Emollients Market Report Scope & Overview:

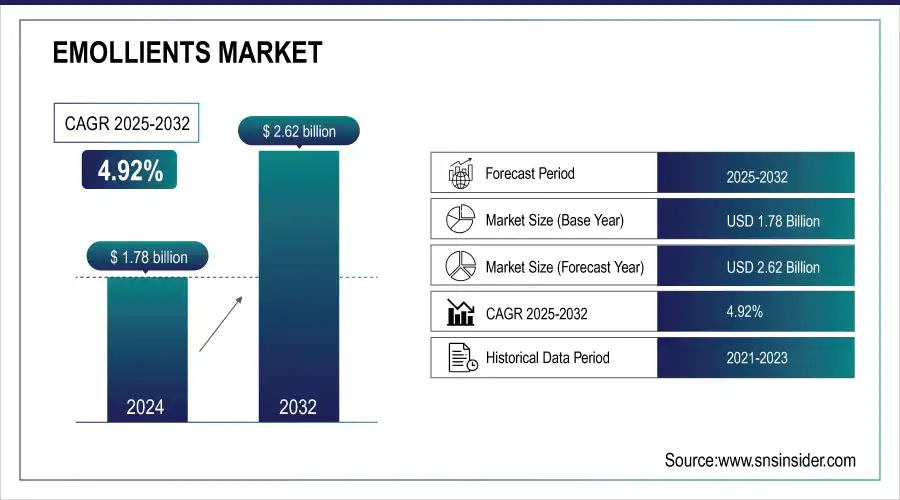

The Emollients Market size was valued at USD 1.78 billion in 2024. It is estimated to hit USD 2.62 billion by 2032 and grow at a CAGR of 4.92% over the forecast period of 2025-2032.

Emollients are substances that are used to moisturize and soften skin care products, making them more supple and smooth. These products are widely used in various sectors, including cosmetics, pharmaceuticals, and personal care. Emollients play a crucial role in maintaining skin health and preventing dryness and irritation. They form a protective barrier on the skin's surface, preventing moisture loss and enhancing its natural hydration. This helps to alleviate skin conditions such as eczema, psoriasis, and dermatitis.

Get E-PDF Sample Report on Emollients Market - Request Sample Report

In recent years, there has been a shift towards natural and organic emollients, driven by the rising demand for sustainable and eco-friendly products. Consumers are becoming more conscious of the ingredients used in their skincare products and are opting for natural alternatives. This trend has prompted manufacturers to develop emollients derived from plant-based diet sources, such as shea butter, coconut oil, and jojoba oil.

Key Emollients Market Trends

-

Increasing adoption of AI and automation for coding, billing, and claims processing.

-

Growing focus on denial management and predictive analytics to reduce revenue leakage.

-

Rising demand for patient financial engagement solutions (price transparency, payment plans).

-

Expansion of telehealth and virtual care billing support due to changing care models.

-

Heightened emphasis on data security, HIPAA compliance, and cybersecurity in RCM systems.

-

Shift from fee-for-service to value-based reimbursement and risk-sharing contracts.

-

Stronger EHR–RCM integration and interoperability to streamline workflows.

-

Increasing trend of RCM outsourcing to manage staffing shortages and cost pressures.

Emollients Market Growth Drivers

-

Growing awareness about the benefits of emollients in maintaining healthy skin

-

Rising disposable income leading to higher spending on skincare products

-

Increasing demand for emollients in the cosmetics and personal care industry

The emollients market is surging due to increasing requirements, mainly in the cosmetics and personal care industry. They serve a vital role in the industry by providing an enhanced material of texture and feel in several cosmetic products. Emollients are recognized for their superior ability to moisturize and smoothen the skin and are in high demand in the manufacturing of skin creams, lotions, and others, which result in a lavish product for the users. In addition, the personal care industry is experiencing a rise in the demand for vegetable emollients due to changes in the attitude of people and their shifting concerns about the usage of natural and organic products that are perceived to be safe and environmentally friendly. Subsequently, the emollients have continued to be in demand as people have become more conscious of issues concerning the skin and the need to take beneficial care of it.

Emollients Market Restraints

-

Stringent regulations and guidelines imposed by regulatory bodies on the use of certain emollients

-

Potential side effects and allergies associated with the use of emollients

One of the most essential concerns connected with emollients is the potential risks of their usage. These substances are designed to nourish and keep the skin hydrated. Nevertheless, there are people who might develop some side effects. For example, a person can get some irritations or a red or an itching reaction as a result of their usage. Another possible response is an aggravation of some severe conditions related to the skin, such as dermatitis or eczema. All these side effects can be very uncomfortable and can discourage many people from continuing to use emollients. Another issue related to allergy can further worsen the situation. There are many substances, such as fragrances, some particular oils, or even preservatives that can trigger allergies in some people. In case of developing an allergy to one or several of the emollient components, a person will most probably have hives, skin rashes, or even problems with breathing. For these reasons, some people may refuse to use emollients, which can increase the challenge and limit the potential market growth.

Emollients Market Opportunities

-

Expanding market for natural and organic emollients due to the rising preference for sustainable and eco-friendly products

-

Increasing demand for emollients in emerging economies with a growing middle-class population

Emollients Market Segment Analysis:

By Form

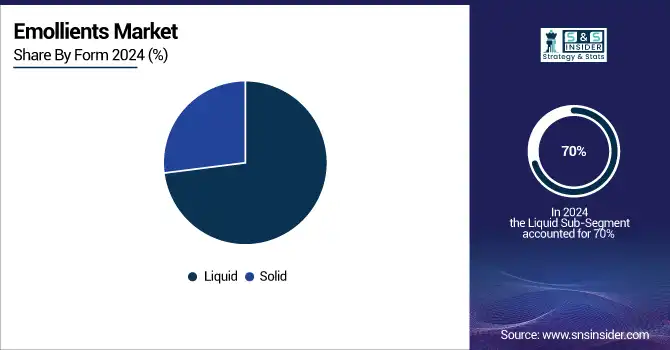

The liquid segment held the largest share around 70% in 2024. The reason for liquid emollients’ dominance is their broad application across various industries, such as cosmetics, pharmaceuticals, and personal care. Oils and esters can be effectively formulated into creams, lotions, and serums, among other products, ensuring a creamier texture and better spreadability onto the skin. They are also absorbed quickly and do not feel greasy, so as a result, they are popular in moisturizers, sunscreens, and anti-aging creams. Moreover, liquid emollients are ongoingly gaining popularity because of their natural origins, such as coconut oil, jojoba oil, and olive oil.

By Type

The esters segment held the largest market share around 42.3% in 2024. The reason for the dominating role is the presence of a variety of applications, which make esters a striking example of all-purpose and general-purpose moisturizers. Whether it is a lotion, cream, or serum, the esters can be added to all these textures with no worries. These compounds excellently work as emulsifiers, which are responsible for mixing all the components and keeping them from separating. As a result, the quality of the substance is considerably improved, and it has a longer shelf life, which is attractive to both customers and manufacturers. Furthermore, esters have shown outstanding compatibility with most of the common skincare ingredients. Using them in combination with such active agents as vitamins, antioxidants, or anti-aging agents, the product achieves a better effect, which is the reason why they are so popular.

By Application

The skin care segment held the largest share around 40% in 2024. There has been an increasing interest in skin care which has led to the increased awareness regarding skin care regression and the increase in the prevalence of such skin problems as eczema, dermatitis, and dry skin. Emollients are important ingredients in any moisturizing cream, lotion, ointment et cetera. In this application, they help maintain the barrier or function of the skin, such as preventing loss of moisture. There are currently increasing demands for such skin products as anti-aging, sensitive skin, and all-natural skincare products, and with them, there has been increased use of emollients as they impart softening soothing and protective effects.

Emollients Market Regional Analysis

Asia Pacific Emollients Market Insights

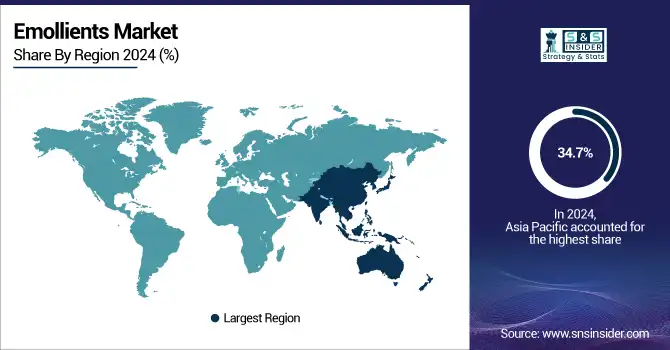

Asia Pacific dominated the emollients market with the highest revenue share of about 34.7% in 2024. The Asia Pacific boasts a population that accounts for nearly 60% of the global population, establishing it as the clear majority. Emollients play a crucial role as key ingredients in a wide range of personal care products, including shampoos, conditioners, moisturizers, lotions, and deodorants, among others. The region's increasing consumption of such products is anticipated to propel market growth. This surge in demand is primarily attributed to the rising popularity of cosmetics products. Millennials and young adults in the region are displaying a remarkable inclination toward personal care products, leading to a surge in demand. Recognizing this trend, numerous companies have been launching personal care products specifically targeting this demographic. For instance, in June 2022, Shiseido introduced Sidekick, a new skincare line tailored for Gen-Z men in the Asia Pacific region. This exemplifies the industry's response to the growing demand among young adults and millennials.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

North America Emollients Market Insights

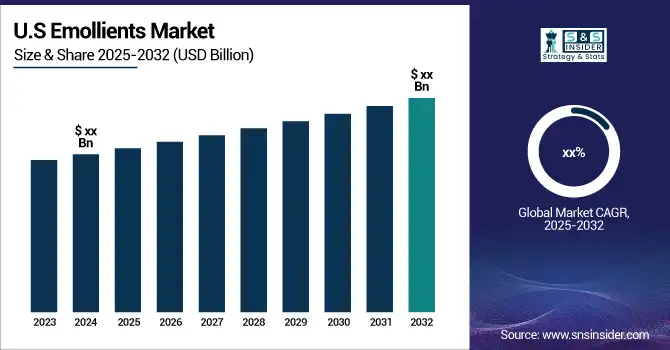

North America is expected to grow with a CAGR of about 5.1% in the emollients market during the forecast period. This growth is attributed to the increasing demand for personal care and cosmetic products in the United States. According to L'Oréal's report for 2021, the United States serves as a significant catalyst for the cosmetics industry's expansion. The emollient market in this region is expanding due to the rapid evolution of consumer lifestyles and the increasing emphasis on beauty and wellness. Moreover, the market growth in North America is further propelled by the ever-changing consumer habits and the growing awareness surrounding beauty and wellness. Additionally, the rising consumer expenditure on skincare cosmeceuticals and anti-aging products also contributes to the market's expansion in this region.

Europe Emollients Market Insights

In 2024, Europe dominated the global emollients market with nearly 28–29% share, supported by strong consumer demand for natural and sustainable ingredients, stringent regulatory frameworks such as REACH, and a mature cosmetics industry driving innovation in bio-based formulations. Within Europe, Germany emerged as a key market leader, owing to its strong natural cosmetics segment and consumer preference for dermatologically tested, eco-friendly products.

Latin America (LATAM) & Middle East & Africa (MEA) Emollients Market Insights

Latin America accounted for around 7% of the market, with Brazil and Mexico leading growth as rising disposable incomes and beauty-conscious consumers boost demand for plant-based skincare. The Middle East & Africa (MEA) held close to 10% of the market, where expanding retail penetration, growing international brand presence, and rising focus on personal grooming in GCC countries are fueling steady adoption of emollient-based products. Together, these regions represent diverse opportunities, with Europe holding a mature leadership position while LATAM and MEA emerge as fast-growing markets.

Emollients Market Competitive Landscape

Oleon

Oleon is a leading producer of natural-based oleochemicals and specialty ingredients, offering innovative emollients and esters for personal care applications.

-

In June 2023, Oleon focused on the development of ingredients through enzymatic esterification. Among its latest launches were Radia 7199ACT, a texture enhancer and emollient, and Jolee 7749ACT, a fatty ester designed to deliver benefits for both skin and hair care formulations.

Clariant

Clariant is a global specialty chemicals company with a strong portfolio of sustainable ingredients and emollients for the cosmetics and personal care industry.

-

In March 2023, Clariant introduced Plantasens Pro LM, a natural emollient developed in response to the growing global demand for high-quality skincare. The product delivers a rich, luxurious, and nurturing skin feel during and after application, catering to consumers’ evolving skincare preferences.

BASF SE

BASF SE is one of the world’s largest chemical producers, offering a wide range of cosmetic ingredients, including high-performance and sustainable emollients.

-

In September 2022, BASF announced a partnership with RiKarbon to develop emollients derived from bio-waste. This collaboration leverages RiKarbon’s advanced research to create new eco-friendly emollients tailored for personal care products, supporting BASF’s commitment to sustainability.

Evonik Industries AG

Evonik Industries AG is a leading specialty chemicals company, providing innovative solutions for the cosmetics sector, including a diverse range of emollients and functional ingredients.

-

In June 2022, Evonik expanded its manufacturing capacity in Shanghai to produce TEGOSOFT® MM MB, strengthening its ability to meet the rising demand for high-quality, sustainable emollients in the Asia-Pacific region.

Emollients Market Key Players

-

Procter & Gamble (P&G) – (Olay Regenerist Moisturizer)

-

Johnson & Johnson – (Aveeno Daily Moisturizing Lotion)

-

Eastman Chemical Company – (Eastman Sustane SAIB)

-

Evonik Industries AG – (TEGOSOFT AC MB)

-

BASF SE – (Cetiol Ultimate)

-

The Lubrizol Corporation – (Carbopol Ultrez 20 Polymer)

-

Sasol – (LIPOCHEM)

-

Hallstar – (HallStar GMS SE)

-

Croda International Plc – (Crodamol ISIS)

-

Clariant – (Plantasens Olive LD)

-

Ashland Inc. – (Nature-Silk Emollient)

-

Stepan Company – (NEOBEE M-5 Cosmetic Emollient)

-

Oleon Health and Beauty – (Radia 7306)

-

Solvay – (Rheozan SH)

-

Vantage Specialty Chemicals – (Liponate GC)

-

Kao Corporation – (Emolient EX)

-

Innospec Inc. – (Iselux)

-

Gattefossé – (Emulium Mellifera MB)

-

Seppic (Air Liquide) – (Montanov 82)

-

Dow Inc. – (DOWSIL 556 Cosmetic Grade Fluid)

| Report Attributes | Details |

| Market Size in 2024 | US$ 1.78 Billion |

| Market Size by 2032 | US$ 2.62 Billion |

| CAGR | CAGR of 4.92% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Esters, Fatty Acids, Ethers, Fatty Alcohols, Silicones, and Others) • By Form (Solid and Liquid) • By Application (Skin Care, Oral Care, Hair Care, Deodorants, and Others) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | P&G, Johnson & Johnson, Eastman Chemical Company, Evonik Industries AG, BASF SE, The Lubrizol Corporation, Sasol, Hallstar, Croda International PLC, Clariant, Ashland Inc., Stepan Company, Oleon Health and Beauty, Solvay, Vantage Speciality Chemicals |