Emission Monitoring System (EMS) Market Size:

The Emission Monitoring Systems Market Size was valued at USD 3.66 Billion in 2024 and is expected to reach USD 7.56 Billion by 2032 and grow at a CAGR of 9.5% over the forecast period 2025-2032. The Market report includes key data points such as regulatory compliance adoption rates, industry-wise emissions reduction percentages (CO₂, NOx, SO₂), and global investment trends in emissions monitoring technology. It also covers the penetration rate of AI and IoT-based analytics, the shift to cloud-based Data Acquisition and Handling Systems (DAHS), and government subsidies supporting adoption. Additionally, carbon credit market trends, new product launches, patent filings, and sector-specific demand projections (e.g., power generation, oil & gas) provide deeper insights into market growth and technological advancements.

Get more information on Emission Monitoring System (EMS) Market - Request Sample Report

Market Size and Forecast:

-

Market Size in 2024 USD 3.66 Billion

-

Market Size by 2032 USD 7.56 Billion

-

CAGR of 9.5% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Emission Monitoring Systems Market Trends:

-

Rising enforcement of stricter emission control regulations by global environmental agencies.

-

Growing adoption of CEMS and PEMS across heavy industries to ensure compliance and avoid penalties.

-

Increasing corporate focus on sustainability and carbon neutrality commitments driving system investments.

-

Integration of AI for predictive analytics and proactive emission management.

-

Expansion of IoT-enabled sensors and cloud-based platforms for real-time monitoring and regulatory reporting.

Emission Monitoring Systems Market Growth Drivers:

-

Stringent Environmental Regulations and Sustainability Initiatives Drive the Growth of the Emission Monitoring Systems Market

Governments worldwide are enforcing stricter emission control regulations to combat air pollution and climate change, driving demand for emission monitoring systems. Regulatory bodies such as the EPA (U.S.), the European Environment Agency, and China's Ministry of Ecology and Environment have mandated continuous emissions monitoring across industries like power generation, oil & gas, and manufacturing. Additionally, corporate sustainability goals and carbon neutrality commitments are accelerating investments in monitoring solutions. Industries are increasingly adopting Continuous Emission Monitoring Systems (CEMS) and Predictive Emission Monitoring Systems (PEMS) to ensure compliance, reducing fines and operational risks while improving environmental performance and sustainability.

Emission Monitoring Systems Market Restraints:

-

High Initial Investment and Maintenance Costs Restrain the Growth of the Emission Monitoring Systems Market

Despite growing demand, the high capital expenditure required for installing emission monitoring systems remains a significant barrier to market growth. The cost of advanced Continuous Emission Monitoring Systems (CEMS), including sensors, analyzers, and data acquisition systems, can be substantial, especially for small and medium-sized enterprises (SMEs). Additionally, ongoing maintenance, calibration, and compliance with evolving regulations increase operational expenses. Companies must allocate significant budgets for system upgrades and staff training. These financial constraints, particularly in developing economies, slow down the widespread adoption of emission monitoring systems, limiting market expansion despite regulatory pressure.

Emission Monitoring Systems Market Opportunities:

-

Advancements in AI and IoT-Based Emission Monitoring Solutions Create Growth Opportunities in the Market

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is transforming emission monitoring by enhancing data accuracy, predictive analytics, and real-time compliance tracking. AI-driven algorithms analyze emissions data, identify trends, and predict potential compliance breaches, allowing industries to take proactive measures. IoT-enabled sensors facilitate remote monitoring and automation, reducing manual intervention and operational costs. These technologies also support cloud-based Data Acquisition and Handling Systems (DAHS), enabling seamless regulatory reporting. As digital transformation accelerates, industries are increasingly investing in smart emission monitoring solutions, presenting significant growth opportunities for market players offering AI and IoT-driven systems.

Emission Monitoring Systems Market Segment Analysis:

By Type

The Continuous Emission Monitoring System (CEMS) segment dominated the Emission Monitoring Systems Market in 2024, accounting for 77% of the revenue share. This dominance is attributed to the widespread adoption of CEMS across industries such as power generation, oil & gas, and manufacturing, driven by stringent environmental regulations and the need for real-time emissions data. Several companies have launched advanced CEMS products, integrating cutting-edge sensor technologies for improved accuracy and efficiency.

For instance, some companies have introduced enhanced multi-pollutant monitoring systems that can simultaneously measure CO₂, NOx, SO₂, and particulate matter, providing comprehensive compliance data.

The Predictive Emission Monitoring System (PEMS) segment is projected to grow at the highest CAGR of 10.9% during the forecast period. PEMS offers the advantage of predicting emissions based on process data, making it an attractive option for industries looking to optimize their operations and ensure continuous compliance with fluctuating emissions regulations. Recent product innovations in PEMS include the integration of AI and machine learning, allowing for better predictive accuracy and real-time adjustments.

By Component

The Hardware segment led the Emission Monitoring Systems Market in 2024, commanding a dominant 54% revenue share. This is due to the essential role hardware plays in the efficiency and accuracy of emission monitoring systems, including components like sensors, analyzers, and data acquisition units. As industries prioritize compliance with increasingly stringent environmental regulations, the demand for high-performance hardware, capable of continuously monitoring pollutants such as CO₂, SO₂, and NOx, has surged.

The Services segment is projected to grow at the highest CAGR of 10.75% during the forecasted period. This growth is driven by the increasing demand for support services such as installation, deployment, training, and maintenance of emission monitoring systems. As industries adopt more advanced monitoring solutions, the need for technical expertise in setup and ongoing system optimization has risen. Recent product and service development trends include service packages that offer end-to-end support, from installation to real-time troubleshooting and system upgrades.

By End-Use

The Oil & Gas segment held the largest revenue share of 26% in the Emission Monitoring Systems Market in 2024. The sector is highly regulated due to its significant environmental impact, particularly in terms of CO₂ and methane emissions. As environmental standards become more stringent, companies are increasingly adopting advanced emission monitoring systems to comply with regulations and reduce their carbon footprint. Innovations in the Oil & Gas segment include enhanced Continuous Emission Monitoring Systems (CEMS) designed to monitor a wider range of pollutants in real-time, as well as predictive technologies that enable early detection of potential compliance issues.

The Power Generation segment is expected to grow at the highest CAGR of 12.42% during the forecast period. This growth is driven by the increasing global demand for clean energy and stricter regulations aimed at reducing greenhouse gas emissions from power plants. The adoption of advanced emission monitoring solutions, such as Predictive Emission Monitoring Systems (PEMS) and smart sensors, enables power generation companies to optimize plant performance while ensuring compliance with emission standards

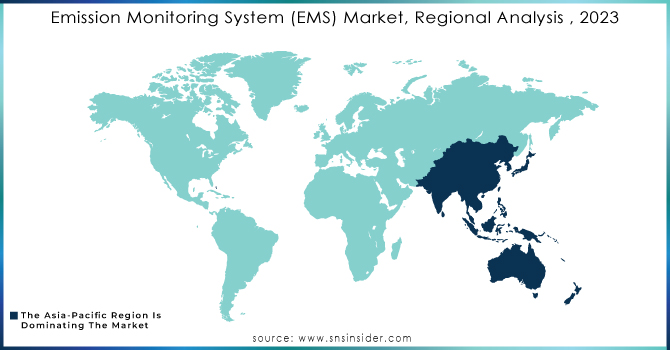

Emission Monitoring Systems Market Regional Analysis:

North America Emission Monitoring Systems Market Insights

North America led the Emission Monitoring Systems Market in 2024, holding a dominant market share of approximately 35%. This dominance can be attributed to stringent environmental regulations and policies in countries like the United States and Canada. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the Canadian Ministry of the Environment enforce strict emission standards, driving demand for emission monitoring systems across various industries, including power generation, oil & gas, and manufacturing.

Asia Pacific Emission Monitoring Systems Market Insights

The Asia Pacific region is the fastest-growing market for emission monitoring systems, with an estimated CAGR of 14.5% during the forecast period. This growth is primarily driven by rapid industrialization, urbanization, and increasing environmental awareness in countries like China, India, and Japan. With industries in these regions expanding rapidly, there is an increased focus on regulatory compliance and emissions reduction to combat severe air pollution and its impact on public health.

For example, China’s government has imposed stringent emissions standards on power plants and manufacturing sectors, pushing for the adoption of advanced emission monitoring technologies. Similarly, India’s rising energy demand and industrial growth have led to the implementation of cleaner technologies and monitoring systems to meet both domestic and international environmental standards.

Europe Emission Monitoring Systems Market Insights

The Europe emission monitoring systems market is growing due to stringent environmental regulations and sustainability initiatives. Adoption of Continuous Emission Monitoring Systems (CEMS) and Predictive Emission Monitoring Systems (PEMS) is rising across power generation, manufacturing, and oil & gas sectors. Advanced AI and IoT integration further enhance compliance, efficiency, and environmental performance across industries in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Emission Monitoring Systems Market Insights

The LATAM and MEA emission monitoring systems market is expanding with increasing environmental awareness and regulatory enforcement. Growth is driven by adoption of CEMS and PEMS in power generation, manufacturing, and oil & gas industries. Investments in IoT-enabled monitoring solutions, sustainability initiatives, and government policies are strengthening compliance capabilities and fostering adoption across these developing markets.

Get Customized Report as per your Business Requirement - Request For Customized Report

Emission Monitoring Systems Market Key Players:

Some of the Emission Monitoring Systems Market Companies are

-

ABB Ltd. (ABB CEMS, ABB ACF5000 Gas Analyzer)

-

AMETEK Inc (Ametek 9200 Series CEMS, Ametek ProLine PEMS)

-

Emerson Electric Company (Emerson Rosemount CT5100 CEMS, Emerson Gas Analyzer System)

-

General Electric Company (GE EPM CEMS, GE 1734 Gas Analyzer)

-

Enviro Technology Services Plc. (ET CEMS-2000, ET Gas Analyzer Series)

-

Horiba Ltd. (Horiba ENDA-5000 CEMS, Horiba PG-300 Gas Analyzer)

-

Fuji Electric Co., Ltd. (Fuji ZPA CEMS, Fuji Electric Gas Analyzer ZFK)

-

Rockwell Automation, Inc. (Rockwell CEMS Solutions, Rockwell SCADA for Emissions Monitoring)

-

Siemens AG (Siemens SIPROCESS GA700, Siemens ULTRAMAT 23 Gas Analyzer)

-

Thermo Fisher Scientific Inc. (Thermo Fisher 42iQ CEMS, Thermo Scientific EMS-10)

-

Parker Hannifin (Parker CEMS Analyzers, Parker Procal 2000 Gas Analyzer)

-

SICK (SICK MCS100E CEMS, SICK GMS800 Gas Analyzer)

-

CMC Solutions (CMC SmartCEMS, CMC Predictive CEMS)

-

Opsis (Opsis DOAS CEMS, Opsis LD500 Laser Gas Analyzer)

-

Ecotech (Ecotech Serinus CEMS, Ecotech Aurora 1000 Gas Analyzer)

Competitive Landscape for Emission Monitoring Systems Market:

ABB is a global technology leader providing advanced emission monitoring solutions for industrial applications. The company offers Continuous Emission Monitoring Systems (CEMS) and gas analyzers that ensure regulatory compliance, improve operational efficiency, and enhance environmental performance. Leveraging AI and IoT integration, ABB delivers real-time data, predictive analytics, and automated reporting, making it a key player in the Emission Monitoring System (EMS) market.

-

In December 2024, ABB announced that its CEM-DAS became the first data acquisition and handling system to successfully pass the new international emissions monitoring standard test, EN 17255. This achievement enabled ABB to offer a complete package of continuous gas analysis and DAHS systems that are fully compliant with international standards.

AMETEK is a leading provider of advanced emission monitoring solutions, offering Continuous Emission Monitoring Systems (CEMS) and Predictive Emission Monitoring Systems (PEMS) for diverse industries. Its innovative gas analyzers and monitoring platforms ensure regulatory compliance, improve operational efficiency, and support sustainability goals. With a focus on accuracy and reliability, AMETEK plays a significant role in advancing the Emission Monitoring System (EMS) market.

-

In November 2023, AMETEK released its 2023 Sustainability Report, highlighting a 26% reduction in Scope 1 and 2 emissions intensity since 2019, progressing towards its target of a 40% reduction by 2035. The report also noted an 11% decrease in electricity intensity and a 10% reduction in total water withdrawal intensity over the same period.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.66 Billion |

| Market Size by 2032 | USD 7.56 Billion |

| CAGR | CAGR of 9.5% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Continuous Emission Monitoring System (CEMS), Predictive Emission Monitoring System (PEMS)) • By Component (Hardware, Software, Services [Installation & Deployment, Training, Support & Maintenance]) • By End-Use (Oil & Gas, Metals & Mining, Power Generation, Chemical & Fertilizer, Pulp & Paper, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ABB Ltd., Ametek, Inc., Emerson Electric Company, General Electric Company, Enviro Technology Services Plc., Horiba Ltd., Fuji Electric Co., Ltd., Rockwell Automation, Inc., Siemens AG, Thermo Fisher Scientific Inc., Parker Hannifin, SICK, CMC Solutions, Opsis, Ecotech |