - Request Sample Report

The Bone Graft and Substitutes Market size was valued at USD 3.71 Billion in 2023 and is projected to reach USD 6.74 Billion by 2032, with a growing CAGR of 6.87% over the forecast period 2024-2032.

The Bone Graft and Substitutes Market is booming as surgeons are favouring synthetic substitutes for their safety, compatibility, and ability to promote bone healing. Regulatory approvals for these innovative products are on the rise. Additionally, the growing popularity of minimally invasive surgeries for fractures, facial injuries, and sports injuries is propelling the demand for bone graft alternatives. An aging population with increasing bone issues further fuels market growth. Advancements in medical technology are leading to the development of superior bone graft products, improving surgical outcomes and patient safety. Supportive regulatory frameworks and ongoing efforts to create even better products are paving the way for further market expansion.

Bone Graft and Substitutes Market Dynamics

Drivers

-

Extending pace of road wounds and joint issues

The pace of street wounds is on the ascent. For example, as per the WHO, around 20 to 50 million individuals experience non-lethal wounds, and roughly 1.35 million individuals kick the bucket because of street mishaps consistently. In addition, as per the National Trauma Institute, 2014, the financial weight because of injury cases has expanded to USD 671 billion, including medical care expenses and lost efficiency costs. Bone graft has various applications in fixing wounds and infections. It could be utilized on account of different or complex cracks or those that don't recuperate well after starting treatment. It is likewise utilized for a combination that assists two bones with recuperating in a sick joint. The Combination is most frequently done on the spine.

-

Improvement of biocompatible produced bone associations

-

Extended interest in dental bone associations

Restraints

-

The Significant expense of the medical procedures

The expense of a bone graft fluctuates generally relying upon the circumstance and the state of the patient. For instance, basic bone uniting for dental purposes utilizing engineered bone will cost anyplace from USD 300 to USD 800 for a solitary embed district. At the point when a patient's bone material is obtained from various pieces of the body for bone graft activity, hospitalization is required, which builds the expense. This type of graft additionally requires the administration of a muscular specialist and an anesthesiologist, bringing about a dental bone graft cost of USD 2,500 to USD 3,500.

-

Chance and entanglements from bone graft methods

Opportunities

-

High interest in the muscular consideration area

Thorough and practically identical appraisals of well-being spending in every nation are a critical contribution to well-being strategy and in proper order. They are important to help the accomplishments of public and global wellbeing objectives. On February 20, 2019, the WHO delivered another report on worldwide well-being consumption, as indicated by which the worldwide spending on well-being in low-and center pay nations expanded by 6% and in top-level salary nations by 4%. State-run administrations represent under 40%of essential medical services spending. Many organizations are grafting the area in light of the great market and an open door. Existing players are burning through huge amounts of cash on research and improvement to add cutting-edge innovations to their portfolios and keep up with their piece of the pie.

Challenges

-

Risk of Complications

As with any medical procedure, bone graft surgeries using substitutes carry some risks of complications such as infection, rejection, or nerve damage.

-

Strict regulations imposed by governing bodies like the FDA can lead to lengthy and costly approval processes for new bone graft substitutes

Bone Graft and Substitutes Market Segmentation:

By Material Type

Allografts (donated human bone) currently holding the biggest share. These are popular due to their ability to promote bone growth (osteoconductivity) and provide immediate structure. However, synthetic bone grafts are expected to see the fastest growth. Synthetics offer lower disease transmission risk, better biocompatibility, and are generally more accepted by patients. This segment is further fueled by the rising burden of bone disorders and increasing demand in developed countries.

By Application

Spinal fusion procedures currently dominate the bone graft market due to their use in treating spinal conditions common among the growing elderly population. However, dental applications are expected to see the fastest growth. This is driven by the increasing popularity of dental implants and bone regeneration techniques, which rely on bone grafts for successful outcomes.

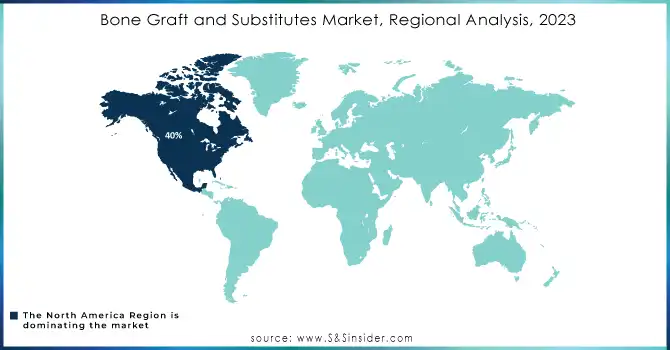

Bone Graft and Substitutes Market Regional Analysis

North America overwhelmed the market with more than 40% portion of the worldwide income in 2023. Developing mindfulness connected with the economically available imaginative items, the openness of an advanced medical care structure, and higher medical services use of 16.9% in 2018 is the significant angles adding to the local market development. The market in the U.S. is driving the North American as well as worldwide market by creating the most extreme interest for bone grafts and substitutes on account of the developing number of injury-related wounds as well as instances of muscular infection.

Asia Pacific is assessed to observe rewarding development during the gauge time frame. This development can be ascribed to rising clinical the travel industry and ideal government drives. Then again, tough administrative rules limit the reception in a couple of countries. For example, in South Korea, the item must be supported prior to advertising by the Korean Food and Drug Administration (KFDA). In Australia, the items are directed by the Therapeutic Goods Administration (TGA). The tough administrative viewpoint in Japan confines the passage of unfamiliar players into the country. However, with the most recent endorsement of DBM in Japan in 2019, the allograft market is set to keep worthwhile development in the Asia Pacific over the course of the following 10 years.

Need any customization research on Bone Graft and Substitutes Market - Enquiry Now

Key Players:

The major players are AlloSource, Baxter International Inc., TBF, Johnson & Johnson (DePuy Synthes), Medtronic Plc., Biobank, NuVasive Inc., Stryker Corporation, Xtant Medical Holdings Inc., Smith + Nephew, Zimmer Biomet Holdings Inc., OST Laboratories, Orthofix US LLC, Geistlich Pharma AG and Other Players.

Recent Developments:

-

October 2023: Orthofix Medical Inc. launched OsteoCoveTM, a novel FDA-approved synthetic bone graft for various orthopedic and spine surgeries. This innovative product comes in putty and strip forms and boasts exceptional bone-forming properties.

-

February 2023: NuVasive, Inc. secured FDA approval for their Modulus Cervical interbody implant, further expanding their C360 product line.

-

June 2022: Medtronic received FDA approval for a ligament-augmenting implant, solidifying their position in the spine surgery market.

-

March 2022: Zimmer Biomet partnered with Biocomposites to distribute their genex bone graft substitutes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.71 Billion |

| Market Size by 2032 | USD 6.74 Billion |

| CAGR | CAGR of 6.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type [Allograft (Demineralized Bone Matrix, Others), Synthetic (Ceramics {HAP, β-TCP, α-TCP, Bi-phasic Calcium Phosphates (BCP), Others}, Composites, Polymers, Bone Morphogenic Proteins)] • By Application [Craniomaxillofacial, Dental, Foot & Ankle, Joint Reconstruction, Long Bone, Spinal Fusion] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AlloSource, Baxter International Inc., TBF, Johnson & Johnson (DePuy Synthes), Medtronic Plc., Biobank, NuVasive Inc., Stryker Corporation, Xtant Medical Holdings Inc., Smith + Nephew, Zimmer Biomet Holdings Inc., OST Laboratories, Orthofix US LLC, Geistlich Pharma AG |

| Key Drivers | • Extending pace of road wounds and joint issues • Improvement of biocompatible produced bone associations • Extended interest in dental bone associations |

| RESTRAINTS | • The Significant expense of the medical procedures • Chance and entanglements from bone graft methods |