Managed Detection and Response Market Report Scope & Overview:

Get More Information on Managed Detection and Response Market - Request Sample Report

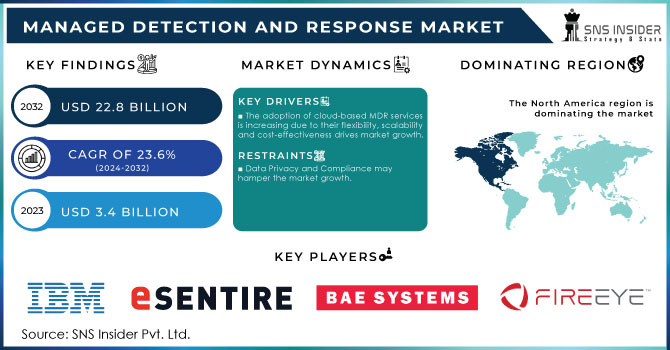

The Managed Detection and Response Market Size was valued at USD 3.4 Billion in 2023. It is expected to grow to USD 22.8 Billion by 2032 and grow at a CAGR of 23.6% over the forecast period of 2024-2032.

As cyber-attacks have become more sophisticated and frequent, due to this concern organizations around the world are searching for security solutions that drive the market growth of managed detection and response. Popular cyber threats, such as ransomware attacks, phishing schemes, and advanced persistent threats (APTs), continue to wreak havoc on businesses and critical infrastructure. The Cybersecurity and Infrastructure Security Agency (CISA) further emphasizes that nearly 80% of organizations reported an increase in cyber threats in 2022, highlighting the alarming trend.

Cybercrime damage costs are expected to grow by 15% per year over the next five years and Cybersecurity Ventures predicts that total annual worldwide cybercrime damages will exceed USD 10.5 trillion annually by 2025. Such a projection reasserts the need for adequate threat detection and response procedures. Various government bodies, like the U.S. Department of Homeland Security (DHS), recommend adopting a proactive cybersecurity posture and suggest that organizations consider investing in managed detection and response (MDR) services to minimize risks. With good cybersecurity, the business can safeguard its key assets and customers' faith as well as other regulatory requirements, a vital ingredient in this season of a less forgiving operational model in its digital hemisphere.

The accelerated movement to cloud and remote work has widened the cyber threat landscape that requires a strong security posture within any organization. According to the report by the U.S. National Institute of Standards and Technology (NIST), cloud services for businesses have increased over these past couple of years by up to 60% because they offer flexibility and scalability in most processes a company implements its business operations. This is a positive change but it has also opened up new vulnerabilities, with the Cybersecurity and Infrastructure Security Agency (CISA) reporting that last year almost 80% of organizations experienced at least one incident involving the cloud.

As businesses increasingly rely on cloud infrastructure, adopting MDR solutions not only enhances their security posture but also aligns with government recommendations for a proactive cybersecurity strategy. This proactive approach helps organizations safeguard sensitive data, maintain compliance with regulatory standards, and mitigate the risks associated with an evolving threat landscape.

Managed Detection and Response Market Dynamics

Drivers

-

The adoption of cloud-based MDR services is increasing due to their flexibility, scalability, and cost-effectiveness drives market growth.

Managed detection and response growth is also propelled by the flexibility, scalability, and cost-effectiveness of cloud-based Managed Detection and Response (MDR) services, which are becoming increasingly popular. The rise in demand for cybersecurity solutions can be attributed to the challenges businesses are facing in strengthening cyber health without paying ridiculously high prices on traditional security infrastructure, therefore moving towards cloud-based solutions. According to the U.S. Small Business Administration (SBA), 70% of small businesses are now using cloud services, marking an impressive turn towards widespread cloud adoption across multiple sectors. This move enables businesses to adjust their security protocols according to the needs of their operations, providing them with essential protection against rising cyber threats.

Besides, cloud solutions have enough flexibility to help in quickly deploying and modifying these as per the requirement without any major upfront hardware or software investments. Cloud-based MDR services are more desirable to businesses looking to make the most of their cybersecurity investments while receiving solid coverage against the increasing volume and complexity of cyber threats because of their low cost & flexibility. Consequently, the demand for cloud-based MDR solutions will likely sustain its upward trajectory in parallel with wider trends of digital transformation and remote workforces.

Restraint

-

Data Privacy and Compliance may hamper the market growth.

Managed Detection and Response (MDR) market causes significant challenges as it has to comply with data privacy and compliance regulations in light of the general-purpose data processing laws like the General Data Protection Regulation (GDPR) in the EU and California Consumer Privacy Act (CCPA) in the US that many organizations must comply with as they start to use MDR services more often. Such regulations come with rigid mandates regarding the collection, storage, and processing of personal data, requiring organizations to adopt stringent compliance protocols with significant penalties for non-compliance as well as risk to brand reputation.

Additionally, nature of compliance solutions is such that molecules will keep changing from time to time and consequently each MDR provider needs to change their offering so that it meets the existing legal standards which can make it a costly affair with more complexity in terms of delivery. Smaller organizations may not have particular resources to ensure compliance and mitigate risks which can deter them from using it. This is why the risks of data privacy and compliance slow down the adoption of MDR services as organizations balance between a security uplift with having to deal with complex regulatory frameworks associated with potential liabilities.

Managed Detection and Response Market Segmentation Overview

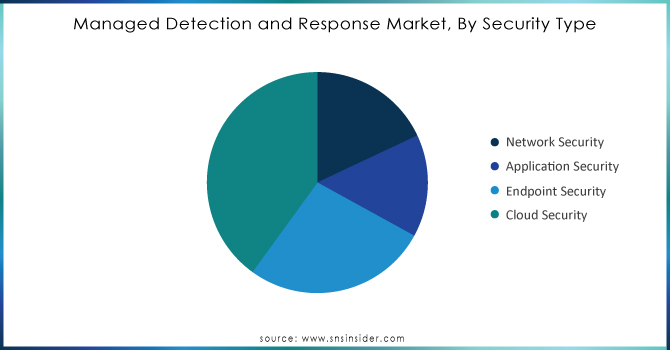

By Security Type

The cloud security segment held the largest market share of over 40% in 2023. It is because businesses around the world are moving to the cloud more and more. As organizations move their businesses into the cloud, new technical challenges arise that traditional on-prem solutions cannot seem to mitigate properly. As data that is generated and processed in cloud environments continues to grow, the increasing cyber threats demand a higher level of security. Moreover, strategies for cloud security are also pushed by regulatory compliance and data privacy concerns that need organizations to find solutions capable of providing a high-quality, end-to-end solution that integrates into their cloud infrastructure. These factors together have secured the largest market share for Cloud security in the MDR space as organizations focus on securing their Cloud environment as threats companion to their threat vector evolution.

Do You Need any Customization Research on Managed Detection and Response Market - Enquire Now

By Organization Size

In 2023, the SMEs segment held the largest revenue share due to SMEs' tendency to work with multiple vendors and partners, leading to a larger attack surface and greater complexity in managing security across distinct environments. MDR services don’t work in a vacuum; they plug directly into existing security tools and platforms, giving companies centralized visibility and control over their entire security infrastructure. EY Ireland in May 2023 launched a managed cyber security service for SMEs and other companies worldwide facing threats from cyberspace. It hopes the service will lower the cost and expertise barriers since smaller companies are increasingly struggling to handle the changing cyber threat landscape.

By Vertical Industry

The BFSI segment held the largest market share around 34% in 2023. It requires a high level of security from different ranges of cyber-attacks. With digital transformation gaining momentum in the BFSI sector, organizations are relying more on online and cloud hosting resources which means a higher risk of data breaches, fraudulent activities, and lack of regulatory compliance. BFSI companies prioritize robust security solutions to protect their assets and maintain customer trust. Managed Detection and Response services provide real-time threat detection, incident response, and compliance support, making them indispensable for BFSI organizations striving to mitigate risks and ensure regulatory adherence. This heightened focus on security has solidified the BFSI sector's leading position in the MDR market

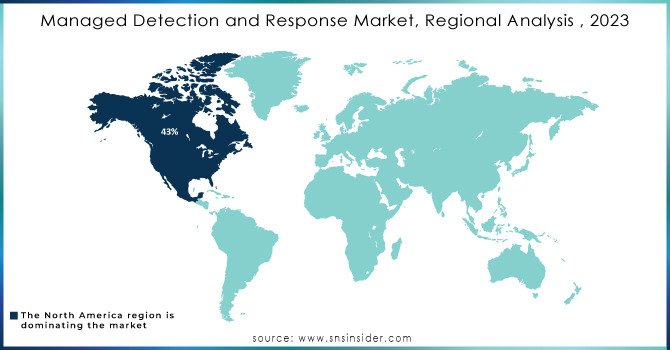

Managed Detection and Response Market Regional Analysis

North America held the highest revenue share of 43% in 2023 and is expected to account for the largest market share during the forecast period from 2024-2032. The United States is the dominant country in the North American MDR market, accounting for over 50% of the market share. The increasing sophistication of cyber threats and the growing complexity of IT environments driving the growth of the MDR market in North America. Some of the leading MDR providers in North America are CrowdStrike, Palo Alto Networks, SentinelOne, Arctic Wolf, Red Canary These providers offer a wide range of MDR services, including threat detection and response, incident response, and security consulting. They also have a strong track record of helping organizations protect themselves from cyber threats.

The Asia Pacific region is also expected to witness significant growth during the forecast period. China is the dominant country in the Asia Pacific MDR market, accounting for over 40% of the market share. The increasing demand for security automation and orchestration and the growing need for security expertise are driving the growth of the MDR market in Asia Pacific. Small and medium-sized enterprises SMEs in the Asia Pacific region are increasingly adopting MDR services due to their affordability and effectiveness in protecting against cyber threats. MDR vendors are customizing their solutions to cater to the specific needs of SMEs in the Asia Pacific region.

Key Players

-

Esentire (Esentire Managed Detection and Response)

-

Bae System (Managed Security Services)

-

FireEye (FireEye Managed Defense)

-

IBM (IBM Security QRadar)

-

SentinelOne (SentinelOne Vigilance)

-

Optiv Security (Optiv MDR Services)

-

Kudelski Security (Kudelski Managed Security Services)

-

Paladion (Paladion MDR)

-

Arctic Wolf Networks (Arctic Wolf Managed Detection and Response)

-

WatchGuard (WatchGuard Managed Detection and Response)

-

CrowdStrike (CrowdStrike Falcon Complete)

-

Secureworks (Secureworks Managed Detection and Response)

-

McAfee (McAfee MVISION EDR)

-

CybSafe (CybSafe Security Awareness Platform)

-

Trustwave (Trustwave Managed Security Services)

-

AT&T Cybersecurity (AT&T Managed Threat Detection and Response)

-

Fortinet (FortiSIEM)

-

Palo Alto Networks (Palo Alto Networks Cortex XDR)

-

Rapid7 (Rapid7 Managed Detection and Response)

-

BlackBerry (BlackBerry Cybersecurity Services)

Key User

-

JPMorgan Chase

-

UnitedHealth Group

-

Walmart

-

AT&T

-

ExxonMobil

-

Microsoft

-

Pfizer

-

Deloitte

-

Amazon

-

Boeing

Recent Development:

-

In January 2023 CrowdStrike announced that it had acquired Humio, a cloud-native security analytics platform. This acquisition will allow CrowdStrike to expand its MDR offering and provide customers with a more comprehensive view of their security posture.

-

In July 2023 Arctic Wolf announced that it had launched a new managed security awareness training offering. This offering is designed to help organizations educate their employees about cybersecurity threats and how to protect themselves from them.

-

In July 2023, SentinelOne announced that it had launched a new managed detection and response offering for critical infrastructure organizations. This offering is designed to help critical infrastructure organizations protect themselves from threats that could impact their operations.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.58 Billion |

| Market Size by 2032 | US$ 7.19 Billion |

| CAGR | CAGR of 19.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Security Type (Network Security, Application Security, Endpoint Security, Cloud Security) • By Deployment Mode (On-Premise, Cloud Based) • By Organization Size (Large, Small and Medium) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Esentire, Bae System, Fireeye, IBM, SentinelOne, Optiv Security, Kudelski Security, Paladion, Arctic Wolf Network, Watchguard |

| Key Drivers | • Increasing Cybersecurity Threats • Technological Proliferation and Increasing Penetration of Iot • The adoption of cloud-based MDR services is increasing due to their flexibility, scalability, and cost-effectiveness drives the market growth. |

| Market Opportunities | • Growing Demand from SMEs Offers a various Opportunity. • Scalability's Advantages for MDR Services |