Hollow Fiber Membranes Market Report Scope & Overview:

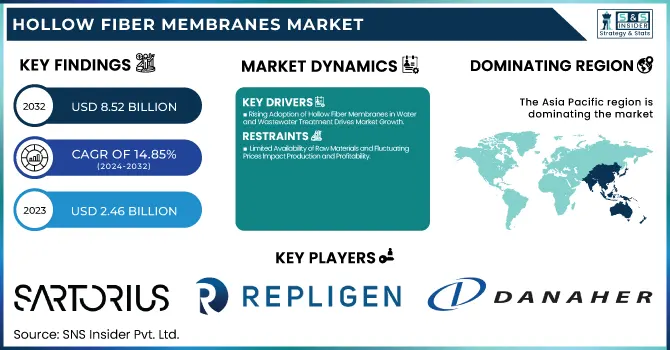

The Hollow Fiber Membranes Market size was valued at USD 2.46 billion in 2023 and is expected to reach USD 8.52 billion by 2032, growing at a CAGR of 14.85% over the forecast period 2024-2032.

To Get more information on Hollow Fiber Membranes Market - Request Free Sample Report

The demand for Hollow Fiber Membranes is rapidly increasing in applications from water treatment to biopharmaceuticals and industrial filtration. The report studies the current developments in production capacity and utilization rates, raw material trends, and fluctuating prices that affect the manufacturing cost. Production and consumption statistics are given, along with investments related to R&D, driving innovation. We also look at the evolving regulatory framework-the FDA, EPA, and ISO- which shapes the market dynamics. Based on data, this report helps you develop good strategic planning.

Hollow Fiber Membranes Market Dynamics

Drivers

-

Rising Adoption of Hollow Fiber Membranes in Water and Wastewater Treatment Drives Market Growth

Increasing demand for safe and clean water worldwide has become a prime factor in the hollow fiber membranes market. With industrialization and urbanization happening at a breakneck pace, levels of water pollution have skyrocketed, which in return calls for efficient filtration and purification systems. Hollow fiber membranes are generally used in water as well as wastewater treatment because of their high filtration efficiency, very low energy consumption, and strong ability to remove bacteria, viruses, and particulates. Strict guidelines on water treatment from governments and regulatory bodies have made industries and municipalities invest in advanced filtration technologies. Moreover, the increasing number of desalination plants for overcoming freshwater shortages is further fueling the hollow fiber membrane market. The growing demand for sustainability and water reuse is also driving market growth since industries are now looking for inexpensive and environmentally friendly filtration solutions that help them adhere to regulatory standards and enhance their operational efficiency.

Restraints

-

Limited Availability of Raw Materials and Fluctuating Prices Impact Production and Profitability

The hollow fiber membranes market heavily relies on specialized raw materials, including high-performance polymers and ceramics that are vulnerable to price changes and supply chain disruptions. Differences in availability of these materials affect production cost, which is why pricing for end users has become volatile. Market volatility is driven by geopolitical tensions, trade restrictions, and environmental regulations on chemical manufacture. Moreover, the increasing prices of raw materials are negatively impacting the profit margins of membrane manufacturers, necessitating them to raise product prices. Manufacturers sometimes are forced to use substitute materials that can reduce the performance and longevity of a membrane. Difficulties in sourcing raw materials are compounded by supply chain disruptions, particularly for countries that depend on importing raw materials. With demand for hollow fiber membranes expected to grow, a steady and low-cost supply of raw materials will be crucial for the sustainability of the market.

Opportunities

-

Growing Demand for Energy-Efficient and Sustainable Filtration Technologies Creates Expansion Opportunities

The growing focus on sustainability and energy efficiency in various industries is a major growth opportunity for the hollow fiber membranes market. As industries try to minimize energy consumption and environmental impact, membrane filtration technologies are emerging as a viable solution. Hollow fiber membranes have lower energy requirements, less chemical usage, and high filtration efficiency, making them ideal for eco-conscious industries. Hollow Fiber Membrane-push for green technologies in water treatment, food processing, and pharmaceutical applications; stricter environmental guidelines imposed by regulatory bodies; and companies investing in sustainable filtration solutions are the key factors leading to increased adoption of hollow fiber membranes. Companies developing next-generation membranes that ensure energy efficiency and recyclability will be better off as they will gain a competitive edge in the market. As sustainability stays on the radar of businesses everywhere, the prospects for hollow fiber membranes in the market are promising and will fuel market growth during the next several years.

Challenge

-

Intense Competition from Alternative Filtration Technologies Restricts Market Penetration and Adoption

Hollow fiber membranes have many advantages, but they are under strong competition with other filtration technologies like spiral-wound membranes, plate-and-frame membranes, and ceramic filters. They can occasionally provide similar or improved filtration efficiency at a far more affordable price point, making them appealing options for industries looking for affordable alternatives. Other filtration methods including even activated carbon and traditional sand liquors are still can be continued to water treatments as they hold a low operating cost and handling. A complex challenge for large-scale adoption in hollow fiber membrane applications is the existence of development-executed filtration plans in low-budget and tailored regulatory practices industries. To remain competitive, this market's manufacturers must constantly push for performance membrane innovation, cost reductions, and improved long-term operating benefits. In the absence of hollow fiber membranes demonstrating significant benefits relative to alternatives more efficient, more durable, and more sustainable their adoption may be limited in certain applications and sectors.

Hollow Fiber Membranes Market Segments

By Membrane Material

In 2023 the polymer membranes dominated the hollow fiber membranes market with a market share of around 85%. These are inexpensive, have reasonable flexibility, and are resistant to a range of chemicals which makes them suitable for most polymer-based membranes that include PES, PVDF, and cellulose acetate. The adoption rate of polymer membranes in both the water treatment and biopharmaceutical industries is also on the rise according to organizations like the American Membrane Technology Association (AMTA) and the European Membrane Society (EMS). This has propelled the U.S. Environmental Protection Agency and the European Commission to focus on polymer membranes for sustainable wastewater treatment processes for a head start in the market. Additionally, polymer membranes produced by companies such as Toray Industries, DuPont, and Koch Membrane Systems are increasingly available, produced on a large scale, and versatile, making their demand higher than ceramic membranes.

By Filtration Type

Microfiltration dominated the hollow fiber membranes market in 2023 with a maximum share of around 45%. Due to its versatility in removing suspended solids, bacteria, and larger particulates, microfiltration is a crucial filtration process in the treatment of water, and processing of dairy products, and drugs, thereby upholding its necessity in such applications. Since regulatory bodies like the FDA keep an eye on pharmaceutical and food industries with their strict filtration standards in biopharmaceutical and food products, demand for microfiltration membranes continues to rise. The WHO WSP also aids in the international promotion of this technology in purifying drinking water, especially in developing countries. Sartorius AG Merck KGaA and Pentair are the leading developers of microfiltration membranes continually innovating newer versions with even higher resistance towards fouling for longer durability hence gaining dominance from ultrafiltration and reverse osmosis over microfiltration.

By End-use Industry

Water treatment dominated the hollow fiber membranes market in 2023 and accounted for a market share of approximately 40%. The increased concern about the scarcity of fresh water and rigorous regulations regarding the treatment of wastewater has created a huge demand for hollow fiber membranes in desalination, municipal water supply, and industrial effluent treatment. U.S. End. The EPA's Clean Water Act and the European Union's Water Framework Directive promote the application of advanced membrane filtration for safe and sustainable water management. International organizations, including the International Water Association (IWA) and the Water Environment Federation (WEF), have noted the increased use of hollow fiber membranes for large-scale water purification. Large players such as LG Chem, Toray Industries, and DuPont Water Solutions have expanded their capacities to support increased demand, giving the segment a stronghold over others.

Hollow Fiber Membranes Regional Analysis

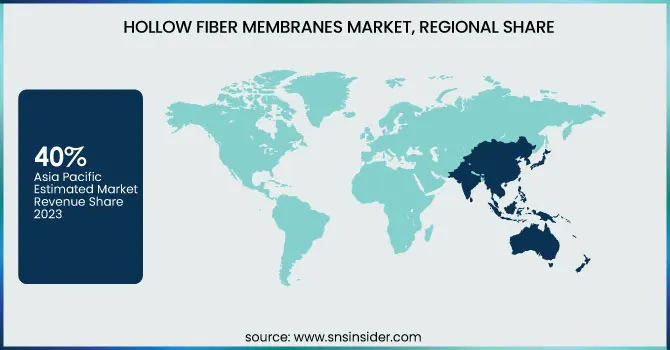

In 2023, Asia Pacific dominated the hollow fiber membranes market accounting for about 40%, due to industrial growth, population increments, and a rise in the demand for water treatment. Although China, Japan and India are the main contributors. China remains the leading consumer and producer, investing heavily in wastewater treatment and desalination, with regulations like the Water Pollution Prevention Action Plan calling for membrane-based filtration. Major producers such as Toray Industries, LG Chem and DuPont have bolstered capacity in China. The country is home to one of the top players in membrane technology, Japan’s Mitsubishi Chemical and Toyobo, the world’s first manufacturers of hollow fiber membrane used in pharmaceutical, food and beverage processing. An increasing proportion of municipal water treatment plants use membrane filtration, the Japan Water Works Association has observed. In India, it is closely following the government's Jal Jeevan Mission which aims to install clean drinking water facilities in rural population; with industrial filtration also at a growth stage, the demand is incrementally positive. Local manufacturers and foreign direct investments have consolidated Asia Pacific's global lead in the hollow fiber membranes market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Sartorius AG (Sartoflow Alpha Plus, Sartocon)

-

Repligen Corporation (TFDF Hollow Fiber Filters, Spectrum Hollow Fiber Filters)

-

Danaher Corporation (Pall Allegro, Pall Microza)

-

Merck KGaA (Pellicon, Durapore)

-

Asahi Kasei Corporation (Microza UF, Planova)

-

Parker Hannifin Corp. (PROPOR TFF, Hollow Fiber TFF Modules)

-

Toray Industries (Toray Romembra, Torayfil)

-

DuPont (DowDuPont) (FilmTec, IntegraFlux)

-

LG Chem (NanoH2O, LG SWRO)

-

Koch Membrane Systems (PURON HF, MegaPure)

-

Mitsubishi Chemicals (Sterapore, DiaFellow)

-

Pentair (X-Flow HF, AquaFlux)

-

Synder Filtration, Inc. (Synder Hollow Fiber UF, Synder TFF)

-

Meissner Filtration Products, Inc. (UltraCap HF, BioFlex HF)

-

GE Water & Process Technologies (ZeeWeed, GE Hollow Fiber UF)

-

Lenntech (Lenntech Hollow Fiber UF, Lenntech Microfiltration)

-

Toyobo (Hollosep, Toyobo Hollow Fiber UF)

-

Microdyn Nadir (AQUADYN, PureULTRA)

-

Polymem France (Neophil, Gigamem)

-

Evonik Industries (Sepuran, Evonik Hollow Fiber UF)

Recent Development:

-

June 2024: Asahi Kasei developed a new membrane system for producing water for injection, intended to speed up pharmaceutical production procedures by reducing water, as well as efficiency.

-

February 2023: Toyobo's hollow-fiber forward osmosis membranes were installed in the world's very first operational osmotic power plant in Denmark to push further for renewably generated electricity.

-

January 2024: Toray Industries developed a high-efficiency membrane for biopharmaceutical manufacturing, where performance was increased along with yields in the production of gene therapy.

-

October 2024: Memsift Innovations acquired graphene-based membrane technology to enhance its filtration solutions in various industries, such as food, pharmaceutical, and textiles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.46 Billion |

| Market Size by 2032 | US$ 8.52 Billion |

| CAGR | CAGR of 14.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Membrane Material (Polymer, Ceramic) •By Filtration Type (Microfiltration, Ultrafiltration, Reverse Osmosis) •By End-use Industry (Water Treatment, Food & Beverages, Biotechnology, Pharmaceuticals, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sartorius AG, Repligen Corporation, Danaher Corporation, Merck KGaA, Asahi Kasei Corporation, Parker Hannifin Corp., Toray Industries, DuPont (DowDuPont), LG Chem, Koch Membrane Systems and other key players |